How should a tax return under the simplified tax system for 2020 be completed? in Excel, see a sample and examples of filling out a declaration for individual entrepreneurs and organizations, and familiarize yourself with the filling procedure, including zero, in this material. Coronavirus has amended the deadlines for filing returns. New deadlines are in this article.

“Pay taxes and live in peace” is not only a common expression, but also a necessary (although not always sufficient) condition for the long-term and fruitful functioning of an organization and an individual entrepreneur. The introduction of a simplified taxation regime has made it possible for many business entities to work under the simplified taxation system (STS). This is due to the fact that reporting under the simplified tax system is significantly simplified: there are fewer taxes, the costs of preparing and processing various reports are significantly reduced, time is saved, the risks of imposing penalties by fiscal authorities are reduced and, ultimately, this saves money and nerves.

Basic provisions for submitting a declaration under the simplified tax system in 2020-2021

Organizations and individual entrepreneurs operating under a simplified taxation system are required to submit a simplified taxation system (STS) declaration-2020 in the prescribed form with a certain filling out procedure. Declaration of the simplified tax system-2020 - its form, as well as the format for submitting the report in electronic form - were approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3 / [email protected]

Companies operating on the simplified tax system must submit declarations of the simplified tax system annually before the cutoff date - March 31. Thus, the 2021 simplified tax system declaration for simplified legal entities must be submitted by 03/31/2021 (this is working Tuesday).

Those using the simplified individual entrepreneurs have more time to submit the declaration - based on the results of 2021, they will have to report no later than 04/30/2021.

Submitting a declaration after the established deadline will result in a fine.

Important! ConsultantPlus warns The fine will be 5% of the amount... And the head of the organization (chief accountant or other official) can... Individual entrepreneurs face administrative liability... Read more in K+. Trial access is available for free.

The tax return under the simplified tax system is submitted to the inspectorate at the place of residence of the individual entrepreneur or the place of registration of the organization. You can submit a declaration in one of three ways:

- on paper in person or through a representative when visiting the tax office;

- on paper by mail;

- via electronic communication channels;

Confirmation of submission of the declaration in the first case will be a mark from the tax inspector on your copy of the declaration, in the second case - a mark on the postal receipt and an inventory of the attachment, in the third - confirmation from a specialized telecom operator.

Deadlines for submitting reports

Please note - due to the coronavirus pandemic, for some individual entrepreneurs and organizations the deadlines for paying taxes and filing reports may be postponed, brief information in the summary table from the Federal Tax Service, details are described in this article.

All simplified workers must report for activities under preferential treatment and pay tax at the end of the year within the following deadlines:

- organizations - no later than March 31, 2021;

- individual entrepreneurs - no later than April 30, 2020.

Those taxpayers who did not conduct any real activities must also report within these deadlines; reporting in this case will be zero.

If the right to a simplified regime is lost due to non-compliance with the requirements (the number of employees or the income limit has been exceeded, an unauthorized line of business has been started, a branch has been opened, the share of a legal entity participant in the company has increased, etc.), the declaration must be submitted no later than the 25th day of the month, following the quarter of loss of the right to the simplified tax system. If during 2021 an organization or individual entrepreneur voluntarily ceases to operate on the simplified tax system, then in addition to reporting for 2021, it is necessary to submit a declaration for the time worked. The deadline for delivery in this case is no later than the 25th day of the next month after the termination of activity.

Declaration of simplified tax system-2020: download form

Declarations of the simplified tax system for 2021 and 2021 are submitted according to the form approved in February 2021. Before this reporting document, prepare the following information to fill it out:

- about the amount of income received in 2021 (if you pay tax on income) and the amount of expenses allowed for the simplified tax system (if the base for calculating the simplified tax system is calculated as the difference between income and expenses);

- the amount of insurance premiums paid, temporary disability benefits paid to employees, and trade fees paid to the budget (if the type of activity carried out by the taxpayer falls under this fee);

- tax advances paid for reporting periods - they will reduce the total amount payable to the budget;

Declaration of the simplified tax system - income minus expenses - the form for filling out in 2021 is the same as in the reporting for the previous year.

You can download the declaration form for the simplified tax system for 2020 for free on our website.

Method and form of document submission

Declaration 1152017 is submitted:

- On paper:

- personally by the taxpayer;

- his representative;

- by mail.

- Electronic.

IMPORTANT!

