When filling out the declaration, you should pay attention to the following features:

- “TIN” and “KPP” fields in each section of the declaration are filled in automatically from the client’s registration card in the “SBIS” system. The page serial number is also filled in automatically;

- all lines 010

automatically reflect the code of the municipality in accordance with OKTMO. You can find out your OKTMO code using the electronic services of the Federal Tax Service “Find out OK” (https://nalog.ru, section “All services”); - in all lines 020

from the directory, budget classification codes are selected, according to which the amounts of indirect taxes are credited.

Attention! In accordance with the Protocol on the collection of indirect taxes within the EAEU, along with the declaration, it is necessary to submit:

- application for the import of goods and payment of indirect taxes;

- a list of applications, which reflects the details and information from those applications, information about which was received by the tax authority in the form provided for by a separate international interdepartmental agreement.

- Title page

- Section 1. The amount of value added tax payable to the budget in respect of goods imported into the territory of the Russian Federation from the territory of member states of the Eurasian Economic Union

- Section 2. The amount of excise duty payable to the budget in relation to excisable goods imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union, with the exception of ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, distillates wine, grape, fruit, cognac, Calvados, whiskey)

- Section 3. The amount of excise tax calculated for payment to the budget when importing ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, distillates of wine, grape, fruit, cognac, Calvados, whiskey), into the territory of the Russian Federation from territories of member states of the Eurasian Economic Union

- Source documents

Who rents

The report on indirect taxes is not included in the list of mandatory reporting for all taxpayers. The declaration must be provided to a limited number of persons. Here's who submits VAT on indirect taxes:

- importers from the countries of the Eurasian Economic Union - legal entities and individual entrepreneurs;

- payers of indirect taxes - value added tax and excise taxes.

The Eurasian Union includes Russia, Belarus, Kazakhstan, Kyrgyzstan and Armenia. If you are a domestic business and import goods from one of these countries, then you are required to file an indirect tax report. VAT on imported goods is paid at the rates accepted in the Russian Federation (10%, 20%).

VAT on imported goods

In the case where goods are imported from the EAEU countries and are subject to VAT, the same tax rates apply as for production in the Russian Federation. Accordingly, their sizes are 10% and 20%.

All importers are payers of import VAT, regardless of the taxation system applied. For example, if an organization applies the simplified tax system, it still must pay VAT if it imports goods from the EAEU countries.

Important! For import transactions, it is necessary not only to pay VAT, but also to submit a tax return to the Federal Tax Service.

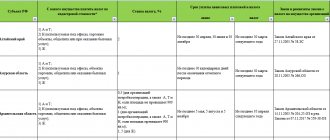

Due dates

They submit a VAT return only in the month in which the import operations were carried out. If the taxpayer received imported products in the current month or transferred a leasing transfer provided for in the agreement, then the report must be submitted to the regulatory authorities. This condition determines the deadline for submitting the 2021 indirect tax return. If you are working with imported goods in the current month, report by the 20th of the next month. In cases where the month is non-operational, there is no need to submit a declaration.

Failure to meet deadlines will result in sanctions. If you are late with your indirect tax return, you will have to pay a fine. The amount of the penalty is not less than 1000 rubles and not more than 5% of the declared tax payment.

Checking the 1C database for errors with a 50% discount

We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

Which form to use

In 2021, a tax return for indirect taxes is submitted in the form of KND 1151088, approved by Order of the Federal Tax Service of Russia No. SA-7-3 / [email protected] dated September 27, 2017. This standard consolidates innovations not only in the format of the form (Appendix No. 1), but also in the rules for filling it out (Appendix No. 2). The remaining annexes specify the coding procedure for imported products.

Title page

On the title page, the payer fills in all the details, except for the section “To be completed by a tax authority employee”

.

When filling out the “Adjustment number” in the primary declaration for the tax period, “0” is automatically entered; in the updated declaration for the corresponding tax period, you must indicate the adjustment number (for example, “1”, “2”, etc.).

