One of the ways to receive fixed assets into an organization is their construction (manufacturing). An organization can build (manufacture) a fixed asset on its own or use the services of specialized organizations (contractors).

With the contract method of construction (manufacturing), the organization that will use the fixed asset in its activities can act either as a customer, or as a customer and investor at the same time (Parts 1–2 of Article 4 of the Law of February 25, 1999 No. 39 -FZ). The accounting procedure for operations related to the construction (manufacturing) of fixed assets depends on what functions the organization performs.

For organizations that have the right to conduct accounting in a simplified form, a special procedure for recording income and expenses is provided (Parts 4, 5, Article 6 of the Law of December 6, 2011 No. 402-FZ).

Initial cost

Fixed assets constructed by contract are accepted for accounting at their original cost (clause 7 of PBU 6/01). Include in the initial price:

- amounts paid to the contractor in accordance with the contract;

- amounts paid for information and consulting services related to the creation of fixed assets;

- the amount of VAT claimed (if the fixed asset will not be used in activities subject to this tax);

- other expenses directly related to the creation (for example, the cost of purchased materials; equipment intended for installation at the facility; costs of examining the safety of the facility, etc.).

This procedure is provided for in paragraph 8 of PBU 6/01, paragraph 5.1.1 of the Regulations approved by the Ministry of Finance of Russia dated December 30, 1993 No. 160, paragraphs 11–15 of PBU 2/2008.

A detailed list of expenses that form the initial cost of constructed (manufactured) fixed assets is given in the table.

During the operation of a fixed asset, its initial cost does not change. The exceptions are cases of completion (retrofitting), reconstruction, modernization, partial liquidation and revaluation of fixed assets. Therefore, if any costs associated with the construction (manufacturing) of an object (for example, interest on a loan) are incurred by the organization after its inclusion in fixed assets, do not change the original cost. And consider the costs as part of current expenses. This procedure follows from paragraph 14 of PBU 6/01.

The fixed asset was received under an exchange agreement

If an asset is received by an organization under an agreement that provides for its execution in non-monetary means, the initial cost will be considered the value of the assets transferred or to be transferred by the organization. This value is equal to the price at which the organization typically sells such assets. If their value cannot be determined, the cost of the fixed assets will be equal to the market value of similar fixed assets.

The transaction itself for accepting OS under a barter agreement will not differ from a regular purchase for a fee:

Debit account 08 – Credit account 60

However, this posting will be accompanied by a set of accounting records for the sale of the property transferred in exchange, as well as for the offset of mutual debt.

Let's show this with an example.

The organization on OSNO, in exchange for its finished products worth 312,000 rubles (in addition to VAT 18% - 56,160 rubles), received equipment from the organization on the simplified tax system. The exchange was recognized as equal. The cost of finished products is 298,000 rubles.

We present the accounting records for the exchange transaction with the organization receiving the equipment in the table:

| Operation | Account debit | Account credit | Amount, rub. |

| Revenue from the sale of finished products is reflected (312,000 + 56,160) | 62 “Settlements with buyers and customers” | 90 “Sales”, sub-account “Revenue” | 368 160 |

| The cost of finished products is written off | 90, subaccount “Cost of sales” | 43 “Finished products” | 298 000 |

| VAT charged on sales of finished products | 90, subaccount “VAT” | 68, subaccount “VAT” | 56 160 |

| Received equipment in exchange for goods | 08 | 60 | 368 160 |

| Reflected offset of debt under the exchange agreement | 60 | 62 | 368 160 |

| Equipment is accepted for accounting as part of fixed assets | 01 | 08 | 368 160 |

We talked about how the disposal of fixed assets is taken into account in our separate material.

Documenting

Determine the amount of expenses that form the initial cost of the object based on:

- primary accounting documents used in construction (act of acceptance of work performed in form No. KS-2, certificate of the cost of work performed and expenses in form No. KS-3, etc.);

- other primary documents confirming the costs incurred (customs declarations, business trip orders, etc.).

For registration, accept documents that contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

To accept the created fixed assets, the organization should create a commission, which should determine:

- whether the fixed asset meets the technical specifications and whether it can be put into operation;

- whether it is necessary to bring (rework) the fixed asset to a state suitable for use.

If the organization's staff consists only of a director, do not create a commission. In this case, its functions must be assumed by the director.

This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

After examining the object, the commission must give an opinion on the possibility of its use. This conclusion is reflected in the act in form No. OS-1.

