Payment

Is it possible to apply UTII and a patent at the same time? The Tax Code allows business entities to combine different

Tax Code >> Chapter 26.2 Article 346.11 General provisions Article 346.12 Taxpayers Article 346.13

All the necessary information about the number of working days, days off and holidays, about working standards

Free legal consultation online The involvement of lawyers in legal disputes is due to the need to fully protect personal

Home / Labor Law / Payment and Benefits / Compensation Back Published: 05/28/2016 Time

Taxpayers submitted reports for 2015 and for the first quarter of 2016. And right away

Home / Vehicles Back Published: 08/19/2020 Reading time: 4 min 0 269

The tax payment procedure is determined by how the peasant (farm) enterprise (peasant farm) carries out its work. Representatives

This approach is documented in letters from the Ministry of Finance dated January 11, 2016 No. 03-03-06/40 and dated March 2, 2007 No.

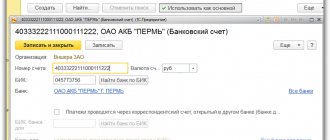

The 1C: Accounting program has a wide range of options for reflecting transactions, including credits