One of the priority areas for the development of the Russian economy is agriculture. In this regard, a special tax regime was developed for enterprises in this area - a single agricultural tax. Unified agricultural tax - what is it in simple words?

Payers on this system are exempt from income tax (individual entrepreneurs from personal income tax), as well as partially from property tax. Instead, they pay a single tax on the difference between income and expenses. In this case, the person must have the status of an agricultural producer. These include legal entities, peasant (farm) enterprises and individual entrepreneurs who are engaged in the production, processing or sale of crops, livestock products, fisheries, and also provide services in the field of agriculture. In addition, the key condition for applying the special regime is a limit on income from other activities. The share of revenue from sales of agricultural products in total revenues must be at least 70%.

Currently, the procedure for taxing persons on the Unified Agricultural Tax has changed somewhat. What innovations have appeared in the Unified Agricultural Tax system since 2021? You can find the latest news in our article.

Unified Agricultural Tax in 2021: changes in payer obligations

From January 1, 2021, agricultural producers in a special regime have an obligation to pay value added tax to the budget. It is established by Federal Law No. 335-FZ of November 27, 2021, amending the Tax Code. Previously, taxpayers of the Unified Agricultural Tax of the Tax Code of the Russian Federation were provided with an exemption from VAT. The exception was the tax paid to the budget when importing imported products. Now companies and individual entrepreneurs on the Unified Agricultural Tax will have to draw up all the necessary documents as payers of value added tax. In particular, keep a book of purchases and sales and prepare invoices for counterparties. In addition, you will need to submit a VAT return.

Submit your Unified Agricultural Tax declaration online

Enter the details of your organization, and Kontur.Extern will help calculate agricultural tax, check the declaration for errors and instantly transfer it to the tax office, and then prepare a payment slip for the bank.

Send a request

Reporting of peasant farms under the Unified Agricultural Tax: reporting forms for extra-budgetary funds

If a peasant farm does not have employees, then its interaction with extra-budgetary funds is carried out in the manner that determines interaction with the corresponding funds of individual entrepreneurs. That is, there is no need to report to the Pension Fund. At the same time, individual entrepreneurs on the Unified Agricultural Tax must pay insurance premiums in a fixed amount.

If a peasant farm has employees, then the farm will have to report:

1. Before the Pension Fund, providing:

- form SZV-M - monthly (until the 15th day of the month following the reporting month);

- form SZV-TD - monthly until the 15th of the previous reporting period.

2. Before the Social Insurance Fund, submitting form 4-FSS to the fund - based on the results of each quarter by the 20th day of the month following the reporting period on paper. If a peasant farm employs more than 25 people, then its reporting to the Social Insurance Fund must be submitted via electronic communication channels. However, it can be submitted 5 days later than the paper version of the report is submitted.

The activities of peasant farms at the unified agricultural system are regulated by a large number of regulations. You can confirm the correctness of what you have written using the materials of the ConsultantPlus system. Get free trial access to the system and watch the explanations of the expert of the NP “Chamber of Tax Consultants” A.V. Anishchenko.

Unified agricultural tax and VAT in 2021: advantages and disadvantages

What are the positive and negative aspects of the new duty of agricultural producers? Paying VAT is an additional tax burden for businesses, which is a negative factor. The volume of reports compiled automatically increases, and therefore labor costs. Also, the emergence of an obligation to pay a new tax means additional control on the part of the tax service.

On the other hand, payers of the single agricultural tax are now more attractive to counterparties. It is often unprofitable for buyers to purchase goods from those persons who do not have to pay VAT. In these cases, they lose their right to receive a deduction. It is expected that the introduction of VAT for agricultural producers will increase demand for their products.

Who are agricultural producers?

- enterprises and individual entrepreneurs that produce, process and sell agricultural products. There is one important condition here: the share of income from the sale of such products must be at least 70% of the income from the sale of all goods and services;

- agricultural consumer cooperatives whose share of income from the sale of agricultural products of their own production is at least 70% of income from the sale of all goods and services;

- fishing organizations and entrepreneurs that meet a number of conditions (the share of income from the sale of catch is at least 70% of the total income, fishing vessels belong to them by right of ownership or under charter agreements, etc.)

- organizations and individual entrepreneurs that provide agricultural producers with services related to auxiliary activities in the field of crop production and post-harvest processing of agricultural products: field preparation, sowing, driving and grazing livestock, etc. The share of income from the sale of the listed services must be at least 70% of the income from the sale of all goods and services

Exemption from VAT for agricultural producers

Firms and enterprises on the Unified Agricultural Tax have the right to receive an exemption from VAT. This is possible in the following situations:

- notification for obtaining VAT exemption and notification of the start of work in a special regime refer to one calendar year;

- or compliance with the standard for revenue from agricultural activities. The threshold value will gradually decrease. So, in order to receive VAT exemption in 2021, income excluding tax in 2021 should not have exceeded 100 million rubles. in a year. The criteria for subsequent years are shown in the table:

