Briefly about the invoice for payment

This document contains the payment details of the recipient, according to which the payer makes payment for the goods (work, services) listed in the invoice.

The invoice for payment does not reflect any fact of economic life, therefore it is not included in the list of primary documents listed in Law No. 402-FZ “On Accounting”. There is also no single form of document approved by law. The main purpose of the invoice is to notify the counterparty’s accounting department that it needs to transfer funds to the supplier in payment for the goods (work, services) indicated in the invoice. In addition, it serves as an offer when concluding a contract. The correctness of the invoice for payment is certified by the signature of the head of the organization and the accountant. Most often, a document is issued after a written agreement is concluded between organizations, but in some situations it is also issued as an independent document.

The specific validity period of the invoice for payment is not established by law. The payment term is not a mandatory detail, so it may not be indicated in payment documents.

When drawing up contracts (supply, contract, provision of services, etc.), the payment period is often tied to the time of receipt of the invoice. But this should not be done, since counterparties may delay the transfer of funds, citing the fact that the document was not received. It is better to count the period from the date of conclusion of the contract, shipment of inventory items, delivery of completed work according to the act, etc.

What does the bill look like?

An invoice for payment can hardly be considered in the general case a primary accounting document, since it does not formalize a business transaction (Clause 1, Article 9 of Federal Law No. 129-FZ “On Accounting”): the shipment of goods is issued with an invoice, the transfer of funds - payment order. The invoice performs auxiliary functions: the supplier informs the buyer of the amount to be paid and additionally reminds of the timing of its transfer.

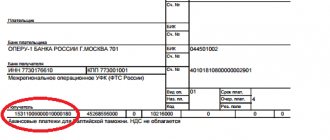

There is no unified form for payment invoices; organizations resolve this issue independently. Traditional account details include:

- details of the supplier - the recipient of the payment, namely name, INN, KPP, bank details (it is assumed that it is on the basis of the invoice that the buyer will draw up a payment order in the form approved in Appendix 1 to the Regulations of the Central Bank of the Russian Federation dated No. 2-P “On non-cash payments in Russian Federation");

- buyer's details (usually only name);

- basis for payment (name, quantity of goods, details of the supply agreement);

- the amount to be paid (if a product is paid for, the sale of which is subject to VAT, the “input” tax is highlighted in the invoice);

- the deadline for paying the invoice (for example, “pay the invoice within 20 calendar days”);

- invoice expiration date (usually in prepaid invoices);

- date and account number (to identify the document);

- signature of an authorized person and seal of the supplier organization.

The legislation does not prohibit concluding transactions in conventional units (clause 2 of Article 317 of the Civil Code of the Russian Federation). This means that the invoice can also be drawn up in y. e. and contain an indication of the rate of conventional monetary units used by the parties (the official exchange rate on the date of payment or the rate fixed in the agreement).

For the purchasing organization, the invoice for payment usually performs a control function. For example , according to the internal document flow rules, a payment from a current account can only be made on the basis of an invoice from a supplier, endorsed by the financial manager. However, often the parties do without issuing invoices, because the amount of debt and payment terms are agreed upon in the contract. Most often, an invoice for payment is considered as a unilateral financial document, which in itself does not give rise to the rights and obligations of the parties.

Prepayment invoice as a contract

As a rule, in the supply agreement the parties stipulate the supplier’s obligation to issue an invoice for an advance payment or for payment for goods already shipped. Therefore, issuing an invoice is one of the actions of the supplier to fulfill its obligation under the contract.

However, there are situations when, due to the peculiarities of the organization of trade, issuing an invoice acts as an offer, and payment of the invoice is considered as acceptance of the offer (Resolutions of the FAS ZSO dated N F04-3677/2009(9195-A45-4), FAS UO dated N F09-8079/ 09-C3, FAS SZO from N A56-9218/2008, FAS PO from N A57-19204/05-15). So, according to paragraph 2 of Art. 437 of the Civil Code of the Russian Federation, an offer containing all the essential terms of the contract, from which the will of the person making the offer is discerned, to conclude an agreement on the conditions specified in the offer with anyone who responds, is recognized as an offer (public offer). In turn, the performance by the person who received the offer, within the period established for its acceptance, of actions to fulfill the terms of the contract specified in it (shipment of goods, provision of services, performance of work, payment of the appropriate amount, etc.) is generally considered acceptance .

