A certificate of fixed assets on the balance sheet is a document that contains a breakdown of fixed assets indicating their residual value as of a certain date.

A breakdown of the book value of property is not one of the mandatory documents included in the financial statements. Such a document is often requested by banks for information about the property pledged when applying for a loan. The form of the form is not regulated by law. Typically, credit department specialists develop the transcript form themselves. The accountant can only enter data on fixed assets.

In addition to banks, detailing of fixed assets is of interest to potential investors - when assessing the value and structure of assets, and business owners - when determining the share during liquidation. The tax authorities have the right to request an extract from the financial statements on the structure of the operating system when conducting an audit on the calculation of income tax. In this case, in addition to the cost of the objects, an explanation of the accrued depreciation will be required.

In some situations, it is required to provide a certificate for a specific object or separately for each fixed asset without indicating the cost. An approximate example of a certificate stating that property is listed on the balance sheet is as follows:

| Limited Liability Company "Ppt.ru" 456789, Russia, Subject of the Russian Federation, prosp. Wonderful, no. 1 INN 1234567890 KPP 121001001 OGRN 2323454567001 "09" December 2021 Reg. No. 101 This is to certify that the Daikin FAQ100В/RR100R/W² air conditioner is the property of and is on the balance sheet of Ppt.ru LLC, inv. number 0102/1212. Gene. Director:_______________/Petrov P.P./ Ch. accountant:___________/Viktorova V.V./ M.P. |

When necessary

In most cases, an accounting certificate about the availability of fixed assets also shows their residual value according to the balance sheet. She:

- helps business owners and its participants analyze the composition and condition of the company’s non-current assets;

- confirms the calculation of income tax;

- promotes insurance, as well as obtaining investments and loans.

The document in question shows the cost of the operating system on a specific date. At the same time, the accounting certificate on the book value of fixed assets is not included in the mandatory financial statements.

Here we remind you about paragraph 49 of the “Accounting and Reporting Regulations” (approved by order of the Ministry of Finance of Russia dated August 29, 1998 No. 34n). According to it, fixed assets appear on the balance sheet at their residual value. It is obtained by adding the actual costs of their acquisition (construction, manufacturing) minus accrued depreciation.

Another important point. Based on paragraph 29 of PBU 6/01 “Accounting for fixed assets,” even if a fixed asset is fully depreciated, it is still kept on the balance sheet because it is used in the operation of the enterprise. That is, there is no need to include fixed assets in the [accounting certificate] when there is (was) a basis for writing it off:

- disposal (sold, morally or physically obsolete, transferred to the capital of another company);

- cannot generate income.

Also see “Service life of fixed assets from 2021: working with changes.”

Why do you need a certificate?

Despite the fact that the certificate is a fairly informative document and can describe in detail the financial picture of the company’s activities, it does not apply to the mandatory documents included in the financial statements.

Most often, it is required to conduct analytical work on the activities of the enterprise and maintain internal reports and records, as well as, in some cases, for interested structures “from the outside.”

The certificate is relevant, for example, when it is necessary to confirm the solvency and reliability of an organization in banking and credit institutions, insurance companies, in front of potential or existing investors, counterparties, etc.

Form

In essence, an accounting certificate on the book value of fixed assets is an extract from the balance sheet. The accountant forms it himself or using special accounting programs.

The mandatory or recommended form of such a document is not approved by law. Therefore, any organization has the right to develop its own form and record it by order of the head.

In its most general form, a sample accounting statement about fixed assets may look like this:

| Where required Certificate of book value of property This is to confirm that, according to accounting data, the book value of property owned by LLC "_______________" as of "____" ______________ 20___ is __________________ (in words) rubles ___ kopecks. Listing of property and its value (can be in tabular form): |

A more specific example of an accounting certificate about the value of a fixed asset may look like this:

| Limited Liability Company "Guru" ACCOUNTING REPORT No. 18-OS Moscow 03/31/2017 As of April 1, 2021, the residual (book) value of the building located at the address: Moscow, st. Ryabinovaya, 17, building 3, with a total area of 75.3 sq. m. m according to those. BTI passport No. 07-09-04444 dated September 10, 2005, accounted for as part of fixed assets (excluding revaluation), amounts to RUB 8,045,458. Performed by: accountant____________Shirokova____________/E.A. Shirokova/Chief Accountant____________Pirogova____________/N.Yu. Pirogova/ |

Also see “Accounting statement: how to draw it up correctly.”

Read also

09.06.2020

Who writes what information into it?

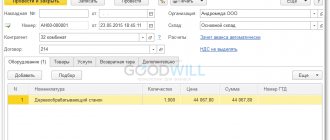

The document is prepared by an accountant using data from the program. For preparation, balance sheets for accounts 01 and 02 are used. By uploading one of these reports into Excel and adding a column with depreciation data for each object, we get the necessary decoding.