In the "Tax period"

The tax period code and the year for which the declaration is being submitted are automatically indicated.

The field “Submitted to the tax authority (code)” reflects the code of the tax authority to which the declaration is submitted, according to the certificate of registration with the tax authority. By default, the program enters the tax authority code specified in the payer’s registration card.

In the “Location (accounting)” , select the code for the place of submission of the declaration by the payer from the corresponding directory. Thus, the largest taxpayers choose code “213”, ordinary organizations - “214”, individual entrepreneurs - “120”, etc.

When filling out the “Taxpayer” , the full (without abbreviations) name of the organization (separate division) is reflected in accordance with the constituent documents or branch of the foreign organization. If an individual entrepreneur submits a declaration, his last name, first name, and patronymic name (in full, without abbreviations) are indicated in accordance with the identity document.

Attention! Fields “Form of reorganization (liquidation) (code)”

and

“TIN/KPP of a reorganized organization”

are filled out only by those organizations that are reorganized or liquidated during the reporting period.

“Contact telephone number” field automatically reflects the telephone number specified when registering the taxpayer.

The field “On ____ pages” indicates the number of pages on which the declaration is drawn up. The field value is filled in automatically and recalculated when the composition of the declaration changes (adding/deleting sections).

When filling out the field “with supporting documents or their copies on ___ sheets”, the number of sheets of supporting documents or their copies (if any) is reflected. Such documents may be: the original or a certified copy of a power of attorney confirming the authority of the taxpayer’s representative (if the declaration is submitted by the taxpayer’s representative), etc.

In the section of the title page “I confirm the accuracy and completeness of the information:” the following is indicated:

- 1 - if the document is submitted by the taxpayer,

- 2 - if the document is submitted by a representative of the taxpayer.

In this case, the full name of the taxpayer or representative and the name of the document confirming his authority are indicated.

Also in this section of the declaration, in the field “I confirm the accuracy and completeness of the information”

The date is automatically indicated.

How to fill it out correctly

The rules for filling out excise and VAT returns are similar to those that apply to other tax registers:

- in the report, only those sections that directly relate to the activities of the taxpayer and for which actual transactions were carried out are filled in;

- dashes are placed in all unfilled fields;

- falsification of information is prohibited;

- corrections on paper, the use of a proofreader, going beyond the boundaries of cells, or damaging pages with fastening tools are not allowed;

- the declaration is certified by the manager or other responsible person entrusted with reporting.

The indirect tax report itself consists of a title page and three sections. The front part and the first section are filled out by all excise taxpayers. Information in the remaining blocks is generated as needed. A current example of filling out an indirect tax return for 2021 will help specialists correctly report to regulatory authorities and avoid sanctions for providing incomplete or unreliable information.

Indirect Tax Return 2021

The declaration form was updated in 2021, and there have been no changes since then. Continue to use the form that was approved by the Federal Tax Service by Order dated September 27, 2017 N SA-7-3 / [email protected] The Order provides for sending the declaration electronically and explains the procedure for filling it out.

Filling out an indirect tax return

The declaration combines payments for value added tax and excise taxes. It includes four sheets - a title page and three sections. The title page and the first section are filled out by all taxpayers who have accepted imported goods for registration, and those whose lease payment due under the contract has come due. The second and third are only those tax payers who import excisable goods and have the corresponding indicators. The third section is needed to calculate excise tax amounts on goods containing ethyl alcohol.

Title page

- Indicate the TIN and KPP of the organization. Individual entrepreneurs indicate only the TIN, and in the “Checkpoint” there is a dash;

- if you are submitting an initial declaration, enter the adjustment number - 0, for an updated declaration - 1, 2 and so on;

- the tax period is a month, so in the appropriate field indicate the month number “01” for January, “02” for February, etc.;

- fill in the “provided to the tax authority” field with the appropriate code, and if you submit a declaration at the place of registration, fill out the “at location” field, indicating code 400.

