| Year of application | Size |

| 2020 | — * |

| 2019 | 1,518 |

| 2018 | 1,481 |

| 2017 | 1,425 |

| 2016 | 1,329 |

| 2015 | 1,147 |

| 2014 | 1,216 |

* Important! From 2021, this deflator coefficient will not be established, because...

it was applied to inventory value, which in turn will no longer be used in calculating tax. Any deflator coefficient is a value established annually that is used to adjust tax payments taking into account inflationary processes. The deflator coefficient for personal property tax is thus a way of adjusting the inventory value of property items taking into account the amount of inflation for a certain period.

New coefficient for the third year according to the cadastre

Please note the following list of subjects of the Russian Federation:

For their residents who own taxable property, a cadastral valuation is used when calculating tax for the third year. Therefore, for the period of 2017 the coefficient has changed: it is 0.6 instead of 0.4 for the previous year 2016.

However, tax authorities do not apply this coefficient in two cases:

- If the tax calculated based on the inventory value exceeds the corresponding amount based on the cadastral value.

- The object belongs to those listed in paragraph 3 of Art. 402 of the Tax Code of the Russian Federation (trade and office buildings, etc.).

Also see What's New in 2021 Tax Notices.

Odds

Calculation of the tax rate, in general, is made by multiplying the cadastral value (CV) of the site by the tax rate (TS), which is established in the given area by local authorities.

The federal law only introduces restrictions on the upper limit of this rate, which depends on the intended use of the land. This NS can be equal to 0.3% or 1.5%.

A rate of 0.3% is used when calculating the taxable income for owners who use their land for housing or agricultural purposes (for example, for summer cottages, gardening or vegetable gardening).

In other cases, an SS of 1.5% is applied.

In some cases, when calculating the tax, coefficients are used to reduce or increase the tax amount. For this purpose, these coefficients are added to the ZN calculation formula as factors.

New coefficient for the second year according to the cadastre

Here is another list of Russian regions in which the Federal Tax Service calculates the property tax of individuals for 2017 in its own way:

Here the cadastral value is used for the second year. Accordingly, the coefficient for the 2017 tax period has changed: it is 0.4 instead of 0.2 for 2021.

Again, this coefficient of 0.4 is not used by tax authorities in two cases:

- The tax calculated based on the inventory value exceeds its corresponding amount based on the cadastral value.

- The object belongs to those listed in paragraph 3 of Art. 402 of the Tax Code of the Russian Federation (trade and office buildings, etc.).

Types of odds

The main types of coefficients for calculating ZN are given in Art. 396 of the Tax Code, which is devoted to the procedure for calculating ZN.

This article defines coefficients whose values depend on:

- from the time of use of the charger (Kv);

- from the availability of benefits under ZN (Cl);

- on the duration of housing construction on the landfill (Kuv.).

The coefficient Kv appears in the case when the taxpayer does not own the land plot for a full calendar year. In this case, Kv is the ratio of the value of whole months of ownership of the memory to the total number of months in the calendar year (12 months).

Moreover, if the ownership of the land plot appeared before the middle of the month inclusive, or it disappeared from the middle of the month, then part of the month of the emergence (termination) of the ownership right is taken as a full month.

If the ownership right appeared after the middle of the month or it disappeared before the 15th day, then this month is excluded from the period of ownership of the property.

Example 1. The right to land plot was registered on November 13. Then:

Kv = 2 months: 12 months = 0.1667.

Example 2. If this right is registered on November 20, then: Kv = 1 month: 12 months = 0.0833.

Authorities of municipalities or cities of federal subordination have the right to allow certain categories of taxpayers not to pay ZN.

Moreover, if the right to a benefit arises during the tax period, such benefit is taken into account using the coefficient Kl. Kl is the ratio of the number of full months during which there are no tax benefits to the total number of months in a year. In this case, an incomplete month of the start of the benefit or an incomplete month of the end of the benefit is considered a full month.

Example 3. The right to the benefit arose on June 2 of the current year. Then: Kl = 5 months: 12 months = 0.4167.

First year according to the cadastre

And these are the pioneer regions:

For their residents, property tax for individuals for the first time since 2021 is calculated based on the cadastral value of objects.

In the first year of payment of property tax under the new procedure, the coefficient for the tax period of 2021 is set at 0.2. Subsequently, every year it will increase by 0.2, respectively.

The general rule begins to apply that tax authorities do not apply this coefficient of 0.2 in two cases:

- The tax calculated based on the inventory value exceeds its corresponding amount based on the cadastral value.

- The object belongs to those listed in paragraph 3 of Art. 402 of the Tax Code of the Russian Federation (trade and office buildings, etc.).

New benefits and deductions

Now taxpayers have the right to make a deduction from the tax base in the amount of the cadastral value of 20 square meters. meters of total area not only in relation to the apartment, but also part of the residential building. A deduction is also provided for part of the apartment, but it is 2 times smaller and amounts to only 10 square meters. A similar procedure is provided for the taxation of rooms. And in Article 407 of the Tax Code of the Russian Federation, beneficiaries for this tax were added, and now disabled children can receive a tax benefit.