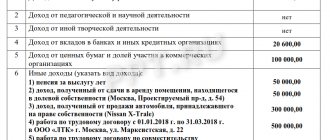

Here, as an example, is a sample extract on fixed assets from the balance sheet provided to the Federal Tax Service:

Explanation for the article “Fixed assets”

The course work is assessed taking into account the results of its defense.

Elements of the course work must be: 1) title page, which indicates the name of the educational institution, faculty, department, discipline, option (grade book number), as well as the last name, first name and patronymic of the student and teacher to whom the work is submitted for review; 2) content, which indicates the name of the theoretical question with a plan for it and the practical tasks presented in the work with an indication of the pages; 3) theoretical part - a detailed answer to the question of the course work in accordance with the option and points of the developed plan; 4) practical part - solving a task with recording data in the prescribed manner, drawing up analytical tables with calculations and explanations; 5) list of used literature.

What is book value. its assessment and truthfulness

Info

In addition, such terms of transactions as the quantity (volume) of goods supplied, deadlines for fulfilling obligations, payment terms usually applied in transactions of this type, as well as other reasonable conditions that may affect prices are taken into account. In this case, the terms of transactions on the market of identical (and in their absence - homogeneous) goods, works or services are recognized as comparable if the difference between such conditions either does not significantly affect the price of such goods, works or services, or can be taken into account using amendments (p .

9 tbsp. 40 of the Tax Code of the Russian Federation). Thus, only if the sale price of land plots deviates by more than 20% from the sale price of land plots with similar quantitative and qualitative characteristics, the tax authority can impose additional taxes based on the application of market prices.

Who draws up the document

The responsibility for drawing up the document is usually assigned to an employee of the accounting department, i.e. an employee who has access to the financial performance of the company.

After the certificate is generated, it must be submitted to the chief accountant for signature, then it must be endorsed by the director.

You need to be very careful when drawing up the certificate; the future of the enterprise sometimes depends on how correctly it is filled out. That is why no errors, inaccuracies, and especially unreliable or deliberately false information in the certificate are unacceptable. If a mistake does occur, you should not correct it; it is better to fill out a new form.

Accounting for entertainment expenses

Representation expenses of a simplified company must be taken into account in accounting. In this case, a posting is generated: Debit 20, 44 and so on – Credit 71. For tax accounting purposes, in the “expenses” column, a note is made that expenses are not accepted.

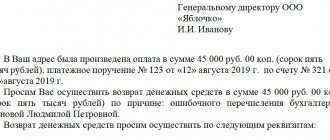

A document such as advance reporting is used to confirm entertainment expenses. It can be found in the tab called “bank and cash desk”.

In the “advances” tab, the document on which the funds were issued must be indicated, and entertainment expenses themselves must be reflected in the “other” tab.

How to determine the book value of a land plot

The procedure for maintaining the state real estate cadastre, approved by order of the Ministry of Economic Development of Russia dated 02/04/2010 N 42). The form of a cadastral certificate on the cadastral value of a property was approved by order of the Ministry of Economic Development of Russia dated 10/01/2013 N 566 and is an extract from the state real estate cadastre containing information on the cadastral value object and its cadastral number (clause 4.1, part 2, article 14 of the Federal Law of July 24, 2007 N 221-FZ). An accounting certificate (form 0504833) is the primary document for recording changes in the cadastral value of a land plot.

Why do you need an extract from the balance sheet?

What kind of explanations and extracts accountants have to compile in the course of their work!

Some of them must be designed according to strictly established standards, others - in any form. One of these “arbitrary” documents is an extract from the balance sheet. There is no specific form for it - each statement is unique and depends on what information and in what volume the user requires.

Let us dwell on the most common situation when an extract from the balance sheet is needed in connection with the company’s decision to exercise the right not to pay VAT (Article 145 of the Tax Code of the Russian Federation).

NOTE! This right is granted by paragraph 1 of Art. 145 of the Tax Code of the Russian Federation for those whose revenue excluding VAT for the previous 3 months in a row did not exceed 2,000,000 rubles.

About how to obtain exemption under Art. 145 of the Tax Code of the Russian Federation, read this material .

Other expenses not included

In addition to entertainment expenses, the tax base cannot be reduced by the following expenses:

- for marketing services;

- for disinfection;

- to connect water and electricity supplies;

- for various promotions for clients;

- for drinking water for company personnel;

- for various printed publications subscribed by the organization;

- to attract workers from other companies (engaged in other activities);

- for the arrangement of the company's office;

- for advertising;

- for staff pensions;

- VAT amounts;

- for certification of workplaces;

- to purchase property rights;

- customs duties when importing goods from abroad;

- penalty for violation of contract terms;

- registration costs.

Every accountant should be able to do at least three things:

- draw up a balance sheet;

- find the error;

- draw up an accounting statement.

It is the last point that will be discussed in this material. First, let’s find out what kind of paper this is. And where can I find a sample accounting certificate?

Registration of a certificate

The certificate can be written by hand or typed on a computer, on an ordinary A4 sheet or on the company’s letterhead (the latter option is preferable because it a priori includes the company’s details).

