From January 1, 2015, foreign workers from “visa-free” countries temporarily staying in Russia are required to obtain patents to work for employers: organizations, individual entrepreneurs, or individuals (357-FZ dated November 24, 2014).

Until 2015, only migrants who provided non-entrepreneurial services to individuals (nannies, housekeepers, drivers, etc.) worked under patents.

Read more about the patent for foreign workers from visa-free countries here.

What is a patent for a foreigner, who needs it?

This document is necessary for a foreign citizen who wishes to officially find employment in the Russian Federation. A patent certifies the legality of employment for a foreigner.

What you need to know about this document:

- It is issued for a period of one month to a year.

- Its action is limited to a certain territory.

- Issued for a specific profession and type of activity.

- To obtain one, you must undergo a medical examination.

- Issued with the permission of the Migration Service.

Nuances of a labor patent

In order for the employment relationship with the employer to be considered completely legal, after obtaining a patent the following actions must be taken:

- Prepare a copy of the employment contract with the employer.

- Contact the Ministry of Internal Affairs for subsequent registration.

Important! The above actions must be performed by the foreign citizen no later than two months after signing the employment contract. It is necessary to pay the tax on time to avoid invalidation of the patent.

How to get

Foreigners who wish to become holders of a patent to work in the Russian Federation must:

- cross the border of the Russian Federation using a foreign passport;

- In the migrant’s card when crossing the border, indicate “purpose” - work;

- take out insurance;

- register. All foreigners are required to do this within 7 days. Exception - citizens of Tajikistan - 15 days;

- apply for a patent (30 days are given for this).

Documents for obtaining a patent:

- application filled out in blue pen;

- passport and its copy with translation. The copy must be certified by a notary;

- migration card;

- voluntary health insurance policy;

- certificate from a medical institution. A foreigner must undergo a medical examination to ensure that he is free of diseases, HIV, etc.;

- confirm the absence of a criminal record;

- present temporary registration;

- confirm registration;

- provide photographs (4 pcs.);

- confirm personal income tax payment;

- confirm successful completion of the Russian language exam. This exam is not taken by representatives of Belarus or school graduates from neighboring countries;

- collect the entire package of required documents and contact the Main Directorate of the Ministry of Internal Affairs of Russia or the state. services. Registration can be done through an intermediary. In this case, beware of fake patents. Many companies simply make money this way. As a result, you will have no money and no patent. Be careful!

The competent authorities check the entire package of documents and if everything is in order, they issue a patent within 10 days. Otherwise there will be a refusal.

After a patent is issued to an employee, he must get a job within two months and confirm this fact - provide a copy of the contract. Otherwise, the patent will be revoked.

By working without a patent, a foreigner exposes himself to risk. If, in the event of an inspection, his place of work is established, he faces a fine (5,000 - 7,000 rubles) and deportation from the Russian Federation. The Main Directorate of the Ministry of Internal Affairs of the Russian Federation can ban entry for up to 10 years.

What taxes does a foreign worker pay?

Having an employment relationship on the territory of the Russian Federation, a foreigner pays types of taxes similar to those of local citizens.

Foreigners have received the right to a personal income tax refund, since they pay it twice. This occurs when paying tax, as well as when the employer withholds 13% when calculating wages. If there is no patent, but there is permission, taxes are calculated at a higher rate. It is tied to the period of residence in the territory of the state:

- A 30% rate is imposed on persons whose stay does not exceed six months.

- If a person has been staying in the Russian Federation for more than six months, the rate is reduced to 15%.

Interesting. Highly qualified specialists are allocated to a separate category. Regardless of the length of stay, the rate for them is 15%.

Certain groups of citizens are not required to purchase a patent. This:

- refugees;

- citizens of Belarus, Kyrgyzstan, Armenia and Kazakhstan.

Personal income tax rate for foreign citizens

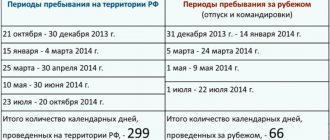

The personal income tax rate will vary depending on the type of income, status and residence. Residence status is determined by the time spent on the territory of the Russian Federation. Thus, foreigners who have stayed in Russia for less than 183 days (calendar) within one year are non-residents. And persons with a special status are recognized as:

- refugees;

- high-class specialists;

- foreigners holding a patent;

- residents of the EAEU countries.

