If your organization employs a foreigner on the basis of a patent, personal income tax on his income is calculated at a rate of 13% from the first day of work, regardless of his status (resident or non-resident). For the entire period of validity of the patent, he pays fixed advance payments for personal income tax. Therefore, an employee can contact you with an application to reduce personal income tax by the amount of tax that he has already paid to the budget. However, keep in mind that in addition to the application from the employee, you must receive a notification from the inspectorate confirming the right to a tax reduction.

When reducing personal income tax, nuances are possible. For example, if the amount of advance payments turns out to be greater than the amount of personal income tax that you have already withheld from the employee’s income for the year, the uncredited balance of the advance payment is not carried over to the next year and is not returned to the employee.

The tax reduction must be reflected in the 6-NDFL calculation and the 2-NDFL certificate.

How is a fixed down payment calculated?

Calculation and payment of income tax (NDFL) to the budget of foreign citizens is carried out in accordance with the instructions of Art. 227.1 Tax Code of the Russian Federation. Paragraphs 2 and 3 of this article state that the migrant makes advance payments for the period of validity of the patent issued to him in the amount of 1,200 rubles per month . The payment amount is adjusted taking into account the following coefficients:

| No. | Coefficient name | Coefficient value | Additional information |

| 1 | Deflator | 1,729 | Sets every year (1.729 is for 2021), see Order of the Ministry of Economic Development of the Russian Federation dated October 30, 2021 No. 595 |

| 2 | Regional | Depends on the subject of the Russian Federation, or 1 (if the region has not set its coefficient) | Approved by the majority of constituent entities of the Russian Federation, for a calendar year. The coefficient reflects the regional characteristics of the labor market. |

| Regional coefficient in regions (examples) | Calculation of fixed payment in the region | Fixed payment amount in the region | |

| Moscow – 2.4099 | 1200 rub. x 1.729 x 2.4099 | 5,000 rubles | |

| St. Petersburg – 1.8315 | 1200 rub. x 1.729 x 1.8315 | 3,800 rubles | |

| Nizhny Novgorod Region | 1200 rub. x 1.729 x 2.06 | 4,274 rubles | |

The migrant must pay fixed payments in the region in which he works under the patent. The duration of the patent is paid until the start date of the period for which the patent is issued/extended/reissued.

Let's consider a special case. Let’s say a foreigner filed a patent for the first time in 2021, made an advance payment taking into account the deflator coefficient, which was in effect throughout 2021. Then the Ministry of Internal Affairs extends the patent until 01/01/2019, and the document expires in 2021. It turns out that the validity period of the patent refers to different tax periods. In this case , the deflator that was in effect at the time of making the advance payment is used . There is no need to recalculate the amounts of fixed advance payments. See Letter of the Federal Tax Service dated January 22, 2021 No. GD-4-11/ [email protected]

Important! If the amount of the fixed contribution paid for a tax period turns out to be greater than the amount of personal income tax payable for a similar tax period (calendar year), the employer can take into account the resulting difference when reducing the amount of tax in the next month of the same tax period.

Section 1. Information about the tax agent

In the “OKTMO code”

the code of the territory in which the tax agent is registered is indicated. This code is selected from the corresponding classifier. You can find out your OKTMO code using the electronic services of the Federal Tax Service “Find out OK” (https://nalog.ru, section “All services”).

When filling out the “Phone”

The tax agent's contact phone number is displayed.

In the fields "TIN"

and

“KPP”

indicate the INN and KPP of the tax agent.

When filling out the “Tax Agent”

The short name of the organization is reflected in accordance with the constituent documents, and if there is none, the full name. Entrepreneurs, lawyers, notaries indicate their full (without abbreviations) last name, first name, patronymic (if any).

Attention! If the tax agent is registered in the SBIS system, then all these fields are filled in automatically.

Reduction of personal income tax for a fixed advance payment (personal income tax for foreign workers on patent)

Important! A foreign employee himself pays an advance payment for personal income tax (NDFL) at the time of obtaining a work patent for the first time or when re-issuing a document. The employer does not have the right to assume such a responsibility, in accordance with paragraph 1 of Art. 45 Tax Code of the Russian Federation, clause 1, art. 227.1 of the Tax Code of the Russian Federation, instructions of the Letter of the Ministry of Finance of Russia dated April 2, 2015 No. 03-05-05-03/18346.

