Sheet 03 of the income tax return - purpose

The indicated sheet must be filled out if there is data on income issued to legal entities based on the results of equity participation or interest paid on securities (paragraph 4, clause 1.1 of the Filling Out Procedure). If settlements are made only with individuals, sheet 03 is not generated. This is due to the fact that on dividends to individuals, it is not the profit tax that is calculated and paid by the tax agents, but the personal income tax. The normative procedure for taxation, withholding and payment of amounts to the budget is defined in stat. 275, paragraph 4, 5 art. 286, art. 284, paragraph 2, 4 art. 287, art. 310.1 Tax Code of the Russian Federation.

The main purpose of sheet 03 is to provide reliable information to the tax authorities on the listed dividends for a particular period. No data duplication required. That is, if the company distributed and paid out amounts for the 3rd quarter, the information is entered and presented in the calculation for the same quarter, the information is not re-submitted in the annual report (paragraph 2, clause 1, article 289 of the Tax Code of the Russian Federation).

Due dates

The deadlines for filing income tax returns with the tax office are the same for everyone. Tax agents are required to submit calculations:

- for the first quarter - no later than April 28 of the reporting year;

- for half a year - no later than July 28 of the reporting year;

- for nine months - no later than October 28 of the reporting year;

- for the year - no later than March 28 of the following year.

The obligation to submit a declaration monthly (no later than the 28th day of the next month) is provided only for taxpayers who make advance payments for income tax based on the actual profit received. This rule does not apply to tax agents.

This procedure is established by paragraphs 3 and 4 of Article 289 of the Tax Code of the Russian Federation.

Sheet 03 of the income tax return - procedure for filling out

The regulatory rules for filling out sheet 03 were approved by the Federal Tax Service by Order No. ММВ-7-3 / [email protected] dated 10.19.16 (Appendix XI). The current declaration form is also shown here. The sheet itself includes 3 sections:

- Sec. A – is intended for calculating tax amounts on dividends from participation in the activities of Russian enterprises. Information is provided by payment period.

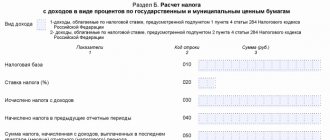

- Sec. B – used to calculate tax amounts on interest income from securities (municipal and state).

- Sec. B - here is a breakdown of the recipients of dividend or interest payments. A separate section is formed for each recipient, provided that tax is charged on such payments.

An example of drawing up sheet 03 of a profit declaration

Let’s assume that based on the results of business activities for 2021, the company allocated 570,000 rubles for the payment of dividends. Of this, settlements with foreign enterprises not registered in the Russian Federation account for 370,000 rubles. (tax rate 0%); with Russian organizations – 200,000 rubles. (rate 13%).

The decision on payments was made in April. Accordingly, the data must be included in the calculation for the 2nd quarter of 2021. In other periods, these amounts do not need to be reflected.

When filling out section A, indicate the agent category code – 1; dividend type code – 2 (annual); period code – 21; year - 2021. On pages 001, 010 the total amount is given - 570,000 rubles; on lines 020, 022 – RUB 200,000.00; on line 040 – 370,000.00 rub. Further on page 090 – RUB 570,000.00. On page 100 the amount of tax calculated according to the formula is entered - 26,000 rubles. (200,000.00 x 13%).

Section B of sheet 03 is crossed out, since there were no interest payments. Section B contains information about the recipient of the income actually issued - a Russian enterprise on the amount of dividends from which tax was calculated and then paid to the state.

Reporting forms

The income tax return form, as well as the procedure for filling it out, were approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

In this case, income accrued by the tax agent in favor of foreign organizations must additionally be reflected in the tax calculation (information), the form of which was approved by order of the Ministry of Taxes of Russia dated April 14, 2004 No. SAE-3-23/286. For information on preparing this calculation, see How to prepare and submit calculations (information) on income paid to foreign organizations.

Lines 010–060 Sale of depreciable property

Fill in lines 010–060 if the organization sold depreciable property. For more details, see How to account for income and expenses from the sale of depreciable property.

Reflect:

- on line 010 – how many depreciable assets were sold;

- on line 020 - how many of them were sold at a loss;

- on line 030 – proceeds from the sale of this property;

- on line 040 - the residual value of the sold property plus expenses associated with its sale;

- on line 050 – profit from the sale of depreciable property (excluding objects sold at a loss);

- on line 060 – separately losses from the sale of depreciable property.

What is profit

Since taxation must have an object from which part of the funds is withdrawn and given to the state, it exists in this case: it is profit. Companies pay royalties on profits, not income. Let's see what is considered profit from the point of view of the law.

