Financial assistance at work

Such payments to employees have no connection with the position held or with labor productivity or length of service - this is an expression of human attitude in the following cases:

- illness of a team member or a close relative;

- death of the employee’s relatives (or himself);

- natural disaster, theft of property;

- the arrival of a newborn in the family;

- marriage;

- anniversary, etc.

Contents of the order issued by management

If the request of the employee who wrote the application for financial assistance is approved, a special decree is issued. The document can be prepared on a special form or plain paper. Authorized persons are responsible for writing. The order contains the following information:

- order number;

- Name;

- date of writing;

- document text.

At the end, the manager’s full name and signature are placed. .

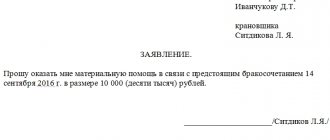

How to apply for financial assistance to an employee in connection with marriage

Upon marriage, an employee must submit an application requesting financial support.

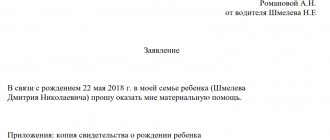

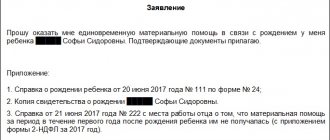

Sample application

The application has the simplest, most common form. At the top right you should indicate:

- full name of the position of the first manager of the enterprise where the employee is employed;

- company name;

- surname and initials of the official to whom the application is addressed;

- from whom the application is coming (your full name, position).

In the center you need to write “Application”, and below the paragraph a specific request: “I ask you to provide financial assistance in connection with marriage.” Below, the applicant must put the date the document was drawn up and a personal signature (with full name).

It is important to know that newlyweds have the right to apply for financial support only after completing the procedure at the registry office and receiving a marriage certificate.

Required documents

In each specific case, different documents will be required. In the case when an employee got married (or an employee got married), the only paper that can confirm that the marriage is not only de facto, but also de jure is a marriage certificate. A copy of this document is attached to the application.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Payment processing procedure

There is no specific legislative procedure for receiving financial assistance. Typically, the appointment of financial assistance in connection with a wedding occurs as follows:

- the employee writes an application, to which he attaches a copy of the marriage certificate;

- the manager considers the appeal - if the decision is positive, he puts a consent visa on the document;

- the personnel service issues an appropriate order indicating the basis for payment (employee marriage), signs it from the manager, introduces it to interested parties (applicant, accounting department);

- the accounting department makes accruals according to the order;

- funds are transferred or issued in cash to the applicant.

The amount of support is determined by the company's management - if the local act does not specify the amount of such assistance, any amount that suits the employer can be allocated. Financial assistance can be provided not only in cash, but also in kind.

How is the amount of payment to an employee in connection with marriage registration determined?

The amount of financial assistance paid to the newlywed may vary; usually its amount is stipulated in a collective agreement (Article 40, Article 41 of the Labor Code of the Russian Federation) or an employment contract.

If such an internal document does not exist, then the amount of financial assistance upon marriage is determined based on the capabilities of the company. The minimum amount of assistance is usually 4,000 rubles, the upper limit is not limited by anything other than the well-being of the company and the attitude of management.

If the employer’s financial situation is difficult, assistance may be refused or a smaller amount may be paid.

Who and where the newlywed works also matters. Full-time students who are married also have the right to receive financial assistance, but the amount depends on the charter of the educational institution or a document agreed upon with the trade union committee of the university or institute. At the university, a married student or a spouse receiving higher education can count on an amount from 4 to 7 thousand rubles . It should be understood that a budget educational institution cannot afford large payments.

The student must contact the trade union committee for help by submitting:

- statement;

- copy of passport, TIN;

- a copy of the marriage certificate.

If a civil servant got married, then financial assistance for the wedding will be paid to him, subject to the presence of such a clause in the service contract (Law of the Russian Federation of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation” - subparagraph 8, paragraph 3, art. 24 and paragraph 4 of Article 50).

Expert opinion

Irina Vasilyeva

Civil law expert

Employees of the Ministry of Internal Affairs have the right, as stated in paragraph 2 of Art. 3 of the Law of the Russian Federation No. 247-FZ, to receive financial assistance in the amount of at least 1 salary per year. And financial support on the occasion of a marriage, like other types of compensation, is not mandatory for a police officer: as stated in Order of the Ministry of Internal Affairs No. 1260, assistance is paid within the limits of funds allocated for monetary allowances by the federal budget.

A police officer can submit an application, and the result will depend on the availability of budget funds.

Is personal income tax charged?

An important point is the amount of assistance payments, since the amount of personal income tax payment will depend on this. There is no need to pay tax in the following cases:

- Payments of assistance due to an employee's retirement. But there is a nuance here: the pension amount should not exceed 4,000 rubles.

- Payments for treatment and medical care

- Payments related to the birth (adoption) of a child. The non-taxable amount should not exceed 50,000 rubles.

- Payments in situations of death of an employee's family member(s).

- Payments to relatives in connection with the death of an employee.

- Payments are made by trade union organizations at their own expense.

- Payments to victims of acts of terror and natural disasters.

Some items of financial assistance are still subject to taxation. In the case of systematic payments for recreational activities, the tax is calculated by analogy with the official salary of the employee.

