In 2021, some changes continue regarding the way property taxes are calculated for citizens of the country. Having lost previous revenues from the export of oil raw materials, the state, in search of sources of income, switched to its own population - the budget is in deficit, every extra penny collected from Russians will come in handy. What has the property tax been like since 2021 for individuals, does it provide benefits, what will happen to the tax next.

The difference between cadastral value and inventory value

The government’s desire to increase revenues to the state budget after the fall in oil prices on the world market forced legislators to radically revise the Tax Code in relation to the scheme for calculating taxes on the property of Russian citizens. By increasing the personal property tax in 2021, the Russian government plans to significantly replenish the budget by increasing the amount of such fees.

The increase in the amount of tax on movable and immovable property of private individuals occurred due to changes in the very mechanism for calculating the amounts collected from private real estate.

The new law on property taxes for individuals 2021 will be based not on the inventory value of the property, but on the cadastral value. Inventory price indicators differ significantly from current market prices downward. Inventory value takes into account:

- time of commissioning of the facility;

- features of construction solutions of the property;

- prices for building materials and construction work.

Cadastral parameters for calculating the value of real estate are based on:

- development of infrastructure adjacent to the facility;

- location of private real estate;

- degree of comfort of private real estate;

- the proximity of its location to important social and public facilities.

If the inventory value almost always remained unchanged, then the cadastral value changes every five years and depends on the level of regional income of each subject of the federation. In fact, the cadastral value of housing is always calculated as the market value and reflects the real current price of the taxable property.

How has the property tax for individuals changed since 2021?

The main innovation to which this type of tax was subjected was the cost of housing that underlies its calculation. If previously the inventory value was taken into account, now the cadastral value is taken into account. In practice, this leads to a significant difference in the old and new tax amounts.

The cost at which the tax was calculated before (inventory) has no connection with the price of an apartment or house on the market and is calculated based on the design of the building, the date it was put into operation, the cost of building materials and work based on state standards for each of these parameters . The purpose of the cadastral value is to obtain the cost of housing as close as possible to the market price. In addition to purely technical aspects, it takes into account the factors of the building’s location in a particular area of the city, the degree of infrastructure development within walking distance of the building, the presence of important social facilities, and much more. This value must be recalculated at least every five years with the help of independent appraisers.

It is clear that the size of the cadastral value will differ quite significantly in different regions of the country, and in different cities of the same region, and even in different districts of the same city, depending on the prestige of the part of the city.

From which private objects will accruals be made?

Over five years, the cadastral value increases by an average of 20% every year. Therefore, private property taxes will always rise. To avoid a sharp increase in tax payments, the legislator has developed so-called reduction coefficients, which decrease immediately after their implementation, and the tax on private property increases, but gradually.

The gradual introduction of the new calculation scheme began in 2014. From 2021, the new tax will be levied in full. For most citizens, such fees will be 0.1% of the market value of their property. Usually these are housing and country houses. The list of taxable objects includes:

- residential buildings and premises;

- unfinished low-rise residential buildings;

- residential complexes;

- outbuildings measuring no more than 50 x 2 m.

When calculating tax fees, it should be remembered that payment is not levied on the entire area of the property, but only on that part of it that is equated to surplus. The new property tax for individuals in 2021 provides for a tax deduction or refund of money with a minimum area of taxable objects.

Thus, owners of privatized living rooms will be able to avoid paying tax for 10 m2. Owners of city apartments are exempt from paying taxes on 20 m2. Owners of private cottages do not have to pay for 50 m2 in their home. All remaining area is taxed as surplus.

When selling an apartment, the owner will first have to pay tax. If the transaction value is less than 1 million, then he is entitled to a refund of the taxes paid.

Assistance from the state to home owners - tax deduction

All owners are provided with a tax deduction based on the area of the property:

- room 10 sq.m;

- apartment 20 sq.m;

- house 50 sq.m.

There is no tax charged on this amount of space. For example, if the room is 18 sq.m., then you will only need to pay tax for 8 sq.m. If the preferential area is equal to or less than the total area, then the owner is exempt from payment. A reduction in the taxable area occurs only when switching to cadastral registration.