There are three basic concepts that you need to understand to understand this type of tax:

- income;

- expenses;

- actual profit.

Income is all the money that a company received as a result of its activities. Expense is the money she spent to carry out the activity. Profit is the difference between income and expenses, that is, the so-called “net” money, from which the entire amount of money invested in the enterprise has already been deducted.

Let's give a simple example. You opened your own baked goods store, which was received with great pleasure by the public. Over a decent period of work, you have built up a clientele and stopped working in the red. Thus, a month of the company’s work pays off with an income of 500 thousand rubles. At the same time, not taking into account temporary expenses that arise in the form of various equipment breakdowns, etc., you spend about 200 thousand monthly on:

- purchase of raw materials;

- room maintenance;

- payment of wages;

- communal payments;

- advertising, etc.

It turns out that the organization’s net profit (C) will be equal to income (A), from which costs (B) will be subtracted.

A-B=C

So, legally the following is recognized as profit:

- for companies whose homeland is Russia, this is the difference between income and expenses that invariably arise during the implementation of activities.

- for foreign companies that operate in our country through open representative offices - the same thing, only cash flow records are kept only for representative offices;

- foreign companies that do not coincide with the previous classification take as profit income that was received from sources located in Russia.

Note! In all of the above cases, expenses may not mean all the company’s expenses that seem appropriate to it. A potential reduction in the amount of income and tax is possible only when expenses coincide with the requirements imposed on them by the Tax Code of the Russian Federation.

What kind of income can the company receive?

To classify income, they can be divided into two main groups:

- received as a result of the sale of manufactured products or work, the sale of services provided, as well as property rights;

- received without the implementation process.

Income in the first case is the revenue that is collected by the company after it has sold its main products. It doesn't have to be a product like face cream. A product can be an action, that is, a service (facial massage) or work (installation of a massage table). In addition, income also comes from the implementation of property rights, for example, leasing intellectual property, and receiving money for it. The proceeds from the above procedures are determined by calculating the funds received that could have been paid for one of the above areas.

The Tax Code includes money acquired through actions from the list below as income received outside the sales process.

- If there is a difference between the rates for the sale and purchase of another country’s currency and those established by the Central Bank of the Russian Federation on the day of purchase or sale of this currency.

- When owning shares of a third-party company.

- When existing property is transferred.

- When fines or other sanctions are assessed for refusal to follow concluded agreements and official obligations.

- When intellectual property is transferred for use by another company, but only in a situation if this source of money is not defined by the taxpayer as sales.

- When receiving interest that is paid to repay obligations on a loan taken from a credit or other organization, or an individual.

- When taking into account reserves that were restored by including the costs of their formation as part of all company expenses.

- Property that was given free of charge. This can be an existing object, or intellectual property.

- When the person paying the tax is a member of an association in the form of a simple partnership, the income distributed to him is not subject to taxation.

- Money for past tax periods of 12 months, discovered only during this reporting period.

- If a positive difference arises during the procedure for revaluing property into foreign currency, it is not accepted as income. This does not include securities priced in foreign currencies.

- The difference between the paid and actually accrued amount for work, provision of services or sale of goods is also not subject to tax accounting.

- Other list items specified on the pages of the Tax Code.

Documentation of the income received is displayed using primary or subsequent confirmations, as well as papers in which tax records are kept.

If part of the taxpayer’s income was received in foreign currency, and part in Russian rubles, then the entire amount is taken into account together, and the tax is deducted from this total amount.

According to the letter of the law, there are only 43 types of income received by the taxpayer, the existence of which does not need to be taken into account when determining the tax base.

- When, together with monetary proceeds, a company receives property, any rights to it, the provision of services, the determination of incoming and expended funds is carried out according to the accrual method.

- If property or rights of a property nature are received as a kind of guarantee of further cooperation and fulfillment of agreements, as well as in the form of a contribution from one of the members of the economic community who leaves it, or during the distribution of the property of the liquidated community among the members of the union.

- When any property, including rights to something, can be valued in rubles or another currency and transferred to the authorized capital as a contribution.

- If some property or money was received as assistance provided on a voluntary and free basis.

- Nuclear power plants are not subject to the gratuitous receipt of safety and protection equipment, which, according to the law, must be used during their work.

- If the property was received by state institutions, in accordance with the decision made by the authorities.

- When the property was received as a result of a loan agreement or a lending agreement.

- If the property was received by a Russian-owned company from:

- another company, while, according to the charter, the recipient’s capital must consist of an amount exceeding the transferred amount by half or more;

- on behalf of an individual, under the same condition as in the first paragraph.

At the same time, the received property is not recognized as income only in the situation where, from the moment of its receipt, it has never been transferred to third parties for 12 months.

