Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

Accounting is regulated by law. An accountant always has with him Federal Law No. 402-FZ “On Accounting” and 24 accounting regulations (PBU), which are considered federal standards. If an accountant has doubts about accounting, he first turns to PBU. In the article we will provide a reference book of PBU with a brief description.

Why do you need PBU 4/99?

PBU 4/99 (hereinafter referred to as PBU) was introduced for mandatory application by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n.

This PBU represents a methodological basis and set of rules for the preparation of reporting by legal entities. Its effect applies to all organizations, with the exception of credit and state (municipal) institutions (clause 1 of the PBU), which are guided in reporting matters by special methodological documents, also approved by the Ministry of Finance of the Russian Federation. For example, autonomous municipal institutions operate in accordance with the order of the Ministry of Finance of the Russian Federation dated December 28, 2010 No. 191n. In PBU 4/99, an accountant will be able to find answers to the questions (clause 3 of PBU):

- about the report forms used;

- about the procedure for their compilation;

- about a simplified version of accounting;

- about the features of the formation of consolidated, liquidation and reorganization reporting;

- on the publication of reporting documents in the media.

Read about who can create accounting reports in a simplified form in this article.

In what cases, when preparing financial statements, is it permissible to deviate from the rules of PBU 4/99? The answer to this question is in ConsultantPlus. Get free demo access to K+ and go to the material to find out the opinion of K+ experts.

Impairment of exploration assets

The new standard does not clarify what impairment of exploration assets is, but it does specify in detail in which situations this procedure must be performed.

Accountants have already encountered the term “impairment” in PBU 14/2007 (clause 22). But if checking for impairment of intangible assets is the right of the company, then in relation to exploration assets this is already an obligation. In both cases, this check should be carried out according to the rules of IFRS, namely IAS 36 “Impairment of assets” (Appendix No. 24 to the order of the Ministry of Finance of Russia dated November 25, 2011 No. 160n).

IAS 36 is based on new characteristics for Russian accountants of non-current assets – “fair value less costs to sell” and “value in use”. The first indicator in practice is determined based on the market value of the object (Article 7 of the Law of July 29, 1998 No. 135-FZ “On Valuation Activities”). And the second indicator is calculated as the discounted value of the cash flows expected from the commercial use of the asset during its service life. Of these two values, you need to establish the larger one and compare it with the book value of the asset. A negative difference would represent an impairment loss on the asset. The value of the asset must be reduced by the amount of this loss:

DEBIT 91 CREDIT 08 subaccount “Exploration assets”

– impairment of a specific exploration asset (MPA or NPA) has been identified.

Let's take, for example, an exploratory well classified by the company as an MPA. Let’s assume that at the date of the impairment test its book value is 15 million rubles, fair value is 11 million rubles, value in use is 14 million rubles. Of the last two indicators, for comparison with the book value, we select the largest - value in use. The difference between it and the book value in the amount of 1 million rubles (15 - 14) represents an impairment loss that must be reflected in accounting.

In essence, impairment is a specific way of depreciating an asset, depending on the characteristics and prospects of the company’s business. After all, revaluation is carried out based on market conditions, which are the same for all business entities (clause 43 of the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). But cash receipts from the use of an asset are the result of the company’s management. But it must be recognized that assessing expected cash flows requires the accountant to form professional judgments that go beyond the scope of current accounting work. This will require specific information - for example, about the volume of oil or gas that a prospecting well will allow to be extracted from the subsoil.

As you can see, IFRS have become an integral part of the accounting regulatory system in Russia. Therefore, there is no reason to put off studying them “on the back burner”.

Users of financial statements

Accounting must be neutral in nature, that is, satisfy the interests of all groups of its users (clause 7 of the PBU), which can be divided into external and internal.

Internal include business owners, managers, internal services and company employees. For example, top managers are interested in final financial indicators for strategic planning of activities and adjustments to the current plan; Sales department specialists will be interested in information about receivables from counterparties for the purpose of further collection.

For internal purposes, a balance sheet may:

- be drawn up for a specific date;

- have an abbreviated form;

- formed for each type of economic activity of the company;

- appear in the form of a current forecast, preliminary and interim report.

External users may need financial information for various purposes:

- tax authorities - to verify the correctness and completeness of payment of taxes and fees;

- credit organizations - to assess the solvency and financial stability of the organization, for example, when making a decision to issue a loan or loan;

- investors and sponsors - for a long-term assessment of their financial investments in a commercial business and obtaining financial returns;

- counterparties - to be confident in the reliability of your business partner.

