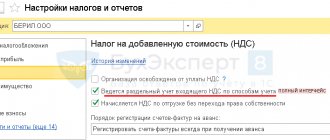

What are the different taxation systems? — There are five taxation systems: OSNO (traditional, also general), simplified tax system (simplified, sometimes simplified tax system 6% and simplified tax system 15%), patent (only for individual entrepreneurs), unified agricultural tax (only for agricultural producers), taxation system for the implementation of division agreements products (a highly specialized system for mining companies).

The last three systems are highly specialized, they are available to a limited circle of people, so we will not consider them now. Let’s look at the differences between OSNO and the simplified tax system. Which tax system is better, traditional or simplified? Which one is more profitable?

The new business will operate on a general basis

So, the general taxation system will apply to the new business. This is possible when all the activities of an individual entrepreneur are carried out under the general taxation regime. Or, for example, in his region an individual entrepreneur pays a single tax on imputed income, but in the new region such a special tax regime has not been introduced.

Do I need to register?

This is the first question that arises when expanding activities. Is it relevant for individual entrepreneurs whose activities are taxed in accordance with the general regime? No, and here's why.

As a general rule, registration of an individual entrepreneur is carried out at his place of residence (clauses 1 and 3 of Article 83 of the Tax Code of the Russian Federation). This rule also applies in the situation under consideration. Thus, if your activity in the new region will operate under the general regime, you do not need to register with the tax office at the place where it is carried out.

Where to pay taxes and submit reports

The answer to this question follows from the previous one. Since there is no need to register with another tax office, the individual entrepreneur should pay taxes on income from the new direction using the same details. That is, he will pay personal income tax on all your income at your place of residence.

The same applies to personal income tax reporting. a declaration in form 3-NDFL (form approved by order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/ [email protected] ) to his tax office at the place of residence, indicating all income and expenses, including including those received and carried out in another region. Please note that it is also not necessary to create a new Book of Income and Expenses and Business Transactions for activities in a new region.

However, there is one caveat. If, as a result of expanding activities, income increases by more than 50%, the individual entrepreneur will also need to submit a declaration to his tax office indicating the planned amount of income for 2014 (clause 10 of Article 227 of the Tax Code of the Russian Federation). In this case, the tax office will recalculate the amount of advance payments for personal income tax. Let us remind you that a declaration indicating the estimated amount of income is submitted in form 4-NDFL, approved by order of the Federal Tax Service of Russia dated December 27, 2010 No. ММВ-7-3/ [email protected]

Enterprise property tax

This type of payment is accrued on all property of enterprises that is listed on the balance sheet. The exceptions are: funds in a current account and a list of what is exempt from taxation by law.

The full value of taxable property is determined by adding the value of all property at the beginning of the month. The entire amount is then divided by the total number of months in question.

The entire tax base is calculated based on the price of fixed assets, inventories and costs, intangible assets, which are visible from the relevant sections of the balance sheet.

New business will be subject to Unified Agricultural Tax

Let’s assume that an individual entrepreneur, who is an agricultural producer and pays the unified agricultural tax, expands his business by transferring part of it to another region. And income from activities in the new region will also be subject to the Unified Agricultural Tax.

Let us note that it is important to continue to comply with the restriction given in paragraph 2 of Article 346.2 of the Tax Code of the Russian Federation. That is, for the further application of the Unified Agricultural Tax payment regime for an individual entrepreneur, it is important that the share of income from the sale of agricultural products in total income is at least 70%.

Do I need to register?

As with the general taxation regime, a general rule applies for individual entrepreneurs paying the Unified Agricultural Tax. Individual entrepreneurs must be registered with the tax office at their place of residence (clauses 1 and 3 of Article 83 of the Tax Code of the Russian Federation). Accordingly, individual entrepreneurs who pay the Unified Agricultural Tax do not need to additionally register with a new tax office in another region.

Where to pay taxes and submit reports

The unified agricultural tax is paid at the place of residence of the individual entrepreneur (clause 4 of article 346.9 of the Tax Code of the Russian Federation). It does not matter where exactly the income from which it is paid was received.

The same applies to tax returns. The tax return under the Unified Agricultural Tax is submitted to the tax office at the place of residence of the individual entrepreneur (subclause 2, clause 1, article 346.10 of the Tax Code of the Russian Federation). And it reflects all income and expenses, including those received (made) in other regions. Accordingly, the accounting book is also kept the same - for all business transactions.