Employment history

Can I issue an invoice to an individual? The creation of such a document for presentation to a private client is not prohibited by law. The enterprise independently decides whether such a form is needed in a particular situation or not.

If it is assumed that payments will be made in cash, then there is no need to prepare an invoice. In the case of non-cash payment, this document is required by the company’s client in order to correctly make a bank transfer. Legal acts focus attention not on the preparation of documents necessary for making a payment, but on the forms confirming the implementation of the transaction.

At the same time, an invoice is an integral element of a sale or purchase transaction or the provision of services if the parties have entered into an agreement and the final cost is not specified in it. In this case, the data from the invoice will identify the exact amount due. A cash receipt will confirm that a transaction has been completed in cash. When an error is detected in the invoice, it is corrected in accordance with the established procedure (clause 29 of the Rules).

If an invoice is corrected, the incorrect indicators are crossed out and the correct ones are entered, then the date of the corrections is indicated. Changes are certified by the signature of the manager and the seal of the enterprise. Please note that only the organization that issued this document can make corrections to the invoice.

It indicates the seller or performer of a certain work (as a legal entity or individual entrepreneur), current account number and bank details, address, list of goods or services that are subject to payment. Quantity, price and, if applicable, VAT must be indicated. The date and number are needed only for internal document flow.

It can be sent by fax, by mail, sent by courier, delivered in person, or electronically.

Account elements

There is no specific form for drawing up an invoice, but there are mandatory components that must be contained in it.

- Requisites individual entrepreneur or LLC (both seller and buyer):

- name of the enterprise;

- legal form of organization;

- legal address of registration;

- Checkpoint (for legal entities only).

- Information about the bank servicing the transaction:

- name of the banking institution;

- his BIC;

- numbers of current and correspondent accounts.

- Payment codes:

- OKPO;

- OKONH.

- Account number and date of its registration (this information is for internal use of the company; numbering is continuous, starting from the beginning every year).

- VAT (or lack thereof). If VAT is present, its amount is indicated.

- Last name, initials, personal signature of the compiler.

Can I issue an invoice from an individual?

Since individuals who are not registered as individual entrepreneurs do not pay VAT, and an invoice can only be issued by an organization or individual entrepreneur with VAT, this function is not directly available to them .

Any serious company will not pay an invoice issued by an individual, exposing itself to taxes. Or you will have to register as an individual entrepreneur/closed joint stock company/LLC in order to be able to issue invoices, or draw up an agreement with an organization for the provision of a certain type of service, and it makes payment as an individual for the work performed. So, from a legal point of view, an individual and invoicing are incompatible concepts.

Information on how to obtain a copy of an individual’s TIN via the Internet is contained in this article. If you are wondering whether notification of the opening of a current account is required to the tax office or other authorities, find out about it here.

Is an invoice required?

The legislation of the Russian Federation does not regulate the mandatory use of an invoice in business documentation; payment can be made simply on the terms of an agreement. However, the law calls the conclusion of an agreement an indispensable condition of any transaction. An invoice does not exist separately from the contract; it is a document accompanying the transaction. It represents, as it were, a preliminary agreement on payment according to the conditions established by the seller - the price that the buyer of the product or service must pay.

The invoice makes calculations much more certain, so entrepreneurs prefer to use it, even if this condition is not specified in the terms of the contract.

IMPORTANT! Since the requirement for an account is not legally required, it does not relate to accounting reporting documents, but is intended for internal use.

In what situations is an invoice issued?

Before the start of any cooperation, counterparties, as a rule, enter into agreements that stipulate payment terms, amounts and other terms of transactions. In addition, our legislation does not require transactions without contracts.

If the terms of the contract do not stipulate that the seller must issue an invoice for payment, there is no need to do this. In this case, the buyer must pay for the service or product only on the basis of an agreement.

This may be the case, for example, when paying for communication services: in contracts of this kind, the amount, as a rule, is not specified in advance. An invoice is issued when an organization carries out transactions subject to VAT, and in other cases established by law.