What expenses does the organization bear?

Since we are talking about income tax, in addition to the income the organization receives, it is necessary to consider its expenses. As we remember, both of these values need to be known in order to calculate the desired profit and be able to calculate in favor of the state the money due to it from this profit.

Like income, costs are divided into two subgroups:

- incurred as a result of the use of funds in the production or sale of goods;

- expenses that were not involved in the implementation process.

Official expense items include only those that have the following characteristics:

- confirmed using official documents;

- are economically justified.

Economically justified costs include those that were justified, that is, useful for production and its activities. Determining who belongs to this characteristic is quite simple for experienced accountants and tax officials.

Documentary evidence means the presence of specialized documents that were drawn up not in free form, but in accordance with the letter of the law. In addition, the documentation must comply with the business standards and principles of the country in which the required costs were incurred. This applies not only to the usual package of documents, but also:

- travel orders;

- submitted customs declarations;

- reporting under the contract regarding the work done specified in it.

The funds spent on production and sale can be:

- material;

- related to wages;

- accrued as depreciation;

- others.

Material expenses include those that involve the acquisition in exchange of resources of various types necessary for production, for example:

- production raw materials (for example, flour, eggs and other bakery products from the example above);

- inventory in the form of various tools, apparatus, appliances, specialized clothing, etc., which does not relate to depreciable property;

- when purchasing products used in the installation of equipment, or products that are only 50% ready and require further preparation by the tax-paying entity;

- purchased water or energy liquid, that is, fuel, etc., the consumption of which is carried out directly to achieve technological goals, for example, supplying energy;

- payment for the activities of hired workers from a third-party organization or branches of the company itself located in its structure.

When including the costs of inventories spent on production in this column, their price is calculated according to receipts for payment, and includes:

- the commission that was paid to intermediary companies;

- customs fees;

- payment when transporting the purchase;

- other expenses having a similar basis.

If raw materials that were intended to participate in the production process are written off from use, you can use one of the existing accounting methods:

- at the price of one item of inventory;

- average market price;

- the cost of the latter, according to the time of purchase (LIFO);

- the cost of the former, according to the time of purchase (FIFO).

Expenses for wages and salaries include all money transferred by the organization to employees that are directly related to the work they perform:

- salary;

- stimulating increases;

- monetary compensation for difficult working conditions;

- bonus incentives;

- other expenses provided for by law and in accordance with employment contracts with employees.

Note. The company's expenses for carrying out various research and development work, further designed to improve the production process, are also recognized as expenses upon completion of the activities and can reduce the tax base, that is, the income received by the company. At the same time, it is desirable that at that stage the research has already paid off or a new product has been released. The process must be completed before the month following the completion of research work.

All listed costs are included by the company paying income tax in one total amount that was spent over the reporting period of 12 months. Those costs that were used in research work and used for development, but ultimately did not bring the desired result, are still subject to accounting and inclusion in expenses.

The remaining group of other expenses related to the production process and further sales includes:

- the amount of tax deductions and other government fees;

- payment of duties when passing customs;

- insurance premiums to the Pension Fund of the Russian Federation;

- payments to the Federal Social Insurance Fund of the Russian Federation (to resolve the situation in the event of the birth of a child);

- contributing money to a fund to obtain health insurance, at the local and federal level;

- costs of obtaining certificates for manufactured goods;

- costs of HR agencies;

- expenses incurred as a result of repair work under warranty, including reserve deductions made in case of warranty cases;

- payments for rent of premises or equipment;

- costs of maintaining a company vehicle fleet, including gasoline, repairs, etc.;

- business trips;

- costs of using the services of professional specialists from the field of jurisprudence, information technology, audit calculations, etc.;

- payments to a private notary office for processing documentation;

- costs of conducting the activities of the company and its branches, in addition to those spent on the purchase of auxiliary services;

- costs of transferring company employees for temporary use to third parties;

- purchase of office supplies;

- payment of bills issued for communication services of all types;

- purchase of specialized software for the operation of each specific enterprise, in addition, acquisition of rights to use it;

- costs of ongoing market research, organization and the process of collecting data relating to the company’s activities;

- other expenses.

In this case, for profit tax purposes, the following expenses are not taken into account:

- dividends;

- monetary sanctions going into the budget;

- statutory contributions to the capital of the company;

- tax deductions;

- payments for exceeding harmful emissions into the biosphere.

What methods exist for recognizing perfect income and expenses?

According to the rules established by law, expenses incurred and expenses received can be recognized in two ways:

- by accrual;

- cash register.

The first method involves taking expenses into account only in the reporting period in which they were incurred, and it does not matter when the funds arrived in the recipient’s account.

