When employees of an enterprise go on vacation, many employers consider it necessary to pay them additional funds so that they can fully enjoy their vacation and appreciate the management’s concern for them. Most often, these funds are given to the employee in the form of money. According to regulations, these payments can be a bonus or financial assistance.

Employers should know the specifics of accounting and taxation of such payments, and employees will benefit from the nuances of documentation and accrual rules.

Question: Does the calculation of average earnings for vacation pay include financial assistance, the payment of which is provided for by an employment (collective) agreement or local regulations? View answer

Financial assistance according to the Labor Code

At the moment, Russian labor legislation does not contain a concept that would mean an additional payment of funds, that is, an increase in vacation pay. This payment is assigned to the employee at the discretion of the employer and nothing obliges him to pay.

Let's take a closer look at the payment of financial assistance. According to Art. 129 of the Labor Code of the Russian Federation, employees, in addition to the salary they are entitled to, can also count on additional increases. These include social support, which is paid in connection with events that affect the financial situation of the employee.

The next type of material support is incentive. It, in turn, depends entirely on the success and work of the employee. Even the fact of accrual also depends on the employee’s performance. But this will no longer be financial assistance, but a bonus for special merits or achievements.

How is the payout calculated?

Since material support is not included in the mandatory list of labor payments provided by social norms, the exact amount is determined on an individual basis.

Most often, the parameters influencing the amount of financial assistance include:

- current earnings of the person going on vacation;

- the employee's current tariff rate;

- monthly average for the last few months;

- duration of work.

There is a certain standard in relation to civil servants - the amount of financial assistance is legally determined equal to the amount of 2 employee salaries. For workers in other budget sectors, financial assistance can vary from one to three salaries.

Distribution of financial assistance for vacation in organizations

The payment of financial assistance sometimes depends not only on the employer, but also on the type of organization in which they work.

So, for example, in commercial, non-state firms, financial assistance depends only on the discretion of the employer and his “favor” towards the employee. But keep in mind that financial assistance for vacation is provided only to those employees who have a clause on this type of material support in their labor (collective) agreement. Of course, subject to the financial capacity of the employer.

The circumstances are somewhat different in government organizations. In the public sector with financial assistance, everything is much simpler. For persons working in government agencies, there is a separate federal law regulating the payment of financial assistance for vacation - Law No. 79-FZ of July 27, 2004 “On the State Civil Service of the Russian Federation.” In accordance with this law, the increase in payments is not only mandatory, but also regular. In this case, financial assistance does not depend on the results of the employee’s work.

The additional payment must be specified in the organization’s collective agreement, employment contract (or additional agreement to the contract), as well as in orders from management. Please note that the amount of financial assistance for vacation should not legally exceed established standards (usually double the employee’s salary).

General provisions

There is no separate article in the Labor Code of the Russian Federation regulating the payment of financial assistance, but there are a number of provisions from which it follows that additional funding for a vacationer is permissible:

- Art. 136 of the Labor Code of the Russian Federation clarifies issues regarding mandatory payments due to an employee.

- Art. 135 of the Labor Code of the Russian Federation describes how financial assistance is distributed as a voluntary measure on the part of management in order to additionally motivate a person to perform his duties efficiently.

- Art. 144 of the Labor Code of the Russian Federation allows the payment amount to be set higher than the tariffs established in the region.

Since labor legislation abolishes the requirement for financial assistance before vacation, personnel should proceed from the internal regulations in force at the enterprise - orders, internal orders, clauses of an employment or collective agreement. For public sector employees, the principle of appointment is determined by special legislative acts.

There are general rules in which cases it is permissible to prescribe financial aid:

- can be paid regardless of the vacationer’s labor achievements, or vice versa, depend on how well the employee coped with the job (acts as a motivational tool);

- implies the right to financial support in the presence of certain social needs;

- serves as an additional voluntary measure in commercial organizations, and mandatory for government agencies;

- is established regardless of the financial results of the company, the achievements of the employee (if he belongs to the public sector);

- issued irregularly, no more than once a year;

- The amount of assistance is determined at the discretion of the enterprise.

There are special types of financial assistance before a wedding or at the birth of a child, but most often the money is allocated before the start of the vacation period.