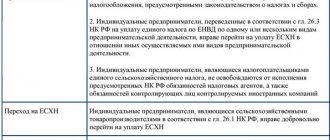

| Year | Revenue threshold |

| 2020 | 90 million rub. in 2021 |

| 2021 | 80 million rub. in 2021 |

| 2022 | 70 million rub. in 2021 |

| 2023 | 60 million rub. in 2022 |

If an agricultural producer plans to exercise the right not to pay VAT, he must submit a corresponding notification to the tax office. A notice of VAT exemption for the Unified Agricultural Tax is submitted up to and including the 20th day of the month from which the payer begins to exercise his right not to pay tax. The application form for exemption from VAT under the Unified Agricultural Tax in 2021 is contained in the Letter of the Federal Tax Service of Russia dated January 15, 2019 No. SD-4-3/ [email protected]

Those companies and individual entrepreneurs that sold excisable products within three calendar months before submitting the notification cannot receive VAT exemption. When the sale of excisable goods begins or when the revenue limit is violated, the agricultural producer loses the right not to pay VAT. In the future, such persons do not have the right to re-release. Please note that if obtaining an exemption is voluntary, then the reverse procedure is not possible unless the above conditions are violated.

Results

The use of the Unified Agricultural Tax for peasant farms assumes that the farm is a full-fledged business entity and has obligations to submit reports to the Federal Tax Service and extra-budgetary funds. The composition of this reporting depends on whether the peasant farm is an employer.

You can get acquainted with other nuances of conducting activities in the Unified Agricultural Tax regime in the articles:

- “KBK for payment of unified agricultural taxes in 2021”;

- “What is the deadline for paying the Unified Agricultural Tax for the year and what to do in case of a loss”.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

- Book of accounting of income and expenses, approved. by order of the Ministry of Finance of Russia dated December 11, 2006 N 169n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax rates of the special regime for agricultural producers in 2021

The unified agricultural tax in 2021 is generally paid at a standard rate of 6%. At the same time, the authorities of the constituent entities of the Russian Federation can establish differentiated rates in the range from 0 to 6%. This opportunity has appeared since the beginning of 2021. The bet size depends on:

- type of agricultural products (or works/services);

- the amount of income from doing business in agriculture;

- places where the person carries out activities;

- number of employees of the company or individual entrepreneur.

Variation of rates allows you to find a balance between the burden on payers and the amount of tax revenue. Some regions have already exercised the right to introduce reduced rates on their territory. For example, in the Moscow region a zero tax rate has been established until December 31, 2021. Until the same date, rates were established by local laws in the Sverdlovsk (5%) and Kemerovo regions (3%).

Report preparation programs

The Unified Agricultural Tax declaration can be prepared using the following programs:

| Software name | Website |

| “Taxpayer Legal Entity” (free) | https://www.nalog.ru/rn77/program/5961229/ |

| "Bukhsoft" | https://online.buhsoft.ru/2017/reps/external.php?rep=23 |

| "Sky" | nebopro.ru |

| "My business" | www.moedelo.org |

| "Taxpayer PRO" | nalogypro.ru |

| "1C" | 1c.ru |

Property tax for Unified Agricultural Tax payers - 2018

An important issue when applying the Unified Agricultural Tax is property taxation. The key changes in the Unified Agricultural Tax system in recent years include the amendment to the Tax Code regarding property tax. Starting from 2021, only property that is involved in agricultural activities is exempt from taxation. It includes assets that are involved in the production, processing, sale of agricultural goods or in the provision of services by agricultural producers. Previously there was no such clause.

Property used in agricultural activities can be divided into two groups. One is directly used for production. For example, sowing equipment, buildings where animals are kept, etc. Others are auxiliary, in particular garages for equipment, warehouses, etc. The right not to pay tax applies to both groups.

Assets subject to property tax and assets involved in agricultural activities must be accounted for separately. However, a situation may arise when an enterprise uses property simultaneously for the production of agricultural products and for other activities. In this case, the property cannot be taken into account separately. In 2018, Federal Tax Service Letter No. BS-4-21 dated July 10, 2021 was issued [email protected] It provides the following explanation: if an agricultural enterprise uses property for other business activities, but at the same time for its intended purpose, then it is not subject to tax. In addition, there is no need to pay property tax if the assets are under conservation, that is, temporarily not used in the main activity.

Filling out a declaration under the Unified Agricultural Tax - step-by-step instructions

Below we will go through the 5 steps of filling out the Unified Agricultural Tax declaration and give examples of filling out each sheet.

