Let's figure out what changes affect financial assistance to employees in 2021. Let's consider taxation with insurance premiums and personal income tax, as well as the impact on the income tax base and the simplified tax system.

The definition of material assistance is given in GOST R 52495-2005 “Social services to the population. Terms and definitions" (Approved by Order of Rostechregulirovanie dated December 30, 2005 No. 532-st).

At a practical, everyday level, this is a payment that is not related to the recipient’s performance of a labor function. Such payments are conditioned by the occurrence of a difficult life situation, for example, due to a natural disaster or other emergency, the death of a family member, the birth or adoption of a child, a wedding, a serious illness, etc.

Let us dwell in detail on the taxation of financial assistance to an employee in 2021.

Financial assistance as a type of income

Such support, unlike other types of income, does not depend on:

- from the employee’s activities;

- from the results of the organization’s activities;

- from the cyclical nature of work periods.

The grounds for receiving financial assistance can be divided into two: general and targeted. It is provided when any circumstances arise in the employee’s life:

- anniversary, special event;

- difficult financial situation;

- illness of an employee or close family member;

- death of an employee or close family member;

- birth of a child;

- emergencies;

- vacation.

A complete list of grounds for calculating financial assistance, as well as their amounts, are established by the regulatory (local) document of the organization. In some cases, for example, due to illness, the amount of financial assistance will be determined by the decision of the manager.

BOO

Let's take a closer look at how personal income tax is applied to material assistance in accounting. The amounts issued relate to other expenses for the current period. But they are not taken into account when calculating income tax or simplified tax system. Let's look at typical wiring:

- DT91 KT73 - attribution of financial assistance to other expenses.

- DT91 KT69 - reflection of contributions under the ESSS in amounts exceeding the limits of financial assistance.

- DT73 KT68 - withholding personal income tax from amounts exceeding the limits for financial assistance.

- DT73 KT50 - issuing financial assistance to an employee “in hand.”

In the 6-NDFL report on pages 020 and 030, you need to indicate only those payments that are subject to taxation in full or in part.

Taxation of financial assistance

The main question that an accountant asks is whether financial assistance is subject to personal income tax?

Each type has its own distinctive characteristics and accounting features for determining the personal income tax base, as well as insurance premiums. The personal income tax and contribution base depends on the basis for which financial assistance was provided. It is indicated in the employee’s application. Taxation of financial aid follows the same principles. At the same time, monetary support from the employer is either completely tax-free or not taxed up to an amount limit, which depends on the basis.

Payment nuances. What documents are needed and how are they prepared?

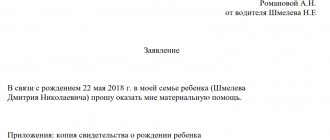

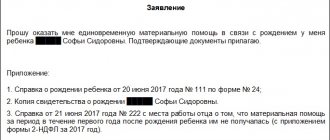

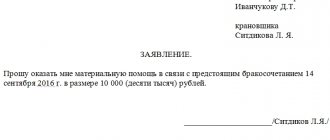

How to write an application for financial assistance?

If an employee applies for financial assistance from an employer, then he must draw up a corresponding application addressed to the director of his company. It is imperative to justify the reason why financial assistance is required. It is also necessary to attach documents that are evidence of a particular event (for example, a copy of a birth certificate).

Application for financial assistance

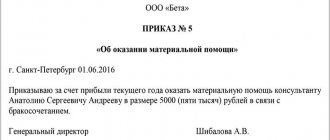

How to draw up an order for financial assistance?

In this order, which is personally drawn up by the director of the company or another responsible person, it is necessary to indicate the reason for this payment and instruct a specific employee from the accounting department to pay financial assistance within a certain period. Give the order to be signed by the employee receiving assistance and the accounting employee responsible for the payment.

Order for financial assistance

Not taxed

The list of such income is specified in Art. 217 Tax Code of the Russian Federation. In particular, financial assistance, tax-free for 2021, is provided in the following cases:

- death of an employee or a close member of his family;

- natural disaster;

- purchasing sanatorium and resort vouchers on the territory of the Russian Federation (compensation depending on the type of support, for example, for accompanying parents of children with disabilities to a place of recreation and recovery);

- emergency situation (terrorist attack and others).

Do I need to pay taxes and medical contributions?