The Federal Tax Service does not have the right to require an electronic declaration. Taxpayers with a staff of 100 or more employees are required to report in electronic format. And for the transition to the simplified tax system, the following condition applies: the staff cannot exceed 100 employees. At the same time, the electronic delivery method eliminates a large number of errors and omissions when filling out.

Composition of the declaration

The declaration under the simplified tax system consists of a title page and three sections:

| Section number of the declaration according to the simplified tax system | Name of section of the declaration according to the simplified tax system |

| 1.1 | The amount of tax (advance tax payment) paid in connection with the application of the simplified tax system (object of taxation - income), subject to payment (reduction), according to the taxpayer |

| 1.2 | The amount of tax (advance tax payment) paid in connection with the application of the simplified tax system (the object of taxation is income reduced by the amount of expenses), and the minimum tax subject to payment (reduction), according to the taxpayer |

| 2.1.1 | Calculation of tax paid in connection with the application of the simplified tax system (object of taxation - income) |

| 2.1.2 | Calculation of the amount of trade tax that reduces the amount of tax (advance tax payment) paid in connection with the application of the simplified tax system (object of taxation - income), calculated based on the results of the tax (reporting) period for the object of taxation from the type of business activity in respect of which, in accordance with Ch. 33 of the Tax Code of the Russian Federation establishes a trade tax |

| 2.2 | Calculation of the tax paid in connection with the application of the simplified tax system and the minimum tax (the object of taxation is income reduced by the amount of expenses) |

| 3 | Report on the intended use of property (including funds), works, services received as part of charitable activities, targeted income, targeted financing |

The taxpayer fills out the sections in accordance with the applicable taxation object.

When sending a declaration via electronic communication channels, in most cases, an automatic check of the control ratios of indicators is carried out, which makes it possible to identify errors or discrepancies (both logical and arithmetic).

If you want to check your declaration yourself before sending it, take the control ratios from the Federal Tax Service letter dated May 30, 2016 No. SD-4-3/ [email protected]

Find out which sections are filled out by “simplified people” depending on the object of taxation in the next section.

General filling rules

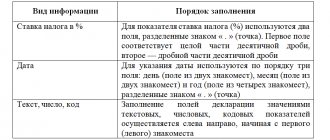

The procedure for filling out the declaration is established by Appendix No. 3 to Order N ММВ-7-3/ [email protected] These are mandatory requirements that must be followed, otherwise the report will be refused. Among them:

- The text fields of the form are filled with capital printed characters;

- All values of cost indicators are indicated in full rubles according to rounding rules;

- Each field contains only one indicator, except for the date and tax rate. To indicate the date, three fields are used in order: day (two familiar places), month (two familiar places) and year (four familiar places), separated by the sign “.” For the tax rate indicator, two fields are used, separated by a “.”;

- When manually filling out a field with a missing indicator, a dash is entered;

- The data is entered in black, purple or blue ink;

- Correction of errors, blots, and deletions is not allowed;

- Only one-sided printing of the document is allowed;

- Pages must not be stapled or stapled;

- The pages are numbered consecutively, starting from the title page; only completed pages are numbered;

- If you use a computer, this makes it easier to fill out the reports, but you must take into account that only Courier New font with a height of 16 - 18 points is allowed. Numerical indicators in this case are aligned to the last right familiarity; dashes in empty cells are optional.

The necessary codes (tax period, place of presentation, forms of reorganization, method of presentation, property received as part of targeted financing) are indicated in the text of the Appendix. If in your case the codes do not correspond to our filling example, then they must be selected from the original source.

The procedure for filling out a declaration under the simplified tax system with different objects of taxation

The USN-2020 declaration is filled out differently depending on the object of taxation: “income” or “income minus expenses”.

ConsultantPlus experts gave a line-by-line procedure for filling out the simplified taxation system declaration “income” and “income minus expenses”. Get trial access to the system for free and move on to the Ready-made solution.

For taxpayers using the simplified tax system with the object “income”, the following sections are required to be completed:

- title page;

- section 1.1, which reflects the amount of the advance payment or tax when applying the simplified “income” taxation system;

- Section 2.1, where tax is calculated for the selected object of taxation “income”.

Sample of filling out the USN-2020 “income” declaration:

Organizations and individual entrepreneurs that are on the simplified tax system with the object of taxation “income minus expenses” are required to fill out the following sections:

- title page;

- section 1.2, where, based on the taxpayer’s data, the amount of tax paid, advance payments or the amount of the minimum tax to be paid (reduced) is indicated;

- Section 2.2, where the tax is calculated for the selected object of taxation “income minus expenses” or the minimum tax.