When the law was adopted, it was announced that as a result of the entry into force of all these amendments to the Tax Code of the Russian Federation, the Russian budget would lose about 6 billion rubles. This means that taxpayers-citizens will actually be able to save money.

New deflator

Please note these regions:

For them, the value of the deflator coefficient has been updated: 1.425 for the period of 2021 instead of 1.329 for 2016.

In some cases, the amount of tax can increase significantly, since the deflator coefficient is applied not to the amount of tax, but to the tax base (inventory value). This may change your tax rate.

Coefficients during construction period

Housing construction can be carried out both for one’s own needs (individual housing construction) and for its subsequent sale.

By using the increasing coefficient Kuv, the state stimulates, through tax policy, faster construction of facilities and a reduction in so-called “long-term construction”.

If individuals or legal entities carry out the construction of various commercial-type objects or residential buildings for the purpose of their further sale, during the first three years of construction the ZN is calculated with a coefficient of 2. If such construction is completed and the object is registered before the expiration of three years, then half of the amount tax paid will be considered overpaid. This amount must be returned to the taxpayer.

If construction continues for more than three years, then for a period exceeding three years, the owner will have to pay tax with a coefficient of 4.

However, after completion of construction and registration of the object, no refund is provided.

For individual housing construction, the procedure for using the ZN increase factor is different. For such construction, the ZN is calculated in the usual way (the increase coefficient is equal to one) for ten years. From the beginning of the eleventh year until the registration of the constructed dwelling, the tax will be calculated with a coefficient of 2.

Providing a plot of land for rent without bidding is possible only for certain categories of citizens or under certain conditions.

What are the nuances of land surveying? We talked about this in detail here.

The cadastral passport is the most important document for a land plot. How to get it, read our article.

Who pays property tax in 2021

Property tax, as before, is required to be paid by citizens who own real estate, which includes:

- residential buildings (note that diverse residential buildings located on plots of land that are allocated for housing construction are classified as residential buildings);

- residential premises (apartments, communal rooms);

- garages, parking spaces;

- unified real estate complexes;

- various unfinished construction projects;

- other buildings, structures, structures, premises considered to be real estate;

- shares in the above immovable properties.

If the taxpayer is the owner of housing in an apartment building, then he pays a tax payment based on the cadastral value of only the apartment itself, and for property included in the general property values of the apartment building (for example, landings, elevator, attic, etc. ), taxes are not required to be paid.

Property tax calculator

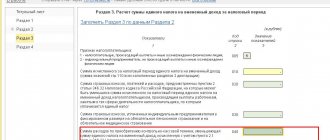

On the page of the official Internet resource of the Federal Tax Service there is a special calculator intended for calculating property tax. In order for the user to receive ready-made final amounts of tax payments, he will need to fill out the fields of the calculator one by one:

- enter the cadastral number of your real estate (you can find out this number from the cadastral passport or on the Rosreestr website);

- fill in the property characteristics requested by the system (the area of the property, its cadastral price, the category of the property - apartment, room, and so on);

- calculate the period of ownership of the relevant real estate (in order to pay the tax payment in 2021, the owner of the property will have to calculate how many months in 2015 he owned the property);

- enter a tax deduction (it can be viewed there, on the Federal Tax Service website);

- enter the amount of tax benefits provided, the list of which can also be found on the Internet resource of the Russian Federal Tax Service.

Ultimately, the tax calculator will produce all the required calculations for your 2015 property tax due.

Tax payment deadline

Payers of property tax in 2021, regardless of their region of residence, must pay the entire amount of the property payment no later than October 1, 2021. If the specified tax payment deadlines are violated, Federal Tax Service employees have the right to charge fines and penalties. Failure of the payer to receive a tax notice does not exempt him from paying the imposed fine.

Procedure for income tax refund when purchasing an apartment

How to carry out the consolidation of land plots in accordance with the Land Code

Subsidy for improvement of living conditions

All the details of obtaining an archival extract from the house register

Features of lifelong inheritable ownership of plots of land

How many acres in a hectare of land

Main legislative innovations

In Chapter 32 of the Russian Tax Code, which regulates the application of tax on real estate for citizen-owners, fundamentally new legislative rules have appeared:

- The base for property tax is established by the cadastral value of houses, apartments, dachas and other real estate. Previously, tax calculations were made on the basis of an inventory assessment carried out by BTI employees.

- For the complete transition of the Russian taxation system to the new calculation scheme, the legislator has established an intermediate transition period - from 2015 to 2021. During this five-year period, all Russian regions must switch to calculating the amount of property tax based on cadastral valuation.

- In some situations, the authorities of Russian municipalities have the right to independently determine the tax base, interest rates, and payment terms.

- New terms have appeared regarding the classification of real estate - parking space and a single real estate complex. The named immovable properties are subject to property tax at standard rates.