According to the cash method, all companies, except credit institutions, can independently determine the day on which income was received or an expense was incurred, if over the previous 12 months the total revenue of the office did not exceed a million for every three months. When this method is used, the income generated is credited when the money is received in the bank account or directly into the company's cash desk. Expenses are also taken into account when the payment is actually made, with the following features taking place:

- costs for the purchase of production resources are taken into account in the full amount of expenses when they are written off for work;

- the procedure for recognizing depreciation is recognized only at the moment the taxpayer pays for the depreciable property used in the work;

- expenses for tax payments and other fees are also included in the company's unified expenses in full.

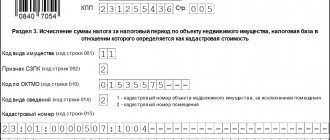

Appendix 3 to sheet 02

Appendix 3 to Sheet 02 is intended to reflect expenses for transactions that are recognized in a special manner for tax purposes. It is drawn up by organizations that, during the reporting period:

- sold depreciable property - lines 010–060;

- sold outstanding receivables – lines 100–150;

- incurred expenses for service industries and farms - lines 180–201;

- received income and incurred expenses under property trust management agreements – lines 210–230;

- sold land acquired during the period from January 1, 2007 to December 31, 2011 – lines 240–260.

First of all, check whether this particular application needs to be filled out, since the indicators from it are further used in other sheets of the declaration. For example:

- in Appendix 1 to sheet 02 - in lines 030, 100;

- in Appendix 2 to sheet 02 - in lines 080, 100;

- on sheet 02 – in line 050.

Filling out the calculation

Fill out the calculation in rubles, without kopecks. Correction of calculation errors by means of a correction or other similar means is not permitted. If there are no indicators to fill out, then put dashes in the corresponding lines and columns. Enter negative numerical values with a minus sign in the first cell on the left. Fill in the text indicator fields in block letters from left to right. For example, when filling out cells with the name of the organization on the title page, starting from the left, indicate this detail in block letters (there is no need to put dashes in the remaining cells).

After the calculation is completed, number all pages sequentially.

Such rules are provided for in section II of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

For more information on filing tax returns, see How to file tax returns.

Filling out the title page

On the title page please indicate:

- TIN and KPP of the organization (fill out the cells allocated for the TIN from left to right, starting from the first cell);

- adjustment number (for the initial calculation “0—”, when submitting an updated calculation, the adjustment number “1—” (“2—”, etc.) is indicated);

- tax (reporting) period code in accordance with Appendix 1 to the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

The title page must contain the date the reports were completed, as well as the signature of the person certifying the accuracy and completeness of the information specified in the calculation.

Such rules are provided for in section III of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Lines 180–201 Service industries and farms

Fill in lines 180–201 if the organization has service industries and facilities, including housing, communal and socio-cultural facilities. For more details, see How to keep tax records of income and expenses of service industries and farms.

For all service industries and farms available in the organization, reflect:

- on line 180 – revenue from sales;

- on line 190 – expenses incurred.

For line 200, calculate the amount of losses using the formula:

| page 200 | = | page 190 | – | page 180 |

Separately indicate on line 201 the amount of loss that is not taken into account for tax purposes.

Lines 100–150 Exercise of the right to claim debt

Complete lines 100–150 if the organization sold outstanding receivables. Indicators are filled in separately for debts sold before and after payment terms.

Amounts reflecting the sale of debts before payments are due, please indicate:

- on line 100 – revenue from sales (clause 1 of Article 279 of the Tax Code of the Russian Federation);

- on line 120 – the cost of realized rights;

- on line 140 - loss corresponding to the amount of interest calculated in accordance with Article 269 of the Tax Code of the Russian Federation.

Fill in line 150 only if the revenue (line 100) is less than the cost of debts sold (line 120) together with the recorded loss (line 140). To do this, calculate the line 150 indicator using the formula:

| page 150 | = | page 120 | – | page 100 | – | page 140 |

If the value turns out to be zero, put dashes on line 150.

In declarations prepared for periods starting from January 1, 2015, transactions for the sale of debts after the payment terms are not reflected. Lines 160–170 are also not filled in.

Responsibility

Late filing of an income tax return is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

Tax liability for late submission of declarations is established by Article 119 of the Tax Code of the Russian Federation. From January 1, 2014, the category “taxpayer” was excluded from the text of this article (clause 13 of article 10 of the Law of June 28, 2013 No. 134-FZ). Therefore, at present, the tax inspectorate can fine for such an offense any organization that must submit income tax reports, but for any reason has not fulfilled this obligation. Including the tax agent.