For a sample of filling out the simplified tax system declaration 2021 (“income minus expenses”), see below.

The features of filling out a zero declaration under the simplified tax system are discussed here.

Based on the results of the desk audit, the Federal Tax Service may request clarification. A sample of explanations for the simplified tax system and the reasons for discrepancies with tax authorities’ data were prepared by ConsultantPlus experts. Get trial access to the system for free.

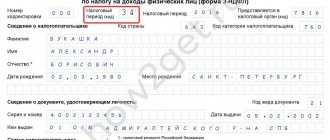

Filling out the title page

The top lines of the sheet are for TIN and KPP. Individual entrepreneurs leave the checkpoint field empty. These fields are duplicated on all other pages of the declaration.

“Adjustment number” field is set to “ 0 ” if the declaration is submitted for the first time.

If you submit an amendment, enter the correction number.

In the “Tax period” , enter code 34 , which corresponds to the calendar year. The year 2021 and the tax authority code are entered in the appropriate fields. In the field “At location (accounting)” you need to put a code - individual entrepreneurs put 120, organizations - 210.

The following is the taxpayer :

- if this is an entrepreneur, you need to write the full name, surname and patronymic, without indicating the status of an individual entrepreneur;

- for the organization, the full organizational and legal form and name are indicated, for example, Limited Liability Company “Romashka”.

OKVED code should be indicated as the main one. When combining tax regimes, we recommend indicating OKVED according to the simplified tax system.

It is advisable to indicate your phone number - it may be needed if the inspector has questions about the declaration. However, the taxpayer has no such obligation.

The “Form of reorganization...” field is intended for companies that are in the process of reorganization.

The person who signs the declaration is indicated at the bottom of the title page. It could be:

- Head of the organization (code 1). The full name, surname and patronymic of the manager is indicated, his signature and the date of signing are affixed.

- Individual entrepreneur (code 1). The individual entrepreneur’s signature and date are placed. Your full name is not indicated in this section.

- The declaration is signed for the manager or individual entrepreneur by a trusted individual (code 2). The name, surname and patronymic of the authorized person are indicated. The date and his signature are put.

- The interests of the taxpayer are represented by a legal entity , the declaration is signed by its representative (code 2). The full name of the representative of the legal entity who acts on the basis of the relevant document is indicated. The field “Name of the organization of the taxpayer’s representative” is filled in. The signature of the person representing this organization is affixed, as well as the date.

If the declaration is signed by the head of the organization or individual entrepreneur personally, and the authorized person only submits it, his data is not indicated on the title page.

Title page

Results

In order to report for 2021, a simplified person will need a declaration form according to the simplified tax system, approved by order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/ [email protected]

Simplified people who pay tax on income and on the difference between income and expenses use the same simplified taxation system declaration form - only the composition of the sections to be filled out changes.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who is required to report?

The final declaration under the simplified tax system is a report that all taxpayers submit to the simplified tax system.

Moreover, the status of the payer does not play any role. Both organizations, including public sector employees, and individual entrepreneurs are required to fill out ND in simplified form. Note that the object of taxation does not affect the obligation to report. Thus, entities who have chosen the simplified tax system “Income” fill out and submit a declaration within the same time frame as payers who have chosen the simplified tax system “Income minus expenses”. But for each group of subjects, officials have provided individual rules for how to fill out the reporting form.

ConsultantPlus experts discussed how an entrepreneur can switch to the simplified tax system. Use these instructions for free.

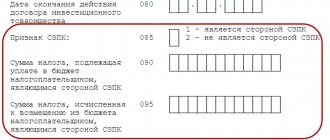

Filling out a new line in the declaration

Line 124

in the first part of the line (6 characters) the tax benefit code is entered in accordance with Appendix No. 6 to the Order of the Federal Tax Service of Russia dated May 10, 2017 No. ММВ-7-21 / [email protected] (this order will become obsolete on January 1, 2021).

After the slash, in the second part of line 124, enter the number or letter designation of the law of the Russian Federation establishing the tax benefit. For each structural unit (position) 4 characters are allocated; the second part of the line is filled in from left to right. If the entry has less than four characters, zeros are indicated in the empty cells to the left of the value.

Line 264

Filled out according to the same rules.

Example. If the tax benefit is regulated by subclause 15.1 of clause 3 of Article 2 of the law of a constituent entity of the Russian Federation, then in line 124 we indicate:

In addition to the above innovations, barcodes will be changed in the declaration.