The previous forms of tax returns and tax calculations for advance payments of corporate property tax, as well as the procedure for filling them out and electronic formats, approved by Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895, will become invalid as of June 13, 2017.

The new declaration form is mandatory starting with reporting for the tax period – 2021. It can also be used during the liquidation (reorganization) of an organization in 2021 until June 13, 2017 (letter of the Federal Tax Service of Russia dated April 14, 2017 No. BS-4-21 / [email protected] ).

And the new form of tax calculation for advance payment is allowed for use at the initiative of the taxpayer, starting with calculations for the first quarter of 2021 - if it is necessary to fill out the calculation taking into account the changes in corporate property tax that have entered into force.

Read also “Organizational property tax: “cheat sheet” from the Federal Tax Service”

Who pays property tax

Tax payers are:

- Organizations using basic tax system. They pay tax on the following property:

- objects (including movable ones) that are on the balance sheet and are listed as fixed assets;

- residential real estate, which is not recognized as fixed assets.

- Organizations using special tax regimes of the simplified tax system and UTII. They pay tax:

- from real estate objects specified in paragraph 1 of Article 378.2 of the Tax Code, for which the tax base is calculated based on the cadastral value (for example, shopping centers, administrative centers and premises located in them);

- from residential real estate, which is not accounted for as fixed assets.

- Foreign organizations if they own taxable property or under a concession agreement.

About movable property

Tax on movable property recognized as fixed assets is paid only by companies on the special tax base. 2021 was the last year in which they paid it in the same manner. Starting this year, new rules apply. In particular, issues regarding the imposition of taxes on one or another type of movable property and the provision of benefits are resolved at the regional level.

Who is required to fill out the document?

An organization must file a declaration if it owns so-called fixed assets that can be recognized as an object of taxation. Article 374 of the Tax Code of the Russian Federation describes in detail exactly how funds fall under this category. Features of the application of taxation depend on which accounting system is used at a particular facility.

If there are no such OS, then there is no need to fill out a zero declaration.

Citizens also pay taxes. But in most cases, all calculations are carried out by the tax service. All you have to do is wait for the receipt and deposit the money.

Deadline for submitting the declaration and sanctions

Property tax reporting must be done by March 30 of the year following the reporting year. Thus, for 2017 you need to submit a declaration no later than March 30, 2018 .

Late deadlines may result in sanctions under Article 119 of the Tax Code. This is a penalty of 5% of the tax amount for each full and partial month of delay. The minimum fine is 1 thousand rubles , the maximum is 30% of the tax amount . In addition, the official may receive a penalty in accordance with Article 15.5 of the Administrative Code in the form of a fine in the amount of 300-500 rubles.

Find out about other important reporting deadlines coming up soon.

Responsibility for late submission of a declaration

Failure to submit an annual declaration within the deadlines approved at the federal level entails the collection of penalties under clause 1 of the article. 119 NK. This is 5% of the unpaid amount of tax due on the basis of an unfiled return. Each month of non-payment is taken into account for the billing month, but the maximum amount of sanctions should not exceed 30% of the indicated amount. The minimum is 1000 rubles. and is charged if a zero report is not submitted.

If the taxpayer violated the legislative norms regarding the submission of advance payments, liability is applied according to stat. 126 NK. According to clause 1, 200 rubles will be charged for each payment submitted late. A decision by control authorities to hold a legal entity liable is possible only after inspection activities have been carried out. In particular, these are desk inspections or on-site inspections according to statistics. 88, 89 NK. And based on the decision, the taxpayer is required to pay a fine.

Property tax return (forms)

Property tax return (filling example)

Places for submitting the declaration

Organizations submit a property tax report at their location. However, if there are separate units, there are nuances. In particular, if the OP is located in other regions, then the following should be reported:

- at the location of the unit that has its own balance sheet;

- at the location of each property, if they are located in other regions.