- In the “reporting year” indicator, indicate the year of the tax period. For example, in the declaration for February 2021 - “2021”.

- In the “taxpayer” field, provide the full name of the organization in accordance with the documents or the full name of the entrepreneur.

First section

At the top, indicate the TIN, KPP and page number. Next, in the appropriate lines, indicate the code OKTMO and KBK of the payment, and in line 030 enter the amount of VAT payable. It is calculated by adding lines 031–035 of the first section, each of which is allocated for its own purposes. For example, 035 for lease payments, and 033 for goods resulting from work.

Example. Paris LLC purchased equipment worth 45,000 rubles and goods for processing worth 4,000 rubles in Kazakhstan.

- Line 032: 4,000 × 20% = 800 rubles

- Line 031: 45,000 × 20% = 9,000 rubles

- Line 030: 9,000 + 800 = 9,800 rubles.

Accordingly, if you paid for goods that were the results of work, paid trade loans or lease payments, take these expenses into account when calculating the total tax amount on line 030. The cost of goods exempt from VAT under Chapter. 21 of the Tax Code of the Russian Federation and imported from the EAEU countries is reflected in line 040.

Second section

In the second section, filling out lines 010, 020 is similar to the first - we indicate OKTMO, KBK. Line 030 reflects the total amount of excise tax payable, calculated as the sum of lines 050 of the second section for the corresponding BCC. In line 040, indicate the country code, it can be found in OKSM: code for Armenia - 051, Kazakhstan - 398, Belarus - 112, Kyrgyzstan - 417.

When calculating the amount of excise duty for each product, indicate:

- code of the type of excisable goods from Appendix No. 5 to the Order and code of the unit of measurement, according to OKEI;

- if you purchased a motorcycle or car, indicate in the column the engine power in horsepower (kW/0.75), and for products with ethyl alcohol - its percentage;

- volume/quantity of goods - only for goods containing ethyl alcohol, or cars, motorcycles. In other cases, put a dash.

- tax base;

- in line 050 - the amount of excise tax on this product.

The declaration may have several sections two if the standard number of lines is not enough to reflect all the indicators.

Third section

The third section must be filled out in case of importing ethyl alcohol from all types of raw materials: denatured ethyl alcohol, raw alcohol, distillates of wine, grape, fruit, cognac, Calvados, whiskey.

Fill out lines 010-040 similarly to the second section. Next, specify:

- The code for the type of alcohol can be found in Appendix No. 5 to the procedure for filling out the declaration established by Order of the Federal Tax Service No. SA-7-3 / [email protected]

- code of the type of excisable product for the production of which the imported ethyl alcohol will be used. If the products manufactured are not excisable goods, put a dash in the column.

- the code indicating the application of the excise tax rate on alcohol is indicated in Appendix No. 6 to the procedure for filling out the declaration established by Order of the Federal Tax Service No. SA-7-3 / [email protected]

- tax base in liters.

In line 050, enter the amount of excise tax payable to the budget in rubles, and in line 060 indicate the number of the notice of payment of the advance payment or exemption from it, if any.

How and where to submit

The report is sent to the Federal Tax Service. Submit the form to the authority at the place of registration or location (in this case, code 400 is indicated on the title page). A completed and verified indirect tax declaration is submitted simultaneously with a package of documents certifying the fact of import operations. Here are the forms provided along with the resulting report:

- bank account statement confirming cash flow;

- agreement between importer and supplier;

- all commodity and transport registers (waybills, invoices);

- agency or guarantee agreement;

- 2021 Indirect Tax Statement;

- application for transfer of VAT and excise taxes to the budget;

- other documents as required by the Federal Tax Service.

The declaration is provided in electronic form. All accompanying forms are sent to the inspection in scanned form. If the inspector requires forms for reconciliation, you will have to bring the original documents legalizing the import of goods to the Federal Tax Service office.

