Excessive daily allowances are subject to insurance premiums - this is a requirement of the Tax Code, but how is it implemented in practice? In the article we will tell you what rules legislators have established for insurance premiums from daily allowances in 2021, and how to correctly set limits and make calculations. When sending an employee on a business trip, the employer is obliged to compensate some of his expenses. So, >“Payment of travel expenses in 2021.”

Before determining whether per diem is subject to insurance premiums, here are some key points to remember about business travel.

The employer is obliged to pay the posted employee:

- travel to and from your destination;

- accommodation (housing rental);

- expenses related to the performance of labor duties;

- costs that compensate for the inconveniences associated with living outside the place of residence, or CP.

Travel and accommodation costs are determined based on actual expenses incurred. Moreover, such expenses will have to be documented. That is, provide checks, tickets or receipts. With SR the situation is different. It is quite problematic to document such expenses. Therefore, it is necessary to set a limit for SR - a specific amount of money that will be given to the employee for one day of stay on a business trip.

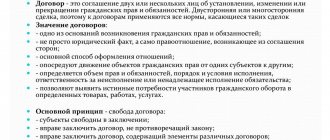

Daily allowance

The legislation calls per diem expenses for employees sent on a business trip associated with living outside their place of permanent residence (Part 1 of Article 168 of the Labor Code of the Russian Federation).

The amount of daily allowance in commercial companies is fixed in internal local regulations. Insurance premiums are not subject to daily allowance in the amount of 700 rubles/day. for business trips in Russia and 2,500 rubles. /day when traveling abroad (clause 2 of article 422 of the Tax Code of the Russian Federation).

Anything paid in excess of the specified limits is subject to insurance premiums. This rule does not affect only personal injury contributions. They are not subject to daily allowance in the amount prescribed by the employer in the local act.

Let us show with an example how to calculate insurance premiums for travel expenses in excess of the norm in 2021:

Employees of Transport Logistics LLC are paid a daily allowance for domestic business trips in the amount of 1,350 rubles per day. This amount is fixed in the collective agreement.

In March 2021, manager Ilyin A.A. was on a business trip in Kaluga for 5 days. He was paid a daily allowance of 6,750 rubles. (5 days × 1,350 rub./day).

At the same time, for the purpose of calculating contributions to compulsory pension, social and health insurance, the accountant divided the daily allowance into two parts:

- non-taxable contributions in the amount of 3,500 rubles. (5 days × 700 rub./day);

- taxable contributions 3,250 rub. (6,750 rubles ─ 3,500 rubles) or (5 days × (1,350 rubles/day ─ 700 rubles/day)).

Thus, daily allowances as one of the types of travel expenses in excess of the norm are subject to insurance contributions.

How are daily allowances calculated? The norm of daily payments according to the law

According to the law, daily allowances are set directly by the employer - it is recommended to take into account the individual requirements of employees to establish large amounts, if there are significant grounds for such. Let's turn to the following table and consider the daily allowance rate established by law:

| Amount of daily payments (norm) | Business trip location |

| 700 rubles | Territory of the Russian Federation |

| 2500 rubles | Foreign territory |

Accordingly, if, for example, a daily payment in the Russian Federation is 1000 rubles, then it will be taxed. This is due to the fact that a large amount is already considered part of the employee’s income (or part of his salary), and is therefore subject to a fixed tax of 13%.

As a rule, the amount of the tax fee must be withheld directly by the enterprise: that is, the employee receives the amount with the withheld fee, and the enterprise, as a tax agent, transfers the withdrawn amount to the appropriate fund or budget.

Calculation of doubtful debts from 01/01/17

According to the Ministry of Finance, set out in Letter No. 03-03-06/1/238385 dated April 20, 2017, when calculating doubtful debt, a legal entity must reduce accounts receivable by accounts payable to the relevant counterparty for any transactions. First of all, accounts payable cover accounts receivable with the longest period of occurrence.