Such an invoice should be issued to the customer (or buyer):

- an organization exempt from VAT (Article 145 of the Tax Code of the Russian Federation);

- an organization that sells goods or services under an agency agreement on its own behalf, subject to the application of the general taxation system, clause 1 of Art. 169 Tax Code of the Russian Federation;

- an organization that has received an advance/partial payment towards the upcoming sale of goods from the customer (Article 168 of the Tax Code of the Russian Federation).

When is an account absolutely necessary?

The legislation specifies the moments when issuing an invoice is mandatory support for a transaction:

- if the text of the agreement did not specify the amount to be paid (for example, for communication services, etc.);

- for transactions involving the payment of VAT;

- if the selling organization is exempt from VAT;

- a selling company located on OSNO sells goods on its own behalf or provides services under agent agreements;

- if the customer made an advance payment to the seller company or transferred an advance payment for a product or service.

So, an invoice for payment is not a mandatory document , just like an accountable document. It cannot in any way influence the movement of financial funds, it can be suspended or not paid at any time - such phenomena occur quite often and do not have any legal consequences. However, this document is equally important for the parties to the transaction, as it allows them to enter into a kind of preliminary agreement on the transfer of funds.

Can the Invoice Date Be Earlier than the Act Date?

The invoice is dated by the date of actual shipment of goods, performance of work, provision of services. According to Article 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for accepting the presented amounts of tax for deduction or reimbursement from the buyer in the prescribed manner.

At least it is not built on hypotheses and guesses. Subject to deductions are tax amounts presented to the taxpayer when purchasing goods (work, services) on the territory of the Russian Federation in relation to goods (work, services) acquired to carry out transactions recognized as objects of taxation.

We recommend reading: Nyagan Admru Housing Policy List of Emergency Housing for 2021

Who issues invoices for payment?

An invoice for payment is always issued by an employee of the accounting department. After the form is completed, the document is handed over to the head of the organization, who certifies it with his signature. It is not necessary to put a stamp on the document, since individual entrepreneurs and legal entities (since 2021) have the right not to use the seal.

An invoice for payment is drawn up in two copies , one of which is sent to the service consumer or buyer, the second remains with the organization that issued it. You can fill out the invoice either on a regular A4 sheet or on the organization’s letterhead. The second option is more convenient, since you do not need to enter information about the company each time.

This document does not have a unified template, therefore organizations and individual entrepreneurs have the right to develop and use their own template or issue an invoice for payment in free form. As a rule, for long-established organizations and individual entrepreneurs the form of the form is standard; only the information about the invoice recipient, the name of the product or service, as well as the amount and date change. Sometimes organizations additionally indicate in the invoice the terms of delivery and payment (for example, percentage or prepayment amount), the validity period of the invoice and other information.

If any errors are made in the document during registration, it is better not to correct them, but to issue the invoice again.

It should be remembered that in some cases, when resolving disagreements between the parties in court, the invoice for payment is a document of legal force and can be presented in court.

Can I issue an invoice from an individual?

Since individuals who are not registered as individual entrepreneurs do not pay VAT, and an invoice can only be issued by an organization or individual entrepreneur with VAT, this function is not directly available to them .

Any serious company will not pay an invoice issued by an individual, exposing itself to taxes. Or you will have to register as an individual entrepreneur/closed joint stock company/LLC in order to be able to issue invoices, or draw up an agreement with an organization for the provision of a certain type of service, and it makes payment as an individual for the work performed. So, from a legal point of view, an individual and invoicing are incompatible concepts.

Invoice for payment from an individual entrepreneur or LLC

Today there is no form approving the type of account or suggesting its standard . It is not even considered an accounting document. An invoice is issued and issued for payment electronically or in paper form. Be sure to indicate the following:

- details of an individual entrepreneur or legal entity (identification code, name of the organization, its legal form and legal address);

- details of the servicing bank (name, address, current and correspondent accounts, BIC);

- codes (OKPO, OKONH).

After the individual entrepreneur has indicated his and the buyer’s details, the invoice number and the date of its formation are entered and the presence or absence of VAT is indicated. At the end of the individual entrepreneur’s document, you must indicate your last name, initials and sign. It is not necessary to put a stamp.