Fill out the act in form No. OS-1 when accepting the object for accounting (at the time of reflection on account 01 “Fixed Assets” or 03 “Income Investments in Material Assets”) (paragraph 2 of the instructions approved by the Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7, Part 3, Article 9 of the Law of December 6, 2011 No. 402-FZ). Draw up the report on the basis of primary accounting documents and technical documentation attached to the construction contract.

Do not fill out the details of the donating organization, which are provided at the beginning of the act, as well as the sections “Information on the condition of the fixed asset object on the date of transfer” and “Passed over”. This is explained by the fact that for the contractor the constructed facility is not a fixed asset. Consequently, he is not obliged to draw up an act in form No. OS-1 (paragraph 8 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7, letter of Rosstat dated March 31, 2005 No. 01-02-09/205).

In the act in form No. OS-1, indicate:

- number and date of its compilation;

- full name of the fixed asset;

- place of acceptance of the fixed asset;

- factory and assigned inventory numbers of the fixed asset;

- depreciation group number and useful life of the fixed asset;

- information about the content of precious metals and stones;

- other characteristics of the fixed asset (total area, number of floors, etc.).

In addition, the act must contain the conclusion of the acceptance committee (for example, the entry “Can be used”). The executed act is approved by the head of the organization.

If a building or structure was manufactured under a contract, when accepting it for registration, fill out an act in form No. OS-1a. When filling it out, apply the same rules as when drawing up form No. OS-1.

If, under a contract, fixed assets (a group of homogeneous fixed assets) other than buildings and structures were manufactured, when accepting them for accounting, fill out a report in form No. OS-1b. When filling it out, apply the same rules as when drawing up form No. OS-1.

This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Simultaneously with drawing up the act in form No. OS-1a (OS-1, OS-1b), fill out the inventory card in form No. OS-6a (OS-6) or the inventory book in form No. OS-6b (intended for small enterprises) in one copy. Prepare an inventory card (book) based on the data in the act and primary documents. In the future, enter into the card (book) information about all changes that affect the accounting of fixed assets (revaluation, modernization, disposal). Reflect this information on the basis of primary documents (for example, on the basis of the acceptance certificate for modernized fixed assets in form No. OS-3).

This procedure is provided for by the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Situation: is it necessary, in addition to form No. KS-14, to also draw up form No. OS-3? The organization carried out technical re-equipment of production buildings, the acceptance committee drew up only an act in form No. KS-14.

Answer: yes, it is necessary.

Form No. KS-14 indicates that the customer accepted the work that the contractor performed for him, that is, the construction of the facility is completed. This act provides general information about who carried out the work at the site, indicates the author of the design and estimate documentation, and the cost of the order. The commission’s conclusion on the condition of the fixed asset is also given here. This conclusion can be drawn from the instructions for filling out the KS-14 form, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

Form No. OS-3 reflects other information: on the condition of objects before repairs (reconstruction, etc.), data on the costs of reconstruction or modernization. As well as the conclusion of the commission that carried out the acceptance and transfer of the fixed asset. In form No. OS-3, they record whether the restoration work has been completed and list the changes that have occurred. This follows from the instructions for filling out form No. OS-3, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Thus, Act No. OS-3 is a document on the basis of which the initial cost of a fixed asset increases after reconstruction or modernization.

Therefore, it is necessary to draw up both Form No. KS-14 and Form No. OS-3.

Attention: the absence (failure to submit) primary documents for accounting for fixed assets is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

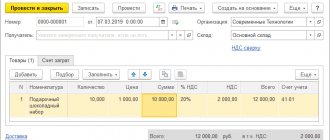

Postings for the construction of fixed assets

The OS can be created in-house or with the help of a contractor.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| Contract construction | ||||

| 08.03 | 60.01, 76.05 | Cost of contractor services | Cost of services, materials, etc. excluding VAT | Contract agreements, certificates of work completed, cost certificates, reports on materials consumption, customs declarations, travel orders, etc. |

| 08.03 | 07 | Equipment transferred to the contractor for work | ||

| 10.07 | 10.08 | Materials transferred to the contractor for work | ||

| 08.03 | 10.07 | Materials used by the contractor | ||

| 01.01 | 08.03 | Accounting for the created OS | Initial OS cost | Acceptance and transfer certificates (OS-1, OS-1a), OS-6 Inventory registration card |

| 19.03 | 60.01,76.05 | Total VAT on costs | General VAT per | Invoice |

| OS construction by the organization | ||||

| 08.03 | 10.01 | Materials for creating an OS | Costs incurred excluding VAT | Invoices, declarations, travel orders, bank statements |