Read also: Russian citizenship for residents of the DPR in 2021

| Foreign citizen status | Personal income tax rate (%) | ||

| Income from employment | Other types of income, with the exception of winnings and dividends, which are taxed at a higher rate | Profits from participation in a joint stock company | |

| Special status/resident of the Russian Federation | 13 | 13 | 13 |

| Special status/non-resident of the Russian Federation | 13 | 30 | 15 |

| No special status/resident of the Russian Federation | 13 | 13 | 13 |

| No special status/non-resident of the Russian Federation | 30 | 30 | 15 |

Advance on personal income tax for foreigners

368-FZ dated November 24, 2014

Since 2015, a new version of Art. 227.1 of the Tax Code of the Russian Federation, regulating the calculation and payment of personal income tax by foreign citizens.

A foreign employee works in the Russian Federation under a patent as follows:

- When receiving or renewing a patent, a foreign citizen pays personal income tax in the form of fixed advance payments of 1,200 rubles per month (Clause 2 of Article 227.1 of the Tax Code of the Russian Federation)

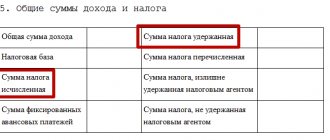

- The employer, the tax agent, calculates personal income tax in the general manner, but when deducting it from the employee’s income, it offsets already paid advance payments (clauses 5 and 6 of Article 227.1 of the Tax Code of the Russian Federation).

- the deflator coefficient established for the corresponding calendar year is 1.810 in 2021.

- coefficient established for the corresponding calendar year by the law of the subject of the Russian Federation. If the regional coefficient is not established by the subject of the Russian Federation, then it is equal to 1.

Thus, the minimum price of a patent for foreign citizens in 2021 will be 1,200 × 1,810 = 2,172 rubles per month.

Reduction of personal income tax by the amount of a patent for a foreign citizen

Taxes are withheld from foreigners in accordance with the law.

It is not possible to issue a recalculation and receive a refund in advance. This can only be done after the tax period, once a year. In 2021, the previously in force order has been maintained. A foreign worker can apply for a deduction in person by contacting the tax service. Or submit an application to your employer, who will prepare documentation for transmission to the tax authorities.

After receiving an application with a package of documents, a tax officer conducts an inspection with the participation of the migration service. A ten-day period has been established for verification.

Read also: Resort fee in 2021

A prerequisite for approval of an application for a personal income tax refund is the implementation of legal work activities. The foreign worker must have all the necessary work permits, supporting documents, as well as a formal employment contract with the employer.

If an employee has several jobs, he makes a tax refund once, through the main employer. When conducting an audit, the tax officer will definitely check whether applications for a specific person have been received from other places of work.

If an organization employs several foreign employees, the accounting department prepares a separate package of documents for each employee to reimburse the tax.

Advance personal income tax payments for patents – 2021, date

Recently, a large number of migrants have been arriving in Russia in order to continue their careers in a new and mysterious country. This practice is commendable - people gain experience and are happy to share it with their colleagues.

However, when hiring foreigners, there may be some difficulties in calculating taxes. Advance payments of personal income tax on a patent in 2021 are what worries accountants throughout Russia.

What it is

The amount of advance payments under a working patent must be calculated in accordance with the regional coefficient and the deflator coefficient, taking into account the fixed part of the payment.

Accordingly, due to changes in the deflator coefficient for 2019, the changes affected the size of the advance payment itself.

Foreigners of the “visa-free” type who work within the Russian state are obliged to make monthly payments, which are called personal income tax.

This is done in order to extend the validity of the labor patent and take advantage of the opportunity to legally work in the Russian state in the future.

In other words, if a foreigner makes a payment for only one month in advance, then in this way he makes payment according to the patent for the next month. That is, a foreigner has the right to pay for a patent for any period of time in advance.

It is also important not to forget that the advance payment for personal income tax must be made only within the established period.

If the payment is not made by the foreign person, the patent will be automatically terminated and it will cease to be valid.

And one nuance will be very important for foreigners - it is imperative to keep receipts proving the fact of payment of the receipt in accordance with the patent for the entire valid period.

