Tax Code >> Chapter 30

Article 372 General provisions

Article 373 Taxpayers

Article 374 Object of taxation

Article 375 Tax base

Article 376 Procedure for determining the tax base

Article 377 Peculiarities of determining the tax base within the framework of a simple partnership agreement (agreement on joint activities), an investment partnership agreement

Article 378 Peculiarities of taxation of property transferred to trust management

Article 378.1 Features of property taxation during the execution of concession agreements

Article 378.2 Features of determining the tax base, calculation and payment of tax in relation to individual real estate objects

Article 379 Tax period. Reporting period

Article 380 Tax rate

Article 381 Tax benefits

Article 382 Procedure for calculating the amount of tax and amounts of advance payments for tax

Article 383 Procedure and terms for payment of tax and advance payments of tax

Article 384 Peculiarities of calculation and payment of tax at the location of separate divisions of the organization

Article 385 Peculiarities of calculation and payment of tax in relation to real estate objects located outside the location of the organization or its separate division

Article 385.1 Peculiarities of calculation and payment of property tax of organizations by residents of the Special Economic Zone in the Kaliningrad Region

Article 385.2 Peculiarities of calculation and payment of tax in relation to property included in the Unified Gas Supply System

Article 386 Tax return

Article 386.1 Elimination of double taxation

Chapter 30 of the Tax Code of the Russian Federation Tax on property of organizations

| Chapter 29 | Chapter 31 |

Comments on Chapter 30 of the Tax Code of the Russian Federation - Organizational Property Tax

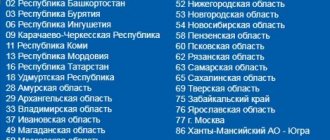

It’s worth starting with the fact that according to the Tax Code of the Russian Federation, the property tax of organizations is regional and a certain procedure for calculation and payment is established by the laws of the constituent entities of the Russian Federation, in addition to the Tax Code. That is, in accordance with the registration of property and connection to the region. The tax is quite common and can be paid by specialists. sensitive enterprises.

Table of changes in property tax 2014–2020.

The foundations for the reform of the property tax of organizations of the Tax Code of the Russian Federation were laid back in 2014 and continue to this day. We have collected the main changes in property tax in the table.

| Year | Change |

| 2014 |

|

| 2015 | The most significant changes in property tax since 2015:

The old rules for calculating property tax of organizations in the Tax Code of the Russian Federation in 2015 were changed in relation to the following points:

|

| 2016 |

|

| 2017 |

Read about the value of these rates in the material “Railroads received a property tax benefit .

|

| 2018 |

Read more about this innovation in the material “Tax on movable property of organizations from 2021”.

|

| 2019 |

For more details, see Art. “The tax on movable property has been abolished”

See here for details.

|

| 2020 |

See “Property Tax Advances: New in Calculation for 2021.”

|

In recent years, additional obligations for the provision of information on property tax of the Tax Code of the Russian Federation have been formulated:

- for legal entities registered in the Unified State Register of Legal Entities, who submit a declaration (tax calculations) to the Federal Tax Service and pay tax regardless of the fact of registration at the location of the property (clause 7 of Article 383 and clause 5 of Article 386 of the Tax Code of the Russian Federation);

- foreign legal entities and foreign organizations that do not form legal entities, which, together with the declaration, provide information about their participants (founders) with a participation share of more than 5% (clause 3 of Article 386 of the Tax Code of the Russian Federation).

ConsultantPlus experts have prepared step-by-step instructions for calculating and paying corporate property tax in 2020:

If you do not have access to the K+ system, get a trial online access for free.

Application procedure for VAT refund

The minimum value of the total amount of taxes, which gives the right to a declarative procedure for VAT refund, has been reduced. Previously, it was required that the total amount of VAT, excise taxes, income tax and mineral extraction tax paid over the previous three years be at least 7 billion rubles. Now it is enough that the specified amount is at least 2 billion rubles (new edition of subparagraph 1, paragraph 2, article 176.1 of the Tax Code of the Russian Federation).