| 08.03 | 70 (68,69) | Accrued wages to employees building the OS | ||

| 08.03 | 23,25,26,60,76 | Other costs | ||

| 19.01 | 60.01,76.05 | Total VAT on costs | VAT | |

| 01.01 (03.01) | 08.03 | Accounting for the created OS | Initial cost (excluding VAT) | Acceptance and transfer certificates |

| 68.02 | 19.03 | VAT deduction on building materials | VAT | Invoice |

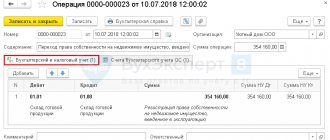

Accounting: cost reflection

In accounting, all costs associated with the construction (manufacturing) of an object (the cost of the contractor’s work, materials consumed, equipment transferred for installation at the site, etc.) are reflected in account 08-3 “Construction of fixed assets”. In this case, make the following entries:

Debit 08-3 Credit 60 (76)

– the cost of contract work for the construction of fixed assets is reflected (based on forms No. KS-2 and No. KS-3);

Debit 08-3 Credit 07

– reflects the cost of equipment transferred for installation to the contractor in the facility under construction;

Debit 08-3 Credit 23 (25, 26, 70, 76...)

– reflect other costs associated with bringing the object to a state suitable for use;

Debit 19 Credit 60 (76)

– VAT charged by the contractor is reflected, as well as on other costs associated with the creation of a fixed asset.

Situation: how to reflect the cost of construction work performed by a contractor in accounting? The construction contract provides for phased delivery of work.

The construction contract may provide for phased delivery of work (Articles 740 and 753 of the Civil Code of the Russian Federation). This means that as each stage is completed, the organization and the contractor must sign an act in form No. KS-2 and a certificate in form No. KS-3. Such rules follow from the instructions approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

At the moment when the act is signed, include the cost of the completed stage in the capital investments for the construction (manufacturing) of the fixed asset. That is, take into account account 08 “Investments in non-current assets”. This follows from the Instructions for the chart of accounts.

At this moment (subject to other conditions required for deduction), the input VAT presented by the contractor upon completion of this stage can be deducted (clauses 1 and 6 of Article 171, clauses 1 and 5 of Article 172 of the Tax Code of the Russian Federation, letters from the Ministry of Finance Russia dated March 5, 2009 No. 03-07-11/52, dated February 19, 2007 No. 03-07-10/06).

Include the finished object in fixed assets upon completion of the last stage of construction (manufacturing) (Instructions for the chart of accounts). In this case, draw up an act in form No. OS-1a (OS-1, OS-1b) (Part 1 of Article 9 of Law No. 402-FZ of December 6, 2011, instructions approved by the Resolution of the State Statistics Committee of Russia of January 21, 2003. No. 7).

Situation: how to reflect in accounting the cost of own materials transferred to the contractor for the construction (manufacturing) of a fixed asset?

In accounting, the cost of materials purchased for use in the construction (manufacturing) of a fixed asset is included in its initial cost. In this case, only those materials that are actually used can be included in the initial cost. This procedure follows from paragraph 8 of PBU 6/01.

The mere transfer of materials to the contractor does not mean that all of them were used in construction. Therefore, it is impossible to include the cost of all transferred materials in the initial cost of the object. You need to know how much materials were actually consumed. This information may be reflected in the contractor's report. There is no standard template for such a report, so it can be compiled in any form. The main thing is that it contains the mandatory details specified in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. The contractor's obligation to prepare such reports, as well as the frequency of their submission, should be stipulated in the contract. The right to demand the organization’s reports from the contractor is given by Part 1 of Article 748 of the Civil Code of the Russian Federation, according to which the customer can control, among other things, the contractor’s use of the materials transferred to him.

In accounting, the receipt of materials purchased for use in construction (manufacturing) is reflected in account 10-8 “Building materials”. When transferring materials to the contractor, transfer their cost to account 10-7 “Materials transferred for external processing”:

Debit 10-7 Credit 10-8

– reflects the cost of materials transferred to the contractor for the construction of the facility.

This procedure is provided for in paragraph 157 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

After the contractor submits a report on the materials used, include their cost in the costs that form the initial cost of the facility under construction:

Debit 08-3 Credit 10-7

– reflects the cost of materials spent on the construction of the facility.

This procedure is provided for in the Instructions for the chart of accounts.

Situation: how can a developer reflect in accounting the transfer of an unfinished construction project to conservation?