Changes to the labor patent

For the current year, the following standards are established for potential migrants:

- Foreign persons can enter the territory of the Russian state only with foreign passports.

- Ukrainians and other citizens must pass specialized tests that determine their level of knowledge of the Russian language.

- Documents must be provided within a month after a person arrives in the country.

In a situation where documents are not submitted on time, first-time violators will have to pay a fairly significant fine. Subsequently, if he violates it again, he will have to forcibly leave Russia.

The next time a foreigner attempts to obtain a patent, he will need to provide notice that will prove that the fine has been paid. It appears in receipt format.

A foreigner must undergo testing, as a result of which he will receive a certificate indicating that he has the required level of knowledge of the legislation of the Russian Federation, the history of the country and the Russian language.

The questions in the tests are quite simple. Knowledge of the school curriculum will be quite enough to show good results.

It is worth paying attention to the fact that the certificate will be valid for five years. In addition, people who received higher or secondary education in the territory of the former USSR do not need to present a certificate.

How to obtain a work permit in the Russian Federation

Since last 2021, the service of the Main Directorate for Migration of the Ministry of Internal Affairs of the Russian Federation has been processing patents. When receiving a migration card on the territory of Russia, it is worth specifying the work purpose of the trip in the appropriate column. It is recommended to take out insurance immediately.

Within a week from the moment of arrival, a foreigner must register.

There are exactly two possible scenarios:

- Go through the registration procedure at your place of work.

- At the place of residence.

The first option will be a priority for citizens who have a certain agreement with their own employer. Foreigners entering Russia for work must register at their place of residence.

It is worth noting that citizens of Tajikistan have a certain relaxation here. They can register within 15 days after arrival.

After this, you should proceed directly to filing a patent. You have 30 days for this from the date of arrival. The month is given not from the date of registration, but from the date of entry. You should definitely take this into account, because if you violate the deadlines, you will have to pay a fine.

How many months in advance can you pay?

If we rely on changes in the sphere of control of migration issues in Russia, namely the abolition of the FMS service and the transfer of the functions of this department to the units of the Main Directorate for Migration of the Ministry of Internal Affairs of Russia, foreigners must now carry out the procedure for renewing patent registration every time they intend to pay an advance payment.

In other words, whenever payment is made by foreigners or stateless people, they will be required to renew their own registration.

Due to the fact that this procedure is very difficult, a logical question may arise: is it possible to pay for a patent for several periods in advance, so as not to renew the registration every month?

At one time, a foreigner has the right to deposit funds for any time within a period of 1-12 months. If he makes a payment exclusively for a month, in accordance with this, he will have to renew the registration for a month.

After a month has passed, everything will need to be done again. Accordingly, for how long the foreigner makes the payment, he must renew the registration for that period.

It is important to understand that foreigners do not have the opportunity to pay for a patent for a period longer than 12 months, since the validity of this document is limited to 1 year.

In other words, if a foreigner deposits funds two years in advance, then the document in any case will have the maximum validity period prescribed by current legislation.

Date of payment of advance personal income tax payments for a patent in 2021

Payment of the fixed payment this year should occur in advance - approximately 3-5 days before the date reflected in the first check for payment of the labor patent.

For example, if the first advance payment was made on September 10, then the next time payment should be made no later than October 10. Payment should be made a little earlier, so that subsequently, by October 10, the payment amount will be in the personal account.

Cancellation if payment deadlines are not met

At the present time, the personal income tax payment control system is fully automated, and for this reason, the lack of receipt of funds on a certain target date can lead to the fact that the foreigner’s work patent will be canceled in the database of the regulatory authorities.

It is for this reason that in a situation in which payment is made later than required, at least one day, the document is automatically subject to cancellation due to late payment for the labor patent.

