Tax regime for individual entrepreneurs

It should be noted that the individual entrepreneur pays all taxes and social contributions, even if he works as a single person, i.e. for himself. But they are accrued not on wages, but on income. An individual entrepreneur cannot pay his own salary; he receives his own income.

An individual entrepreneur can use the general regime for paying the following taxes:

- Personal income tax at the rate of 13% of income.

- VAT.

- Pension Fund.

- Social Insurance Fund.

- Federal Compulsory Medical Insurance Fund.

Income tax is calculated on the amount of income minus expenses. If there are no documents confirming the costs, the costs are considered conditional in the amount of 20%.

Individual entrepreneurs also pay taxes such as transport, property of individuals, land and water.

The entrepreneur keeps records of his activities

Payments not subject to taxation:

- Material aid.

- For donation.

- Alimony.

- Scholarships.

- Severance pay.

- Amount for damage caused in the form of injury.

- Business trips.

- Compensation.

General provisions for calculating payroll tax are specified in Article 210 of the Tax Code of the Russian Federation. Non-taxable income is discussed in Article 217. The regulation of tax deductions is set out in Articles 218–221. The nuances regarding the personal income tax rate are set out in Article 224.

New items in the list of non-taxable payments

Here is what income is not subject to personal income tax from 2021:

- one-time supplement to pension (clause 8.5 of Article 217 of the Tax Code of the Russian Federation);

- monthly payments to military veterans (clause 69 of article 217 of the Tax Code of the Russian Federation);

- payments to some self-employed people - nurses, tutors, housekeepers, cleaners, subject to notification of tax authorities about their employment (clause 70 of article 217 of the Tax Code of the Russian Federation).

Also see “Tax holidays for self-employed individuals from 2021”.

Personal income tax: calculation sequence

To calculate the amount of income tax on wages, the following algorithm is used:

- The salary is calculated in full.

- Highlight tax-deductible co-payments.

- The tax payer status is determined.

- The right to charge the tax of an individual taxpayer is justified.

- The tax deduction and the non-taxable portion of the income are subtracted from the total income.

- The final result is that part of the income from which personal income tax is calculated.

Calculation of income tax from salary

To calculate personal income tax, you must do the following:

- The necessary payments for a person are calculated: salary, bonus, additional payments. coefficients.

- An analysis is carried out for the presence of deductions and benefits.

- The tax rate is determined.

- Calculation is in progress.

According to Art. 217 of the Tax Code of the Russian Federation, the following payments are not taken into account during the calculation:

- State benefits, payments and compensations that are paid to a citizen in accordance with the legislation of the Russian Federation;

- Pensions (old age, social, long service);

- Rewards for medical care provided, for example, to donors;

- Alimony;

- Grants aimed at developing the scientific and cultural sphere of the state;

- One-time payments in accordance with the Tax Code;

- Scholarships;

- Income that is derived from economic activities, the resources from which were taken exclusively from the personal funds of the taxpayer;

- Inheritance;

- Shareholder payments (dividends are subject to certain taxes);

- Prizes for sporting achievements;

- Charitable help;

- Income received as part of military service.

You can find a complete list of exceptions for income taxation in the full version of the document of the Tax Code of the Russian Federation, Art. 217.

back to menu ↑

Rights of residents and non-residents

If the taxpayer is a resident of the Russian Federation, 13% is charged on his income. For non-residents - 30%.

A citizen who stays within Russia for 183 days in one calendar year is considered a resident. The following categories correspond to this status:

- Citizens of Russia.

- Foreigners.

- Stateless individual.

It follows that a resident can be a person with different citizenship, regardless of his permanent place of residence.

At the end of each year, it is necessary to clarify the status of the tax payer in order to correctly calculate the amount of income tax.

An illustrative example of calculation

Let's take a clear example of calculating income tax:

There is an individual whose salary is 20,000 rubles per month, based on this indicator we make the calculation:

- Let's calculate the annual salary: 20,000 x 12 = 240,000 rubles.

Since the annual salary of the tax period must be at least 512 thousand rubles, and in our case this figure is less, then we take a rate of 13%.