How to submit an indirect tax return in 2021

The reporting period is 1 month, therefore, if you imported goods from EAEU member countries during the month, fill out and submit a declaration for the next month. The form must be submitted by the 20th day of the month following the imported goods were accepted for registration. If a company imports goods that are the subject of leasing, then the declaration is submitted in the month following the leasing payment.

Submit the declaration to the tax office at the place of registration. This can be done in person, send the document by mail or via TKS. If you decide to submit the declaration yourself, the submission date will be the day you brought the document to the tax office. When sent by mail or TKS, the day of presentation coincides with the day of dispatch.

Along with the declaration, the taxpayer must submit a package of documents. They can be submitted in the form of certified copies with a seal, except for import and tax applications. Package includes:

- application for import of goods;

- application for payment of indirect taxes;

- bank statement confirming payment of taxes;

- transport documents, invoices and shipping documentation;

- contract for the purchase of imported goods;

- contract of assignment, commission or agency.

The preparation of invoices, commodity or shipping documents may not be provided for by the legislation of the counterparty, then the tax authorities cannot demand them from you.

You can deduct the VAT that you paid when importing goods from the EAEU after the tax authority confirms payment of the tax. A tax deduction can be obtained if you use goods in activities subject to VAT, or when providing services (performing work), the place of sale of which is not recognized as the territory of the Russian Federation.

Author of the article: Elizaveta Kobrina

The cloud service Kontur.Accounting will help you accurately prepare indirect tax returns and other types of reporting. Reporting is generated automatically, and you don’t have to visit the tax office - you will submit your declarations online. Get free access to the service for 14 days right now.

VAT rate

The rate is influenced by the nature of the imported valuables - 10 or 18%.

To determine the appropriate rate for imported goods, you need to set codes according to the Commodity Classification of Foreign Economic Activity of the Customs Union, and then compare them with the codes of goods for which a 10% rate is provided (they are listed in special lists of the Russian government). If among the imported goods and materials there are goods from these lists, then you need to use a rate of 10%, otherwise - 18%.

An example of determining an appropriate rate

The company imports capers from Germany to the Russian Federation. What rate should I apply?

In the Commodity Nomenclature of Foreign Economic Activity of the Customs Union, capers are included in category 0709 “Vegetables..” and have the code 0709 99 400 0. This code is included in the list of goods with a 10% rate, approved by Resolution No. 908 of December 31, 2004, so when importing capers, companies need to calculate added tax of 10%.

How to pay VAT when importing from Belarus and Kazakhstan

An organization applying a special tax regime imports goods from the territory of countries participating in the Customs Union. Special regime officers who imported goods from the territory of the Republic of Belarus or Kazakhstan are also payers of import VAT (clause 1, article 2 of the Protocol ratified by Federal Law of May 19, 2010 No. 98-FZ, clause 1 of the Procedure approved by order of the Ministry of Finance of Russia dated 7 July 2010 No. 69n).

Such organizations are required to calculate VAT, transfer it to the budget and submit a special tax return, attaching all the necessary documents to it (clause 8 of Article 2 of the Protocol, ratified by Federal Law No. 98-FZ of May 19, 2010).

Package of necessary documents

Before filling out the declaration report, prepare the documents necessary to complete and confirm import transactions. List of required documentation:

- agreements, contracts or agreements on the basis of which imports of goods, works, services are made;

- invoices, invoices accompanying the delivery;

- transport declarations, if the cargo is transported by a transport company;

- payment documents (payment orders, checks, receipts, money orders, bank statements, currency conversion certificates, etc.);

- customs declarations and certificates confirming import and payment of customs duties;

- excise tax declarations when importing excisable products;

- other.

Controllers have the right to request other supporting documentation. For example, the customs declaration number in the VAT return. This is the customs declaration registration number assigned to reporting during inspection by customs authorities. For details, see the article “How to find out and indicate the registration number of the customs declaration.”