It’s even better to use a special program that generates invoices. In addition, it will automatically keep records of all completed transactions, significantly simplifying accounting reporting. It will also allow you to track the payment of bills, eliminating the occurrence of errors, for example, transferring money to another account.

What is the difference between invoices for payment from LLC and individual entrepreneur

The sample received from the “private owner” has one signature. The LLC will issue a paper containing two “autographs” - the chief accountant and the director. Besides:

- Individual entrepreneurs indicate only full name, companies - the name recorded in the charter;

- The individual entrepreneur form contains only the TIN, the organization - TIN and KPP.

Differences when issuing with VAT and without VAT

VAT payers show the tax amount separately.

If the supplier is exempt from the contribution due to the use of a special tax regime (simplified system, single tax, patent), then the VAT amount is not included when writing the document. However, the corresponding mark is still affixed. And the reason must be given. For example, under the simplified tax system it is written:

- for individual entrepreneurs - paragraph 2 of Article 346.11 of the Tax Code of Russia>;

- organizations - paragraph 3 of this regulatory act.

Common mistakes when preparing an invoice

During the process of drawing up and issuing an invoice, the following mistakes are most often made:

Lack of signature decryption

Without deciphering the signatures of authorized persons, the document may be declared invalid. If the invoice is issued electronically, then there is no need to decipher the signature, because all necessary information is already contained in the electronic signature.

Violation of the five-day invoice deadline

Many people confuse the concepts of “date of preparation” and “date of issue” of the invoice. In paragraph 3 of Article 168 of the Tax Code of the Russian Federation, these terms are not defined. The law only states that the invoice must be issued no later than 5 days from the date of shipment of the goods. In addition, the details of the standard form of the document use only one date, which simultaneously acts as the date of preparation and the date of invoice.

The invoice was not received during the tax period claimed for VAT deduction

According to the recommendations of the Ministry of Finance, the deduction should be claimed in the same tax period in which the invoice was received. To eliminate the possibility of discrepancies, it is recommended that you keep receipts and keep a log of incoming mail.

The copies of the seller's and buyer's invoices show different dates

This can happen in cases where the document was revised and the final version was not saved. If copies of the same invoice indicate different dates, the document cannot be considered evidence of the transaction. In addition, when drawing up an invoice, mistakes are often made in the design of the “header” of the document. For example, incorrect information may be indicated in the name of the seller or buyer, in their addresses, TIN, etc., due to which the document will be considered invalid. To correct an error in an invoice, the incorrect indicator should be crossed out, the correct data should be entered, then the date of modification of the document should be noted, and the signature and seal of the company should be affixed. Please note that only the organization that issued the invoice has the right to make changes to this document.

Related articles:

- Production calendar for 2021 for a six-day and five-day workweek

- Accountant's tax calendar for 2015

- Changes in accounting and tax accounting in 2015

- Production calendar for 2015 with a five-day and six-day working week

- New Year's weekend 2015: how we will relax in 2015

- How to choose a name for an LLC: examples

- Russia's transition to winter time in 2014 will be final

- Change in the order of payments in 2014

Instructions for preparing an invoice for payment

From an office management point of view, this document should not cause any particular difficulties in developing and filling out.

At the top of the document information about the recipient of the funds is indicated. Here you need to indicate

- full name of the company,

- his TIN,

- checkpoint,

- information about the bank servicing the account,

- account details.

Next, in the middle of the line, write the name of the document, its number according to internal document flow, as well as the date of creation.

Then the payer of the invoice (also the consignee) is indicated: here it is enough to indicate only the name of the company that received the goods or services.

The next part of the document concerns the services directly provided or goods sold, as well as their cost. This information can be presented either in a simple list or in the form of a table. The second option is preferable, as it avoids confusion and makes the score as clear as possible.

In the first column of the table of services provided or goods sold, you must enter the serial number of the product or service in this document. In the second column - the name of the service or product (without abbreviations, concisely and clearly). In the third and fourth columns, you must indicate the unit of measurement (pieces, kilograms, liters, etc.) and quantity. In the fifth column you need to put the price per unit of measurement, and in the last column - the total cost.