- We take into account the required deductions and benefits. Let's assume that the citizen in question has 3 minor children. According to Tax Code of the Russian Federation 218, we have the following:

20,000 – 1400-1400-3000 = 14200 rub.

- We determine personal income tax: 14,200 x 13% = 1846

So, an individual, having a monthly income of 20,000 and benefits for three minor children, must pay personal income tax - 1846 rubles.

We have given a standard calculation example, let's look at a situation where some difficulties may arise.

Parents who are divorced, and accordingly one of them is raising a child, he is given a double deduction. For example, a citizen receiving 20,000 rubles instead of 1,400 rubles. deduction, has 2,800 rubles for raising a child under 18 years of age.

We get: 20,000 – 2,800 = 17,200 rubles. A tax rate of 13% is calculated on this amount, hence the amount of income tax:

17,200 x 13% = 2,236 rubles.

It follows from this that the net salary of this employee will be 17,764 rubles, but the difference of 2,236 is the amount of tax to be deducted.

Let's look at another example, but with an interest rate of 23%. Let's take an individual who has a salary of 60,000 rubles. The annual total will be 720,000 rubles. This figure exceeds the established minimum.

Therefore, in this example it is necessary to take into account the 23% rate. Then the amount to pay the tax will be as follows: 60,000 x 23% = 13,800 rubles.

back to menu ↑

Tax deductions

When calculating income tax, it is necessary to clarify whether tax deductions are applicable to a particular individual.

The following types of deductions exist:

- Standard. Benefits in the amount of 500 rubles. – participants of the Second World War and military operations; disabled people of І and ІІ groups; Heroes of the USSR and the Russian Federation; retired military; victims of the Chernobyl accident; 1,400 rub. are due to parents of minor children; 3,000 rub. – liquidators of the Chernobyl Nuclear Power Plant and PA Mayak with disabilities; parents or guardians of 3–4 children or a child with a disability; persons who became disabled during military operations; nuclear weapons testers.

If you fall into several categories, a larger deduction amount is taken into account. Standard deductions are taken by the employer.

- Social.

- Professional.

- Property.

To obtain a document confirming the right to deduction, you need to submit a declaration of income to the Federal Tax Service based on the results of the past year and present documents on expenses.

The calculation of the tax base is based on the following income:

- Salary.

- Rates.

- Premium.

- Allowances.

- Odds.

In a situation where an employee did not have earnings due to vacation or illness, income tax for this period is calculated based on average earnings.

Personal income tax is calculated for contractor employees in accordance with the general procedure.

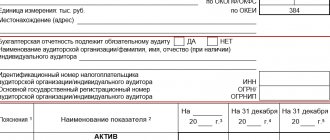

To calculate salary tax, you will need a 2-NDFL certificate. It is issued for the period worked (one year or six months) and contains the following information:

- About the employer.

- About the employee.

- Total and monthly income.

- Code values of deductions.

- Personal income tax amount.

This certificate is issued by the company’s accounting department within 3 days, certified by the signature of the boss and the company’s seal. No corrections are permitted in this document.

Certificate 2-NDFL is needed to obtain a large bank loan or a mortgage loan.

Sample certificate 2-NDFL

KND form code: 115 10 78

Peculiarities of settlements with refugees

How much personal income tax is charged to refugees?

| Foreign taxpayer status | Citizen status | Proc. Personal income tax | Standard deduction |

| non-resident (stays in Russia less than 184 days during the year) | refugee, person granted temporary asylum | 13 | not provided |

| resident (stays in Russia 184 days or more during the year) | refugee | 13 | provided |

| non-resident | lost refugee status and has not yet acquired resident status | 30 | not provided |

This procedure is regulated by paragraph 3 of Article 224 of the Tax Code.

Personal income tax for an employee with children

The income tax of an employee whose family has a child is calculated taking into account the standard deduction due to him. How to calculate the tax deduction due to an employee with children is determined by Article 218 of the Tax Code of the Russian Federation. The following documents are required for its calculation:

- Statement.

- Child metric.

- Certificate of full-time education of the child.

- Documents about disability.

