Vacation is paid based on the citizen’s average earnings for the pay period, usually a year. The calculation of average earnings is regulated by Government Decree No. 922 dated 12/24/07 (“Regulation”). This document states that financial assistance should be excluded from the formula for calculating vacation pay. At the same time, in some cases, financial assistance may be included in the calculation of vacation payments.

Question: What types of financial assistance exist for an employee and how to provide it? View answer

What is financial assistance for vacation?

In order to answer the question of whether financial assistance is included in the calculation of vacation pay, you should decide what is meant by financial assistance in the context of vacation payments.

The Presidium of the Supreme Arbitration Court of the Russian Federation, in its resolution dated November 30, 2010 No. VAS-4350/10, states that financial assistance should include employer payments that are not related to the employee’s performance of a labor function and aimed at meeting the social needs of a citizen in a difficult situation. This could be, for example, damage to property and/or health due to an emergency, serious illness, death of a close relative, birth (adoption) of a child, etc.

According to the logic of this resolution, financial assistance—including vacation—should also include payments that:

- are not included in the wage system;

- are not paid on a regular basis;

- not related to labor productivity;

- are not stimulating.

And if this or that payment (it does not matter whether it is one-time or multiple) meets the specified 4 criteria, then it may well be classified as financial assistance.

In order to prove to the inspectors that such payments are precisely material assistance - for vacation or not, it does not matter - the employer company can provide a clear definition of material assistance, as well as the criteria for its provision, in the collective labor agreement or in the regulations on financial assistance. We can take the theses of the Supreme Arbitration Court of the Russian Federation that we have considered as a basis.

See the material “Regulations on the provision of financial assistance to employees” for more details.

Terms of service

Vacation is provided to all employees who have worked for the company for a year (Article 114 of the Labor Code of the Russian Federation). In such a situation, an employee can qualify for paid days off for 28 days (Article 115 of the Labor Code of the Russian Federation).

In some cases, this period increases. For example, when an employee works irregular working hours, he receives an additional 3 days.

Leave can also be received by employees who perform a job function part-time. Part-time workers receive it. Vacation is provided according to the vacation schedule.

If an employee has just found a job, he can rest after 6 months of work. For some categories of employees this period is not taken into account, including minors.

What is the significance of the fact that payments are classified as financial assistance?

The criteria for classifying certain payments as financial assistance for an employer may play a role:

1. When maintaining tax records.

The fact is that material assistance cannot be included in expenses when calculating the taxable base for income tax (clause 23 of Article 270 of the Tax Code of the Russian Federation). In turn, payments to employees that are not recognized as financial assistance are included in expenses.

Find out how financial assistance affects the amount of income tax in the Ready-made solution from ConsultantPlus by receiving a free trial access.

How financial assistance is subject to insurance premiums, read this article.

See also:

- “Is financial assistance to an employee subject to personal income tax?”;

- “We reflect financial assistance under the simplified tax system “income minus expenses”.

2. When calculating vacation pay.

Financial assistance can be either completely excluded from the formula for calculating vacation pay (clause 3 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of Russia dated December 24, 2007 No. 922), or in a number of cases and with certain restrictions included in it (clause 6 Rules for calculating the salary of federal civil servants, approved by Decree of the Government of the Russian Federation dated September 6, 2007 No. 562, hereinafter referred to as the Rules).

But when should financial assistance for vacation (or provided before it) be included in the calculation of vacation pay?

The answer to this question depends on the legal status of the employer's company. The fact is that the legislation of the Russian Federation establishes separate rules for calculating vacation for:

- federal civil servants;

- other employees (including employees of regional and municipal departments).

How to take into account financial assistance for vacation in accounting, as well as correctly calculate personal income tax and insurance premiums, ConsultantPlus experts explained. Get trial access to the system and study the issue in more detail.

FAQ

The process of calculating vacation pay quite often raises questions among employees. Indeed, the law says little about making calculations.

In fact, all actions are carried out by the accounting department and it can be very difficult to determine the correctness of the calculations.

In addition, in practice, different situations arise that should also be taken into account when making calculations. For example, how is the average salary for a part-time worker calculated, will income for an incompletely worked month be taken into account, and are all bonuses excluded from the income base?

Partial month worked

We have already mentioned that when calculating average earnings, only fully worked months are taken into account. What to do if an employee was sick or on maternity leave during the billing period? Or in his case there were other periods that should be excluded.

If such a situation arises, then it is necessary to take into account not the entire month, but only those days that the employee performed his labor function, then in order to calculate the days included in the total period, the following calculations must be performed:

29.3/number of days in a month*days that the employee performed his job function.