Related links:

- You can write off a bad receivable late 02/21/2014

- The debt reconciliation act signed by the counterparties interrupts the limitation period on 07/29/2015

- Debt write-off without statement? 10/19/2012

Per diem above normal

Daily allowances in excess of the established norm are the amount of daily allowances exceeding the amount specified in the Labor Code of the Russian Federation, regardless of the amount of daily allowances established at the enterprise and stated in the official documents of the enterprise itself. Thus, for such amounts, the company pays personal income tax and insurance premiums to the posted employee. Such amounts are the direct income received by an employee of the enterprise.

Taxation and insurance premiums on daily allowances in excess of the norm

As stated above, daily allowance amounts that are not recognized as income of the posted employee. And for which taxes are not calculated, they amount to 700 rubles and 2,500 rubles, paid as part of a business trip in Russia and abroad, respectively. Taxes are calculated on amounts exceeding these norms established by law:

- Personal income tax, personal income tax. Equal to 13%. Deducted from the amount exceeding the daily allowance norm. The deduction must be made in the month of approval of the employee's advance report;

- income tax. An employee's travel expenses can be included in the tax base within the amounts specified in the local document of the enterprise. These expenses can be taken into account if the seconded employee provides all primary documents that confirm these expenses. Such documents are checks and receipts for accommodation, checks or travel documents, checks for fees or consular payments, receipts for payment for services for issuing visas, passports, invitations, etc.;

- Insurance premiums. Accrued for the entire amount in excess of the daily allowance. These amounts are accrued at the time of approval of the advance report provided by the posted employee. For social insurance the percentage is 2.9%;

- Insurance premiums. For pension insurance it is 22%;

- Insurance premiums. For compulsory health insurance it is 5.1%.

Insurance premiums for injuries in the amount of daily allowance are not calculated.

If an enterprise does not transfer contributions to insurance funds or does not withhold personal income tax from a posted employee, it will receive a fine in the amount of 20% of the amount of funds not transferred plus the mandatory transfer of the necessary amounts to the funds and deduction of funds from the employee’s salary.

If an employee returned from a business trip abroad, the daily allowance was given to him in foreign currency, calculated at the exchange rate on the day the application for advance was submitted. To calculate daily allowance, personal income tax and insurance contributions, amounts are recalculated at the rate on the day the employee reports an advance report.

Documentation of daily allowances

The final calculation of the daily allowance is made by the accountant or the head of the enterprise after the employee returns from a business trip, upon provision of an advance report and a list of documents that are drawn up by the company when the employee is sent on a business trip and after his arrival. Such documents are:

- order to send an employee on a business trip. This document must specify the purpose of the business trip and the period for which the employee is sent. Information about the duration is needed to calculate the amount of daily allowance, and information about the purpose of the business trip is needed to confirm the production nature of the trip;

- memo, if necessary. Compiled by the posted employee after returning from the trip. It is drawn up in the absence of documents for accommodation or travel, in order to confirm the whereabouts of the employee at the time of the business trip, also in the event of a delay or postponement of the employee’s departure for technical reasons, etc. This document is drawn up at the request of the enterprise management;

- document regulating business trips outside of a regular employee. Information about the reimbursement of funds must be specified in the civil contract at the time of its conclusion or amended to it after the need to send the employee on a business trip.

There is no need to provide documents confirming expenses associated with the amount of daily allowance, that is, checks and receipts to the employer.

Basic accounting entries - examples

Art. 168 of the Labor Code of the Russian Federation contains a list of travel expenses that must be reimbursed by the employer to its employee. The list of expenses exempt from contributions includes (Part 2, Article 9 of Law No. 212-FZ):

- daily allowance;

- targeted expenses, including expenses:

- renting accommodation;

- for travel to and from your destination, as well as for baggage transportation, this also includes station and airport fees and various types of commissions;

- to pay for the services of communication institutions;

- for obtaining a service passport and visas;

- to receive foreign currency or issue a bank check for foreign currency.