If the company operates under the VAT system, then this must be indicated and highlighted in the invoice. If there is no VAT, you can simply skip this line. Then, below the right, the full cost of all goods or services is indicated, and under the table this amount is written in words.

Finally, the document must be signed by the organization’s chief accountant and manager.

What date should I issue an invoice for payment?

If you issue invoices and statements for the same service to the same clients from month to month, you can create a new document by simply copying the previous one. It is also very convenient to issue acts for a group of accounts at once. To do this, in the document register, you simply check the boxes opposite those accounts for which you need to issue closing documents.

With one click on the “Create” button, acts or invoices will be generated. Any document created in the service can be downloaded in Excel or PDF format. But the second document, the invoice, is a confirmation of the completed transaction for tax accounting; it is issued only by the service provider or the seller only after he has completed the transaction, and includes not only the total price, but also separately indicated VAT.

An invoice has a standard form, is a document of strict reporting and is submitted to the tax office, whereas an invoice is not. Since the legislation does not establish a specific form of invoice for payment

, then such a document can be presented in paper or electronic form. An individual entrepreneur has the right to draw up an invoice using special software, which will automatically generate documentation after entering the necessary data. You can also prepare the document yourself.

In this case, the supply agreement will be considered concluded only after the goods are transferred to the consumer and the delivery note is signed. But even after paying for the goods, the buyer, having such an imperfect invoice, will not be able to present claims to the supplier based on the supply agreement. For example, the buyer will not be able to demand that the product be replaced or its quantity changed.

But he has the right to demand the return of the money paid for the goods, based on unjust enrichment. On our website you can find free invoices for 2021, compiled based on the requirements of the most common accounting programs.

- outgoing and incoming own number;

- name, contact details of the seller;

- information and contact details of the buyer or customer;

- discharge date;

- company and tax information;

- date of dispatch/delivery/purchase/services rendered;

- order number or other number by which the customer can track the progress of delivery;

- total amount;

- payment terms;

- and other information, for example, special conditions, information about taxes, penalties for late delivery, late payment or refunds in case of damage to the order.

Such an invoice may be issued by the seller (or performer) after the sale of goods or services. It is used to confirm payment of VAT and excise duty. In addition, it can inform about the country of origin of the goods and contains information about the customs declaration number (if the goods are imported).

It is issued in a strictly established form and is considered the basis for deducting VAT amounts from the buyer. Issued in two copies. Any serious company will not pay an invoice issued by an individual, exposing itself to taxes.

Or you will have to register as an individual entrepreneur/closed joint stock company/LLC in order to be able to issue invoices, or draw up an agreement with an organization for the provision of a certain type of service, and it makes payment as an individual for the work performed. So, from a legal point of view, an individual and invoicing are incompatible concepts. It indicates the seller or performer of a certain work (as a legal entity or individual entrepreneur), current account number and bank details, address, list of goods or services that are subject to payment.

Why do you need an account?

Apart from issuing an invoice, there is no other way to speed up settlement between the parties . The invoice acts as a preliminary agreement, when the seller sets prices for his goods, and the buyer makes payment on its basis (without the actual existence of an agreement), the remaining documents are drawn up upon receipt of the goods. In this case, the invoice is usually issued in one copy.

Such an invoice may be issued by the seller (or performer) after the sale of goods or services. It is used to confirm payment of VAT and excise duty. In addition, it can inform about the country of origin of the goods and contains information about the customs declaration number (if the goods are imported). It is issued in a strictly established form and is considered the basis for deducting VAT amounts from the buyer.

Issued in two copies.

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

How long is an invoice valid for payment according to law?

An invoice for payment can hardly be considered in the general case a primary accounting document, since it does not formalize a business transaction (Clause 1, Article 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”): the shipment of goods is issued with an invoice, transfer of funds - by payment order. The invoice performs auxiliary functions: the supplier informs the buyer of the amount to be paid and additionally reminds of the timing of its transfer.

To answer this question, it is necessary to establish whether the buyer (customer) had the opportunity to pay for goods (work, services) without receiving invoices from the supplier (contractor, performer). In other words, is the absence of an invoice after the parties have signed invoices for the transfer of goods, certificates of work performed, services rendered an obstacle to payment under the contract?