To correctly analyze reporting indicators, various methods are used, which you will learn about from our material “Rules and methods for evaluating balance sheet items .

Latest edition of PBU 4/99 “Accounting statements of an organization”

The latest (current) edition of PBU 4/99 is dated November 8, 2010, as amended by the Decision of the Supreme Court of the Russian Federation dated January 29, 2018 No. AKPI17-1010. Compared to the text that existed before it, the provisions of the PBU have changed slightly.

The updates turned out to be related to the replacement of wording. The definition of “budgetary organizations” was replaced by “state (municipal) institutions” due to a change in the status of the latter (Order of the Ministry of Finance of the Russian Federation of November 8, 2010 No. 142n). Such institutions were divided into budgetary, autonomous and state-owned.

And the Supreme Court excluded from the PBU the requirement for the preparation of interim reports by all organizations.

Financial statements of the organization according to PBU 4/99 in 2020–2021

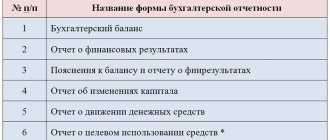

The financial statements for 2021 include (clause 5 of the PBU):

- balance sheet;

Read about the rules for filling it out in the article “Procedure for drawing up a balance sheet (example)” .

For a sample filling, see the material “Balance Sheet for 2021: Sample Completion.”

- financial results report;

For information on how to fill it out, read the article “Filling out Form 2 of the balance sheet (sample)” .

- reports on changes in capital, cash flows and intended use of funds;

For information on these forms, see the publication “Filling out Forms 3, 4 and 6 of the Balance Sheet” .

- explanatory note for accounting.

Read about the features of its design in the material “Drafting an explanatory note to the balance sheet (sample)” .

ATTENTION! From 2021, financial statements, incl. simplified, submitted exclusively electronically. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2021 the reporting forms were updated.

We prepare an annual report with Consultant Plus

The developers of the legal reference system Consultant Plus traditionally publish an annual analytical material, “A Practical Guide to Annual Accounting Reports.” This material usually includes very detailed explanations about the formation of an accounting report for the year, with examples, comments, samples of filling out document forms, etc.

The unique tool contained in this material, the “Interconnection of indicators” section, will help you once again check your finished report for the correctness of the details.

Read more about the Practical Guide to the Annual Report from Consultant Plus.

General rules for preparing financial statements according to PBU 4/99

Despite the fact that each form has its own characteristics of filling out, the PBU prescribes a general approach to the preparation of accounting records, which highlights the following points:

- accounting records must be reliable and complete, must be compiled in accordance with the norms of current legislation (clause 6 of the PBU);

- it is filled out in Russian (clause 15 of PBU) and indicating the amounts in rubles (clause 16 of PBU);

- for enterprises with branches, unified (general) reporting is generated (clause 8 of the PBU);

- data for the reporting year must be interrelated with previous periods (clause 33 of the PBU);

- the allocation of information reflected in the reporting determines the principle of materiality (clause 25 of the PBU);

- reporting period - calendar year (clause 13 of PBU);

- it is possible to prepare interim reporting (clauses 48–52 of the PBU) on a monthly or quarterly basis on an accrual basis with 2 mandatory forms (balance sheet and financial results report) no later than 30 days after the end of the period;

- accounting records are open to access by interested parties (clause 42 of the PBU);

- assets and liabilities of the balance sheet are divided into short-term (up to 1 year) and long-term (more than 1 year) (clause 19 of PBU);

- accounting data should be confirmed by an inventory of property and liabilities (clause 38 of the PBU);

- offset between the items of assets and liabilities, profits and losses is not carried out, except for the cases prescribed in PBU 4/99 (clause 34 of PBU);

- indicators must be reflected at net (net) value (clause 35 of PBU 4/99).

In the report header you will need to indicate:

- the unit of measurement is in thousands of rubles, you cannot fill out reports in millions;

- code from OKVED2.

Reporting deadlines and penalties for lateness

Organizations have 3 months after the end of the reporting year to generate reporting forms. The last day of March is the last possible date. Submission of accounting reports after it threatens with fines.