The decision to mothball an unfinished facility is made by the head of the organization (which is the construction developer). It is formalized by an order (instruction) in any form. In this document, indicate the time frame within which the documentation necessary to carry out the work and ensure the safety of equipment, structures and materials at the site will be prepared. An order for the conservation of an unfinished construction object is issued in the same way as an order for the conservation of a fixed asset object. Notify the contractor of your decision.

During conservation, an inventory of unfinished construction is carried out (clause 26 of the Regulations on Accounting and Reporting). The procedure for its implementation is established by paragraphs 3.32–3.35 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49. For unfinished capital construction, the inventories indicate the name of the object and the volume of work performed on this object, for each individual type of work, structural elements, equipment, etc. Inventory is carried out through control measurements. At the same time, the actual volumes of construction and installation work performed must be compared with the data of local estimates, as well as with the accounting data of the developer and contractor. After the inventory, the developer accepts from the contractor mothballed objects, as well as material assets that the contractor cannot use in the construction of other objects. For more information on conducting an inventory, see How to conduct an inventory.

After this, the parties must sign:

- estimates for work related to conservation and construction safety;

- act on suspension of construction in form No. KS-17 (approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100).

This procedure is confirmed by the letter of the USSR State Construction Committee dated August 18, 1986 No. 61-D.

A design organization is engaged to develop an estimate for the conservation and protection of a construction site. According to this estimate, the contractor performs construction and installation work on the basis of an additional agreement to the general contract. The developer pays the contractor for all work performed and costs associated with conservation. These rules follow from the provisions of Articles 452, 740, 752 of the Civil Code of the Russian Federation, paragraph 17.10 of the Methodological Recommendations, approved by Protocol No. 12 of January 5, 1999.

The costs associated with the conservation of an unfinished construction project, including the costs of its maintenance, should not be included in the cost of construction. Such costs in accounting form other expenses of the customer (clause 14 of PBU 2/2008). Reflect them on account 91 “Other income and expenses”. This procedure follows from paragraph 11 of PBU 10/99, Instructions for the chart of accounts (account 91) and letter of the Ministry of Finance of Russia dated January 13, 2003 No. 16-00-14/7.

In accounting, reflect this operation by posting:

Debit 91-2 Credit 10 (23, 60, 68, 69, 70...)

– the costs of conservation and maintenance of mothballed property are taken into account.

For the convenience of tracking information about the condition of the property for account 08, open a separate sub-account - “Objects of unfinished construction under conservation.” This approach is consistent with the Instructions for the chart of accounts (account 08).

Reflect the transfer to mothballing of an unfinished construction project by posting:

Debit 08 subaccount “Unfinished construction objects under conservation” Credit 08 subaccount “Construction of fixed assets”

– an unfinished construction site was transferred for conservation.

An example of reflecting the costs of conservation of an unfinished construction project in a developer’s accounting

Last year, Alpha LLC (developer) entered into an agreement with Proizvodstvennaya LLC (contractor) for the construction of an office for a period of two years. This year, construction has been stopped due to a lack of funds to cover costs. At the time of construction termination, the total cost of the work performed was RUB 1,852,000.

For the development of an estimate for the conservation of the facility, Alpha paid the design organization 11,800 rubles. (including VAT (18%) - 1800 rubles).

An additional agreement was concluded with “Master” to carry out conservation work. The “Master’s” expenses for these works amounted to 118,000 rubles. (including VAT (18%) - 18,000 rubles). Alfa bears monthly expenses for the maintenance of the mothballed facility in the amount of 50,000 rubles. (watchman's salary including insurance premiums).

To make it easier to track information about the condition of property, Alpha’s accountant opened separate sub-accounts for account 08:

- “Object of unfinished construction under conservation”;

- "Construction of fixed assets."

This year, the accountant made the following entries in the accounts:

Debit 08 subaccount “Object of construction in progress” Credit 08 “Construction of fixed assets” – 1,852,000 rubles. – the unfinished office building was transferred for conservation;

Debit 91-2 Credit 60 – 10,000 rub. (RUB 11,800 – RUB 1,800) – reflects the costs of preparing estimate documentation for the conservation of the office building;

Debit 19 Credit 60 – 1800 rub. – VAT is taken into account on the amount of costs for preparing estimate documentation;

Debit 91-2 Credit 60 – 100,000 rub. (RUB 118,000 – RUB 18,000) – reflects the costs of paying the contractor for the conservation of the office building;

Debit 19 Credit 60 – 18,000 rub. – VAT is taken into account on the cost of the contractor’s work on conservation of construction;

Debit 60 Credit 51 – 129,800 rub. (RUB 11,800 + RUB 118,000) – bills of the design organization and contractor have been paid;

Debit 91-2 Credit 70 (69) – 50,000 rub. – the salaries of the guards guarding the mothballed facility were accrued, as well as contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from it.