Insurance premiums are not charged provided that these expenses are documented. From January 1, 2015, this is directly provided for in the law, and before this date it followed from the explanations of officials (see letter of the Ministry of Health and Social Development of Russia dated May 26, 2010 No. 1343-19). At the same time, there is no difference between domestic and foreign business trips.

To learn about whether it is necessary to levy contributions on expenses for which there are no supporting documents, read the material “Was it necessary to charge insurance premiums before 01/01/2015 to compensate for the costs of renting housing on a business trip in the absence of supporting documents?”

Daily allowances, as part of travel allowances, are classified as expenses for ordinary activities (clauses 5, 7 of PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

Travel expenses are taken into account on the date of approval of the advance report by the head of the company.

- a day of stay on a work trip across Russia (700 rubles);

- trip to another country (2500 rubles).

- payment for accommodation in another locality;

- transportation costs (the general director of the organization determines its type);

- expenses for additional personal needs.

- registration of a foreign passport and visa;

- use of lounge services at airports and train stations;

- Internet and cellular communications;

- currency exchange commission.

- for a cultural event – RUB 14,000.00;

- for an excursion – 5,000.00 rubles;

- for buffet service (cultural event) – RUB 20,000.00;

- for the purchase of gifts and souvenirs – RUB 20,000.00.

Personal income tax is withheld in cases where the amount of compensation exceeds the specified standards.

If a company reimburses an employee for per diem in excess of the norm, his income is subject to taxes. It is recognized regarding the last day of the month on which the advance report is approved, which is sent by the employee returning from a business trip.

Personal income tax is payable after the following payments are made to the employee; this requirement also applies to salary. Payment must be made on the first business day following the listed payments to the official. This procedure is regulated by the Tax Code of the Russian Federation, Article 226.

Compensation for other expenses is made to the official with his daily allowance, which is provided by the company management. The amount may be increased by appropriate decision of the company’s management.

While on a work trip, the employee does not incur financial losses. The company must cover all the official's expenses that arise during the trip when paying the very first salary. The state levies certain taxes on these and other payments.

Calculation of entertainment expenses according to the example:

- The amount of entertainment expenses included in the list taken into account when calculating income tax: 70,000.00 15,000.00 10,000.00 = 95,000.00 rub.

- Of these, an amount of no more than 4% of labor costs is taken into account - RUB 60,000.00.

- The amount of other expenses for a representative reception not included in the list is: 14,000.00 5,000.00 20,000.00 20,000.00 = 59,000.00 rub.

- The accounting policy stipulates the use of direct costing when accounting for indirect costs.

Accounting for entertainment expenses posting: Date Account Dr Account Kt Amount, rub.

InfoK travel expenses include:

- Travel expenses;

- Housing rental expenses;

- Daily expenses;

- Other expenses with the permission of the employer.

A business trip can also be considered a one-day departure or travel of a remote worker to the company’s office. Important! All travel expenses, except for daily allowance, must be documented and economically justified. When transferring accountable amounts to a card for travel expenses, for documentary confirmation you must:

- Receipts display the use of funds from this particular card with the obligatory indication of the last name;

- When paying in cash, have ATM receipts for withdrawals for travel expenses.

Payment for business trips is based on average earnings.

Other payment is also possible, for example, salary, but not less than the amount of average earnings. How such expenses are reflected in accounting, what applies to them, how they should be executed and what transactions are generated for them - we will consider further. Table of contents

- 1 How to account for travel expenses in accounting

- 2 Personal income tax and travel expenses

- 3 What are daily expenses for a business trip

- 4 Typical entries for travel and daily expenses

- 5 Accounting for entertainment expenses 5.1 Typical entries for entertainment expenses

- 5.2 Entertainment expenses - how to arrange them using an example

How to take into account travel expenses in accounting Costs associated with travel and entertainment expenses of enterprises are included in other expenses associated with production and sales. In this case, the following entries are made: Debit Credit Name of transaction 50.3 76 A ticket was purchased for a posted employee. 71 50.