Note! Individual entrepreneurs cannot have separate divisions. Entrepreneurs are often interested in this issue. Do they need to register a separate division if they started operations in another region? Should an entrepreneur report to the tax office about his separate division if he has created permanent jobs in a new region? The answer is negative. Based on the provisions of paragraph 1 of Article 11 of the Tax Code of the Russian Federation, a separate division can be owned exclusively by an organization. But individual entrepreneurs do not have divisions.

What is tax

According to Article 8 of the Tax Code of the Russian Federation, a tax is a mandatory payment that is levied on companies and individuals and is free of charge . The money goes to the consolidated budget of the Russian Federation, consisting of federal, regional and local budgets. Subsequently, the funds are distributed between them in certain proportions. For example, 85% of personal income tax goes to the regional budget, 15% to the local budget. And VAT and mineral extraction tax go entirely to the federal budget.

Taxes are necessary for the functioning of the state and municipalities - they are spent on improving the area, repairing roads, building hospitals and schools, as well as on the salaries of officials.

Tax payments are collected at a certain frequency (usually once a month or quarter). They should be distinguished from fees - mandatory one-time fees that make it possible to obtain any right, license, permit or government service . That is, the fees are compensated.

New business works on the simplified tax system

A situation where a business in a new region will operate on a “simplified” system is possible if the individual entrepreneur previously submitted an application to switch to a simplified system.

Do I need to register?

Just as in previous cases, there is no need to register with the tax office at the place where the new activity is conducted. Individual entrepreneurs must be registered with the inspectorate at their place of residence - this rule also applies if a simplified taxation system is used.

Where to pay taxes and submit reports

“Simplified workers” working in another region will also not have any difficulties with taxes and reporting. Payment of tax under the simplified system is made at the place of residence of the individual entrepreneur (clause 6 of Article 346.21 of the Tax Code of the Russian Federation). And this applies to the tax under the simplified tax system, paid on all income, including those received in another region.

Individual entrepreneurs must also submit a tax return according to the simplified tax system based on the results of the tax period to the tax office at their place of residence (clause 1 of Article 346.23 of the Tax Code of the Russian Federation). And it must also indicate all income, regardless of the region in which it was received.

There is no need to create a new Book of Income and Expenses for activities in another region. Record all indicators in the same Accounting Book.

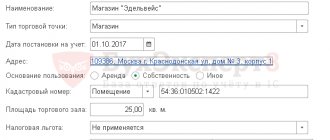

Example 1. Individual entrepreneur A.P. Kirpichev applies the simplified tax system and is engaged in retail trade in food products. The businessman is registered in Moscow. In December 2013, the entrepreneur opened another store in Shchelkovo, Moscow region. What are the tax consequences if an individual entrepreneur would also like to apply the simplified tax system for a new store?

If an individual entrepreneur does not want to apply the taxation system in the form of UTII in relation to a store in the city of Shchelkovo, but prefers a simplified system, then he does not need to register with the tax office in the city of Shchelkovo. It is enough to be registered with the tax office at your place of residence - in Moscow.

The tax under the simplified tax system on all income, including from a store in Shchelkovo, must be transferred by an individual entrepreneur according to the details of the Moscow tax office. And an individual entrepreneur also needs to report tax under the simplified tax system on all income to the tax office in Moscow.

How to choose OKVED codes for production

The process of selecting codes seems simple, but only until you first open the classifier, which has more than 400 pages. If the codes do not correspond to the activity being carried out, you can:

- receive a fine of up to 10,000 rubles for failure to provide, untimely provision of information contained in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs or for providing inaccurate or unreliable information;

- lose the opportunity to apply preferential tax regimes. This happens when, according to the codes, you carry out activities for which the simplified tax system, for example, cannot be used, but in practice you are doing something else;

- receive a refusal to deduct VAT, for the application of which goods that are not related to the registered activity are indicated;

- not receive benefits or assistance from the state intended for individual entrepreneurs and LLCs from certain areas;

- pay injury premiums at a higher rate.

New business is transferred to UTII payment

Now the situation is different - an individual entrepreneur started a business in a new region and decided to pay UTII in relation to it. Let us remind you that not the entire business is transferred to the taxation system in the form of UTII, but only certain types of activities, therefore this tax regime can be combined with others.

Do I need to register?

According to paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation, individual entrepreneurs who have expressed a desire to apply the taxation system in the form of UTII must register at the place of activity. Thus, if you started an activity in a new region and decided to pay UTII, then you will have to register with the tax office in this region.