Let's demonstrate with an example. Ivanov A.P. goes on vacation. In September he took sick leave for 14 days. Accordingly, he actually worked for 16 days. Now let’s calculate the number of days that will be included in the billing period: 29.3/30*16=15.63

Do bonuses count?

Cash rewards are part of the remuneration system, so they are included in the income part. The timing of the accrual of the incentive does not matter.

Payments that are made per day, month or year are taken into account equally if they were issued during the billing period.

But these rules apply only to bonuses that are defined by internal documents and are not one-time in nature.

This is interesting: Calculation of average earnings for vacation

When should vacation pay be transferred according to the law? Read here.

Do I need to pay insurance premiums from vacation pay? Details in this article.

Part-time job

The part-time worker has the right to leave. Weekends at additional work are provided in parallel with the rest period at the main place.

Vacation pay is calculated according to the same rules.

Financial assistance (one-time payments) when calculating leave for federal employees: nuances

Federal civil servants include employees of departments who receive salaries from the federal budget without attracting other budgetary sources of funding (Clause 1, Article 10 of the Law “On the Public Service System” dated May 27, 2003 No. 58-FZ).

Financial assistance is a type of additional payments for a federal civil servant (clause 2 of the Rules). It is isolated from various allowances and incentives and therefore can be considered as unrelated to the remuneration system.

At the same time, in accordance with clause 6 of the Rules, financial assistance is included in the calculation of vacation pay for employees of federal departments. But not completely, but limitedly - like 1/12 of each accrued payment for the billing period before the vacation (12 months).

In this case, only actual payments are taken into account, and not regulatory ones, if any are provided for (letter of the Federal Tax Service of Russia dated November 23, 2007 No. BE-6-16/906). The formula for calculating vacation pay can take into account several payments of financial assistance - before or before the vacation (letter of the Ministry of Health and Social Development of the Russian Federation dated November 15, 2007 No. 3495-17).

The jurisdiction of the Rules introduced by Resolution 562 applies to all positions in federal departments, except for those for which the amount of remuneration is determined based on performance indicators (in the manner established by paragraph 14 of Article 50 of the Law “On the State Civil Service” dated July 27. 2004 No. 79-FZ).

Features of accrual

Vacation pay is payments that are made while an employee is on vacation. During this time, the employee does not receive wages.

The funds are provided to him at a time - 3 days before the vacation.

Vacation pay is calculated based on average earnings. To obtain this indicator, it is necessary to identify the billing period and summarize the income received during this period.

The legislator defines the concept of average earnings in the Labor Code of the Russian Federation. It is necessary to adhere to the rules established by law for its calculation.

What payments are taken into account?

When calculating average earnings, the employee's payments for the pay period are taken into account. You need to know that not all profits will be considered when making calculations.

Thus, the following incomes are not taken into account when calculating average earnings in 2021:

- temporary disability benefits;

- benefits that are not subject to personal income tax;

- business trips;

- payments that are compensatory in nature (for food, travel, etc.).

Certain types of bonuses are not taken into account in the calculations. Namely, those that are not provided for by the accepted employee remuneration system.

Average earnings

Average earnings are calculated using the formula: income received in the billing period/12/29.3, where:

- 12 – number of months of the billing period (may be less than 12);

- 29.3 – average number of days in a month.

When calculating average earnings, it is necessary to obtain data on the employee’s income for the billing period.

Such payments include the following:

- salary size;

- profit from piecework;

- non-monetary remuneration;

- royalties;

- additional payment for performing work functions overtime;

- bonuses and additional payments that are established by the remuneration system.

The billing period is determined in months that are fully worked out.

Days are excluded from this period if the employee did not work due to the following reasons:

- absence from work due to illness or injury, which is confirmed by a certificate of temporary incapacity for work;

- maternity leave;

- periods of downtime;

- leave without pay.

Is financial assistance taken into account when calculating vacation in a private company?

In private firms and all those business entities that do not belong to the system of federal departments, material assistance is not taken into account when calculating the amount of vacation pay - like other social payments. This rule applies, in particular, to municipal employees (decision of the Kovylkinsky District Court of the Republic of Mordovia dated March 25, 2015 No. 2-116/2015).

It should be noted that the very fact of using the concept of “material assistance” in local and industry-wide departmental (at levels below federal) standards will mean nothing if the payments associated with this concept do not actually meet the criteria for material assistance. Payments called material assistance in the local act, but not corresponding to them in essence, will be considered labor payments (letter of the Ministry of Finance dated June 26, 2012 No. ED-4-3 / [email protected] ). They will need to be taken into account when calculating vacation.