We invite you to familiarize yourself with: Insurance premiums for compulsory health insurance are

3 A ticket was issued to an employee 20, 23, 25, 26, 29 (44) 71 The costs of purchasing a ticket 68. VAT were written off 19 VAT on travel expenses was sent for deduction Example of accounting for travel expenses Employee Ivanov is sent on a business trip for 5 days, he was issued a report amount 20,000 rub. Ivanov’s daily allowance is 1000 rubles. Upon return, he provides an advance report with attached documents:

- round trip train tickets totaling 8,000 rubles. (including VAT 1220 rubles, see how to calculate VAT from the amount here, follow the link to find an online calculator for calculation), VAT is highlighted on a separate line.

- invoice from the hotel on strict reporting form in the amount of 5,000 rubles.

Fresh materials

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...

In what cases are travel expenses subject to insurance premiums?

Insurance fees are charged on all travel expenses , except for those stated in paragraph 2 of Article 9 of Law No. 212-FZ . Upon returning from a business trip, an employee of an organization must document the money spent and return the excess travel advance to the accounting department of the enterprise.

However, it happens that for some expenses incurred during a business trip, an employee is not able to provide payment documents . Insurance premiums must be charged on the amounts of such monetary costs if the costs go beyond the standards regulated by law. If there are no regulated standards, insurance fees are charged on the entire amount of expenses.

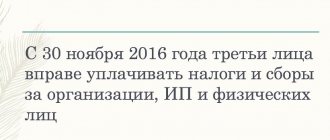

As for daily allowances for business trips, from January 1, 2021, insurance deductions are subject to daily allowances in the amount of more than 700 rubles per day of a business trip within the Russian Federation and above 2,500 rubles per day of a business trip abroad.

Answers to common questions

Expert opinion

Ilyin Georgy Severinovich

Practicing lawyer with 6 years of experience. Specialization: criminal law. Law teacher.

Question No1: A business trip was cancelled. Do I have to pay insurance premiums for expenses incurred in connection with obtaining a visa?

Answer: No need. In the Federal Law of July 24, 2009. No. 212-FZ contains information that the costs of obtaining a visa and compulsory medical care. insurance (since the need for it arises in connection with obtaining a visa) is not subject to insurance. contributions. If the trip is cancelled, the meaning of the above remains the same.

Question No. 2: How to deal with the taxation of travel expenses of a freelancer by insurance premiums?

Answer: It is assumed that a civil contract has been concluded with a freelancer, and trips under such an agreement are not recognized as business trips. However, the expenses should not be deductible, even though such expenses do not qualify for deductible travel expenses.

Here you need to pay attention to paragraph 2 of Article 709, paragraph 2 of Article 975 and Article 783 of the Civil Code of the Russian Federation, which regulate employee expenses that appear within the framework of a civil agreement. Subparagraph “g” p.

2 hours 1 tbsp.

9 of Law No. 212-FZ prescribes not to charge insurance premiums for these costs. The law does not cancel the obligation to document expenses and negotiate the terms of compensation for travel allowances in an agreement between the employee and the employer.

Question No. 3: Can business trip expenses be considered per diem if there is a trip to an area from where the employee can go home at the end of the working day?

Answer: No. In the case where the employee can return to his place of permanent residence at the end of each business trip, per diem should not be paid at all.

When going on a business trip, the employer pays the worker all necessary expenses - travel, housing, etc.

The income of officially working citizens is subject to insurance contributions.

The question often arises: what is the situation with travel expenses?

- Are they taxable?

- How to calculate deductions from overpayment?