What's happened

An invoice is an optional paper that contains the seller’s details, according to which the buyer transfers funds for the goods, works and services provided on the paper. An advance payment is required.

What does the completed document look like?

The seller has the right to issue a report for payment if he has:

- invoice;

- certificate of completion;

- goods or waybill.

Important ! The invoice for payment specifically to the individual entrepreneur and payment documents for payment received from the company may differ slightly from each other.

The differences are that in the check the entrepreneur:

- indicates his full name, and the company - its name according to the charter;

- puts his signature, and in the organization the head of the company, the chief accountant signs the check;

- indicates only its TIN, and the company - TIN, KPP;

- does not put his seal, but on the condition that the businessman works without it.

What happens if you don't pay your bill on time?

In the hustle and bustle of daily affairs, it is very important for an accountant or individual entrepreneur not to forget how many days an invoice is valid for payment, if it is defined. For late payment, you may have to pay a penalty, which is a way to ensure the obligations stipulated by the contract. The penalty is charged as a percentage for each day of delay in accordance with Art. 395 of the Civil Code of the Russian Federation.

From what day should the penalty begin to accrue? It all depends on the type of contract and the terms of payment in it. If the agreement clearly states the terms of payment, the penalty is calculated from the day following the last day of payment under the agreement.

If a clear date is not set, the calculation of the penalty is carried out as follows:

- under a supply agreement - after 3 working days from the date of transfer of the goods;

- under a work contract - after 7 days from the date of filing a claim with the debtor demanding payment.

Can the Invoice Date Be Earlier than the Act Date?

1) sale of goods (work, services) on the territory of the Russian Federation, including the sale of collateral and transfer of goods (results of work performed, provision of services) under an agreement on the provision of compensation or novation, as well as the transfer of property rights. Article 167. Moment of determining the tax base

1. When selling goods (work, services), transferring property rights, the taxpayer (tax agent specified in paragraphs 4 and 5 of Article 161 of this Code), in addition to the price (tariff) of the goods (work, services) being sold, transferred property rights, is obliged to present to payment to the buyer of these goods (works, services), property rights the corresponding amount of tax. Article 169

The invoice was not received on time: will there be a delay in payment?

—————————— Resolution of the Autonomous Region of the Moscow Region of September 10, 2014 N F05-8237/14 art. 190 Civil Code of the Russian Federation; Resolution 20 AAS dated 01.10.2012 N A62-2870/2012 clause 1 art. 486 Civil Code of the Russian Federation, clause 1, art. 711 Civil Code of the Russian Federation, clause 1, art. 779, paragraph 1, art. 781 of the Civil Code of the Russian Federation Resolution of the Federal Antimonopoly Service of the Russian Federation dated May 13, 2013 N F03-1578/2013 Resolution of the Federal Antimonopoly Service of the Moscow Region dated September 5, 2012 N A40-13105/12-137-119; FAS PO dated 04/22/2014 N A06-3458/2013; 13 AAS dated January 18, 2012 N A56-42250/2011; FAS North Caucasus Region dated 01.03.2013 N A53-22404/2012 clause 1 art. 486 Civil Code of the Russian Federation; clause 16 of the Resolution of the Plenum of the Supreme Arbitration Court of October 22, 1997 N 18; Part 5 Art. 5 of the Law of June 27, 2011 N 161-FZ, clause 2, art. 314 Civil Code of the Russian Federation; Resolution of the Federal Antimonopoly Service NWZ dated May 16, 2013 N A26-6244/2012; 13 AAS dated 08.11.2010 N A56-12577/2010

- under a supply (purchase and sale) agreement - after 3 working days (the period allotted to banks for transferring a non-cash payment) from the date of transfer of the goods. For example, if the goods were transferred on the 10th, then the last day of payment will be the 13th (provided that the days from the 11th to the 13th are working days), and the penalty will begin to accrue on the 14th;

Providing character: what date to issue the act and invoice

According to clause 3.11 of GOST R 6.30-2021, adopted and put into effect by Resolution of the State Committee of the Russian Federation for Standardization and Metrology dated 03.03.2021 No. 65-st, the date of the act of provision of services is the date of the event recorded in the document. In this case, acts, as documents issued by two or more organizations, must have one (single) date.