Repair costs

There are two types of repairs:

- Current;

- Capital.

When reconstructing and modernizing, repair costs increase the cost of the facility. For repairs, both current and capital, they are written off as current expenses.

OS repairs are carried out economically, that is, on our own, or contractually, with the involvement of third-party performers. The costs of repairs are written off to production cost accounts, that is, included in the cost price.

General cost allocation scheme:

If the costs of repairing the OS amount to significant amounts, then the organization can restore these costs from the previously formed fund in account 96 “Reserve for future expenses.”

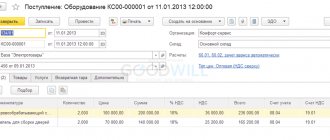

Accounting: acceptance of ready-made objects for accounting

Reflect the acceptance of ready-made objects for accounting on account 01 “Fixed Assets” or account 03 “Profitable Investments in Material Assets”, to which open the subaccounts “Fixed Assets in Warehouse (In Stock)” and “Fixed Assets in Operation”. If the time of registration of a fixed asset and its commissioning coincides, make the following entry:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 08-3

– the created fixed asset was accepted for accounting and put into operation at its original cost.

If the moments of registering a fixed asset and its putting into operation do not coincide, make the following posting:

Debit 01 (03) subaccount “Fixed asset in warehouse (in stock)” Credit 08-3

– the created object is taken into account as part of fixed assets at its original cost.

This procedure is provided for in paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts.

Fixed assets in accounting

Fixed assets are material assets that are planned to be used to carry out the activities of the institution for at least 12 months.

Moreover, in the process of recognizing fixed assets in accounting, its value does not play any role. In 2021, public sector employees are required to maintain asset accounting according to the new federal standard. We talked about the key changes that are regulated by this regulatory legal act in the article “Understanding the new accounting standards.”

Synthetic and analytical accounting of fixed assets in a budgetary institution is carried out on account 0 101 00 000. Accounting objects are included in the balance sheet of the organization at their original cost:

- if the cost of fixed assets is up to 10,000 rubles - it is considered to be of low value and is recorded on off-balance sheet accounts;

- when assessed up to 100,000 rubles, but more than 10,000 rubles. — the object is accounted for in the corresponding account 101, while the original cost (posting below) is written off to the corresponding depreciation account 0 104 00 000 in the amount of 100%;

- objects costing more than 100,000 rubles are subject to accounting on balance sheet account 101 with periodic depreciation accrual, according to the chosen method.

Let's look at the key transactions for fixed assets in accounting 2021 for budgetary institutions using specific examples.

Features of construction as a type of business and their impact on accounting

All enterprises in the Russian Federation use uniform accounting standards, but taking into account industry specifics. The main regulatory act that reflects the features of accounting in construction is PBU 2/2008 “Accounting for construction contracts.”

The start and end dates of construction work often fall in different periods. Therefore, the results are reflected in accounting “as soon as they are ready.”

In the general case, accounting must be kept separately for each object for which there is a separate estimate or project. Even if a single contract has been concluded for the entire complex, consisting of several objects, accounting is often carried out separately for each of them. To do this, the following conditions must be met:

- income and expenses can be distinguished for an object;

- there is separate technical documentation for the object

But the opposite situation is also possible, when several contracts are concluded for the construction of one complex facility. From an accounting point of view, they can be considered as a single contract if:

- they relate to one object for which, according to the accounting policy, uniform standards are established;

- work under contracts is performed simultaneously or within a sequential cycle.

Another peculiarity of the construction industry is that facilities owned by one company may be located in different regions. Therefore, branches are often opened at the location of construction sites. The parent enterprise is obliged to report the opening of a branch to the tax authorities at its location within a month, and about the closure - within three days (Clause 2 of Article 23 of the Tax Code of the Russian Federation).

If branches are created within the structure of the organization, a number of issues related to the organization of accounting should be resolved:

- determine the features of accounting in separate divisions;

- determine the list of persons responsible for the timely preparation of the “primary report” according to the approved document flow schedule;

- determine the timing of the transfer of documentation to the parent company for timely reflection in accounting.