- Accrual example

- When to pay - payment terms

- conclusions

The legislative framework

Within the framework of this issue, it makes sense to mention two codes at once - Labor and Tax. Both of them contain general or detailed information about excess daily allowance and how this payment is subject to insurance premiums. The following table will help to clearly consider this issue:

| Code | Information about excess daily allowances |

| Labor Code | 1. According to Art. 168, the employer is obliged to reimburse the employee’s expenses related to living outside his place of permanent residence. 2. The employer can independently determine the amount of daily allowance, fixing it in a local regulation or in a collective agreement. 3. A business trip is work carried out by an employee for a specified period outside the place of work and involving residence in a place remote from his permanent home. If the work officially involves traveling, then such a trip is not considered a business trip. At the same time, while on a business trip, an employee cannot lose the established salary or lose his job: his working conditions must remain the same throughout the entire period of the business trip. |

| tax code | 1. Daily allowances that exceed the norm established by the Government do not make the income tax base smaller (Article 264). 2. Article No. 217 limits the amount of daily allowance paid to an employee, which is not taxed. 3. Compensation payments established by local, regional, district, and federal legislation, the amount of which does not exceed the norms established by law, are completely exempt from taxation (Article 217). 4. Article No. 226 specifies the procedure for withholding personal income tax from daily allowances, which it is recommended that the accountant adhere to. |

In addition, it is important to refer to two decrees of the Government of the Russian Federation that address the issue of daily allowances. The first of them, No. 93, contains information about the rate of daily allowance paid and some of their features. Second, No. 729 includes the amount of reimbursement of travel expenses within budgetary organizations.

Check if there are any controlled transactions among the 2021 transactions

The deadline for submitting notifications of controlled transactions for 2021 to the tax authority is approaching - May 20 (in 2021 the deadline is postponed to Monday, May 22). To avoid fines, we advise you to check whether any of the transactions you entered into in 2016 were controlled. We offer an “introductory course” to the procedure for determining controlled transactions and market prices for tax purposes.

Fines

The fine for failure to provide notification of controlled transactions is 5,000 rubles.

The fine for underpayment of tax due to the use of non-market prices for controlled transactions in tax accounting is 40% of the amount of the arrears, but not less than RUB 30,000. (from 2021).

Controlled transactions

Among transactions with which counterparties should you look for controlled transactions? First, among interdependent individuals. The criteria for classifying persons as interdependent are approved in Art. 105.1 Tax Code of the Russian Federation. Secondly, among counterparties registered in countries included in the approved list of offshore companies.

The list of offshore companies was approved by Order of the Ministry of Finance of Russia dated November 13, 2007 N 108n.

In addition, transactions carried out with interdependent persons through intermediaries are considered to be transactions with interdependent persons, if the intermediaries do not perform any additional functions, as well as transactions in the field of foreign trade in goods of world exchange trade (oil, ferrous and non-ferrous metals, mineral fertilizers, precious metals and stones).

Transactions equivalent to transactions with related parties: 1) transactions carried out with related parties through intermediaries, if the intermediaries do not perform any additional function; 2) transactions in the field of foreign trade in goods of world exchange trade (oil, ferrous and non-ferrous metals, mineral fertilizers, precious metals and stones); 3) transactions with companies registered offshore.

Transactions with related parties and transactions equivalent to transactions with related parties are considered controlled when certain amount criteria are exceeded. The calculation of the amount criterion is carried out by summing the amounts of all income / expenses received / incurred as a result of transactions with one counterparty during the year. The amount criteria depend on the status of interdependent persons (resident / non-resident), the taxation systems they apply, and the subject of transactions.

| Types of transactions | Volume of transactions with the counterparty for the year, rub. |

| Transactions with a related party – a resident of the Russian Federation | 1 000 000 000 |

| Transactions with a related party - a non-resident of the Russian Federation | 0 |

| Transactions with an interdependent party paying the unified agricultural tax or UTII | 100 000 000 |

| Transactions with a related party – a resident of a special economic zone | 60 000 000 |

| Transactions with a related party exempt from the obligations of a profit tax payer or applying a tax rate of 0% in accordance with clause 5.1 of Art. 284 Tax Code of the Russian Federation. | |

| Transactions with a related party that takes into account income (expenses) in accordance with Art. 275.2 Tax Code of the Russian Federation | |

| Transactions with an interdependent party - a participant in a regional investment project that applies a tax rate for profit tax subject to credit to the federal budget in the amount of 0% and (or) a reduced tax rate for profit tax subject to credit to the budget of a constituent entity of the Russian Federation, in the manner and under the conditions provided for in Art. 284.3 and 284.3-1 Tax Code of the Russian Federation | |

| Transactions with an interdependent party - a corporate research center specified in the Federal Law “On Innovation”, which applies exemption from the duties of a VAT payer in accordance with Art. 145.1 Tax Code of the Russian Federation | |

| Transactions in the field of foreign trade in goods of world exchange trade | |

| Transactions with companies registered in a country from the list of offshore companies |