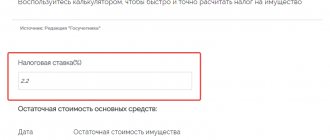

Calculation of tax rates

A special formula has been introduced to calculate tax payments:

Tax = (Nk x Sk - Ni x Si) x K + Ni, in which:

- Nk and Ni - cadastre and inventory taxes;

- Sk and Si - tax rates for cadastre and inventory;

- K is a reduction factor depending on the type of property.

The formula will remain in effect until 2021 to gradually increase residential property taxes. To do this, each year the decreasing coefficient will increase by 20%. By 2021, its size will have to be 100% in relation to the then current market value of taxable objects.

Table for calculating cadastral rates when calculating tax on private real estate

| Cost of the property | Tax rate as a percentage |

| Up to 10 million rubles. | 0,1 % |

| From 10 to 20 million rubles. | 0,15 % |

| From 20 to 50 million rubles. | 0,2 % |

| From 50 to 300 million rubles. | 0,3 % |

| Over 300 million rubles. | 2 % |

| Garages and parking spaces | 0,1 % |

| Unfinished construction of a residential building | 0,3 % |

| Other objects | 0,5 % |

The tax rate always depends on the current price of the property, as well as on the purpose of the property itself. The new formula for calculating the interest rate is currently applied only if the cadastral value of taxable real estate is higher than the inventory value.

Important! To prevent a sharp increase in tax payments for individuals, the state has introduced a transition period that will last from 2021 to 2021.

What benefits can real estate owners take advantage of?

Information about preferential rates and deductions

First of all, tax benefits include a reduction coefficient, which will be valid until 2021 throughout the country. In addition, the regional government has the right to vary the amount of tax and expand the list of federal beneficiaries. This includes disabled people of groups 1 and 2, citizens with many children, pensioners, etc.

The legislator changed the previously existing rules on benefits. Now you can be exempt from payment for only one object. Previously, citizens sought to transfer property to older family members who are pensioners in order to avoid payments to the budget. To receive benefits, you will need to personally visit the Federal Tax Service and present a certificate that gives you the right to ease the tax burden.

Pensioners are exempt from property payments for one apartment, cottage or garage. For example, having two apartments in the property, a citizen personally selects the object of taxation, for which he fills out a standard application form.

Who will be exempt from payments?

From 2021, the following are completely exempt from paying taxes on residential properties not used for commercial purposes:

- Knights of the Order of Glory, Heroes of the Soviet Union and Heroes of Russia;

- disabled children;

- veterans of the Great Patriotic War and the war in Afghanistan;

- persons affected by nuclear tests, liquidators of the Chernobyl accident and those who worked in the field of nuclear weapons testing.

Beneficiaries who own several apartments can apply for their residential property tax benefits for only one property. For the rest, they will have to pay tax based on the cadastral value of housing. They can exempt any object they own from taxation by issuing preferential documents for it.

Important! Only federal benefits remain unchanged. Regional benefits will depend on the size of the regional budget, the ability of regional authorities to support those categories of the population that have received regional benefits in paying property taxes.

In addition, a temporary exemption period is being introduced for owners of real estate purchased after January 2021. If, for example, a mother of two children bought a new home during this period, then she can pay taxes without paying the 13% DFL fee after 5 years from the date of purchase.

This is provided for in Art. 217 clauses 1-2 of the Tax Code of the Russian Federation, which came into force at the beginning of 2021. Until this time, owners of new apartments could not pay taxes on the purchased property for three years from the date of purchase.

Reforms in the real estate market

The reforms also affected transactions with real estate. Selling real estate without the state demanding a 13 percent income tax is now allowed only five years after its acquisition, compared to the previous three years. This applies to real estate that a person has purchased since 2016; with this measure, the state is trying to introduce restrictive measures to combat speculation.

Please note that this only applies to real estate that has passed into new ownership through a purchase and sale transaction, while housing as a gift or inheritance can be sold tax-free after three years, as before.

The procedure for submitting information about real estate to tax authorities has also undergone changes. Owners must now inform the tax authorities that they own the property, otherwise they will be fined 20 percent of the amount of the unpaid fee. Of course, this does not apply to all real estate, but only to those that were purchased during the current year.

Bottom line

It should be noted that the new property tax in 2021 for individuals demonstrates a trend of increasing tax collections from ordinary citizens who are taxpayers. New articles of laws demonstrate a tendency to expand the tax base of the state to create conditions for stable revenues to the state budget from payments from private individuals, which should in the near future become the main source of state income, replacing the decreased revenues from oil and gas production.