It is important to strictly observe only one condition - the document must be signed by the head of the organization (or a person who is his official representative), as well as the chief accountant. In this case, the signatures must be “live” - the use of facsimile autographs, i.e. printed in any way is unacceptable.

Today it is not necessary to certify a certificate using various types of stamps - this should be done only when the norm for the use of seals and stamps for endorsing papers is enshrined in the internal local legal acts of the company.

The certificate is usually made in one original copy, but if there is any need, additional certified copies can be made.

Information about the certificate is entered in a special accounting journal, and if it is intended for a third-party institution, also in the outgoing documentation journal.

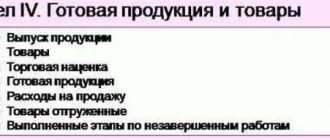

Explanations of the main lines of financial statements

rub.

(as of the last reporting date) Machinery and equipment Prod. and household inventory Other fixed assets Explanation of pages 1170 “Financial investments” and 1240 “Financial investments (except for cash equivalents)” Residual value, rub.

(as of the last reporting date) Nature of the investment (for example, investments in shares, acquired shares in an LLC, long-term loan) Repayment period (if any) Structure of buyers (customers forming at least 5% of revenue are indicated) Share in revenue Structure of suppliers ( suppliers that form at least 5% of the cost are indicated) Share in the cost As of the last reporting date Nature of the debt (under a supply/contract agreement/advance payment, etc.) Balance of the debt (thousands)

Current and non-current assets

The assets of any company are divided into two types:

- Negotiable. These include:

- inventory, including products ready for sale;

- cash in the organization’s cash desk and in its current bank accounts;

- accounts receivable, i.e. everything that can be converted into monetary value in a short period of time.

- Non-negotiable . These are fixed assets and non-property assets, which are much more difficult to convert into monetary form (buildings, equipment, production, information systems, etc.).

Details about current assets.

Details about non-current assets.

A good indicator is if current assets are higher than non-current assets - in this case, the company is considered successful in terms of financial activities and solvent, which means that the likelihood of achieving its goals is much more serious.

Sample on how to draw up an accounting statement

There is nothing complicated in compiling this paper. Let's consider, for example, a sample accounting certificate about the correction of an error, or, as it is called, reversal. In it, the accountant must outline the essence of the transaction, as well as the circumstances under which the error occurred. It is also necessary to write entries with corrections and indicate how this affected taxes. If there have been changes in their calculation, you need to indicate which updated reports need to be submitted. The chief accountant certifies the accounting certificate with his signature.

Only on the basis of such paper can an accountant make corrections in the General Ledger of the organization, where no corrections are allowed.

Universal report in 1C

Another way to display the necessary information is to use a universal report (you can read more about it in the article). This report is based on register data. Which registers contain the necessary information can be seen by the movements that a particular document makes.

Let's consider the movements of the document “Acceptance for accounting of fixed assets” (Fig. 9).

There are many registers, let’s select the “OS location” information register and use it as an example to build a universal report (All functions – Reports – Universal report).

To generate a report, you first need to select a data storage object, in our case it is . Then select the register itself - “OS location”. Finally, we select the indicators: organization, MOL, fixed asset, period and registrar.

Entertainment expenses: general information

Representation expenses include:

- expenses for holding an official reception for negotiators;

- transportation costs for delivering company representatives to the venue of official events and back;

- costs of catering during official meetings and negotiations;

- costs for the services of translators who take an active part in the negotiations and are not full-time employees of the simplified company.

For general-regime organizations, entertainment costs are included in expenses in the amount of no more than 4% of labor costs in a given period. Representative expenses under the simplified tax system do not include income minus expenses in the list of expenses for simplifiers, since this list is closed. This means that these expenses are not taken into account and it is impossible to reduce the size of the tax base by them. However, despite this, representative costs must have an economic justification and be supported by documents.

You can verify your hospitality expenses through receipts, event programmes, expense reports and expense estimates. If entertainment expenses were paid non-cash, invoices and acts will serve as confirmation.

If entertainment expenses are incorrectly documented and do not have confirmation, the tax office may recognize them as personal and charge not only taxes, but also fines.

Car evaluation: sequence and duration

A car appraisal for inheritance can be done at any organization that deals with appraisal work.

At the same time, the information reflected in it is valuable for carrying out activities and making various types of management decisions. This is primarily due to the fact that fixed assets, unlike current assets, are less liquid and therefore more fully reflect the picture of the organization’s financial condition.

Also, in addition to using this certificate in the company’s own interests, investors, creditors and insurers can use it to assess the payment capabilities of their partner, as well as identify objects that can be used as collateral.

Sales and estimated value of land plots

- Attention

Change in cadastral value of land plots 2017

- Valuation of land plots to reduce cadastral value

- Land assessment

- Cadastral value

What is book value and the procedure for calculating it? Important Second: income from the rental of specific equipment or real estate is calculated for several years and then the property is valued using a certain formula. Third: the cost of restoring the property at the time of valuation is determined, and then, taking into account the depreciation rate, the value of the asset is determined using a formula.