Although transactions meet these criteria, they may not be controlled. For example, transactions whose parties are persons who simultaneously meet the following requirements are not controlled:

- registered in one subject of the Russian Federation;

- do not have separate divisions outside the constituent entities of the Russian Federation;

- do not pay income tax to the budgets of other constituent entities of the Russian Federation;

- do not have losses accepted when calculating corporate income tax;

- are not payers of the unified agricultural tax, UTII, mineral extraction tax, are not exempt from paying income tax and do not apply a tax rate of 0% for income tax.

From January 1, 2021, the following are not controlled : 1) transactions for the provision of sureties (guarantees) if all parties to such a transaction are Russian organizations that are not; 2) transactions for the provision of interest-free loans between interdependent persons, the place of registration (residence) of all parties in which is the Russian Federation.

Income and expenses for calculating the sum criterion are determined according to the rules of Chapter 25 of the Tax Code of the Russian Federation. For example, in relation to a transaction of purchase and sale of property, the amount threshold must include the proceeds from the sale of property, in relation to a loan - the amount of accrued interest on the loan.

At the same time, in the notification of controlled transactions, income and expenses are reflected in accordance with accounting rules.

Notification form

The notice shall include the following information:

- subjects of transactions;

- information about participants in transactions;

- the amount of income received and (or) the amount of expenses incurred;

- applied pricing methods.

The form, electronic format and filling procedure are approved by Order of the Federal Tax Service of Russia dated July 27, 2012 N ММВ-7-13/ [email protected]

Determination of market prices

Prices used in transactions between persons who are not recognized as interdependent are recognized as market prices.

If the price of a transaction between related parties differs from the market price, then taxes must be calculated based on the income (expenses) that would have arisen if the transaction had been carried out on market conditions.

For example, if an organization sells a product to a related party at a price of 5,000 rubles, and sells it to other counterparties at an average price of 10,000 rubles, then for the purposes of income tax and VAT, the proceeds from sales should be calculated based on the price of 10,000 rubles.

Taxes subject to recalculation due to the use of market prices: income tax, VAT, personal income tax, mineral extraction tax.

The taxpayer has the right to independently apply the market price for tax purposes if the use of actual prices leads to an understatement of taxes.

To reflect independent adjustments, sheet 08 of the income tax return is intended (order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3 / [email protected] ).

Transaction prices are recognized as market prices in the following cases:

- prices are applied in accordance with the requirements of the antimonopoly authority,

- the transaction was concluded based on the results of exchange trading,

- the price of the transaction, in which the assessment of the object of the transaction is mandatory, corresponds to the assessment of an independent appraiser,

- the price of a one-time transaction corresponds to the assessment of an independent appraiser (an example of such a transaction could be a real estate purchase and sale transaction, if such a transaction does not relate to the main activity of the organization).

The main way to determine the market price is to compare the transaction price with comparable transactions concluded with parties that are not related. In Art. 105.5 of the Tax Code of the Russian Federation provides the conditions depending on which transactions are recognized as comparable (for example, the volume of transactions, terms of delivery and payment, credit history and solvency of the counterparty, etc.).

Information used when comparing transaction terms:

- information on prices and quotes on Russian and foreign exchanges;

- customs statistics of foreign trade of the Russian Federation;

- information on prices (limits of price fluctuations) and stock exchange quotations contained in official sources of information or in other published and (or) publicly available publications and information systems;

- data from information and pricing agencies;

- information about transactions made by the taxpayer.