True, there is an exception to this rule. It applies to UTII payers providing motor transportation services (subclause 5, clause 2, article 346.26 of the Tax Code of the Russian Federation), engaged in distribution or peddling retail trade (subclause 7, clause 2, article 346.26 of the Tax Code of the Russian Federation) or performing advertising placement services with the use of external and internal surfaces of vehicles (subclause 11, clause 2, article 346.26 of the Tax Code of the Russian Federation). These entrepreneurs also need to register as UTII payers, but only with the tax office at their place of residence (clause 2 of Article 346.28 of the Tax Code of the Russian Federation).

Please note that if you are already registered with the tax office for any reason, then if you start conducting “imputed” activities, you still need to register as a UTII payer. This is confirmed by the Ministry of Finance of Russia in letter dated September 27, 2010 No. 03-02-08/58.

A few words about how to register as a UTII payer. Within five days from the moment you became a UTII payer, that is, you started working in a new region, you need to submit an application to the tax office. An application for registration of an individual entrepreneur as a UTII payer is submitted using form No. UTII-2, approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV-7-6 / [email protected] In the application itself, indicate your full name, OGRNIP and the date of commencement of the activity , in respect of which UTII will be paid. And in the appendix to the application, record the address where the new business is located and the type of activity code. Codes for types of entrepreneurial activities can be found in Appendix No. 5 to the Procedure for filling out the UTII declaration, approved by Order of the Federal Tax Service of Russia dated January 23, 2012 No. ММВ-7-3/ [email protected]

Where to pay taxes and submit reports

UTII is paid at the place of registration as a payer of this tax (clause 1 of Article 346.32 of the Tax Code of the Russian Federation). Therefore, if you have registered in a new region as a UTII payer, then you will need to transfer the tax using the details of this tax office. You will need to submit quarterly tax returns for UTII to the same tax office (clause 3 of Article 346.32 of the Tax Code of the Russian Federation).

Example 2. Individual entrepreneur I.S. Surkov provides tailoring services. It is registered in the city of Elektrostal, Moscow region and applies the general taxation regime. In December 2013, an individual entrepreneur decided to open a new location in Vladimir and pay UTII on income received there. Where does an individual entrepreneur need to register as a single tax payer on imputed income?

When providing household services, UTII payers must register at the place of activity. Thus, an individual entrepreneur must register with the tax office in Vladimir by submitting an application there on form No. UTII-2. He will also need to transfer the single tax according to the details of the tax inspectorate in Vladimir and submit a tax return for UTII to the same inspectorate.

New business is transferred to the patent system

And finally, expanding his business in a new region, an individual entrepreneur decided to purchase a patent. Let us remind you that it is possible to apply the patent taxation system if this special tax regime has been introduced in the region. In addition, a patent can be obtained when carrying out the types of activities specified in paragraph 2 of Article 346.23 of the Tax Code of the Russian Federation. At the same time, the average number of employees of an individual entrepreneur for all types of activities during the tax period should not be more than 15 (Clause 5 of Article 346.23 of the Tax Code of the Russian Federation).

Do I need to register?

The patent is valid only in the territory of the region indicated in it (clause 1 of Article 346.45 of the Tax Code of the Russian Federation). However, the law does not prohibit an individual entrepreneur from obtaining several patents in different regions. That is, if you want to obtain a patent in a region where you are not registered, you need to submit an application to one of the tax offices of that region. And any one - according to your choice. In this case, you do not need to submit an application for registration. According to paragraph 1 of Article 346.46 of the Tax Code of the Russian Federation, registration of an individual entrepreneur applying the patent tax system is carried out by the tax authority to which he applied for a patent within five days. Patent application form No. 26.5-1 was approved by order of the Federal Tax Service of Russia dated December 14, 2012 No. MMV-7-3/ [email protected]

Where to pay taxes and submit reports

Everything is simple here. The patent must be paid for at the place of tax registration (clause 2 of Article 346.51 of the Tax Code of the Russian Federation). That is, according to the details of the tax office that issued it. There is no need to submit a tax return under the patent system (Article 346.52 of the Tax Code of the Russian Federation). If you do not use a patent system in your region, then in addition to income related to patent activities, you will have to maintain another Accounting Book. The form of the Book of Accounting for Income from Sales for individual entrepreneurs using the patent system was approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 122n.