Employer reporting

Olga Yakushina

Tax expert-journalist

Current as of September 19, 2019

On holidays and important dates, employers reward employees with money or give gifts in kind. Presents more expensive than 4,000 rubles. taxed and shown in form 6-NDFL. Let's look at how to do this correctly.

Gifts in 6-NDFL: how to correctly indicate tax amounts

Section 1 of Calculation 6-NDFL reflects the cumulative totals for the year, and Section 2 provides data on the amounts of income and tax for the last quarter.

If the gift is presented in kind, then the date of actual receipt of income when filling out page 100 of Section 2 will be the day the gift was given. For a gift in cash, this date is considered the day of payment (transfer) to the employee (clause 1 of Article 223 of the Tax Code of the Russian Federation).

There is no need to reduce the value of the gift at the expense of tax: when receiving natural income, personal income tax is withheld from other immediate cash payments, for example, salaries or bonuses. Such a tax can be withheld in an amount of no more than 50% of the amount of cash income received (clause 4 of Article 226 of the Tax Code of the Russian Federation). Personal income tax must be transferred no later than the day following the tax withholding.

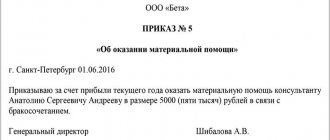

The company provided financial assistance of more than 4,000 rubles

In the second quarter, the company provided an employee with financial assistance in the amount of 15,000 rubles. Only 4,000 rubles are exempt from personal income tax.

Financial assistance of more than 4,000 rubles per tax period must be shown in the calculation. On line 020, write down the entire amount of assistance. And in line 030, reflect the deduction in the form of a non-taxable amount - 4,000 rubles (clause 28 of article 217 of the Tax Code of the Russian Federation).

The date of receipt of income in the form of financial assistance is the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). As of the same date, the company withholds personal income tax. Therefore, write down the payment day in lines 100 and 110 of section 2 of the calculation. You can transfer the tax the next day.

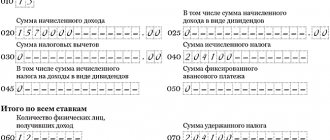

On May 17, the company provided the employee with financial assistance - 15,000 rubles. On the same day, I withheld personal income tax - 1,430 rubles. ((RUB 15,000 - RUB 4,000) × 13%). In addition to financial assistance, during the six months the company accrued income to 14 employees - 1,600,000 rubles, calculated and withheld personal income tax - 208,000 rubles. (RUB 1,600,000 × 13%).

Section 1. In line 020, the company recorded accrued income and financial assistance - 1,615,000 rubles. (1,600,000 + 15,000). In line 030 - deduction of 4000 rubles. In line 040 - personal income tax on income and assistance 209,430 rubles. (208,000 + 1430).

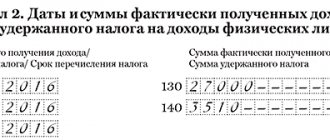

Section 2. In lines 100 and 110, the company reflected the date of issue of financial assistance. Line 120 shows the next business day. In line 130, the company recorded the full financial assistance - 15,000 rubles. The company filled out the calculation as in sample 59.

Sample 59. How to fill out the calculation if the company provided financial assistance of more than 4,000 rubles:

6-NDFL: gifts up to 4000

In section 1, the value of the gift is reflected on line 020, but if during the year the employee received gifts with a total value of no more than 4,000 rubles. – such gifts may not be reflected at all in the 6-NDFL declaration. This is stated in the Letter of the Federal Tax Service dated July 21, 2017 No. BS-4-11/ [email protected]

If the cost of gifts given to an employee during the year exceeds 4,000 rubles, then the amount of gifts and the deduction must be shown in the corresponding lines of form 6-NDFL (lines 020 and 030).

Example

For the 1st quarter, Location LLC accrued income to its employees in the amount of 210,000 rubles. (70,000 rubles per month). The amount of standard deductions for the quarter was 4,200 rubles. (1400 rubles per month). The salary payment date is the 7th.

Personal income tax in each month of the quarter was: (70,000 -1,400) x 13% = 8,918 rubles.

The amount of calculated personal income tax for 3 months is equal to: (210,000 – 4,200) x 13% = 26,754 rubles.

The withholding tax (p. 070) does not include the amount for March, because March's salary was paid in April.

In addition, in February, an employee was given a gift worth 3,500 rubles, and by March 8, an employee was given 4,000 rubles. Since these amounts did not exceed the established limit, the gifts were not reflected in 6-NDFL. Sections 1 and 2 were completed as follows:

The company gave a gift worth more than 4,000 rubles

The company gave the employee an anniversary gift. The gift cost more than 4,000 rubles. The company withheld personal income tax from the next salary.

Payments that are only partially exempt from personal income tax are reflected in the 6-personal income tax calculation. Including gifts worth more than 4,000 rubles (clause 28, article 217 of the Tax Code of the Russian Federation).