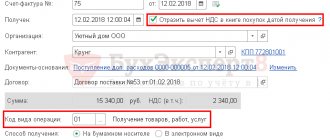

VAT deduction during construction: order and procedure, documents

The construction of capital construction projects for use for production purposes can be carried out using the enterprise’s own funds and capabilities or involving contractors.

In this case, all work, from the formation of the project and estimate to the final cycle - turnkey delivery - is carried out by highly specialized specialists - professionals.

But in any situation, this event lies in the sphere of state interests.

The construction of facilities is the basis for taxation, one of the main state taxes that fill the budget.

Actually we will talk about value added tax and filling out the corresponding declaration.

And today we will consider the refund (deduction) of VAT during the construction of residential buildings, fixed assets by contract, as well as the deduction of VAT from the developer during shared construction and other cases of compensation.

General rules

So, let's look at VAT refunds for capital construction, refunds for the construction of a private house, VAT for writing off unfinished construction, and other cases of the possibility of such deductions. The production of a complex of construction and installation work in connection with the conditions for deducting VAT in modern legislation is considered as follows:

- Contracting organizations. At the same time, the organization that accepts the constructed object as a fixed asset on its balance sheet also accepts the amount of VAT on construction for deduction, which the contractor presents to it.

- Construction using one's own resources or in an economic way. Art. 116 of the Tax Code of the Russian Federation regulates the procedure for deducting VAT during the construction of facilities for one’s own needs. The deduction amount is formed from VAT on materials and goods purchased, services used and work performed.

- Mixed construction method. The deduction is formed by the amounts presented by the involved organization, the costs of purchasing the necessary materials, goods and services, as well as those accrued in the process of carrying out the work by its own team and purchased building materials.

This video will tell you about VAT calculation in construction:

Method of purchasing building materials

The method of purchasing building materials is also important.

- If the materials are provided by the contractor, then VAT is included in the cost of the work.

- When transferring materials from the customer to the contractor, a separate deduction for work and materials is accepted.

- In the case of the supply of building materials at the expense of the contractor, the investor deducts the consolidated VAT on work and materials.

- When a customer sells building materials to a contractor, after completion of construction the customer causes VAT to be deducted from the sales volume.

No deduction possible

Both the possibility of deduction and its absence are stipulated by a number of legislative acts. Thus, it is impossible to deduct VAT in the following cases:

- Clause 1 Art. 172 of the Tax Code of the Russian Federation. Payment documents that actually confirm the payment of import VAT amounts when crossing the border of the Russian Federation are missing or collected incompletely.

- Clause 1 Art. 171 Tax Code of the Russian Federation. The constructed facility is not subject to transactions subject to VAT.

- The development cannot be registered in accordance with Art. 172 clause 1 of the Tax Code.

We will tell you below how to get VAT benefits in construction.

This video will tell you about VAT in construction under the simplified tax system:

Required documents

In order to carry out the VAT deduction procedure, it is necessary to submit to the local tax authority an application of the established form and a package of necessary documents confirming the right to deduction. A standard application form can be found on the website of the Federal Federal Service of the Russian Federation or at the local tax authority.

The legally approved grounds for claiming VAT deduction are:

- When construction is carried out by a contractor - form KS-2, which confirms the fulfillment of contractual obligations for development, completed individual installation, commissioning and other work inextricably linked with the facility.

- When constructing using an economic method or a mixed method, in order to deduct VAT, you will need invoices, delivery notes and accompanying shipping documentation, bank statements with attachments in the form of payment orders for payment for materials and work, a selection of acts of work performed and estimates for services consumed.

- Financial documents confirming payment of input VAT when goods cross the border of the Russian Federation.

Construction and its taxation is one of the most complex and time-consuming accounting tasks. Therefore, if you have insufficient experience, it is better for a novice accountant to resort to the services of specialized firms and bureaus.

simplified tax system

Organizations using the simplified system are required to keep accounting records, including fixed assets, in full (Part 1, Article 2 of Law No. 402-FZ of December 6, 2011). At the same time, in order not to lose the right to apply the simplification, the organization must control the residual value of fixed assets, which cannot exceed 100,000,000 rubles. (Subclause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation).

For information on the features of accounting for fixed assets built (manufactured) using economic methods, when simplified, see How to take into account the receipt of fixed assets and intangible assets using the simplified tax system.

Situation: is it possible to take into account when calculating the single tax the costs of constructing a fixed asset built on an economic basis? The organization applies a simplification and pays a single tax on the difference between income and expenses.

Yes, you can.