The requirements for guarantors who undertake to pay taxes for a company or entrepreneur applying for a declarative VAT refund procedure have also been adjusted. Previously, the total amount of VAT, excise taxes, income tax and mineral extraction tax paid by the guarantor for the three previous years could not be less than 7 billion rubles. Now this figure has been reduced to 2 billion rubles. While the share of net assets corresponding to the amount of liabilities under surety agreements has been increased from 20% to 50%. In addition, there was a clarification that the guarantor should not have debts not only for taxes, fees, penalties and fines, but also for insurance premiums (new edition of clause 2.1 of Article 176.1 of the Tax Code of the Russian Federation).

All of these innovations apply to transactions made starting from October 1, 2021.

How Article 378.2 of the Tax Code of the Russian Federation was changed

Art. 378.2 of the Tax Code on corporate property tax, calculated using cadastral data, has been adjusted several times (see table below).

| Year | Adjustments to Art. 378.2 Tax Code of the Russian Federation |

| 2015 |

For information on where to find a list of objects subject to cadastral value tax in 2017 in Moscow, read the material “Moscow has approved the “cadastral” list for 2021.” |

| 2016 | The obligation to pay tax on the cadastral value is established not only for owners of property, but also for those who dispose of it according to the right of economic management (subclause 3, clause 12, article 378.2 of the Tax Code of the Russian Federation) |

| 2019 | The person conducting the calculation of the property of the partners is obliged to provide information on the cadastral value of the real estate that constitutes the common property of the partners (subclause 11, clause 6, article 378.2 of the Tax Code of the Russian Federation). |

| 2020 | Added taxation objects (see previous section). If the cadastral value of real estate has not been established, property tax is calculated based on the average cost of fixed assets (subclause 2.2, clause 12, article 378.2 of the Tax Code of the Russian Federation) Sub-paragraph has expired. 3 clause 12 art. 378.2 of the Tax Code of the Russian Federation that an object of real estate is subject to taxation from the owner of such an object or from an organization that owns such an object with the right of economic management |

Re-submission of documents previously submitted to the Federal Tax Service

The previous version of paragraph 5 of Article of the Tax Code of the Russian Federation prohibited inspectors from requesting for inspection documents that had previously been submitted to the Federal Tax Service. Now there is no such ban, which means tax authorities can request documents again. What to do in such a situation? If the taxpayer decides not to submit documents requested a second time, then he needs to notify the inspectorate that these documents have already been submitted. The notification should indicate the details of the document with which the requested contracts, invoices and invoices were submitted or to which they were attached, and the name of the inspection that received it. This must be done within the deadlines designated for submitting the requested documents.

This rule does not apply to original documents submitted by the taxpayer and received back by him, as well as to documents lost by tax authorities “due to force majeure circumstances.” Such papers must be submitted a second time. The corresponding amendments come into force on September 3, 2018.

Receive requests from the Federal Tax Service for free and send the requested documents via the Internet

What tax clarifications will the Federal Tax Service request?

The listed points significantly complicate not only the calculation of property tax, but also its verification. Since the Federal Tax Service cannot easily obtain data for its calculation from accounting, it will ask organizations for clarification.

The most likely questions will be about data decryption:

- for movable property registered since 2013, and since 2015 related to preferential property;

- fixed assets from 1–2 depreciation groups;

- residual value of fixed assets subject to tax based on cadastral value;

- residential properties not included in the OS;

- depreciation of residential properties reflected in the balance sheet;

- the cost of land plots included in the OS.

For information on how land tax is calculated, read the article “How to calculate land tax for 2021 in 2021 (example)?” .

Results

In recent years, many changes and additions have been made to the tax legislation on property tax: movable property of the 1st and 2nd depreciation groups was removed from taxation (until 2021, movable property acquired after 2013 was also subject to the benefit); began to be calculated based on their cadastral value and other innovations.

From 2021, movable property is not subject to property tax, if such a possibility is provided for by regional legislation.

If the regional authorities have not adopted such a law, movable objects are taxed at a rate of 1.1%. From 2021, movable property is excluded from taxable objects. Since 2020, property tax, calculated based on cadastral value, is levied on the property of individuals. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.