The employer does not pay insurance premiums and personal income tax on lump sum payments that were made for the following reasons:

- natural disasters or emergencies causing property damage or harm to health;

- death of a loved one;

- birth (adoption, guardianship) of a child, if the amount of payment does not exceed 50 thousand rubles. for each baby;

- the amount of financial assistance did not exceed 4,000 rubles. in year.

Taxes are also not paid on money intended for the purchase of medicines if there is a doctor's prescription and receipts confirming the expenses.

On a note! Alimony payments from financial assistance are withheld.

Taxed over the limit

This applies to support that is of a general nature by providing:

- birth, adoption, establishment of guardianship rights - in the amount of no more than 50,000 rubles for each child when paid within 1 year after birth;

- the amount of partial compensation for sanatorium and resort vouchers in the Russian Federation in the amount of up to 4,000 rubles (taking into account the type of assistance, for example, to support the health of children due to severe environmental and climatic conditions, etc.);

- anniversary, special event (wedding) - up to 4,000 rubles;

- support for an employee in a difficult life situation, vacation - up to 4,000 rubles.

Let us remind you that the limit of financial assistance for the birth of a child is 50,000 rubles per parent. Such clarifications were given by the Ministry of Finance of the Russian Federation in letter dated 08/07/2017 No. 03-04-06/50382. Previously, officials considered the set amount to be the limit for both parents or guardians.

IMPORTANT!

When calculating personal income tax, a deduction for financial assistance on a general basis up to 4,000 rubles is provided once, regardless of how many times the support is provided.

When can I ask?

There is no clear definition of who is entitled to financial assistance at work, so any employee at his own discretion can ask for financial support, but if certain situations arise in life:

- the need to purchase expensive medications or pay for treatment;

- organizing a funeral for a close relative;

- birth of a child, adoption or guardianship;

- emergency incidents that resulted in damage or destruction of property (flooding of an apartment, fire, etc.);

- holding a wedding.

Meanwhile, the listed grounds do not oblige the boss to give money if the employment contract or internal documents do not stipulate clear conditions for the provision of financial assistance. In some organizations, an additional amount is added to vacation pay, in others they pay employees raising disabled children, in others they time payments to specific holidays (Disabled Person's Day, Elderly Person's Day, Mother's Day, etc.).

Income codes and material support deduction codes

The personal income tax tax base codes are fixed in the Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/ [email protected] Depending on the basis of financial assistance, the following are determined:

- material assistance income code (Appendix 1 of the Order of the Federal Tax Service);

- deduction code that provides financial assistance (Appendix 2 of the Federal Tax Service Order).

Let's look at an example. As a result of the fire, the employee lost her husband, long-term treatment did not produce results, the employee took leave due to life circumstances. By decision of the head of the organization, the employee was provided with financial support:

- in connection with a natural disaster - 100,000 rubles;

- in connection with the death of a spouse - 80,000 rubles;

- compensation for the cost of treatment - 60,000 rubles;

- in accordance with the collective agreement, when taking annual leave, an employee is entitled to support in the amount of two salaries (salary for the position held is 20,000 rubles), thus, financial assistance for leave amounted to 40,000 rubles.

Below we discuss the taxation of financial assistance to an employee in 2021, as well as financial assistance up to 4000 (2021 taxation).

Other grounds

Financial assistance for other reasons. An employer can provide assistance to its employees for any other reasons, for example: on the occasion of the death of his brother/sister; for vacation; in connection with marriage; due to a long illness.

Amounts of such material assistance are not subject to personal income tax and contributions to funds only within the limit of 4,000 rubles per employee per tax (settlement) period (clause 28 of article 217 of the Tax Code of the Russian Federation; subclause 11 of clause 1 of article 422 of the Tax Code of the Russian Federation; subclause 12 Clause 1, Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ).

In the 2-NDFL certificate (order of the Federal Tax Service of Russia dated January 17, 2021 No. ММВ-7-11 / [email protected] ), which the tax agent is obliged to submit to the Federal Tax Service at the end of the year no later than April 1 (clause 2 of Art. 230 of the Tax Code of the Russian Federation), not all financial assistance should be reflected, but only according to the available corresponding codes 2710, 2760, 2762, as well as deductions from it - 503, 508 (order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] ).

For example, for financial assistance provided to an employee in connection with the death of a close relative, a code is not provided; accordingly, these amounts do not need to be indicated in the 2-NDFL certificate.

The tax agent is obliged to submit Form 6-NDFL to the Federal Tax Service based on the results of each quarter no later than the last day of the month following the corresponding period, and for the year - no later than April 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation) (order of the Federal Tax Service of Russia dated October 14 2015 No. ММВ-7-11/ [email protected] ).