In 2021, this date falls on a weekend, so it is shifted to the next working day - no later than 04/02/2018, your reporting should reach:

- to the statistics body (Rosstat order No. 220 dated March 31, 2014);

- to the tax authorities (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

If you fail to send reports on time, penalties may follow:

| Violation | Code article | Amount of fine, rub. | Who pays |

| Accounting statements submitted late (or not submitted): | |||

| 19.7 Code of Administrative Offenses | 3,000 ─ 5,000 rub. | intruder |

| 300 ─ 500 rub. | official of the offender | ||

| Clause 1 of Article 15.6 of the Code of Administrative Offenses | ||

| clause 1 art. 126 Tax Code of the Russian Federation | 200 rub. for each reporting form | intruder |

Example

TransGroup LLC was 4 days late in sending accounting reports to statistics. As a result, the material losses of TransGroup LLC to pay penalties will amount to (minimum) 3,300 rubles. (3,000 rub. + 300 rub.), of which 300 rub. will be paid by the general director of TransGroup LLC, and 3,000 rubles. the company will transfer from its current account.

Read also

11.12.2017

Contents of financial statements

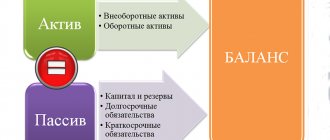

The balance sheet must indicate the financial position of the company as of the reporting date (clause 18 of the PBU). This is achieved by reflecting data on the balances in the accounts of assets and liabilities as of this date. The balance sheet includes numerical indicators reflected in 5 of its sections (clause 20 of the PBU):

- 2 asset sections dedicated to non-current and current assets;

- 3 sections of liabilities allocated to capital and reserves, long-term and short-term liabilities.

Income and expenses in the financial results report are divided into ordinary and other, which must be presented in several numerical indicators (clause 23 of the PBU).

Explanations for the balance sheet and financial results report take the form of 3 additional reports (on cash flows, changes in capital, intended use of funds) and an explanatory note (clause 28 of the PBU).

Explanations for accounting statements must contain the following information (clause 27 of the PBU):

- on the availability at the beginning and end of the period, the movement of fixed assets (including leased ones) and intangible assets, financial investments; on capital, issued shares, accounts receivable and payable, reserves for future expenses;

- about sales volumes;

- about production costs;

- about other income and expenses;

- about received and issued obligations;

- about emergency events that occurred in the activities of the enterprise;

- about facts that happened at the enterprise after the reporting date.

And also (clause 31 of PBU):

- legal address of the company;

- main types of activities carried out by the enterprise;

- data on the average annual number of personnel;

- composition of the executive and supervisory bodies of the company, indicating positions.

The cash flow statement must reflect information about cash flows for 3 types of activities: financial, current and investing. It discloses actual data on balances at the beginning and end of the reporting period, cash inflows and outflows (clause 29 of the PBU).

The report on changes in capital must inform about the decrease and increase in capital: additional, authorized, reserve (clause 30 of the PBU).

The explanatory note must contain a note stating that the statements have been prepared in accordance with the requirements of Russian accounting legislation (clause 25 of the PBU).

Explanations must contain information about the applied accounting policy and additional information disclosing the data included in the reporting (clause 24 of the PBU). This information cannot be shown in the balance sheet and financial results report. But without them it is impossible to give a real assessment of the financial condition of the enterprise.

Company liabilities

Liabilities are a company's obligations to provide cash or other benefits to another party. A liability occurs when another party provides funds for the company to use. There are two types of liabilities: 1) Capital - the rights of the owner or owners to the company's assets. 2) Liabilities - rights to the company's assets of individuals and organizations other than the owners that arose as a result of past transactions and events, for example if the company took out a loan or goods were delivered to it. When settling liabilities, there is usually an outflow of assets (usually cash).

Classification of liabilities

Liabilities are usually divided into equity (the rights of the owner) and liabilities (the rights of external parties). Liabilities, in turn, are classified as short-term and long-term. Current liabilities are amounts due in the short term (usually within 12 months). Long-term liabilities are amounts payable that do not qualify as current liabilities.

Publication of financial statements

Since accounting must be open to its users, the enterprise must provide access to it. Some companies are required to publish their financial statements. These include:

- public joint stock companies;

- credit and insurance organizations;

- companies preparing consolidated financial statements;

- joint stock companies and LLCs that engage in public placement of securities.

Public joint stock companies are exempt from the obligation to publish accounting reports in printed publications (letter of the Ministry of Finance of the Russian Federation dated June 5, 2014 No. 45n).

Results

PBU 4-99 - Financial statements of an organization are mandatory for use by all legal entities in our country, except for credit and state (municipal) organizations.

This document sets out the composition of accounting reports, its content, the procedure for compilation and publication. Accounting records must be complete and reliable, and also formed in accordance with the norms of current legislation. The financial statements include 6 forms. In cases of a mandatory audit, its conclusion is attached to the accounting records. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.