Important information: starting from 2021, employers no longer submit information on the average number of employees in the KND form 1110018. In accordance with the order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] information on the number of employees is included in the DAM report, which is required submit by February 1, 2021 for the 4th quarter of 2021.

Calculation of the average number of employees must be done taking into account the requirements of Rosstat, and this is not always easy. What is the average number of employees and how to calculate it?

Payroll and average number

The SSC indicator is closely related to the headcount indicator. To understand how to calculate the average payroll, let’s figure out who is on the payroll.

The payroll (or payroll) takes into account everyone with whom employment contracts have been concluded at their main place of work.

IMPORTANT!

If the founder of the organization works under an employment contract, he is also included in the payroll.

IMPORTANT!

For inclusion in the payroll, the duration of the employment contract does not matter. Even if the employee worked only 1 day, he must be taken into account when calculating the indicator.

To determine the payroll number, such an important document as a working time sheet . In order to have correct data, a time sheet must be kept every day , noting in it those who came to work and those who for some reason did not show up.

In addition, for each person who appears at work, the amount of time (hours) worked should be noted on the timesheet.

Based on the notes on the payroll in the time sheet, you can then determine the average number of employees for a period of time.

Regulatory framework

When forming the personnel roster, the employer should adhere to the provisions of the following legislative documents:

- Instructions for filling out forms No. 498;

- Instruction number 17-10-0370. This document was developed and approved by Rosstat back in the USSR, but is still valid today.

To accurately determine the payroll, the employer should use the following personnel documentation:

- Employment orders;

- Personal cards of employees;

- Orders to terminate employment relationships;

- Orders on the transfer of employees to other places of work;

- Other.

Calculation of the average headcount using the Rosstat methodology

The basic methodology for calculating the SCN was established by Rosstat - the Instructions were approved by order No. 711 dated November 27, 2019.

Let us note that previously the accountant may have encountered other rules for calculating the SCH. This was due to the fact that extra-budgetary funds (PFR and Social Insurance Fund) offered their instructions for calculating the indicator indicated in the reports for them.

For example, the Law “On Insurance Contributions” No. 212-FZ (repealed) included the phrase “the average number of individuals in whose favor payments and other remunerations are made.” Thus, all individuals receiving remuneration from the policyholder were included in the calculation of the SCH for the funds. Including those who do not need to be taken into account according to the Rosstat methodology (for example, external part-time workers and those working under GPC agreements).

By 2021, laws and other regulations with such wording have lost force . All laws and instructions for calculating the SCN for different departments now refer to the Instructions of the authorized statistics body. That is, Rosstat.

Let's consider the rules for calculating the average headcount according to the current Rosstat Instructions.

How to reflect in documents

Currently, such an indicator as the actual number of employees is not included in any reporting document, but regulatory authorities may still sometimes request such information. The form of its provision can be different (for example, a statement of distribution of the number of employees of the annual actual volume or a letter on the number), but most often a certificate is used, filled out by the responsible persons of the enterprise (chief accountant or personnel inspector) in free form.

Calculation of the average value for a full month

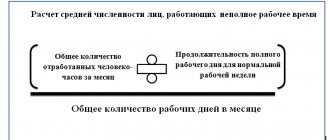

The formula for calculating the average headcount for a month, given in the Rosstat Instructions, is as follows:

The number of employees on a weekend or holiday is recognized as the same as on the working day the day before.

IMPORTANT!

2 categories of employees are taken into account in the payroll, but are not included in the SSC. This:

- employees on maternity and child care leave;

- employees who took additional unpaid leave to enroll in educational institutions.

EXAMPLE

As of December 31, the payroll numbered 20 people. The New Year holidays lasted from January 1 to January 10. Since the 11th, 3 new employees started working. Since January 20, one employee went on maternity leave. What is the average headcount for January?

- from January 1 to January 10 (10 days) – payroll 20 people;

- from January 11 to January 19 (9 days) – 23 people;

- from January 20 to January 31 (11 days) – 22 people (on payroll 23 people, but to calculate the MHC we exclude the employee on maternity leave).

TSS for January = (10 (days) × 20 (persons) + 9 × 23 + 11 × 22)/31 = (200 + 207 + 242)/31 = 20.93 = 21 ( rounded to whole units).

How to calculate the number of employees

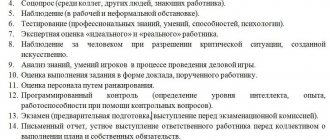

When calculating the number of employees, you should be guided by Rosstat Resolution No. 69 dated November 20, 2006 (hereinafter referred to as Resolution No. 69). It sets out in detail the procedure for determining the payroll number of the organization and the total number of all employees, including external part-time workers and those who work under civil contracts.

Average headcount

Basically, the accountant calculates the average number of employees. For example, in one of the options for calculating the share of profit attributable to separate divisions, it is necessary to determine the share of the average number of employees (Article 288 of the Tax Code of the Russian Federation). This indicator is also used in Chapters 21 “Value Added Tax” (Article 149 of the Tax Code of the Russian Federation), 24 “Unified Social Tax” (Article 239 of the Tax Code of the Russian Federation), etc.

In addition, the opportunity to submit tax reports in paper form is provided based on this criterion. This is defined in Article 80 of the Code. Let us recall that in 2007, taxpayers whose average number of employees in 2006 did not exceed 250 people had this right. This is established in paragraph 6 of the Federal Law of December 30, 2006 No. 268-FZ. From January 1, 2008, the limit will be 100 people. Other taxpayers must submit tax returns electronically, unless a different procedure for submitting information constituting a state secret is provided for by the legislation of the Russian Federation.