Financial assistance, for which codes are provided, is reflected both in the first section and in the second. The date of receipt of income in the form of financial assistance is the date of its payment to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). For example, assistance in connection with a marriage was accrued by order of the manager in January 2021 in the amount of 15,000 rubles, and paid on payday February 7, 2021. On the same day, personal income tax was withheld and transferred from her. The income receipt date will be February 7, 2021.

Due to the fact that some financial assistance is income subject to insurance premiums, it should be reflected in the quarterly calculation of insurance premiums (Order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11 / [email protected] ), which the employer submits to the Federal Tax Service no later than the 30th day of the month following the billing period (clause 7 of Article 432 of the Tax Code of the Russian Federation). And also in Form 4 - FSS (Order of the FSS of the Russian Federation dated September 26, 2021 No. 381), which the employer submits quarterly to the FSS on paper no later than the 20th day or in the form of an electronic document no later than the 25th day of the month following for the reporting period (clause 1 of article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

As a rule, material assistance is non-productive in nature, and these expenses cannot be justified, economically justified expenses (Clause 1 of Article 252 of the Tax Code of the Russian Federation). That is why its amount does not reduce the income tax base if the organization applies OSNO (clause 23 of Article 270 of the Tax Code of the Russian Federation), and is not taken into account in expenses when applying the simplified tax system “income minus expenses” (clause 2 of Article 346.16 of the Tax Code of the Russian Federation) . An exception is financial assistance for vacation, provided that it is enshrined in an employment or collective agreement and depends on the amount of wages and compliance with labor discipline (letter of the Ministry of Finance of Russia dated September 2, 2014 No. 03-03-06/1/43912). But insurance premiums calculated from financial assistance in excess of the limits can be included in expenses for all organizations (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation and subclause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Reflection of financial assistance in section 1 of form 6-NDFL for the first quarter

| Line code | Name | Sum |

| 020 | Amount of accrued income | 15,000 rub. |

| 030 | Amount of tax deductions | 4000 rub. |

| 040 | Amount of calculated tax | 1430 rub. |

| 070 | Amount of tax withheld | 1430 rub. |

Reflection of financial assistance in section 2 of form 6-NDFL

| Line code | Name | Row exponent |

| 100 | Date of actual receipt of income | 07.02.2018 |

| 110 | Tax withholding date | 07.02.2018 |

| 120 | Tax payment deadline | 08.07.2018 |

| 130 | Amount of actual income received | 15,000 rub. |

| 140 | Amount of tax withheld | 1430 rub. |

Calculation of the base for insurance premiums

IMPORTANT!

If payments are reflected in one of the reporting forms, then, based on clause 3 of the inter-document control relationships, prepare explanations for discrepancies in the forms. For example, non-taxable income not indicated in the 2-NDFL certificate and reflection of the dates of transfers for the specified payments in the 6-NDFL form.

Finally, let’s figure out whether financial assistance is subject to insurance contributions or not.

When determining the base of insurance premiums, support amounts are legally excluded on the same grounds as the base for calculating personal income tax.

A special case

Is financial assistance subject to personal income tax if we are talking about a one-time payment to a member of the workforce who has a child? No, if the amount of financial assistance does not exceed 50 thousand rubles. In this case, the payment can be made to either one of the spouses or both at once. If the amount exceeds the specified limit, you will have to pay personal income tax.

This payment should be considered separately. Firstly, such compensation is often called a “birth bonus” in collective agreements. As mentioned earlier, incorrect wording of the operation can reclassify the payment from financial assistance as any other. Therefore, in the collective agreement and the order for the transfer of funds, it is necessary to indicate that we are talking specifically about financial assistance.

Secondly, the payment is limited to 50 thousand rubles. If parents work in different organizations, then management may request a certificate from the employee confirming that the second parent received financial assistance. Officials say there are no special requirements in this regard. The Ministry of Finance believes that it is better to play it safe and get a certificate of income of the second parent. If he is not employed, then you can provide a copy of your employment record or a certificate from the employment service. In some regions, tax authorities accept a statement from the second parent about the lack of financial assistance.

If an additional payment is made to the payment received by one employee in connection with the birth of a child on the basis of a new order, then it will no longer be considered a one-time payment. Personal income tax will have to be withheld from this amount. This payment to the employee must be included in the payroll. The document should also reflect all such payments, include the cashier’s signature and the organization’s seal.