In section 1, reflect the gift in the period when the company gave the gift. In line 020, write down the entire cost of the gift, in line 030 - a deduction of 4,000 rubles. In line 040, fill in the calculated personal income tax. Fill out line 070 if you were able to withhold personal income tax from the gift during the reporting period. Do not fill out line 080 if you can withhold personal income tax until the end of the year.

ndfl_1.png

If during this year the same employees receive more gifts from the company, then in the quarter when this happens, it will be necessary to reflect the total value of all gifts and show a deduction of 8000 (4000 x 2 employees) on line 030.

Let's continue our example:

Let’s assume that in the second quarter the monthly salary of employees remained the same as in the 1st quarter – 70,000 rubles. Also on April 15, employees received another gift in connection with the company’s anniversary - 5,000 rubles. every. The total cost of gifts for the six months was 17,500 rubles. (4000 + 3500 + 5000 + 5000). Then the following should be indicated in the Half-Year Calculation:

According to page 020, the amount of income is 437,500 rubles. (210,000 for 1 quarter + 210,000 for 2 quarters + 17500).

On page 030, taking into account the deduction for gifts, the amount will be 16,400 rubles. (1400 x 6 months + 4000 + 4000).

The total calculated amount of personal income tax (line 040) is 54,743 rubles. ((437500 – 16400) x 13%).

At the same time, personal income tax should be withheld from the above-limit value of gifts - 1235 rubles. ((17500 – 8000) x13%).

In the 1st quarter in 6-personal income tax, gifts up to 4000 were not shown. Tax on gifts received in April was withheld when paying salaries for April and reflected in the semi-annual Calculation.

Filling out form 6-NDFL for the six months:

The company provided financial assistance of less than 4,000 rubles

The company provided financial assistance to employees during the quarter. Each employee received less than 4,000 rubles for six months.

Payments that are only partially exempt from personal income tax must be reflected in the calculation. Material assistance is exempt from tax in an amount that does not exceed 4,000 rubles for the tax period (clause 28 of article 217 of the Tax Code of the Russian Federation).

At the same time, if an employee received less than 4,000 rubles in a year, the company does not submit 2-NDFL for him (letter of the Ministry of Finance of Russia dated 05/08/13 No. 03-04-06/16327). This means that assistance within the non-taxable amount may not be reflected in the calculation. If you fill out the payment in the 6-NDFL calculation, the information for the year will not agree with the 2-NDFL certificates (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

For the first half of the year, the company paid salaries to 10 employees - 840,000 rubles, and withheld personal income tax - 109,200 rubles. (RUB 840,000 × 13%). In the second quarter, the company provided financial assistance to employees. Total amount of 100,000 rubles. Assistance to each employee amounted to 3,500 rubles. Therefore, the company did not reflect this payment in the calculation. The company filled out Section 1 as in sample 58.

If the company issues assistance to the employee again, the income may exceed the non-taxable limit. In the period when this happens, reflect in the calculation the amount of assistance that has been issued since the beginning of the year. In this case, write down a deduction of 4,000 rubles in line 030 of the calculation.

Gifts in 6-NDFL over 4,000 rubles.

So, if the gift exceeds 4,000 rubles, then personal income tax must be calculated from the excess amount and the entire cost of the gift must be included in page 020 of Section 1. On page 030, you need to indicate a deduction of 4,000 rubles. The amount of tax withheld on page 070 is indicated if tax was withheld from the amount of the next cash payment. If the employee no longer has cash income from which tax can be withheld on the value of a gift given in kind (for example, he quit), then the amount of unwithheld tax is shown on line 080.

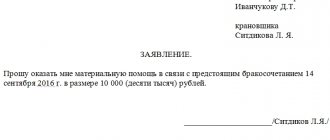

Example

An employee was given an expensive gift for his wedding day with a total value of 42,000 rubles. At the same time, personal income tax was calculated taking into account the deduction:

(42,000 – 4000) x 13% = 4940 rub.

The gift was ceremonially presented to the employee on March 25, 2021, and personal income tax was withheld only when his salary was paid for March - April 10, 2021. In the declaration 6-NDFL for the half-year, the following lines will be filled in regarding the gift:

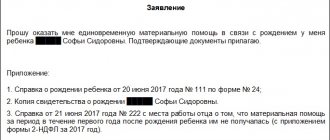

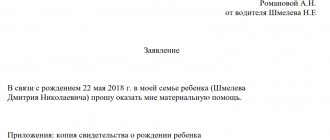

The company provided financial assistance along with vacation pay

The company provided the employee with vacation pay and financial assistance for the vacation, which is subject to personal income tax.