- The second parent submits an application to waive such benefits.

The employer bases it on the employee's total taxable income. From the moment his income exceeds 280 thousand rubles, the tax base decreases every month:

- 1400 rub. for the first two children.

- 3000 rub. for the 3rd and subsequent children.

- 3000 rub. for a child with a disability.

- 3000 rub. for a full-time student until he turns 24 years old, if he has a disability of groups I and II.

Guardians, adoptive parents and trustees can also enjoy such benefits.

If the second parent refuses to receive the deduction or there is only one parent in the family, the benefit is accrued in double amount.

Parents have the right to a tax deduction from the first month of the child’s birth if he was born in the current year.

Who can receive personal income tax deductions?

Those citizens who:

- recognized as tax residents in Russia;

- receive income on which they pay monthly tax at a flat rate of 13%.

Important: to receive a refund on the duty paid, both of these conditions must be met.

There are categories of citizens who cannot count on receiving a tax deduction due to the lack of taxable income. These include:

- unemployed whose main source of income is state benefits;

- private entrepreneurs who are under a special tax regime and do not have income subject to personal income tax.

Please note that citizens working unofficially also cannot count on receiving a deduction. This happens because the employer does not make deductions from their wages to the tax office.

If you need to file a tax deduction, the deadline for filing a return is not tied to a specific date. You can submit an application to the tax office at any time, but only after the tax period. That is, to receive a deduction for 2021, the application must be submitted in 2018.

Important: you can apply for a deduction only for the previous 3 periods up to the year in which the deduction declaration was issued. That is, if you bought a home in 2013, and decided to receive a deduction in 2018, then only 2021, 2016, 2015 will be refundable.

Register now and get a free consultation from Specialists

Personal income tax for single mothers and pensioners (with formulas)

There are a number of categories of workers who need social protection, in particular single mothers. They are provided with double benefits, at the moment: 2000 rubles. per child and 400 per employee. This amount is deducted from income and only the remainder is taxed.

There are no benefits for working pensioners when calculating personal income tax (Chapter 23 of the Tax Code of the Russian Federation). Standard approaches apply to this category, in particular tax deductions if the retired employee has the right to them. If, for example, the pensioner has a dependent child or the pensioner has a disability, the amount of accrued income tax will be reduced by the amount of the corresponding tax deductions.

Formula tax calculation:

The following formula will help you get the correct result of the income tax amount:

Personal income tax = RNB x NS/100, where:

RNB - size of the tax base:

NS - tax rate.

Usually, as a result of calculations, amounts in rubles and kopecks are obtained, which complicates further monetary transactions. In accordance with clause 4 of Article 225 of the Tax Code of the Russian Federation, the amount of tax must be presented in full rubles. The rounding process is carried out as follows: if the amount is presented in rubles with kopecks up to 50, then the kopecks are discarded, if more than 50, then the amount is increased by 1 ruble.

You can also use the following formula:

CH = OD - NV, where

SN - tax amount, OD - taxable income, NV - tax deduction.

Calculation examples:

Standard tax calculation . Employee Nikitin A.O. has an income of 50,000 rubles, interest rate 13%:

50,000 x 13% = 6,500 rub.

The monthly tax amount is 6,500 rubles.

Personal income tax including tax withholding . The same employee has a minor child, which means he enjoys a benefit in the amount of 1,400 rubles:

(50,000 – 1400) x 13% = 6,318 rubles.

The amount of tax calculated every month, taking into account the deduction, is 6,318 rubles.

Personal income tax on vacation pay . Employee Nikitin A.O. was paid vacation pay in the amount of 48,000 rubles:

48,000 x 13% = 6,240 rubles.

The tax on vacation pay will be 6,240 rubles.

How to legally save on tax?

The state stipulates that in some cases Russians can count on a tax deduction. This is the name of a benefit that allows you to reduce the tax base and thereby get back part of the amount spent on purposes specified by the state.