For commercial organizations, it is primarily important whether the company’s profits allow it to pay additional amounts to vacationers. If a company is facing bankruptcy, you should not wait for financial assistance to be allocated when financial indicators indicate a lack of profit or free cash resources.

The issue of the possibility of payments in relation to public sector employees is resolved in a similar way - with a budget deficit, the enterprise is unlikely to have sufficient available funds to provide financial assistance.

Payments in a private organization may also be called a bonus or allowance, and the incentive itself is paid when summing up some results of work.

Social payments are considered regardless of the achievements of a particular person and are associated with the occurrence of certain events:

- a disease requiring expensive treatment;

- meeting the needs of a large family;

- death of a family member;

- incapacity for work due to an accident or accident at work;

- other situations with negative consequences.

When determining who is eligible for assistance, some restrictions common to all organizations should be taken into account.

When is financial assistance paid?

As vacation time approaches, the question arises about financial assistance, what it is, who is entitled to it and how it is paid.

If the enterprise has a general procedure for assigning financial assistance to a vacationer, there are some limiting factors under which a lump sum payment for vacation is not possible:

- If a person has worked at the enterprise for less than six months, it will not be possible to receive an additional amount for vacation, since the right to another paid vacation appears after working for at least 6 months.

- When terminating an employment contract immediately after a vacation, there is no point in the employer spending additional funds that are used to reward existing employees.

- Pregnant workers, when applying for maternity leave, do not have the right to count on financial assistance, since this type of leave does not apply to regular paid leave and is formalized as a social measure by the state, with the appointment of benefits to the employee for the period of maternity leave.

Since financial assistance is a purely voluntary measure, you should not count on it in advance, before a vacation has been agreed upon. It also makes no sense to demand additional funding if it is not covered by the provisions of the employment contract.

Application for financial assistance for vacation - sample

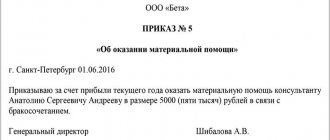

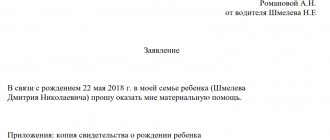

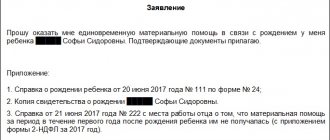

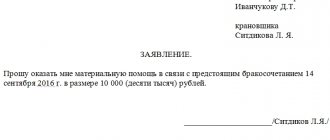

Next, we will consider the design and preparation of an application for financial assistance for vacation. If you are an employee of a commercial organization and the employer plans to pay you incentive support, then this is possible by issuing an order. When paying social assistance, you need to write an application.

Please note that there is no unified form for writing an application of this type, so an employee can draw it up in free form if local regulations do not provide a writing sample.

An application for the provision of financial assistance for vacation must contain key points: the applicant’s details (full name, position), name of the organization, grounds for payment of financial assistance (reason for payment), duration of the vacation and its terms, date of writing the application and, of course, a signature with a transcript.

You can find a sample application for financial assistance for vacation below:

Results

Thus, financial assistance when providing the next annual paid leave is paid in accordance with a local legal act or (in some cases) on the basis of regulatory legal acts (for example, in the case of municipal or state civil servants). It may take the form of a social benefit and depend on the occurrence of certain circumstances or act as a component of the salary paid in any case to the employee when going on vacation. As a general rule, such assistance can be provided only if you are actually on vacation, therefore, if you quit your job and receive compensation for unused vacations, it is impossible to receive it.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxation

Financial assistance refers to payments unrelated to the commercial or production activities of the company.

If it is not included in the wage system in force in the institution and is not systematic in nature, social contributions are not collected from it.

However, in this case, the employer cannot reduce the size of the base for calculating income tax by the amount of financial assistance. In other cases, he must make insurance contributions, but only if the payment exceeds 4 thousand rubles.

As for personal income tax, it is also calculated and paid only if the amount of financial assistance is more than 4 thousand rubles. Moreover, tax is paid only on the excess amount. For example, if the payment amount is 5,000 rubles, the tax amount will be equal to:

Personal income tax = (5000 - 4000) * 13% = 130 rubles.

If the corresponding contributions and taxes were not timely transferred to social funds and the tax office, then they must be additionally accrued and transferred after the error is discovered. Otherwise, the employer may be held liable.