Benefits for pensioners and other categories of citizens

The group of beneficiaries for taxation of property of individuals is formed by pensioners, disabled people, military personnel serving under a contract, etc. These categories of citizens retain the entire package of benefits and are exempt from paying tax, but with some reservations. For example, if a beneficiary owns an apartment and a garage, then he will not have to pay tax, since the listed objects are different types of property, that is, the benefits apply only to one object from a group of similar ones.

If you have already been granted benefits, then every year you do not need to collect documents and write a corresponding application to the Federal Tax Service.

In practice, the absence of an application from a taxpayer of the category in question regarding the choice of a preferential object is not a problem, since the Federal Tax Service independently resolves this issue - it selects an object with the highest amount of calculated tax.

How to pay taxes

The tax can be paid at any bank with a receipt, which is sent along with the notification. If you are a client of any bank, you can pay online.

Using Sberbank Online as an example, let’s look at how quickly and easily you can pay using your Taxpayer Identification Number (TIN).

- Log in to your personal account.

- Go to the Transfers and Payments tab.

- In the Payment for purchases and services section, find the category of traffic police, taxes, duties, budget payments.

- Select the subcategory Federal Tax Service.

- Go to the tab Search and pay taxes to the Federal Tax Service.

- Fill in the requested fields.

- Pay for the service using a card.

We recommend creating a personal account on the Federal Tax Service website. You can generate a receipt yourself and pay the tax directly on the website.

You can activate registration at any Federal Tax Service or using a confirmed account through the State Services portal.

Is it possible to pay tax for another person?

From 2021, anyone can pay tax for you. The innovations do not specify the list of persons who have the right to do this. Now in the payment document, in the “Payer” field, the person actually making the payment must be indicated, and the purpose of the payment must indicate for which citizen the payment is being made.

Previously, everyone had to pay for themselves. It was possible to pay to a third party if the owner was under 18 years of age. The right to pay tax for a minor owner belonged to the parents.

Violations of the Tax Code

Fine for violating deadlines for submitting reports on insurance premiums

| On what basis: | Takes effect: |

| Article 119 of the Tax Code | from January 1, 2017 |

They will be fined for violating the deadlines for submitting calculations for insurance premiums. For late payment submission, a fine of 5% of the unpaid amount for each month is imposed. The maximum is 30% of the amount, the minimum fine is indicated as 1000 rubles. Regulated by the norms of the Tax Code of the Russian Federation in accordance with Art. 119 of the Tax Code of the Russian Federation.

Failure to pay insurance premiums, or violations of the rules for accounting for income and expenses, resulting in an underestimation of the base for calculating contributions, is now subject to a fine of 20% of the unpaid amount (clause 3 of Article 120, Article 122 of the Tax Code of the Russian Federation).

Violation of personalized accounting

| On what basis: | Takes effect: |

| Federal Law No. 27-FZ | from January 1, 2017 |

Violation of the deadline for providing SZV-M will also entail a fine of 500 rubles for each employee. Thus, the amount of the fine for a company consisting of 10 people will be 5,000 rubles.

A new fine has appeared for violations of the procedure for providing personalized accounting information. Failure to comply with the rules for providing information in the form of an electronic document will result in a fine of 1,000 rubles (Article 17 of Law No. 27-FZ).

A statute of limitations has been introduced for violations in the field of personalized accounting of 3 years. Regulated by art. 17 of Law No. 27-FZ.

Other changes

If you do not provide other documents, there is also a risk of receiving a fine. The fine is 200 rubles for each missing document (Article 126 of the Tax Code of the Russian Federation).

In 2021, failure to submit reports on time will result in the suspension of account transactions (Article 76 of the Tax Code of the Russian Federation).

Interesting facts about taxes

There have been many interesting facts related to taxes throughout the history of mankind, including in Russia.

- One of the initiatives of Peter I was the tax on baths, introduced in 1704. For their home baths, people had to pay from 15 kopecks (the rate for peasants) to 3 rubles (the rate for first-class merchants and duma people). All other classes contributed 1 ruble.

- During the time of Peter I they also levied a tax on non-working capital. It was considered contraband and was confiscated.

- Officials in the Tver region refused to collect taxes on dacha plots because delivery of receipts cost twice as much.