Example. In 2021, Anna Viktorovna Zaitseva’s salary was 35,000 rubles per month or 420,000 rubles per year. 420 thousand rubles is the tax base from which income tax is withheld 420,000 * 13% = 54,600 rubles. Also in 2021, Zaitseva needed an operation costing 30,000 rubles. Anna Viktorovna, as a citizen of the Russian Federation, filed a deduction for treatment. As a result, the tax base decreased to 390 thousand rubles0). And the income tax, taking into account the recalculation, amounted to 390,000 * 13% = 50,700 rubles. It turns out that for 2021 Zaitseva overpaid to the budget 54,600 - 50,700 = 3,900 rubles. And Anna Nikolaevna should be returned 3,900 rubles as overpaid.

On a note! Only Russian citizens who pay income tax at a rate of 13% can count on a personal income tax refund.

There are five types of deductions:

- Social - deduction for your treatment or treatment of relatives, education of children.

- Standard deductions are provided to certain groups of the population (disabled people, veterans, families with minor children, etc.).

- Deductions upon sale of property.

- For investors.

- Professional.

The state has determined the maximum amounts from which a deduction can be obtained:

- Treatment - 120,000 rubles.

- Own education - 120,000 rubles.

- Education of a child, brother, sister - 50,000 rubles.

- When purchasing housing - 2 million rubles.

- When purchasing a home with a mortgage - 3 million rubles.

On a note! If the treatment of a Russian citizen is classified as “expensive”, there is no limit on the amount of deduction. The patient can receive a personal income tax refund on the entire amount he paid for the provision of medical services.

Most often, company employees receive deductions of 1,400, 3,000 or 500 rubles. Everyone who has minor children is entitled to the first type of deduction. The second is paid to the parent whose child has a disability. Five hundred rubles of tax money is returned to disabled adults.

How to apply for a benefit?

The procedure for applying for a tax deduction begins with submitting an application to the employer. You must also attach documents confirming your right to a refund:

- If a deduction is made for treatment, along with the application you must submit a 3-NDFL declaration, as well as checks and contracts for the provision of medical services.

- To apply for a deduction for property, contact the tax office and receive a notification about the possibility of returning your personal income tax indicating the exact amount. With the document from the Federal Tax Service and the application, go to the employer.

- Standard deductions are also processed by the company you work for. If you plan to receive benefits for a child, attach his/her birth certificate to the package of necessary documents.

On a note! If at the end of the year the amount of deductions is greater than income, the tax base and calculated tax will be equal to zero.

Changes in accrual in 2021

The main news for citizens of the Russian Federation is that taxes are not increasing. The basic rate remains the same - 13%. The highest rate of 35% is for those who receive high interest rates from bank loans, expensive prizes and winnings. For non-residents, 30% and 15% remain, depending on the source of income.

A 9 percent rate is used for the following types of income:

- If a resident of the Russian Federation receives income in the form of dividends from equity participation in the operation of the enterprise.

- Interest on bonds (before January 1, 2007) with mortgage backing.

Calculation example

Let's look at the example of Lampochka LLC: personal income tax - how much percentage of the salary, calculation of the withheld amount.

In Lampochka LLC the following people work in the design department:

- Sidorov S.I. is a citizen of the Russian Federation, has 3 minor children.

- Petrov G.N. - citizen of the Russian Federation, disabled.

- Svanidze S. Ya. is a citizen of Georgia, has been in the Russian Federation for 4 months, non-resident.

- Akopyan V.S. is a citizen of Armenia, has been in the Russian Federation for 4 months, non-resident.

- Delon A. is a French citizen, a highly qualified specialist, he has been in the Russian Federation for 4 months, a non-resident.

- Svetlanova M.I. - has refugee status, has been in Russia for 4 months, has 1 young child, non-resident.

- Gavrilin N.I. - has been in Russia for 4 months, has a patent for labor activity, the balance of the advance payment to the budget for personal income tax is 3000.

- Lvov P.P. - refugee, resident, has 1 young child.

- Kovtun I.V. - non-resident, received dividends.

The example shows monthly income, personal income tax percentage, rate, size.