The right to take into account the costs of constructing a fixed asset is in no way connected with the method of construction or manufacture of fixed assets (subclause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Therefore, the organization has the right to take into account in expenses when calculating the single tax the costs of constructing a fixed asset using economic methods.

BASIC

In tax accounting, reflect fixed assets constructed on an economic basis at their original cost.

Input VAT on costs associated with creating an object and bringing it to a state suitable for use should be deducted at the time they are accepted for accounting (for example, on account 10 - for materials) (clauses 1 and 6 of Article 171, clause 1 and 5 of Article 172 of the Tax Code of the Russian Federation). Along with this, other conditions required for deduction must be met.

Carrying out construction and installation work for one’s own consumption is subject to VAT (subclause 3, clause 1, article 146 of the Tax Code of the Russian Federation). Therefore, at the end of each tax period, the organization must charge a tax on their value (clause 2 of Article 159 and clause 10 of Article 167 of the Tax Code of the Russian Federation). You can accept it for deduction in the same tax period (clause 6 of Article 171 and clause 5 of Article 172 of the Tax Code of the Russian Federation).

Starting from the next month after the facility is put into operation, begin calculating depreciation.

Starting from the next month after accepting the fixed asset for accounting (reflected on account 01 or 03), include its value in the property tax base (clause 1 of Article 374 of the Tax Code of the Russian Federation).

An example of reflection in accounting and taxation of the production of fixed assets on an economic basis. The organization did not involve contractors during the construction process

CJSC Alfa began construction of a hangar in January using a self-propelled method without the involvement of contractors. The organization completed construction in March. The hangar was put into operation in the same month.

In January, the organization purchased construction materials in the amount of 590,000 rubles. (including VAT – 90,000 rubles). All of them were completely spent during the construction process: in January - in the amount of 200,000 rubles. (excluding VAT), in February - by 200,000 rubles, in March - by 100,000 rubles. The monthly salary of workers involved in the construction of the facility (including contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases) amounted to 98,000 rubles.

Operations related to the construction of the hangar are reflected in the accounting records using the following entries.

In January:

Debit 10-8 Credit 60 – 500,000 rub. – purchased building materials;

Debit 19 Credit 60 – 90,000 rub. – reflected input VAT on building materials;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 90,000 rubles. – accepted for deduction of input VAT on building materials;

Debit 08-3 Credit 70 (69) – 98,000 rub. – the wages of workers involved in the construction of the hangar in January are reflected in capital investments;

Debit 08-3 Credit 10-8 – 200,000 rub. – the cost of building materials transferred for the construction of the hangar in January is reflected as part of capital investments.

In February:

Debit 08-3 Credit 70 (69) – 98,000 rub. – the wages of workers involved in the construction of the hangar in February are reflected in capital investments;

Debit 08-3 Credit 10-8 – 200,000 rub. – the cost of materials transferred for the construction of the hangar in February is reflected as part of capital investments.

In March:

Debit 08-3 Credit 70 (69) – 98,000 rub. – the wages of workers involved in the construction of the hangar in March are reflected in capital investments;

Debit 08-3 Credit 10-8 – 100,000 rub. – the cost of building materials transferred for the construction of the hangar in March is reflected as part of capital investments.

Debit 01 subaccount “Fixed asset in operation” Credit 08-3 – 794,000 rub. (98,000 rub. × 3 months + 200,000 rub. + 200,000 rub. + 100,000 rub.) – a hangar built on an economic basis was registered and put into operation.

On the last day of March, the accountant charged VAT on the cost of construction and installation work and then reflected the tax deduction. The following entries were made in the organization's records:

Debit 19 Credit 68 subaccount “VAT calculations” – 142,920 rubles. ((98,000 rubles × 3 months + 500,000 rubles) × 18%) - VAT is charged on construction and installation work performed on a self-employed basis;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 142,920 rubles. – VAT accrued on construction and installation work performed on a self-employed basis is accepted for deduction.

Thus, in accounting, the initial cost of the constructed hangar was 794,000 rubles. The accountant indicated this amount in the act in form No. OS-1a, which he drew up when registering the finished object.

In tax accounting, Alpha's accountant included the hangar as part of depreciable property at an original cost of RUB 794,000.

Situation: how can an organization record the receipt of investments for the construction of real estate under a concession agreement?

In your accounting when you receive investments, reflect the accounts payable to the grantor. Write off the debt after transferring to the grantor the costs of constructing the facility in part of these investments. In tax accounting, reflect the receipt of investments as non-targeted budget subsidies.