The amount of excess of the established limits is subject to personal income tax and is 20%.

Features of taxation

It is important to know that financial assistance in connection with marriage, as specified in Art. 217 of the Tax Code of the Russian Federation, is the income of individuals. persons and is subject to taxation, but there is a significant relaxation: the amount of financial assistance is 4,000 rubles. is considered non-taxable. Thus, the tax will only be calculated on amounts in excess of 4 thousand. For example, if an employer allocates 10 thousand rubles to a newlywed for a wedding, then tax will be taken only from 6 thousand rubles.

This means that the amount of 4000 rubles. - not one-time assistance, but the total assistance that the young spouse received throughout the year (Article 216 of the Tax Code of the Russian Federation). Only the amount of the difference in excess of 4 thousand rubles will be taxed. (Personal income tax in this case is 13%). If the alimony payer has decided to get married, then the newlywed father must be prepared for the fact that alimony will certainly be withheld from financial assistance for the wedding.

Results

Financial assistance to an employee upon marriage can be provided by the employer as an additional social guarantee and enshrined in a local legal act or collective agreement.

Its amount can be any, but in accordance with tax legislation, only 4,000 rubles per reporting period are not subject to income tax. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Former retired employees

Enterprises, as a rule, do not forget the labor merits of retired employees. In a difficult life situation, an employer can financially help a person who has dedicated many years of his life to working for the company. Such payments are distinguished between “Social Security” and “Other Expenses”.

Must be paid by decision of the head of the organization or its owner. All expenses are formalized and go through the accounting department. The management order must state the purpose of the payment (health improvement, treatment or purchase of medicines). Like other benefits, assistance to retirees is not taxable. Most often, the organization creates a special fund, which is constantly replenished. Funds for help are taken from it. To receive support, as in other cases, an application is written addressed to the manager with all the necessary certificates attached.

Provision of financial assistance by the employer

Relations between employees and employers are regulated by the Labor Code.

This regulatory act allows enterprise management to provide in their regulations for the provision of financial assistance to employees in various situations that may not be related to financial or life problems. Download for viewing and printing: Labor Code of the Russian Federation

Thus, it is possible to transfer funds to an employee in connection with an anniversary or wedding.

This measure is left by the legislator at the discretion of the employer himself. But, if local regulations at the enterprise have been adopted, management is obliged to comply with them.

The amount of payments is determined taking into account the employee’s current situation, average earnings and financial well-being.

Important! The state also provides financial assistance to citizens. It is provided in the form of a lump sum payment. Its size as of 2017 was 4,000 rubles.

Sick leave during wedding leave.

If an employee begins to get sick, the days of leave for a wedding according to the labor code are not extended. In this situation, the employee (as usual) takes sick leave from the doctor, and after it is closed, gives this document to the HR department.

Personal and property rights and responsibilities of spouses: what are the rights and responsibilities of spouses.

Financial assistance to contract military personnel during marriage

A military man serving under a contract has the right to financial assistance on the occasion of marriage. This type of financial support can only be paid if the military personnel submit a report.

The calculation procedure is regulated by Law No. 306-FZ “On monetary allowances for military personnel and the provision of individual payments to them,” as well as the contract.

The Government of the Russian Federation highly values the mission of the military, guarding the security of the state, and strives to provide maximum financial support to contract soldiers who are ready to risk their own lives, so payments for the wedding usually amount to a significant amount.

Starting a family is an important event that requires large financial expenses, so the employer can meet the employee halfway and pay financial assistance. The basis for financial support for the newlywed is his application with a marriage certificate.

Dear readers, the information in the article may be out of date, please take advantage of a free consultation by calling: Moscow, St. Petersburg or using the feedback form below.

Helping a former colleague

For significant services to the institution, organizations can pay former employees additional financial incentives. Resources under this article are accrued exclusively from the organization’s profit in its pure form, and are subject to regulated taxes. The decision on the payment of funds and the amount rests solely with the authority of the manager.

In budgetary institutions, assistance is provided through a special fund of funds. A former employee can apply for various financial assistance from the institution: medical needs and medical care, recreational activities, payments for special events (wedding, birth of children) and others. Such assistance is considered a labor expense.

Armed with knowledge of your legal rights, you can confidently insist that you are right and demand that the employer fulfill its obligations towards its employees.

Court practice

For example, by resolution of the Arbitration Court of the West Siberian District dated 04/07/2017 No. F04-888/2017 in case No. A27-16563/2016, the applicant’s request to cancel the act of the Pension Fund body on the additional accrual of insurance premiums (and the resulting penalties and fines) was satisfied. on the grounds that financial assistance during marriage registration was not remuneration for the employee, since it did not depend on working conditions.

A similar position is set out in the resolution of the Seventh Arbitration Court of Appeal dated July 25, 2017 No. 07AP-5424/2017 in case No. A27-6618/2017, the resolution of the Fifteenth Arbitration Court of Appeal dated September 2, 2016 No. 15AP-8331/2016 in case No. A53-33784/ 2015 and other judicial acts. Thus, extensive judicial practice has developed that makes it possible to unambiguously regulate the issue of calculating insurance premiums for this payment, as well as classifying such payment as a type of income that is not included in wages.