Table for calculating deductions made for March 2021:

| Last name I.O. | Income for March 2017 | Status | Deduction | Percent Personal income tax | Personal income tax calc. | Prepaid expense. payment | Personal income tax due to the budget |

| Sidorov S.I. | 50000 salary | resident | 5800 | 13 | (50000-5800)x13%= 5746 | 0 | 5746 |

| Petrov G.N. | 50000 salary | resident | 500 | 13 | (50000-500)x13%= 6435 | 0 | 6435 |

| Svanidze S.Ya. | 50000 salary | non-resident | 0 | 30 | 50000x30%=15000 | 0 | 15000 |

| Akopyan V.S. | 50000 salary | non-resident | 0 | 13 | 50000x13%=6500 | 6500 | |

| Delon A. | 200000 salary | non-resident | 0 | 13 | 200000Х13%=26000 | 26000 | |

| Svetlanova M.I. | 50000 salary | non-resident refugee | 0 | 13 | 50000x13%=6500 | 6500 | |

| Gavrilin N.I. | 50000 salary | non-resident patent | 0 | 13 | 50000x13%=6500 | 3000 | 3500 |

| Lvov P.P. | 50000 salary | resident refugee | 1400 | 13 | (50000-1400)x13%= 6318 | 6318 | |

| Kovtun I.V. | 5000 Divylands | non-resident | 0 | 15 | 5000Х15%=750 | 750 |

Registration and retention

Income tax is calculated and calculated, and accounting entries are made:

Debit70 Credit68 - income tax subaccount - deduction from the earnings of an ordinary employee.

Debit76 Credit68 - income tax subaccount - deduction from the contractor's income under the contract.

Sample accounting entries with personal income tax:

Applicable to all forms of enterprise ownership

Highly qualified foreigners

For foreign highly qualified specialists (hereinafter referred to as HQS), the personal income tax rate does not depend on status and is always 13%.

Highly qualified specialists are foreigners who have work experience, skills or achievements, whose work is paid in accordance with Law No. 115 - Federal Law, Article 13, 2, paragraph 3.

The reduced income tax rate (13%) for high-tech foreigners applies only to remuneration for work activity: salary, bonuses, official bonuses, payment for work in the evening and at night, for work on holidays, etc.

Income not related to the wage fund is taxed at a rate of 30% (if the HQS has non-resident status).

These include: payment for the cost of travel documents to a vacation destination, reimbursement for treatment, payment for additional vacation days, and the like.

The rule for calculating the personal income tax rate of 13% is applicable when a specialist is working under an employment or civil contract for the provision of services, then the rate increases to thirty percent if the status of the HQS is non-resident.

Insurance and social contributions

In addition to personal income tax, various insurance and social contributions are deducted from wages (Federal Law No. 212 “On insurance contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund”). In 2021, changes have occurred: contributions to the Social Insurance Fund will not exceed 718 thousand rubles, pension contributions will not exceed 796 thousand rubles. (PRF Resolution No. 1265). There are no restrictions for the FFOMS.

Amounts of insurance premiums:

- Pension - 22%, (preferential - 20%), contributions exceeding the limit - 10%).

- FSS - 2.9%.

- FFOMS - 5.1%.

Innovation No. 7. The emergence of a new reporting form - annual 6-NDFL

This is an important answer to the question, personal income tax reporting in 2021: what changes have occurred. In 2021, companies submitted annual form 6-NDFL to the fiscal authorities for the first time. The deadline for submitting the form is 04/03/17 (April 1 is a non-working day, so the deadline is postponed to April 3).

All organizations and individual entrepreneurs that paid wages (or other forms of income) to individuals at least once during 2016 must submit the form. Even if the transfer was made once in January, after which there was no activity, an annual report is prepared.

The procedure for compiling the annual 6-personal income tax is similar to the formation of the quarterly one. The form states:

- all types of employee income;

- the deductions they receive;

- the amount of personal income tax accrued and paid to the budget throughout the state.

Tax officials will verify data from reporting forms submitted at the end of the year. Therefore, check whether the 2-NDFL report in 2017 is correct (changes must be taken into account) and whether its data matches the information in 6-NDFL.