At the same time, the taxpayer must document the expenses incurred (clause 1 of Article 252 of the Tax Code of the Russian Federation). That is, as long as the organization does not have the documents, it will not be able to accept as expenses the services provided by the counterparty.

Payment of invoice within 5 banking days

Federal Law No. 129 of 1996, which regulates the basics of accounting in the Russian Federation, establishes that an invoice for payment is not included in the list of primary accounting documents.

In addition to the provisions of the law, the legal field uses such a concept as business customs, which have legal force by analogy with the law.

According to them, in the event of a controversial legal relationship between the parties to the contract, it is considered by the court as the primary document of the financial statements.

At the enterprise, invoices are stored in the “Payment Documents” folders. Its presence is necessary for the seller, since it indicates payment has been made for the product or service. In most cases, an invoice for payment for products (services) is issued in advance. It does not have a strict form, since the law did not include this document in the primary documentation.

Based on this, enterprises independently create forms, approving the document as an annex to the accounting policy. How long an invoice is valid for payment may not be indicated, since there is no direct legal requirement for it to be recorded in a document - this rule applies both to organizations and to issuing invoices from individual entrepreneurs.

Article 9, paragraph 2 of this law establishes the details of primary accounting documents:

- account number, date of its creation;

- payment details of the recipient of funds;

- payment details of the payer for the invoice;

- name of the organization (enterprise), address, contacts;

- a list of paid goods and services, indicating their list, name, VAT.

The list is closed: based on this, we can say that the invoice payment period is not included in the content of the primary documentation. Consequently, according to business customs, it can be equated to such documents. Failure to sign the payment deadline will not be considered a violation of the law.

If the party issuing the invoice decided to include a validity period in it, it is specified additionally in the contract. This may be 5 days or more.

In this case, the seller is obliged not to set a new price for the product in the direction of its increase until the invoice is paid.

Typically, contracts drawn up between business entities provide for penalties for late payment. Their accrual begins to take effect the next day after the expiration of the specified period.

Article 9 No. 129-FZ does not establish the mandatory presence of provisions on payment terms in the payment document. The validity period of the invoice for payment according to the legislation of the Russian Federation is not specified.

If everything is clear with the deadline specified in it - the parties to the transaction established it by agreement with each other, what to do in another situation when the deadline is not specified?

Firstly, there is a situation in which the parties did not indicate the period for how many days the invoice for payment is valid, but stated it in the contract. In this case, you should rely on the provisions of the contract.

Secondly, the situation may be complicated by the fact that the duration of the invoice for payment will not be indicated, just like in the contract. In this case, it will be considered issued without specifying a period.

Thirdly, it can be written out as an offer: in this agreement, addressed to a circle of people, a period is always indicated. If it has expired, the invoice has not been paid, the agreement is no longer considered an offer (Article 443 of the Civil Code of the Russian Federation).

Read more about the rules for registering an account...

The invoicing period is clearly defined by the Tax Code of the Russian Federation; when selling products, the seller has 5 days to issue an invoice.

Porcelain LLC sells tea sets. In September 2021, the company shipped a batch of goods in accordance with the concluded contracts, and, by agreement with another buyer, received an advance payment for the upcoming delivery. Terms of shipment and receipt of advance payment:

- JSC "Uyut" - delivery of tea sets was made on September 8;

- JSC "Mir" - issued an advance on September 12 for the supply of tea sets (upcoming).

When should an invoice be issued to Porcelain LLC for these counterparties? For the first company - no later than September 13, for the second company - no later than 19 of the same month.

JSC "Maks and Tovarishchi" sells building materials. In particular, the buyer is IP "Ivanov". The agreement of the parties established that the individual entrepreneur will be able to own construction materials only after they have been paid for.

The goods were shipped to the entrepreneur on September 10, he paid on September 17, therefore, he acquired ownership of the building materials on September 17. JSC "Max" must issue an invoice no later than the 15th of the current month, since the fact of shipment is recorded on the 10th.

Mandatory – is there a deadline for payment on time?