If there is information about comparable transactions made by the taxpayer with persons who are not recognized as interdependent with him, the Federal Tax Service of the Russian Federation does not have the right to use other information to determine the range of market prices.

To determine the market price level, the following pricing methods are used:

- method of comparable market prices;

- subsequent sale price method;

- cost method;

- comparable profitability method;

- profit distribution method.

The methods are described in detail in Chapter 14.3 of the Tax Code of the Russian Federation.

The preferred method is the comparable market prices method.

These methods for determining market prices are used only for tax calculation purposes. When concluding transactions, taxpayers are free to apply any prices.

In the matter of justifying the “market value” of the transaction price, it is important who first drew up the justification for the market price level: you or the regulatory authority. It is more difficult to refute an existing formalized calculation. Therefore, when drawing up a notification about controlled transactions, it is worth immediately (“hot on the heels”) to prepare documentation confirming that the actual price of the transaction corresponds to market prices, taking into account all the features of the transaction. The documentation will need to be provided to the regulatory authority upon the relevant request (Article 105.15 of the Tax Code of the Russian Federation).

Natalia Mezentseva, accounting and taxation expert

Source: Clerk.Ru

Past issues:

- Issue No. 173 dated May 10, 2021 Online cash registers: a quick reference for an accountant

- Issue No. 172 dated April 18, 2021 Table of fines for tax violations in 2021

- Issue No. 171 dated April 4, 2021 Calculation of insurance premiums in 2017

Base for calculating insurance premiums

Federal Law No. 212-FZ calls the basis for calculating insurance premiums the full amount of earnings and other monetary incentives related to the object of taxation of contributions that were received by employees of organizations within the tax period (calendar year). The same law also provides for exceptions to the rule, but travel expenses have nothing to do with them.

Accordingly, insurance premiums will be charged on the full amount of all expenses incurred during business trips that are not in any way justified by the posted employee. If no papers have been provided to prove the basis for the costs incurred, the costs are considered unjustified. The law establishes that such expenses must be subject to insurance premiums within the limits of the norms regulated by law, but no mention of such norms is contained in any legislative act. Based on this, undocumented travel expenses are subject to insurance premiums in full.

conclusions

The employer is obliged to pay employees the amounts guaranteed by the legislation of the Russian Federation. Any payments to employees not directly established by the legislation of the Russian Federation or constituent entities of the Russian Federation, for the purpose of their economic justification, must be secured by an internal document of the bank: a collective agreement, an employment contract or other local document approved by the head of the bank.

And, of course, in order to minimize the risks of additional assessment of insurance premiums and personal income tax by supervisory authorities, it is necessary to train (conduct consultations, draw up memos, instructions, etc.) employees in the correct execution of primary documents confirming expenses incurred. First of all, this concerns travel expenses, and especially expenses associated with foreign business trips, where the composition of documents issued to confirm payment may differ significantly from those accepted in Russia.

Sources

- https://nalog-nalog.ru/strahovye_vznosy/nachislenie_strahovyh_vznosov/oblagayutsya_li_komandirovochnye_strahovymi_vznosami/

- https://online-buhuchet.ru/sutochnye-sverx-normy-dokumentalnoe-oformlenie-nalogooblozhenie-straxovye-vznosy/

- https://nalog-nalog.ru/ndfl/uderzhanie_ndfl/platim_ndfl_s_komandirovochnyh_rashodov/

- https://online-buhuchet.ru/oblagayutsya-li-sverxnormativnye-sutochnye-straxovymi-vznosami/

- https://glavbuhx.ru/strahovie-vznosi/vznosi-na-travmatizm/sutochnye-sverh-normy-vznosy-na-travmatizm.html

- https://online-buhuchet.ru/oblagayutsya-li-komandirovochnye-strahovymi-vznosami/

- https://WiseEconomist.ru/poleznoe/82229-straxovye-vznosy-ndfl-vyplate-srednego-zarabotka-komandirovochnyx