VAT calculation

If the need to add tax is determined and the current rate is determined, then VAT can be calculated as follows:

VAT = (customs value of imported valuables + duty + excise tax) * tax rate

The amounts of duties are determined by the Unified Customs Tariff of the EAEU. Excise rates are determined by Art. 193. Tax Code of the Russian Federation.

If the goods are exempt from duty and the imported valuables are not excisable, then it is enough to multiply the cost of the goods and materials by the tax rate.

VAT is determined for each item of imported valuables, after which the amounts of additional tax are summed up for all items. The amount received must be converted into Russian rubles.

You need to calculate the added tax yourself, and then reflect its amount in the DTS-1 or DTS-2 declaration. If the customs authority disagrees with the calculations made, an adjustment will be made, with which the declarant can either agree or try to defend his opinion (including in court).

How are copies of the application distributed?

The importer will be required (clause 1 of the Rules for filling out the application - Appendix No. 2 to the Protocol on the exchange of information between the tax authorities of the EAEU member countries dated December 11, 2009):

- 4 paper copies of the application + application in electronic form; or

- electronic application signed with digital signature.

For what purpose the digital signature obtained from the Federal Treasury is used, find out from the publication.

Distribution of paper versions of the application:

- 1 - tax authorities take it;

- 1 - the importer keeps it;

- 2 - the importer sends it to his counterparty (to confirm the validity of applying the zero VAT rate).

Learn about ways to submit various reports to controllers from the following materials:

- “How do you submit SZV-M reports on paper?”;

- “Electronic reporting via the Internet - which is better?”.

Additional Tips

There are several ways to submit your declaration. The most impressive is the electronic version. But printed ones are also common.

The second option is more often used by smaller firms. It must be provided in an approved form that is computer oriented. The declaration is filled out manually or printed on a printer. In this case, correction of records and double-sided printing are not allowed.

Sometimes it can be difficult to correctly determine the tax base.

When registering goods that are subject to excise taxes, it is formed by the following articles:

- the estimated value of the cost of goods that were sold within the allowable period;

- volume of products sold in kind;

- a combined tax amount collected from fixed percentages.

In other situations, the tax base is formed on the basis of the cost indicators of imported products. If the goods are the result of the fulfillment of contractual obligations, then the costs of the entire transaction are recognized as the cost. Certain expenses can increase the tax base.

General provisions

Among the most important provisions, the following factors should be highlighted. The new declaration form came into force in July of the tenth year. Order of the Ministry of Finance 07/07/2010 No. 69N confirms this. The deadline for submission is earlier than the twentieth day of the month following the month in which the imported products were registered.

Materials for filling out the document when importing products from states that are members of the customs union:

- Order of the Finance Ministry No. 69;

- reference Information;

- VAT allowance;

- 2021 and 2021 Annual Tax Reports articles;

- nuances of filling out documents when importing things from Armenia, Belarus, and Kazakhstan.

Filling example

Let's look at how to fill out a declaration when importing goods from the Republic of Belarus. An example of filling out a VAT return for imports is generated using several data.

Vesna LLC imports goods from Belarusian organizations. For September 2021, the company calculated indirect taxes on goods accepted for registration:

- tax in the amount of 16,952 rubles;

- excise tax in the amount of 4180 rubles. on alcohol-containing products (dietary supplements).

The total volume of the batch is 25 liters. The content of anhydrous ethyl alcohol in it is 10 liters.

Vesna LLC filled out the title page, sect. 1, 2 declarations.

Sample: declaration for import from Belarus

Postings

Transactions for calculating tax payments are attributed to account 68 of accounting. Reflect in your accounting the following entries for indirect VAT taxes:

| Contents of operation | Debit | Credit |

| Customs VAT calculated | 19 | 76, 68 |

| VAT charged | 90, 91, 19, 76, 62 | 68 |

| VAT is accepted for deduction | 68 | 19 |

| Tax withheld by tax agent | 60, 76 | 68 |