If in the regulations governing the work of specifically federal departments, the concept of “material assistance” is directly associated with the wage system (and does not fall under clause 3 of the Regulations under Resolution 922), then, nevertheless, such assistance should be taken into account when calculating vacation pay for federal employees necessary according to the Rules approved by Resolution 562.

Thus, paragraph 32 of the Regulations, introduced by order of Rosobrnadzor dated July 17, 2015 No. 1247, establishes that employees of the Federal Service for Supervision in Education and Science are entitled to a one-time provision of financial assistance in the amount of one salary. The connection between financial assistance and labor function is obvious, but its amount is not included in the calculation of vacation pay in full, but only in 1/12 of the part - as prescribed by a higher departmental regulation.

See also “Financial assistance upon dismissal of one’s own free will.”

Some nuances of accounting for financial assistance for civil servants

The situation is somewhat complicated by the fact that the law establishes separate rules for calculating vacations for civil servants.

Clause 6 of Decree of the Government of the Russian Federation dated September 6, 2007 No. 562 states that financial assistance is included in the calculation of vacation pay for employees of federal departments in the amount of 1/12 of each accrued payment for the 12 months before the start of the vacation. This requirement applies to all civil servants, with the exception of those whose remuneration depends on performance results.

In all other economic entities (including private organizations), financial assistance is not taken into account as part of average earnings and for vacation pay. It must be taken into account that these payments must meet a number of criteria. They should not be of an incentive nature, cannot be paid regularly and do not depend on the results of work.

An example of calculating vacation pay for a civil servant

We take the average monthly number of calendar days in the billing period as 29.3 days (clause 6 of Resolution No. 562). First, you need to calculate the average daily earnings (taking into account payments received):

Results

Financial assistance for vacation is included in the calculation of vacation pay by an employer in the status of a federal department, but not in full, but in the amount of 1/12 of the actual payments. For other employers - it is included only on the condition that the payments, which are called financial assistance by local standards, are actually labor payments (incentives, incentives). Payments in the form of financial assistance that are not related to the labor function in private firms and budgetary organizations that are not related to federal departments are not taken into account when calculating vacation pay.

As a rule, the frequency of payments is not a criterion for classifying them as financial assistance or labor incentives.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Law “On State Civil Service” dated July 27, 2004 No. 79-FZ

- Decree of the Government of Russia dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

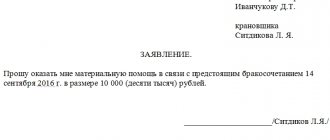

matpomoshch.jpg

Related publications

One of the types of non-production payments to employees is financial assistance paid to employees in need of funds upon their application. The list of reasons for payment is not limited; financial assistance can be paid: for an employee’s vacation, for treatment, in connection with a marriage, the birth of a child, etc. The employer himself makes the decision on payment, focusing on the financial capabilities of the company. Is financial assistance included in the calculation of vacation pay and average salary? Can it be considered as income for working employees? The answers are in our material.

Is it included?

Article 139 of the Labor Code of the Russian Federation states that the average salary should include only those payments that are provided for by the remuneration system. Financial assistance is a one-time payment paid as financial support to an employee. As a general rule, these funds cannot be provided for in wages, and therefore should not be included in vacation pay.

This is also confirmed by clause 2 of the Regulations approved by Resolution No. 922, which explains exactly which income should be taken into account when calculating and which should not be included. The list of amounts taken into account does not include financial assistance.

Clause 3 of the Regulations indicates those incomes that are not included in the calculation of average earnings, and, therefore, in the calculation of vacation pay - social and other funds not provided for in wages; it is indicated in parentheses that this includes material assistance.

Financial material payments to an employee should not be taken into account as part of earnings for vacation pay if they can be interpreted as social or not related to remuneration for the employee’s work.

It would seem that everything is clear, but in practice, controversial issues arise regarding whether it is necessary to take into account individual amounts paid as part of earnings to pay for vacation. This is due to the fact that labor legislation does not have a clear definition of the concept of “material assistance”.

Read more: Mortgage with maternity capital VTB 24 calculator

Therefore, some organizations disguise under this phrase bonuses of a one-time and one-time nature, paid to an employee for various reasons.

Premium amounts should already be taken into account, and in a special order, prescribed in the same Regulations.

If the employer does not include the income paid out in the calculation of vacation pay, which he calls financial assistance, but essentially pays for achievements in work, then this will be a violation of labor legislation, artificially lowering the base for paying annual leave.