Let's explain everything in order. Under a concession agreement, the concessionaire is obliged, at his own expense, to create or reconstruct an object, the ownership of which belongs or will belong to the grantor. This gives the concessionaire the right, during the period determined by the agreement, to use this facility in his business activities. In this case, the grantor may assume part of the costs of creating (reconstructing) the object of the concession agreement. Such rules are established in parts 1 and 13 of Article 3 of the Law of July 21, 2005 No. 115-FZ.

In our case, the grantor assumed part of the costs in the form of investments in construction. This must be reflected in accounting in a special way.

Accounting

In the accounting of the concessionaire, in terms of investments from the grantor, neither income nor expenses arise. Reflect the receipt of investments by posting:

Debit 51 Credit 76 – receipt of investments from the grantor.

Reflect the expenses for the construction of concession property on account 08:

Debit 08 subaccount “Expenses for the reconstruction of concession property” Credit 10 (23, 60, 68, 69, 70, 76 ... ) – expenses for the construction of the facility are reflected.

When the reconstruction is completed, reflect your own expenses on account 04. And transfer the expenses regarding the received investments to the grantor. Make the following entries in your accounting:

Debit 04 Credit 08 – own expenses for the construction of the facility are included in intangible assets;

Debit 76 Credit 08 – expenses for the construction of the facility, in part of the investments received, were transferred to the grantor.

From the month following the month of completion of construction, begin accruing depreciation on the intangible asset. Do this for the duration of the concession agreement. The wiring is like this:

Debit 20 (23, 25, 26) Credit 05 – depreciation has been accrued on an intangible asset.

The constructed object itself should be accounted for in the off-balance sheet account. For example, you can open account 012 “Property received under a concession agreement.” Accept it for accounting at the cost indicated in the acceptance certificate. From the month following the month the object was accepted for accounting, begin accruing depreciation. Accrue depreciation over the term of the concession agreement. Account for depreciation amounts in a separate off-balance sheet account, for example 013 “Depreciation of property received under a concession agreement.”

Make the following entries in accounting:

Debit 012 – the constructed concession facility is reflected;

Debit 013 – depreciation accrued.

This procedure follows from PBU 14/2007, information letter of the Ministry of Finance of Russia No. PZ-2/2007, Instructions for the chart of accounts (accounts 08, 04, 05, 10, 20, 51, 76) and confirmed by the Ministry of Finance of Russia in a letter dated February 8, 2021 No. 03-05-05-01/6120.

Income tax

In tax accounting, take the constructed object into account at its original cost. This will be the sum of the costs of constructing the facility and bringing it to a state suitable for use. Including expenses financed by the grantor. This conclusion can be drawn from the provisions of paragraph 10 of paragraph 1 of Article 257 of the Tax Code of the Russian Federation.

Starting from the month following the one in which the object was put into operation, begin calculating depreciation (paragraph 6, paragraph 1, article 256, paragraph 4, article 259 of the Tax Code of the Russian Federation). Depreciate the asset over its useful life. In Chapter 25 of the Tax Code of the Russian Federation there is no special procedure for determining the period of use of fixed assets received under a concession agreement. Therefore, follow the general rules (letter of the Ministry of Finance of Russia dated October 20, 2010 No. 03-03-06/1/654).

The investments themselves should be considered as a budget subsidy, which is not recognized as a target subsidy for tax accounting purposes. Therefore, include the funds received in income as you recognize depreciation charges as expenses.

At the end of the concession agreement, include the amount of investment not included in income into non-operating income. Do this on the last date of the reporting (tax) period in which the transaction took place. And take into account the amount of underaccrued depreciation on the object as part of non-operating expenses.

This follows from the provisions of subparagraph 8 of paragraph 1 of Article 265, paragraph 4.1 of Article 271 of the Tax Code of the Russian Federation, Article 78 of the Budget Code of the Russian Federation. This approach is also confirmed by representatives of the Russian Ministry of Finance in private explanations.

Accounting: creation by contractor

In the process of creating a fixed asset on an economic basis, an organization can attract contractors to perform individual works. Also take into account the cost of their services when forming the initial cost of the fixed asset being created (clause 8 of PBU 6/01). Make the following wiring:

Debit 08-3 Credit 60 (76) – reflects the cost of contract work for the construction of a fixed asset;

Debit 19 Credit 60 (76) – reflects VAT presented by the contractor.

For information on the specifics of accounting for fixed assets manufactured by contract, see How to reflect the construction of fixed assets by contract in accounting.