What if - dismissal?

If an employee resigns of his own free will, on the last day of his work he must receive compensation for the remaining vacation days for the current period. However, this does not apply to the payment of financial assistance, since it is accrued only when taking out the next annual leave.

A person cannot apply for financial assistance for a vacation that has not yet taken place and will not happen due to dismissal.

Thus, if an employee plans to say goodbye to the institution and has unused vacation days, a possible solution would be to first receive legal vacation along with financial payment, and after its end, apply for resignation. However, if the reason for dismissal was not the employee’s good will, but the employer’s initiative (for example, for various types of violations and guilty actions on the part of the employee), the employee may not be provided with leave not previously used, followed by dismissal.

Taxes on financial aid for treatment

Chapter 23 of the Tax Code of the Russian Federation regulates that taxes on the income of individuals are withheld in accordance with the legislation of the Russian Federation according to general rules, with the exception of certain cases. These include:

- A one-time issue to family members of an employee who has passed on to another world or upon the death of a relative of a colleague.

- Due to unforeseen incidents.

- Victims of terrorist attacks.

- Financial support paid for treatment.

In addition to personal income tax, insurance premiums are withheld from the cash subsidy:

- In some cases - according to the general rules, if it is more than 4,000 rubles.

Consequently, you will have to pay tax on the amount exceeding 4,000 rubles on the support paid.

An application for financial support in case of a serious illness is usually submitted after a course of treatment has been completed. To submit a substantiated application, the application must be supplemented with an extract from a medical illness, documents for the purchase of medicines, and certificates with a diagnosis. And all this must be certified by the seal of the attending doctor.

Despite the fact that the application template for financial support is not regulated by law, it still refers to an official document, the preparation of which must comply with the rules of business etiquette.

- In the right corner, starting from the top, you need to display the position and full name. the boss who is authorized to resolve the issue. This could be the boss or his deputy, or the chairman of the trade union committee.

- Below, the position and full name are displayed. document submitter. If the company is large, then most likely you will have to display the department where the author of the petition works.

- Next, in the middle of the line of the sheet, enter the name of the form - “Application”.

- The text of the appeal sets out the essence of the request, clearly displaying the problem. It is advisable to support your request with documentation.

- At the end of the form, the author of the letter puts the date and signs with a transcript of the surname.

to contents

Accrual procedure

Together with the conditions for assigning one-time assistance, the employer establishes the regime for its accrual. These rules are not immutable.

In commercial organizations

Each organization sets its own formula by which the amount of financial assistance is calculated. In practice, the following calculation methods are used:

- from average earnings, salary, tariff rate;

- as a percentage of the named indicators;

- in a fixed form.

The amount of the bonus may be influenced by length of service, position held, and other indicators. Many employers establish fixed financial assistance, stipulating it in local regulations.

Example 1. Janitor of Meridian LLC Bugaev G.A. submitted an application for annual leave and financial assistance to him. In accordance with the company’s remuneration regulations, he is entitled to a one-time additional payment in the amount of 70% of his salary. According to the employment contract, the employee’s salary consists of the following parts: salary - 10,000 rubles, bonus for intensive work - 3,000 rubles. When calculating, the accounting department will only take into account the salary. Thus, together with vacation pay, Bugaev G.A. will receive financial assistance in the following amount: 10,000 x 70% = 7,000 rubles.

Financing of one-time bonuses is carried out from the company’s profits at the discretion of the founders. In practice, the question arises whether financial assistance for vacation is taken into account when calculating vacation pay. In order to answer it, you should read the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. Based on the systematic interpretation of the norms of the said document, we can conclude that incentive bonuses are taken into account when calculating average earnings. It is on this basis that vacation pay is calculated. Only social payments are not taken into account. One-time assistance when going on vacation does not apply to these.

In government agencies

As for government institutions, for public sector employees the procedure for calculating financial assistance is determined by the founder. Government departments at various levels of government act in this capacity. For example, the Ministry of Health of Russia or a specific subject, the Ministry of Internal Affairs of Russia, the department of education of a subject of the Russian Federation, etc.

For subordinate institutions, a standard regulation on wages with a tariff schedule and types of additional payments is approved. Financing is provided from the appropriate budget. Based on the standard document, organizations develop their own provisions taking into account their specifics.