Payments can be shown in one block of lines 100–140 if all three dates coincide: receipt of income, personal income tax withholding and the deadline for tax remittance. The date of receipt of income and withholding of personal income tax on vacation pay and financial assistance is the date of payment. The company reflects this date in lines 100 and 110. In line 120, the company writes the deadline for transferring the tax. Personal income tax on vacation pay can be paid until the end of the month (Clause 6, Article 226 of the Tax Code of the Russian Federation). But the tax on material assistance is due no later than the next day. The dates on lines 120 are different. This means that in section 2, reflect payments separately.

On April 25, the company gave the employee vacation pay - 16,000 rubles. and financial assistance for vacation - 7,000 rubles. On the same day, the company withheld and transferred personal income tax from these payments - 2,080 rubles. (RUB 16,000 × 13%) and RUB 390. ((RUB 7,000 - RUB 4,000) × 13%).

The date for receiving income and withholding personal income tax is April 25. The deadline for transferring personal income tax from vacation pay is April 30. This is a holiday, so the deadline is moved to May 4th. Tax on material assistance must be paid no later than April 26. The company filled out payments in different blocks of lines 100–140, as in sample 60.

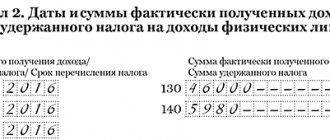

Sample 60. How to reflect vacation pay and financial assistance issued on the same day:

Taxpayer PRO, 2017

Gift from a legal entity to an individual

As you know, domestic legislation allows donations on behalf of organizations in favor of ordinary citizens.

This legal relationship is regulated by the general rules of Chapter 32 of the Civil Code, but at the same time it has a number of features in the registration and gratuitous transfer of certain types of gifts, as well as additional restrictions and grounds for canceling the transaction.

In addition, the specifics of taxation require special consideration—the donor also becomes obligated to pay taxes.

Registration of donation between a legal entity and an individual

A gift between an organization and an individual, as a general rule, is formalized by a gift agreement (Article 572 of the Civil Code).

According to it, the organization transfers free of charge or undertakes to transfer any thing, property right or release the donee from property obligations.

Please note that such an agreement cannot contain any property obligation or counter-representation of the donee, otherwise it will be void.

Important

If the value of the gift transferred to the legal entity. person exceeds 3 thousand rubles, the agreement must be drawn up in writing . Violation of this rule entails the nullity of the concluded transaction (clause 2 of Article 574 of the Civil Code).

Note that the requirement for any agreement concluded by a legal entity to be in writing. person, contained in paragraph 1 of Art. 161 Civil Code.

In addition to the form, the contract must meet the requirements and. So, according to Art. 432 of the Civil Code, the contract must contain a condition on the subject . According to paragraph 2 of Art. 572 of the Civil Code, a gift agreement that does not indicate a specific gift is void. Thus, the deed of gift describes in detail all the significant characteristics of the gift, distinguishing it from among similar items.

In addition to the subject matter, the procedure for its transfer to the recipient citizen must be specified in the contract. In particular, the conditions of transfer, the method and timing of delivery, additional documents to be drawn up, procedures to be carried out, third parties involved, etc. must be determined.

If the gift being transferred has shortcomings that may cause any harm to the recipient, then a representative of the donor’s organization is obliged to inform him about them (Article 580 of the Civil Code). In addition, it is advisable to also reflect these shortcomings in the contract.

Since making a donation is not only a transaction, but also a financial transaction that requires accounting, then in addition to the gift agreement, the legal entity needs to prepare other documents. In particular, the donation is also formalized by an order from the head of the organization and a statement of issuance of the gift, which serves as a deed of transfer.

Please note that on behalf of the organization, a gift transaction is always concluded by its authorized representative, who acts under a power of attorney issued by the head of the organization. According to paragraph 5 of Art. 576 of the Civil Code, such a power of attorney must necessarily contain an indication of the donee and the subject of the donation .

Donation of a car by a legal entity to an individual

The procedure for donating a car by a legal entity in favor of a citizen is not much different from a standard deed of gift, however, it still has characteristic features. So, for a number of reasons (participation of legal.

persons, the value of the gift, the need to register it), such an agreement is subject to mandatory written execution .

In addition to the contract itself, other documents confirming the expenses of the legal entity must be drawn up.

After receiving a car as a gift, the individual. a person will need to register him/her with the traffic police. The procedure for such registration is provided for by Order of the Ministry of Internal Affairs of the Russian Federation No. 1001 dated November 24, 2008.

When donating in favor of individuals.

persons, it should be remembered that paragraphs 2 and 3 of Art. 575 of the Civil Code, the legislator determined the list of persons in whose favor donations are prohibited .

Thus, this list includes employees of educational, medical and social institutions, as well as state and municipal employees.

According to Art. 432 of the Civil Code, the only essential condition for a gift is the condition about the object (gift). In view of this, the deed of gift must contain a detailed description of the car - its make, model, type, color and body number, engine number, as well as other individual characteristics. Ignoring this rule does not allow the deal to be considered concluded.