If such situations are identified, the employer will be obliged to recalculate vacation pay and accrue additional payments.

In order to clearly know when financial assistance should be included in earnings and when not, you need to analyze the simultaneous presence of the following series of criteria.

A cash payment can be interpreted as financial assistance if the following conditions are met:

- Has no connection with the performance of labor functions;

- Has a clear focus on meeting social needs (a significant event in life, a difficult or critical situation);

- Not included in the remuneration system, not prescribed in advance in the collective agreement, LNA of the company;

- Has a one-time issuance nature (there should not be a regular basis);

- Does not have work stimulating properties.

If at least one of the specified conditions is not met in relation to the amount paid, then it can no longer be called financial assistance.

What payments are not taken into account?

Examples of financial assistance that are not included in vacation pay:

- amounts. paid as support in the event of a difficult financial situation in the employee’s family (for example, the need to repay a loan);

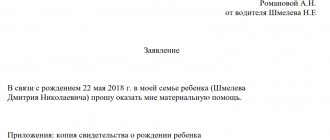

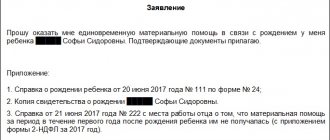

- issued on the occasion of significant, important or tragic events in the life of an employee - the birth of a child, marriage, death of a loved one, fire, flood, other natural disaster or emergency situation in which the employee suffered;

- financial support provided in connection with expensive treatment of an employee or his relatives;

- other payments that are not planned by any internal document of the organization and are not assigned for achievements in work.

What amounts are included?

Since there is no clear definition for financial assistance, the organization must independently analyze the income paid and correctly take into account this or that amount when calculating vacation pay.

Depending on what the sum of money is issued for and whether it is provided for by the internal local acts of the organization, the procedure for accounting for it as part of average earnings depends.

If the income given to an employee can be interpreted as a bonus, then it should be included in earnings, and in a special manner.

The employer has the right to call the income paid in addition to the salary whatever he wants - a bonus or financial assistance, it does not matter. But the amount must be taken into account as part of earnings for vacation pay if the following conditions are met with respect to income:

- The presence of a stimulating nature - that is, money is paid for some achievements in work, for the good performance of duties, for meeting indicators.

- Inclusion in the system for remuneration of personnel.

- The obligation to issue money is enshrined in a collective agreement, employment contract or other internal local act.

It is enough to fulfill one of the specified conditions in order to recognize the amount paid as a bonus subject to accounting for vacation pay. It does not matter what nature of the payment is - one-time, one-time or periodic, systematic.

What amounts should be called a bonus, and not financial assistance, and included in the calculation of average earnings:

- paid for success in work, to stimulate work activity;

- appointed due to holiday events, personal dates of employees - for the anniversary, for March 8, February 23, on the occasion of the New Year and other holidays (such payments are prescribed in the local acts of the company);

- issued, for example, for vacation - if this obligation is specified in a collective agreement or other act, or is of a systematic nature, for example, every year when going on vacation, an employee receives additional financial assistance based on work results or in a fixed amount.

conclusions

Financial assistance is not always subject to exclusion from earnings for the calculation of vacation pay. Some employers use this wording to refer to bonuses paid that should be taken into account.

For example, additional payments made in case of going on vacation are usually called financial assistance. Moreover, their payment is systematic - money is issued every time you take out an annual paid vacation, in addition, as a rule, it is provided for by a collective agreement or other internal act.

Read more: Dividends are included in the calculation of insurance premiums

Financial assistance of a one-time nature is not included in the calculation, the payment of which is not planned by any act in advance, the purpose of which is not related to the employee’s work activity and is exclusively of a supportive social nature.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

How financial support is paid

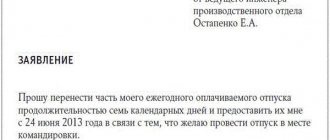

To get checkmate. assistance, the employee needs to write an application and attach documents confirming the need for these funds. This type of assistance has the following characteristics:

- calculated individually;

- not paid systematically;

- is not an encouragement;

- does not reimburse costs;

- is accrued regardless of salary, career growth or the company’s field of activity.

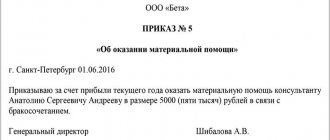

The application is submitted to the manager. If he decides in favor of transferring financial assistance, a separate order is issued. It states the employee’s full name, reason and a link to a document confirming it, the specific amount, and the payment period. The source from which funds will be allocated from profits for a period of time or from wages is also taken into account.