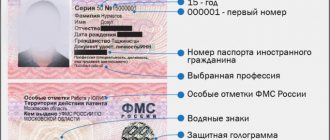

In accordance with paragraph 1 of Art. 13.3 of the Federal Law of July 25, 2002 No. 115-FZ, the employer has the right to hire only foreign citizens who arrived in the Russian Federation on a visa-free basis, who are in Russia with the status of temporary residents and who, before official employment, have issued a patent (a document authorizing employment, approved by Order of the Federal Migration Service of December 8, 2014 No. 638).

The employer (and his accountant, in particular) needs to take into account the fact that the patent has a limited validity period, which is longer, the longer the foreigner has paid a fixed advance payment for personal income tax over a longer period (clause 5 of article 13.3 of the Federal Law of July 25, 2002 No. 115-FZ, clause 2 of article 227.1 of the Tax Code of the Russian Federation). Payment is made in proportion to full months. And the amount of the payment varies depending on the subject of the Russian Federation, on the territory of which the foreigner draws up a document and intends to find employment (clause 3 of Article 227.1 of the Tax Code of the Russian Federation).

The employer, at the time of paying wages to a foreign employee and calculating the amount of personal income tax, can take into account the advance payment made by his employee when registering/renewing a patent and reduce the amount of personal income tax. In this case, only the advance payment that was paid by the migrant during the validity period of the patent relating to the current calendar year is taken into account, i.e. current tax period . This is stated in Art. 216 of the Tax Code of the Russian Federation, paragraph 6 of Art. 227.1 of the Tax Code of the Russian Federation, in Letter of the Federal Tax Service of Russia dated March 16, 2015 No. 3N-4-11/4105.

Important! Since 2015, regardless of the length of stay of a foreign citizen in Russia, his income must be taxed (personal income tax) at a rate of 13% if he is employed on the basis of a patent. See paragraph 3 of Art. 224 Tax Code of the Russian Federation, Art. 227.1 Tax Code of the Russian Federation.

The registration of such a “deduction” for personal income tax is carried out in accordance with the following algorithm:

| Stage | Actions on the part of the employer | Clarification |

| 1 | Ask a foreign employee to prepare a tax deduction application (free form) | If an employer constantly hires foreign workers on a patent, it is advisable to develop an application form and issue a “blank” if necessary (see the table below for an example of an application). |

| 2 | Take paid receipts from the foreign employee and photocopy them | First, copies of receipts will be the basis for the deduction. Secondly, the presence of receipts will give confidence in the authenticity of the patent. |

| 3 | Contact your “native” Federal Tax Service, submit an application for the need to receive a notification that confirms the possibility of reducing the amount of personal income tax by fixed payments in the current year | The application should be written in the form recommended by the tax authorities (see Appendix No. 1 to the Letter of the Federal Tax Service dated February 19, 2015 No. BS-4-11/2622). It is recommended to submit the document when the employee’s application and receipts are available (it is better to attach copies of them to the application). |

| 4 | Wait for a special notification from the Federal Tax Service allowing the deduction (notification approved by Order of the Federal Tax Service dated March 17, 2015 No. ММВ-7-11/ [email protected] ) | If the following 2 conditions are met, the notification will be sent within 10 business days. days from the date of application:

(clause 6 of article 227.1 of the Tax Code of the Russian Federation, clause 6 of article 6.1 of the Tax Code of the Russian Federation) |

| 5 | Make a personal income tax deduction for the next payment in favor of a foreign employee | Until a notification is received from the Federal Tax Service, the law does not allow advance payments to be counted! |

An application from a foreign employee for a deduction for personal income tax on account of advance payments made when registering/renewing a patent may look like this:

General Director of UniSand LLC

Emelyanenko P.R.

from Murodov Sodikjon Alizhonovich

STATEMENT

I ask you to reduce the personal income tax withheld from my salary for 2019 by the amounts of fixed advance payments I pay based on the submitted receipts for payment of the patent for the period of its validity in 2021.

Date July 15, 2021 Signature ______________ (S.A. Murodov)

Page not found

In any case, the employee himself must contact the tax office at his place of work and receive a notification about the legality of such a deduction.

Important! A foreigner can receive such a deduction only at one workplace. If he works in several places, then to his main job the employee must bring a certificate confirming that he did not exercise this right with other employers. It is also worth paying attention to the fact that the amount of personal income tax reduction cannot exceed the monthly amount of the fixed payment paid for the patent. If the amount of tax at a rate of 13% is less than the amount of the advance payment, then the personal income tax is subject to a full refund to the employee.