Table indicating fixed payments for each region of the Russian Federation

| The subject of the Russian Federation | Regional coefficient | Tax amount |

| Moscow | 2,1566 | 4200 |

| Vladimir region | 1,797 | 3500 |

| Murmansk region | 1,4 | 2727 |

| Leningrad region | 1,54 | 2999 |

| Arhangelsk region | 1,7 | 3311 |

| Krasnodar region | 1,786 | 3244,8 |

| Rostov region | 1,6 | 1816 |

| Stavropol region | 1,8 | 3506 |

| The Republic of Dagestan | 1,3 | 2332 |

| Republic of Bashkortostan | 1,596 | 3109 |

| Orenburg region | 1,76 | 3428 |

| Chelyabinsk region | 1,848 | 3600 |

| Novosibirsk region | 1,67 | 3252 |

How to calculate the cost using the formula

A patent should be calculated using this formula:

SP = BS*RK*KD

SP – advance payment, BS – rate, RK – regional coefficient, CD – deflator.

Example

As an example, we can take the calculation of the cost of a patent for foreigners registering in the Moscow region. Let's start with the fact that the base rate is 1200 rubles. For Moscow Region, the regional coefficient is taken to be 2.05381.

As for the current year, the generally accepted deflator coefficient is 1.623.

All that remains is to simply substitute the values into the generally accepted formula:

SP = 1200 * 2.05381 * 1.623 = 4000.

You can also take cost calculations for Moscow as an example.

Slightly different values will apply here, similar to those in force in the Moscow region:

SP = 1200 * 2.1566 * 1.623 = 4200.

It is this formula that should be used when making detailed calculations of the cost of an advance payment for a labor patent. This formula is universal and the most important thing here is to find the actual regional coefficient.

If we consider the situation as a whole, we can understand that when using this formula, each foreigner who acts as a potential migrant can independently calculate the cost of a labor patent.

In this case, you can immediately find out the payment amount for one, three or more months in order to make longer-term payments.

It is also worth understanding that all values undergo certain changes every year. Therefore, every foreigner must be interested in all the necessary values in order to accurately calculate the advance payment for a certain reporting period of time.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Source: https://101zakon.ru/migracija/patent-na-rabotu/avansovye-platezhi-ndfl-po-patentu/

Errors when withholding personal income tax from a foreign worker

The most common mistakes are as follows:

- Incorrect calculation of the amount to be paid to the budget. It happens that a foreigner mistakenly transferred a larger amount to pay taxes than he should have. Such actions can also be intentional. In this situation, you should not hope for a refund of the overpaid amount. In accordance with the Tax Code, such excesses will not be recognized as overstatement.

- Difficulties in identifying persons from the categories of refugees or those who have received temporary asylum in the territory of the Russian Federation who are entitled to the deduction. Refugees, as well as persons granted temporary asylum in the Russian Federation, pay income tax of 13% at a preferential rate. Such non-residents cannot claim deductions. However, having received resident status and continuing to pay income tax, they will be able to claim deductions provided for in Articles 218-221 of the Tax Code.

Article 218 of the Tax Code of the Russian Federation “Standard tax deductions”

Article 219 of the Tax Code of the Russian Federation “Social tax deductions”

Article 220 of the Tax Code of the Russian Federation “Property tax deductions”

Article 221 of the Tax Code of the Russian Federation “Professional tax deductions”

The procedure for paying personal income tax by an employer for foreigners

para. 1 clause 6 art. 227.1 Tax Code of the Russian Federation

The income of temporarily staying citizens with a patent received from work under an employment contract is subject to personal income tax at a rate of 13% (Letter of the Ministry of Finance of the Russian Federation dated March 16, 2016 No. 03-04-05/14470).

When withholding personal income tax from a foreigner’s income, the employer needs to reduce it by the amount of fixed advance payments already paid by the employee in the corresponding tax period.

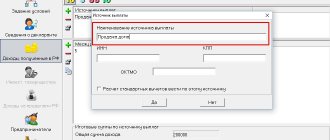

To offset advance payments you need:

- Employee statement;

- Documents confirming payment of advance payments;

- Notification from the Federal Tax Service confirming the right to reduce the amount of personal income tax by the amount of advance payments paid.

para. 2 and 3 clauses 6 art. 227.1 Tax Code of the Russian Federation

A personal income tax reduction can be made during the tax period only with one tax agent at the taxpayer’s choice. This moment is controlled by the Federal Tax Service, issuing a notification to one tax agent during the tax period.

If the amount of advance payments paid for the period of validity of the patent in the corresponding tax period exceeds the amount of personal income tax calculated by the tax agent for this period, then the amount of such excess is not an excessively withheld tax and is not subject to either refund or offset.