It is important to know! Autonomous institutions have the right to establish additional types of financial assistance. It is paid from income received from business activities.

As a rule, financial assistance in calculating vacation pay cannot be assigned solely by the head of the institution. After applications for leave are received from employees, a commission consisting of at least three people is assembled. The issue of financial assistance is resolved at the meeting. Based on the results of the meeting, a protocol is drawn up. Based on it, an order signed by the manager is prepared.

Example 2. In the city hospital of Blagoveshchensk, there is a wage regulation, according to which, when taking leave, employees are given a one-time additional payment in the amount of 30% of the salary. In May 2021, the HR department received applications for leave and financial assistance from the nurse in the surgical department, Karlova E.V. and emergency room nurse Stepanova I.A. The hospital has created a commission that is considering the issue of awarding incentive bonuses. It consists of a chief accountant, a deputy chief physician for economics and a deputy chief physician for medical affairs. The commission considered the statements of Stepanova I.A. and Karlova E.A. A protocol was drawn up, according to which Stepanova I.A. you need to accrue one-time assistance for vacation in the amount of 2,000 rubles, Karlova E.A. – 4,000 rub. Based on the statements and protocol of the commission, the chief physician signed the order and submitted it to the accounting department for execution. Financing is carried out from funds received from business activities.

Let's summarize

Financial support in the form of material assistance to state employees planning to go on annual leave, although it has an encouraging function, is provided at the federal level. Any employee has the right to receive it, along with the vacation pay due (once a year) upon a written application submitted in advance of the upcoming vacation. If the amount of financial assistance exceeds 4 thousand rubles, such payment will be subject to taxation. But the amount of the payment does not affect alimony penalties - the required amount will be withheld from her in the prescribed manner. An employee who wants to quit will receive only compensation for unused rest days, but not financial assistance, since this payment can be accrued directly when taking annual leave.

To the employer

A leader who values his colleagues, on his own initiative or at their request, can provide financial support in a situation where money is needed to restore health or carry out a necessary operation.

Since such support is individual in nature, it is not included in the staff payroll. It is paid from the profit fund or the undistributed reserve fund.

To provide such support, an application from the working person addressed to the employer is required. In it, in addition to the usual details - the “header”, the name of the form, an application for payment of financial assistance - it is required to display the essence of the problem due to which the person needed money.

There is no need to detail the diagnosis and costs. All this must be documented.

The decision to issue or refuse is made by the employer. If the issue is resolved positively, an order is issued, and the accounting department issues money on this basis.

Registration of financial assistance

To receive payment to an employee or former employee, you must write an application in any form. In the text part of the application, describe the circumstances in as much detail as possible. Attach documents confirming your life situation (certificate from the Ministry of Emergency Situations about a natural disaster, death certificate of a relative, birth or adoption certificate of a child, extract from the medical history, doctor’s report).

The manager, having considered the employee’s appeal, makes a decision on the amount of financial assistance based on the financial situation and complexity of the employee’s life situation.

Payment of financial assistance is made on the basis of an order (instruction) of the manager. The material may be divided into several parts and paid in several payments, for example, due to financial difficulties in the organization. But only one order is made. It should indicate the frequency of transfers. If several orders are created for one reason, then tax authorities recognize only the payment under the first order as financial assistance, and the rest are recognized as remuneration for work.

What amount should you expect?

The amounts that subordinates receive as additional bonuses for rest days will vary depending on the organization. Large companies with large annual profits can afford to pay employees an additional 10,000 and 30,000 rubles for vacation. Small enterprises do not have that kind of money, so if they wish, they can limit themselves to 3,000–5,000 rubles, since the law does not establish limits on financial assistance.

At the same time, the current regulatory framework forces some employers to save on taxes. Thus, according to the norms of the Tax Code of the Russian Federation, amounts up to 4,000 rubles, registered as financial assistance to employees, are not subject to personal income tax (clause 28 of Article 217 of the Tax Code of the Russian Federation) and insurance contributions (clause 11 of clause 1 of Article 422 of the Tax Code of the Russian Federation). On additional income exceeding this limit, you will have to withhold both tax and insurance contributions. Therefore, in many companies the maximum amount of financial assistance will be exactly 4,000 rubles.