Personal income tax Due to the standard payment of 13% personal income tax for foreigners with a patent, they are reflected in section 1 of the 6-personal income tax report in the same way as other employees. Whether a foreigner is a resident or not does not matter. If there was a tax reduction on the amount of advance payments, then field 050 is filled in.

Line 040 reflects the amount of personal income tax calculated from the salary, and if the amount is less than the payment for the patent, then in field 140 you must enter 0 rubles. If the amount is greater, then line 140 indicates the difference between the accrued tax and the patent fee. The remaining lines are filled in in a standard manner applicable to Russian citizens.

An example of reducing personal income tax due to advance payments for a patent

An employer from St. Petersburg signed a GPC agreement with a foreigner for the period of validity of the patent. The foreign employee's patent was issued for a period from April 1, 2019 to June 30, 2021 . The amount of the fixed advance payment was 3800 rubles. x 3 months = 11,400 rubles . The employee's salary is 42,000 rubles .

| Month | Salary | Personal income tax (2 x 13%) | Balance of advance payment at the beginning of the month | Personal income tax payable (3-4) | Remaining AP, transfer to next month (4-3) |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 04.2019 | 42 000 | 5460 | 11400 | 0 | 5940 |

| 05.2019 | 42 000 | 5460 | 5940 | 0 | 480 |

| 06.2019 | 42 000 | 5460 | 480 | 4980 | 0 |

Example of filling out line 050 in a report

Let's look at filling out this line using an example.

A foreign employee issued a patent for six months, for the period from April to September 2021. Fixed advances were paid at the rate of 2,000 rubles. per month. Total amount of advance payments = 12,000 rubles. (RUB 2,000 × 6 months).

In April, he started working with a salary of 40,000 rubles. Calculated personal income tax = 5,200 rubles. for each month (RUB 40,000 × 13%).

The organization received a notification of the right to a tax reduction for 2021 from the Federal Tax Service in July 2021. The accountant recalculated the taxes and revealed that the overpayment to the budget for personal income tax for April - June amounted to 6,000 rubles. (RUB 2,000 × 3 months). Thus, the employee’s data by month after receiving the notification will be as follows:

| Month of salary accrual | Salary amount | Amount of personal income tax withheld |

| 5,200 - 2,000 = 3,200 - write off as overpayment. Amount to be withheld - 0. Amount to be issued - 40,000 rubles. Remaining overpayment: 6,000 - 3,200 = 2,800 rubles. | ||

| 5200 - 2000 - 2800 (overpayment) = 400 rubles. The amount to be issued to the employee is RUB 39,600. Overpayment closed | ||

| September | 5,200 - 2,000 = 3,200. The amount to be paid to the employee is 36,800 rubles. |

Let's reflect these transactions in the 6-NDFL reports for half a year and 9 months. To simplify the example, let’s assume that this employee is the only one in the company.

Half year:

9 months of 2021:

Common mistakes on the topic “Withholding income tax from foreign workers in 2021”

Error: The employer submitted an application to the Federal Tax Service to issue a personal income tax deduction for a foreign employee on account of the advance payments he made when “purchasing” a patent. Without waiting for notification of permission to make deductions, the employer reduced the personal income tax from the migrant’s next salary.

Until the Federal Tax Service Inspectorate sends a notification about the possibility of a tax deduction, the employer of a foreign employee does not have the right to reduce the amount of personal income tax from the migrant’s wages. Even if the notification does not arrive for a long period of time.

Error: An employer whose enterprise is registered in St. Petersburg hires a foreign citizen who has issued a patent in the Moscow region.

A foreign citizen must carry out labor activities in the territory of the region in which he issued the patent. If the work is found in another subject of the Russian Federation, the patent will have to be reissued.

How to fill out an application and submit it to the tax office

The application is written strictly according to the model developed and approved by the Federal Tax Service.

The form includes information about the employer and foreign worker, as well as the tax office to which the application is submitted, but the amount of personal income tax is not indicated in it.

Once the application has been properly completed, it must be submitted to the tax office. You can do this in any convenient way:

- coming to the tax office in person,

- coming with a representative holding a power of attorney,

- through electronic means (provided that the employer has a digital signature registered in accordance with all the rules),

- by sending via Russian Post by registered mail with acknowledgment of receipt.