If a company has not paid wages to anyone during the calendar year, it is not considered a tax agent and is not required to file 6-NDFL. This conclusion is contained in the explanations of the Federal Tax Service. In her opinion, there is no need to inform regulatory authorities about the reasons for failure to submit the document.

6 Personal income tax zero: to hand over or not?

Experts still advise you to play it safe and write to “your” Federal Tax Service a letter in any form (indicating the name of the organization, Taxpayer Identification Number, legal address), which will state the reason for failure to submit the form - the lack of payments to individuals in the reporting period. This will help avoid unnecessary questions and proceedings.

An accountant who wants to organize his work correctly and in accordance with the law must know everything about personal income tax in 2017: what changes (rate, deadlines, reporting) have occurred, how to take them into account in current activities. Keep your finger on the pulse of innovations, and you can avoid problems and disputes with regulatory authorities.

Similar articles

- Reporting period for personal income tax - dates from 2021

- KBK for personal income tax for employees

- Personal income tax changes in 2021

- How to reflect carryover vacation pay in 6 personal income taxes

- Deadline for submitting 2-NDFL (with sign 2) for 2021

Ways to minimize taxes

No matter how law-abiding the employer is, he is interested in making as few payments as possible on wages and, just like the employee, is interested in the minimum number of deductions from wages. To minimize the amount of tax payments, you can use the following instructions :

- It is advisable to hire according to the GPA. In this case, the employee becomes an individual entrepreneur who applies a simplified tax system. The income tax will be only 5% and 150 rubles. pension contribution. This is much less than personal income tax - 13% and insurance premiums up to 35%. There is another trick - show zero income, and then only the pension fee will remain.

- If you replace your salary with the payment of dividends from shares, you will not have to pay a single social contribution, but will only have to pay the 9% tax rate on dividends. For this purpose, another legal entity is registered, and the employees are registered as the founders of the company.

- Instead of an employment contract, a lease agreement is drawn up. Accordingly, not the salary is paid, but the rent. Thus, the income tax will be only 6%.

- Each structural unit of the enterprise should be registered as a separate legal entity and switch to a simplified taxation system. An agreement for the provision of services is concluded between the established companies. In such a situation, the main enterprise will pay lower rates for insurance premiums.

What percentage of fees are collected from the material benefits of citizens?

Typically, personal income tax is expressed as a percentage of wages. May vary for different categories of citizens.

- 35%. Applies to everyone in the case of payments that cannot be classified into any of the other categories, but which are regarded as a financial benefit. Citizenship does not matter.

- thirty%. In the case of foreign citizens staying in the country for less than 6 months.

- 9% - applies to the founders of mortgage departments.

- 13% - for all citizens of the Russian Federation, or foreigners with a stay in the country for 6 months or more.

Calculation formula, recommendations for determining the result

Personal income tax on the amount of wages for 2021 involves the use of the following algorithm in calculations:

- First, all the profit received at a certain workplace is added up. This applies not only to wages, but also to bonuses and other motivational transfers.

- The amount of deductions to which a particular citizen is entitled is determined.

- The second value is subtracted from the first value.

- The current status of the employee affects the final rate.

- Percentages are calculated from the amounts received after the first three steps. The money is then sent to the federal treasury.

- The salary is handed over to the employee, taking into account all the elements.

Calculation and transfer of payroll taxes is a monthly activity. An accurate determination of personal income tax is made easier if you fill out the form of special calculators. The step-by-step instructions are as simple as possible. At the first stage, the site visitor enters the amount of income, before subtracting tax rates. The next stage involves determining the rates applicable to the citizen.

At the last stage, press a button that automatically begins the calculation procedure. Below, in different lines, the calculation results will be shown. This allows you to understand how much salary a citizen will ultimately receive.

What if a citizen does not work in the Russian Federation?

Writing off taxes is an obligation that may not be enforced. This happens if you have registered for employment in a company from the Russian Federation, and the profit is provided by the same company. But the citizen is constantly abroad. Income is defined as received outside the state. This means that the employing company does not play the role of a tax agent.

When living abroad for 183 days or more, taxes are not deducted from your salary. Another situation is when they retain their resident status. Then payment of personal income tax remains mandatory.