Under certain circumstances, a company with separate divisions and property in other regions may report to the Federal Tax Service at its location . In this case, the following conditions must be met:

- the organization does not belong to the category of the largest taxpayers;

- the tax is payable only to the budget of the subject;

- the basis for calculating tax is the book value;

- The tax office allowed this.

In what form should reports be submitted?

To file a property tax return, standard rules from Article 80 of the Tax Code of the Russian Federation . The following are required to report in electronic format:

- taxpayers from the largest category;

- organizations in which the average number of employees exceeds 100 people for the previous calendar year;

- new companies with more than 100 employees .

All other organizations can independently choose the form of filing the declaration. It can be sent to the TKS inspection, by mail, or submitted in person.

How to calculate property tax

The base for property tax for legal entities is:

- in the general case - its average annual cost ;

- in relation to real estate objects specified in Article 378.2 of the Tax Code of the Russian Federation - cadastral value .

To determine the average annual cost it is necessary:

- add up the residual value of real estate at the end of each month;

- divide the result by 13.

Next, the average annual or cadastral value is multiplied by the rate. The rate is set by the authorities of the constituent entity of the Russian Federation, but cannot exceed 2.2% .

The result will be the amount of tax payable for the year. If advance payments , they must be subtracted from this amount.

If a legal entity owned the property for less than a full year, tax should be paid only for this period. First, the coefficient is calculated : the number of months of ownership of the object is divided by 12. Next, the tax base is adjusted taking into account this coefficient.

Who submits the reports

Organizations that have property recognized as an object of taxation (clause 1 of Article 373 of the Tax Code of the Russian Federation) must report using new forms. For Russian organizations, taxable property includes (clause 1 of Article 374, clauses 1, 7 of Article 378.2 of the Tax Code of the Russian Federation):

- movable property and real estate reflected in accounting as fixed assets (including leased, temporary possession, trust management, contributed to joint activities or received under a concession agreement);

- real estate from the list of objects approved in the subject of the Russian Federation, taxed at cadastral value, namely: administrative and business centers and shopping centers (complexes) and premises in them, offices, retail facilities, public catering and consumer services, as well as residential buildings and premises not reflected in accounting as fixed assets.

At the same time, the objects listed in paragraph 4 of Article 374 of the Tax Code of the Russian Federation are not subject to property tax for organizations, including:

- land plots and other environmental management facilities;

- objects recognized as objects of cultural heritage (historical and cultural monuments) of the peoples of the Russian Federation of federal significance;

- ships registered in the Russian International Register of Ships;

- fixed assets included in the first or second depreciation group, etc.

We fill out a declaration on property tax for legal entities

The declaration form and the procedure for filling it out (hereinafter referred to as the Procedure) were approved by order of the Federal Tax Service dated March 31, 2021, number MMV-7-21/ [email protected] . The form consists of a title page and sections 1, 2, 2.1 and 3. The declaration is filled out in relation to the amounts of tax payable according to the corresponding municipal code, that is, in the context of OKTMO .

Next, we'll look at how to fill out each section.

Title page

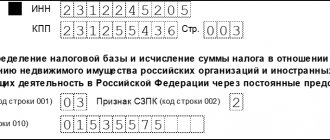

The title page contains basic information about the taxpayer, the declaration and the tax authority. The following lines are filled in at the top of the sheet:

- TIN - for an organization it is 10 characters.

- KPP - indicates the code assigned by the Federal Tax Service at the location of the company, separate division or real estate (if it is in other regions).

- Tax period - code “34”, corresponding to the year. The exception is companies that are being liquidated or reorganized - they indicate the code “50”.

- Reporting year — 2021.

- Submitted to the tax authority (code) - the code of the tax authority is indicated. In this case, the first 2 digits indicate the region, the second - the Federal Tax Service number.

- At the location (registration) - enter the code “214”, corresponding to the legal entity.