Important: In supply contracts, the term (Article 506 of the Civil Code of the Russian Federation) is an essential condition; without it being fixed in the text of the document, the contract is invalid. Consequently, the parties always write it down when concluding a transaction; it is mandatory, as it affects the settlement period between the partners. It is not necessary to include it in the bill.

Penalty

A penalty is a way to ensure the obligations provided for in the agreement of the parties. Applies to a participant in legal relations who has violated obligations.

The penalty is charged as a percentage for each day of delay: the parties themselves set the percentage amount. The penalty is not subject to VAT.

We invite you to familiarize yourself with Russian Railways benefits for disabled children in 2020

If a penalty is applied by the parties as an element of pricing (that is, it increases the cost of products), then the tax authorities, in the process of checking a legal entity, assess a tax.

If the contract includes a condition that if the buyer is late in paying for the goods by no more than 10 days, the cost of the goods (initial) increases by 20%.

Forms and samples of invoices for payment

Mandatory details include the names of the parties, their bank details, addresses, name of goods, works, services, price per unit of goods, quantity, mandatory indication of the rate and amount of taxes included in the price of the goods, the total amount payable.

Conditions for reflecting the validity period Fulfillment of obligations (validity period) The period is not indicated in the invoice for payment, but is reflected in the agreement, contract concluded by the parties. Obligations must be fulfilled within the time limits reflected in the agreement. The deadline is not indicated in the invoice for payment and is not reflected in the agreement concluded by the parties to the transaction. Obligations can be fulfilled at any time, since in this case the invoice is considered to be issued without a time limit.

Based on this, enterprises independently create forms, approving the document as an annex to the accounting policy. How long an invoice is valid for payment may not be indicated, since there is no direct legal requirement for it to be recorded in a document - this rule applies both to organizations and to issuing invoices from individual entrepreneurs.

OPTION 2. The payment period is determined solely by the moment of receipt of the invoice. For example, the contract may say: “The buyer makes an advance payment for the goods no later than 5 banking days from the date of invoice.” In such cases, the courts do not consider the time limit set.

Since it is not allowed to tie the deadlines for the fulfillment of obligations to events that depend on the will or actions of the parties. Therefore, the obligation must be fulfilled within a reasonable time, which is counted from the deadlines established by the Civil Code of the Russian Federation.

And counterparties sometimes take advantage of this and delay payment, citing the fact that the invoice has not been received. Is the counterparty considered to be late in payment in such a situation? And should he pay the penalty provided for by the contract or law, and if it is not provided for, interest for the use of other people’s funds (hereinafter referred to as interest under Art.

395 Civil Code of the Russian Federation)?

Within the framework of the law, the length of employment of any employee is calculated from the moment of concluding a joint cooperation agreement until the termination of legal relations, regardless of the length of annual and administrative leave, as well as other cases of exemption from immediate duties.

Moreover, according to Art.

9 Federal Law No. 255, the time spent on sick leave not only does not affect the duration of leave at the expense of the employee, but is also not subject to payment, due to the fact that the worker does not require release from immediate duties. Moreover, if the worker’s sick leave continues after the end of the unpaid release from work, the period of incapacity for work, which already coincides with working days, will be paid.

A current account with Sberbank is opened without any time limit. At the request of the client, it can be closed at any time after writing a written application.

The remaining funds from the account must either be transferred to another client account or issued in cash. The bank may terminate the agreement if there is no money in the account within 2 years and no transactions are made.

In this case, the account owner is sent a written notice two months before the expected closure of the account.

These documents are not mandatory, but their use helps management and accounting keep control of cash flow and compliance with the terms of contracts by both parties.

How long is an invoice valid for payment under the law? What happens if you miss the payment deadline? Answers to these and other questions can be found in the article.

- When contacting a bank, a citizen, using a pre-filled receipt or details, makes a payment in favor of one or another body, and in return receives a note from the bank about the payment.

- The transfer of funds can occur non-cash from account to account; the document confirming payment will be a payment order with a bank mark.

- Through automatic payment terminals using the same details, you can make a payment in favor of a particular organization.

- Through the personal account of the Online Bank service, the state fee can be paid at a convenient time anywhere from a mobile device or home computer.

- If you have a valid bank card and a personal account on the State Services portal, payment can be made directly through the website.