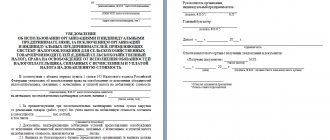

Step 1 - Filling out the title page

If you have already filled out some kind of declaration or read, for example, an article about filling out a declaration for the simplified tax system-Income, then putting the data on the title page will not be difficult for you. Everything is very simple here, you need to enter:

- Individual entrepreneurs provide an INN, and legal entities also indicate a checkpoint;

- The page number on the title page will be 001, on the following sheets - 002, etc.;

- We initially indicate the correction number as “0—”, if you then submit an updated declaration, enter “1—”, if you will correct it again, “2—”, etc.;

- Tax period code - set to 34 (corresponds to the year, see the remaining codes in Appendix 1 to the approving order of the Federal Tax Service);

- Then we enter the reporting year 2021, the code of our tax office and the code of the place of representation (for individual entrepreneurs it will be “120” - at the place of residence, for ordinary legal entities “214” - at the location, see the remaining codes in Appendix No. 2 all in addition to the one already indicated above the order of the Federal Tax Service);

- Then the individual entrepreneur indicates the full name line by line, the legal entity - the full name;

- We enter the OKVED code;

- If necessary, enter the reorganization/liquidation form code, as well as the corresponding INN/KPP of the reorganized legal entity;

- We indicate the phone number for contacts;

- We indicate the number of pages (how many are there in total in your declaration) and the number of pages of attachments (if there are any attachments).

Next, as usual: the left block is for the person confirming the information in the declaration, the right block is for the Federal Tax Service employee.

An example of filling out a title page looks like this:

Step 2 - Do the calculation in Section 2

Why are we skipping the first section? Section 1 is final, so you must first fill out the data in Sections 2 and 2.1.

In Section 2 we have very few lines, we put here:

- On line 010 – the amount of income for the year;

- On line 020 - the amount of expenses for the year;

- On line 030 – we calculate the tax base, line 030 = 010 – 020;

Important! If the difference between income and expenses is negative, that is, we received a loss, then we consider that our tax base = 0 and we will have dashes on line 030.

- On line 040 - we enter the amount of loss from previous periods by which we reduce the tax base for this year; we take this figure from line 010 of Section. 2.1. We will show you how to make calculations in this section below.

Important! The indicator on line 040 cannot be greater than line 030, since we cannot write off more losses than we have profits for the current year.

- On line 045 – set the tax rate (standard – 6%);

- On line 050 – we calculate the tax, line 050 = (030 – 040) * 6%.

Step 3 — Fill in the damage amounts in Section 2.1

This section must be completed if in previous years the entrepreneur received a loss rather than a profit. You have the right to write off this loss over a period of 10 years, reducing the tax base for it, but this can only be done in chronological order. That is, for example, we had a loss in the previous three years: in 2015 – 120 thousand rubles, in 2021 – 50 thousand rubles, 2021 – 10 thousand rubles. In this situation, we first write off the loss of 2015, then 2016, and only then 2021. At the same time, you can reduce the tax base in the current year either by the entire loss or by part of it, just remember the rule that in Section 2, line 040 cannot be larger than line 030.

So, what do we indicate here:

- On line 010 - we enter the total amount of losses from previous years that have not yet been carried forward to the beginning of the completed tax period. According to our example, this line will be equal to 180,000 rubles.

- In the block of lines 020-110 - we describe this amount by year. Following our example, we write three years in lines 020, 030 and 040, in the rest we put dashes;

- On line 120, we indicate the amount of loss for this year. Line 120 is equal to the difference between lines 020 and 010 from Sec. 2 (if expenses are greater than income). In our example, a profit was made in 2021, so there are dashes in this line;

- On line 130 - we enter the amount of loss that remained not transferred to reduce the base of this year and will be transferred in future tax periods. In our example, let us move Section 040 to line 040. 2 only 60,000 rubles, respectively, for the next periods we will have 120 thousand rubles left.

- In lines 140-230 we describe this amount by year. In our example it will be like this: 2015 – 60 thousand rubles, 2021 – 50 thousand rubles, 2021 – 10 thousand rubles.

Important! The indicators of line 130 and lines 140-230 from this declaration will go to line 010 and lines 020-110, respectively, in the declaration at the end of the next year.

An example of filling out this section looks like this:

Step 4 - Indicate the final data in Section 1

Now we return to Section 1. What we fill out here:

- In line 001 – we write down our OKTMO code;

- In line 003 - if the OKTMO code has changed during the year - put its new value, if it has not changed - dashes;

- In line 002 – we indicate the amount of the advance payment under the Unified Agricultural Tax, calculated based on the results of the six months. Let's say that we transferred a payment of 20 thousand rubles.

- In line 004 – we enter the amount by which additional tax should be paid at the end of the year. In our example, line 050 Section. 2 = 74,790 rubles, of which we have already transferred 20 thousand rubles, which means line 004 = 54,790 rubles.

Important! If it turns out that we overpaid in advance for half a year, then we have line 002 Section. 1 more than line 050 Sec. 2, then we fill out not line 004, but line 005 - tax to be reduced. This situation is possible when in the second half of the year large expenses were incurred that covered all income, and as a result, at the end of the year we had a loss.

An example of completed Sections 1 and 2 looks like this:

Step 5 - How to complete Section 3

Here everything is similar to the declaration using the same simplification:

- We enter the admission code;

- We set the date of receipt and period of use;

- We indicate the amount received and the amount of funds used;

- We indicate the amounts of funds that were used for their intended purpose / for other purposes;

- At the end of the report we summarize the final indicators.

An example of a completed Section 3 is shown below: