Form 1 Personal Income Tax is used to reflect the income of individuals that the organization pays to employees as a tax agent. Since 2011, the use of this reporting is optional. But a card of this format is the most convenient way to present a tax register, which companies are required to maintain (with the right to develop their own forms).

Help 1-NDFL, section 1

This section includes basic information about the tax agent (organization), or more precisely, data such as:

- TIN and KPP of the organization acting as a tax agent for personal income tax;

- code of the Federal Tax Service, to which information about the taxpayer will be submitted (as a rule, this is the tax office with which the tax agent organization is registered);

- name of the tax agent and his OKTMO.

It is also advisable to add the company’s OGRN and its telephone number to this section.

Highlights ↑

Despite the fact that document 1-NDFL was converted from a card to a tax register (Federal Tax Order N ММВ-7-3/ [email protected] ), this report is still compiled by employers.

This form has special fields for reflection:

- Income of individuals received during the month and quarter.

- Tax deductions that led to a reduction in the tax base.

- The amount of actual personal income tax payments sent to the treasury.

When drawing up 1-NDFL, tax agents are required to take into account the current identifier codes of income and tax deductions, as well as the types of tax deductions due to employees, as well as documents confirming such rights.

As a result, the information provided should become the basis for identifying the taxpayer and establishing his status.

Form 1-NDFL must indicate the dates of payment of income to the employee and withholding of personal income tax, as well as indicate the details of payment documents.

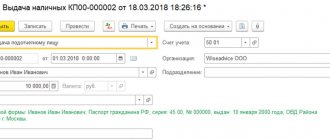

Currently, the document is integrated with the 1C program, which allows you to automate the accounting of income and tax deductions for each employee.

If the tax agent does not submit 1-NDFL on time for verification to the tax authorities, then he will be subject to a fine of 10,000 rubles (Article 120 of the Tax Code of the Russian Federation).

Concepts

| Personal income tax | A national tax of federal significance, which is charged on all types of cash receipts of individuals at a rate of 13%, 30%, 9% and 35%. It is often also called income tax (Chapter 23 of the Tax Code of the Russian Federation) |

| Form 1-NDFL | It is a special tax card that allows you to take into account all a citizen’s income, as well as the amount of tax deductions and deductions accrued to the tax base (Order of the Federal Tax Service N BG-3-04/583). This paper is often considered as a primary accounting document for each individual individual maintained by his employer |

| Tax accounting register | An analogue of 1-NDFL, which at the same time has a free form of preparation. In other words, the tax agent has the right to enter into the document analytical data regarding the cash receipts of employees and taxes accrued on them in any form convenient for them |

Currently, 1-NDFL is compiled on the basis of the form established by the Federal Tax Service of Russia, but it is still often called the income tax register.

Who must submit the certificate

It was already mentioned earlier that document 1-NDFL should be generated based on the cash receipts of each individual.

At the same time, it is filled out not by the citizen himself, but by his tax agent - the employer. In the organizations themselves, 1-NDFL is considered as the primary tax accounting document.

There are several rules for filling out 1-NDFL, namely:

- it is formed based on the results of each month, when salary statements are compiled and tax is calculated on the employee’s income;

- The accounting department generates information for each individual employee and enters it into the certificate.

It is worth noting that tax agents do not reflect all income in 1-NDFL. Thus, the following are not reflected in the statement:

- maternity benefits;

- payments on the occasion of the birth or adoption of a child;

- child care benefits;

- unemployment payments.

Normative base

Issues related to the collection of income tax from individuals are reflected in detail in Chapter 23 of the Tax Code of the Russian Federation.

Moreover, Article 230 clearly states that:

| Tax agents | Keep records of cash receipts of individuals, as well as deductions and accrued taxes established on them using special registers |

| Tax registers | Also considered as form 1-NDFL have a strictly established form |

The 1-NDFL form itself was adopted and approved in 2003 by Order of the Federal Tax Service N BG-3-04/583. Later, it was allowed to fill out the document in free form - in the way that is convenient for the tax agent.

Nowadays there is a return to the previous scheme, since this provides a more streamlined process for accounting for income, deductions and tax deductions.

Help 1-NDFL, section 2

This section displays information about the individual taxpayer to whom the organization paid income and withheld personal income tax. The following data is presented on it:

- TIN of an individual taxpayer in Russia and country of citizenship;

- FULL NAME.;

- Date of Birth;

- identity document and its code;

- citizenship with country code;

- data on the number of days of stay in the Russian Federation (to determine tax status (resident, non-resident) for each month of the tax period).

Information not to be included in the document data

1 personal income tax does not include data regarding types of profit that are not subject to taxation (Article 217 of the Tax Code of the Russian Federation):

- State benefits, payments (except for payment of personal income, including child care).

- Pension contributions (including insurance and funded pensions).

- Rewards for the birth (adoption) of a child and for caring for him.

- Compensation payments related to injury to health, for sublease of housing, dismissal, for the death of a military personnel, etc.

- Payments to reimburse costs within the framework of contracts for the gratuitous performance of duties (volunteers).

- Alimony.

- Profit in the form of grants, prizes or other forms for participation in competitions, competitions, etc.

- Material assistance (for family members of the deceased, victims of a natural disaster, etc.).

- Compensation for sanatorium-resort vouchers to sanatoriums and other health institutions.

- Other types of income provided for by law.

When an employer pays travel expenses to an employee, daily allowances are not included in the tax base, but not exceeding 700 rubles for each day of a business trip within the Russian Federation and 2.5 tr. - in another country.

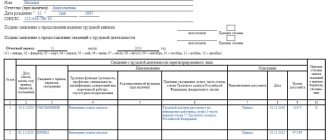

Help 1-NDFL, section 3

In this part of 1-NDFL, the personal income tax tax base is directly calculated at rates of 13 and 30% (13% is the main rate in the Russian Federation, and 30% is the income rate for non-residents).

In form 1-NDFL, the form contains a table in which the indicators by income code are summarized monthly for the entire year and the deductions provided are also indicated monthly.

Income codes for the 2-NDFL certificate for 2021 can be found in our article “List of income codes in the 2-NDFL certificate (2012, 4800, etc.)” .

After this, the tax base is formed in 1-NDFL and the personal income tax is calculated. The tax withheld is indicated. Tax debts are identified, taking into account debts at the beginning of the year.

It is advisable to add to this section 1-NDFL:

- dates of receipt of income;

- tax withholding dates;

- dates of tax payment to the budget;

- information about the payment document for tax transfer;

- information about tax deductions by their types (standard, social, property, professional, investment), codes, amounts for each month of the tax period and the grounds for their application;

- information on the amount of fixed advance payments paid by foreign citizens, accepted as a reduction in the amount of calculated tax;

- information on the grounds for reducing the calculated amount of tax by the amount of fixed advance payments paid by the foreign taxpayer (details of the notification from the Federal Tax Service, the taxpayer’s application, details of the document on payment of fixed advance payments).

Filling procedure

The form is maintained by employees whose responsibilities include payroll.

Section 1 is filled out in accordance with the constituent documents of the legal entity, the Federal Tax Service code is assigned in accordance with the registration documents with the tax authority.

As information about an individual (section 2), personal data provided by the employee during employment is used, and the remaining fields are filled in as contributions to the budget are calculated. Data is entered monthly after the statements are closed to avoid errors.

There are two options for filling out the certificate:

- using specialized software products - automatically;

- manually.

Missing information must be clarified with the employee.

Applicable codes

According to Pr. Federal Tax Service No. MMB-7-11/ [email protected] dated September 10, 2015, when filling out the form, the codes corresponding to the types of profit and deductions are used:

| INCOME CODES (Appendix No. 1) | |

| 2000 | all types of payments to the employee for the performance of labor duties (salary, bonuses, etc.) |

| 2012 | accrued vacation pay |

| 2300 | transfers based on certificates of incapacity for work provided to the accounting department |

| 2400 and 1400 | profit received from the rental or other use of transport units or property, respectively |

| 2760 | calculated financial assistance |

| 4800 | other payments |

| 1010 | received dividend income |

| 1530 | income from transactions with securities |

| DEDUCTION CODES (Appendix No. 2) | |

| 126-149 | standard for children (taking into account the nuances of applying the deduction) |

| 311,312 | property: related to the purchase of housing, construction or repayment of a loan for relevant purposes |

| 320,321,324 | social: for tuition or medical care on a reimbursable basis |

| 403-405 | professional: under a GPC agreement, associated with the costs of receiving royalties, etc. |

| 501,503,508,505 | deductions provided for receiving gifts, winnings, financial assistance, etc. |

Filling example

Sample of filling out 1 personal income tax as a tax accounting register for an employee of Romashka LLC.

Fill out section 1.

The organization's data is entered into the form in accordance with the fields provided:

Section 2

An example of processing data about an individual – Petrov P.P.:

- in clauses 2.1 – 2.5 information is entered in accordance with the citizen’s passport, TIN certificate;

- in clause 2.6 the country code is indicated according to the All-Russian Classifier of Countries of the World (OKSM), for Russia -643;

- Clause 2.9 is filled in with “1” for residents and “2” for non-residents.

Section 3

This paragraph reflects tax deductions provided in accordance with Article 218-220 of the Tax Code of the Russian Federation.

Section 4

Reflects directly the calculation of the tax base and personal income tax at a rate of 13%:

- first, the types of remuneration for performing job duties are entered in a tabular version;

- the income code is assigned in accordance with the classifier - “2000”;

- Next, the amount of tax accrued and withheld for each month is indicated;

- When reflecting data on transfers, details of payment documents are entered.

Section 5

If the taxpayer is provided with deductions, they must be indicated in these fields.

Section 6

The result of filling out the certificate is the formation of data graphs. The total amount of profit and calculated personal income tax is reflected here.

Section 7

Information about issued certificates for submission to the Federal Tax Service is entered.

This is one of the options for converting form 1 personal income tax into the form of a tax accounting register for income tax. Each legal entity can develop samples at its own discretion, but in compliance with the norms established by law. Those. income and deductions must be reflected in accordance with the accepted code system.

Help 1-NDFL, section 5

This section lists all income taxed at a rate of 35%.

The table is maintained for each income code, taking into account a deduction in the amount of 4,000 rubles, provided for in clause 28 of Art. 217 Tax Code of the Russian Federation. Then the tax base is formed, then the amount of tax calculated and withheld, as well as tax debts, are indicated.

It would be useful to indicate in this section 1-NDFL and the dates of receipt of income, tax withholding, the date of payment of taxes with data on the payment document.

Features of filling out the tax register form

In sections reflecting the employee’s income, data is entered for each payment. When accounting for benefits provided to employees in the form of deductions, a monthly data accounting procedure is applied. The timeliness of accounting transactions will eliminate cases of exceeding the maximum value of the provided benefit. If it is necessary to take into account a large number of benefits, the form is modified taking into account the conditions for entering data.

Due to changes in legislation since the publication of the form, it is necessary to make adjustments to the composition of these sections. Enterprises must take into account the dates of receipt of income, types of tax benefits, the procedure for providing which to taxpayers has changed since the approval of the original type of form.

To automate accounting and maintenance of 1-NDFL, the following programs are used:

- 1C: Salary and personnel management. The program pays attention to the dates of income accrual, withholding and transfer of tax. Information is reflected in the register based on primary accounting forms;

- Salaries and personnel CompSoft. The resource provides the ability to change settings according to the specifics of the enterprise’s accruals;

- PC “Taxpayer”, which provides calculation of wages, taxation and creation of registers.

Most programs used by enterprises when calculating wages include a register based on 1-NDFL in their documents for recording data for each employee.

Help 1-NDFL, section 6

This section summarizes all personal income tax rates calculated in previous sections based on the results of the tax period (year).

Let's abolish ineffective rates in 1-NDFL, leaving only those that are relevant today: 13, 30 and 35%. The section indicates the total amount of tax for the year - calculated, withheld, transferred for collection to the tax authority. Recalculation for previous tax periods is also taken into account, and debts at the end of the period are shown.

It is recommended to add this section:

- date of receipt of income;

- date of tax calculation;

- tax withholding date;

- tax payment deadline;

- date of actual tax payment;

- KBK and OKTMO, according to which the tax is transferred.

Read more about the current personal income tax rates in the article “ What percentage is personal income tax? " .

Due dates

This reporting form refers to internal documents of a legal entity. It is filled out for the reporting period on a monthly basis with an accrual total and is stored with other forms of primary accounting documentation.

There is no need to provide a certificate to the tax authorities; Federal Tax Service employees can request it when checking the payment of personal income tax to the budget. The exception is cases of overpayment by the tax agent. To process a refund, a legal entity will need to provide an extract from the tax register indicating that the amount of personal income tax has been paid in excess.

Results

Today's legislation does not require maintaining 1-NDFL for each employee throughout the year. But in accordance with Art. 230 of the Tax Code of the Russian Federation, an organization must maintain tax registers, which it needs to develop independently. To simplify the creation of tax registers, it is most advisable to download form 1-NDFL, modify it according to our recommendations for each section and fill out the resulting register for each individual to whom the organization paid income.

You can read about maintaining a tax register for personal income tax and download a sample of it in our article “How is a tax register for personal income tax maintained?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Responsibility for the lack of tax accounting forms

The Tax Code of the Russian Federation provides for punishment for enterprises for the lack of tax registers. Additionally, an administrative fine may be imposed on the manager for failure to provide information necessary for tax control.

| Grounds for imposing a sanction | Amount of fine |

| Art. 120 of the Tax Code of the Russian Federation for lack of tax accounting | 10,000 rubles |

| Also, again | 30,000 rubles |

| Art. 126 for refusal to provide documents | 200 rubles for each document |

| Art. 15.6 Code of Administrative Offenses for failure to provide information | From 300 to 500 rubles |

Information about disability benefits and vacation pay

Tax officials believe that temporary disability benefits do not relate to wages. Therefore, they are not classified as income received for performing certain duties. It is enough to simply write that the amounts were paid.

As for vacation pay, you need to immediately decide whether it will be payment for work or not? If yes, then the tax is withheld on the very last day of the month. If the answer is negative, then the deduction occurs on the same day when the income is paid.