- Taxpayer - indicate the name of the organization as shown in the following image (full organizational and legal form and name):

Sample of filling out the main details of the declaration

If we are talking about a reorganized / liquidated entity, then it is necessary to fill out the appropriate block that follows the name. In it you need to indicate the TIN/KPP of the organization, as well as the code of the reorganization (liquidation) form :

- 1 - transformation;

- 2 - merger;

- 3 - separation;

- 5 - connection;

- 6 - separation with simultaneous joining;

- 0—liquidation.

Contact phone number - you should indicate a phone number that is available for contact. Indicate the code of the country, city or other locality and telephone number without spaces or other symbols.

The lower part of the title page confirms the accuracy and completeness of the information provided . One of the codes is indicated:

- 1 - if the declaration was signed by the head of the organization;

- 2 - if signed by a representative.

Next you should indicate the full name of the person who signed the declaration :

- head of the organization;

- representative - if this is an individual;

- an authorized representative of a legal entity, if the taxpayer is represented by a legal entity.

In the latter case, in the lines below, you need to indicate the name of the representative company .

Next, indicate the name and details of the document that confirms the authority of the representative.

Filling out the bottom of the title page if the declaration was signed by the director

Features of the title page

The cover page contains general information related to the taxpayer. At the top, the organization must indicate the checkpoint and tax identification number. Next comes the number of adjustments.

There are also some nuances here:

- 0 is set when the document is first submitted.

- 1,2 or other numbers are used when preparing so-called updated documents that have gone through several revisions.

The specific figure depends on how many times changes were made in a particular case.

Then they move on to the tax period. In Appendix 1 of the General Procedure it is easy to find the codes that are used at a given specific point in time. 54 is the number for declarations for the calendar year. 50 – for organizations that have undergone liquidation or reorganization.

The next part is the code designation of the tax service where documents are submitted. They are contained in the 3rd Appendix. The taxpayer provides a contact telephone number.

In addition, the declaration must contain other information:

- Indication of documents that confirm this or that information. Their number and the total number of pages are indicated.

- The number of pages contained in the declaration itself.

- The name coincides with what is indicated in the constituent documents.

- Reorganization or liquidation code.

- OKVED code.

Section 1

This section consists of line blocks 010-040 . You must fill in as many blocks as OKTMO tax is due. The blocks are filled in like this:

- line 010 displays the OKTMO code;

- line 020 indicates the budget classification code;

- line 030 reflects the positive result of the tax calculation, that is, its amount that is payable to the budget;

- line 040 reflects the tax amount if it turns out with a minus sign (tax to be reduced).

Sample of filling out lines 010-040 of Section 1

Section 2

This section is intended to calculate the average annual value of the property. It should be filled out separately in relation to property:

- located at the location of the organization;

- relating to separate divisions;

- taxed at different rates, and so on.

The full list can be found in paragraph 5.2 of Section V of the Procedure .

The following table contains line-by-line completion of section 2.

Table 1. How to fill out section 2 of the corporate property tax return

| Field | Index |

| Property type code (line code 001) | Code from Appendix No. 5 to the Procedure |

| OKTMO code | Must match the code from line 010 of the corresponding Section 1 block |

| Lines 020-140 | Residual value of fixed assets at the beginning of each month (date indicated in column 1). Column 4 indicates the cost of preferential property included in the amount indicated in column 3 |

| Line 141 | Cost of real estate included in the property |

| Line 150 | Average annual value of property ( sum of lines 020-140 divided by 13 ). |

| Line 160 | Before the “/” sign - tax benefit code, if any (Appendix No. 6 to the Order). After the "/" sign:

|

| Line 170 | The average annual value of property, which is not taxed ( the sum of indicators from column 3 of lines 020-140, divided by 13 ). |

| Line 180 | Filled in only if the property type code is “02” . The share of the book value of a real estate property in the territory of the corresponding constituent entity of the Russian Federation. |

| Line 190 | In general, tax base = Line 150 - Line 170. If the property type code is “02” (line 180 has a value): base = (Line 150 - Line 170) x Line 180 |

| Line 200 | To be filled in if the law of the subject establishes a reduced rate:

|

| Line 210 | Tax rate |

| Line 215 | Coefficient applied to railway tracks |

| Line 220 | Tax amount for the year: Line 190 x Line 210 / 100 |

| Line 230 | Amount of advance payments |

| Line 240 | If you have a regional benefit with a code 2012500:

|

| Line 250 | Amount of tax benefit by code from line 240 |

| To be filled in if the property type code is “04” . The amount of tax paid outside the Russian Federation in respect of property owned by a Russian legal entity is indicated. | |

| Line 270 | Residual value of fixed assets at the end of the year |

Section 2.1

This section contains information about the objects in respect of which Section 2 was completed. It consists of blocks of lines 010-050 , which indicate:

- on line 010 - cadastral number of the object;

- on line 020 - conditional number from the Real Estate Register;

- on line 030 - inventory number (in the absence of cadastral and conditional);

- on line 040 - code OKOF;

- on line 050 - the residual value of the object at the end of the year.

The number of blocks must correspond to the number of taxable properties.

Section 3

The last section of the declaration is intended to calculate property tax, which is calculated based on the cadastral value of the property. Filling out the rows is in the following table.

Table 2. Filling out section 3 of the corporate property tax return

| Field | Index |

| Property type code (line code 001) | Code from Appendix No. 5 to the Procedure , usually code “ 11 ” |

| OKTMO code (line code 010) | OKTMO |

| Line 014 | Cadastral number of the building (structure, structure) |

| Line 015 | Cadastral number of the premises inside the building, if the object is this premises |

| Line 020 | Cadastral value of the property |

| Line 025 | Non-taxable part of the cost (included in line 020) |

| Line 030 | If the object is in common (shared) ownership, indicates the size of the share |

| Line 035 | Filled in if the cadastral value is determined for the building, but not for the premises inside, which is the object of taxation. A share equal to: Room area / Building area is indicated |

| Line 040 | Before the “/” sign - the benefit code in accordance with Appendix No. 6 to the Procedure (except for codes 2012400 and 2012500). Only for code 2012000 : after the “/” sign - the number, clause, subclause of the regional law that introduced the benefit |

| Line 050 | To be filled in if the object is located on the territory of different constituent entities of the Russian Federation. The share of the cadastral value related to the given region is indicated |

| Line 060 | Tax base: (Line 020 - Line 025) x Line 030 (if filled out) x Line 050 (if filled out) |

| Line 070 | If a benefit with a code is installed 2012400:

|

| Line 080 | Amount of preferential rate (if Line 070 is filled in) |

| Line 090 | For foreign organizations. A coefficient is indicated equal to: number of months of ownership of the object / 12 |

| Line 100 | Tax amount for the year:

|

| Line 110 | Amount of advance payments within a year |

| Line 120 | If there is a benefit with a code 2012500:

|

| Line 130 | Benefit amount from Line 120 |

Description of additional filling requirements

The document is formed strictly at the end of the year. The numbering of sheets begins with the title page. Numbers are written from left to right. An example of the beginning of numbering is the number 001.

There are other characteristics that matter:

- Prohibition on the use of two-sided printing. The use of correctors and putties falls under the same rule.

- When filling out, capital block letters are used, even if everything is entered manually.

- Filling goes from left to right.

- According to the last familiarity, the indicators are aligned when filling out using special software.

- The field is simply crossed out if there is nothing to fill out.

- OKTMO is a code that is also entered from left to right. The remaining cells are simply filled in using handwriting.

- The title page uses the information originally present in the registration documents.

- Declarations are certified only with personal signatures.

Sometimes enterprises take into account several real estate objects, combining them into one. In this case, several lines are still filled in, one for each active object. Each of the blocks contains relevant information regarding the residual inventory value.

You should not combine objects so as not to get confused again.

Movable property and highly energy-efficient properties owned will allow companies to count on additional discounts.

Sample filling

See how to fill out the corporate property tax return for 2021:

- Title page:

- Section 1:

- Section 2:

- Section 2.1:

- Section 3: