This approach is documented in letters of the Ministry of Finance dated January 11, 2016 No. 03-03-06/40 and dated March 2, 2007 No. 03-03-06/1/146, Federal Tax Service of Russia dated March 14, 2005 No. 02-1-07/23). Include these depreciation amounts in expenses from the 1st day of the month following the date when the modernization was completed (clause 7 of article 259.1, clause 9 of article 259.2 of the Tax Code of the Russian Federation).

Example 1. Depreciation of OS after upgrade. Officials' option The company bought a woodworking machine and included it in the 4th depreciation group, establishing a useful life of 80 months. The initial cost of the OS is 420,000 rubles. (without VAT). After some time, the company decided to modernize the machine. For these works the contractor was paid 110,000 rubles. (without VAT). At the time of their completion, the facility had been in operation for 60 months. Depreciation accrued using the straight-line method amounted to RUB 315,000. (RUB 420,000 / 80 months x 60 months). The organization decided not to increase the SPI of the fixed asset. Amopremium does not apply. The amount of depreciation charges after modernization is 6,625 rubles. ((RUB 420,000 + RUB 110,000) / 80 months). The remaining useful life of the OS is 20 months (80 – 60). During this period, the company will accrue depreciation in the amount of 132,500 rubles. (RUB 6,625 x 20 months). That is, the final amount of depreciation during the SPI is 447,500 rubles. (315,000 + 132,500). But depreciation did not “eat up” all of the changed original cost of the object. Its balance at the end of the SPI is 82,500 rubles. ((420,000 + 110,000) – 447,500). This means that the company will continue to accrue depreciation outside the SPI until it fully pays off the “current” cost of the fixed assets. For this she will need 13 months. In the last month, equal to 3000 rubles. (RUB 82,500 – (RUB 6,625 x 12 months)).

As we can see, the period for repaying the value of the asset through depreciation has increased. Of course, such “smearing” is not beneficial for companies. At the same time, from the provisions of the main tax document it follows that it is not prohibited to charge depreciation on fixed assets outside of its SPI. After all, paragraph 5 of Article 259.1 of the Code states that depreciation is terminated only when the cost of the object is completely written off or fixed assets are disposed of from the depreciable property for any reason.

Organizations don't like this approach and have been fighting it for years. Companies advocate an alternative option, in which depreciation is calculated based on the residual value of the object, increased by the amount of modernization costs, and the remaining fixed income. In this case, they refer, inter alia, to paragraph 3 of paragraph 1 of Article 258 of the Tax Code of the Russian Federation. This allows you to transfer the cost of fixed assets to expenses during an initially determined period, as well as to avoid differences between accounting and tax accounting (clause 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

With a similar approach, in our example, depreciation after modernization will be 10,750 rubles. ((RUB 420,000 – RUB 315,000 + RUB 110,000) / 20 months). As a result, the machine is completely depreciated for the remaining SPI.

Of course, fiscal officials are not happy with this option. But the judges don’t see anything “criminal” in him. An illustrative example is Resolution of the AS of the West Siberian District dated September 1, 2016 No. F04-3528/2016. It states: the provisions of paragraph 2 of Art. 257 and paragraph 1 of Art. 258 of the Tax Code of the Russian Federation establishes a procedure for determining depreciation taking into account the changed initial cost and the remaining SPI and, as a consequence, changes in the depreciation rate for modernized objects. And in Resolution No. F06-4506/2015 dated January 22, 2016, the Volga District Autonomous District emphasized: if, as a result of modernization, the SPI remains the same, the company takes into account the cost of such OS over the remaining service life, increasing the amount of its monthly depreciation. Similar conclusions can be found in many other verdicts (see resolutions of the Moscow District AS dated November 2, 2016 No. F05-16149/2016 and the FAS of the same district dated April 6, 2011 No. KA-A40/2125-11, Volga District FAS dated July 17, 2007 No. A49-998/07, left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated November 22, 2007 No. 14740/07). At the same time, the judges note that the inspectors’ method leads to the repeated write-off of previously recorded costs (depreciation), which is unlawful.

By the way, in recent comments, financiers are no longer so categorical. They indicate that depreciation after modernization “may (!) be accrued” according to the initially established standards (see, for example, letter dated August 30, 2019 No. 03-03-06/1/66957). Therefore, in our opinion, companies have all the prerequisites for successfully applying a more advantageous point of view.

Important

The initial cost of a modernized fixed asset does not include interest on targeted loans or borrowings. They must be taken into account separately as part of non-operating expenses in accordance with Article 265 of the Tax Code of the Russian Federation. This is the opinion of both the Ministry of Finance (letter dated October 23, 2009 No. 03-03-06/1/682) and the servants of Themis (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated October 23, 2008 No. F08-6332/2008).

Depreciation after modernization

Companies have the right to modernize fixed assets that are either fully depreciated or still have a residual value. In both situations, it is necessary to take into account reconstruction costs and calculate depreciation. How to do it? The algorithm of actions is as follows:

- Accumulation of all modernization costs, i.e. collection of documented expenses and drawing up the total amount. Modernization work can be carried out by attracting third-party specialized companies, or on your own (if there is appropriate potential). The document confirming the commissioning of the facility modernized by the contractor is the acceptance certificate signed by representatives of the company and the contractor, and the scope of work and the amount of costs is the act f. KS-2 and certificate of cost of work f. KS-3. Work on the reconstruction of the facility using economic means (on our own) is confirmed by a whole block of documents: requirements-invoices for the release of goods and materials, limit cards, work orders. Completion of work and commissioning is recorded by an internal acceptance certificate indicating the full cost of the work;

- Registration of the protocol of the inventory commission for the commissioning of a modernized facility with a decision to increase the cost of the facility and increase the useful life after modernization, if the capital work carried out actually increased the SPI. In accounting, there is no procedure for determining a new SPI if an object with an expired term is being modernized, however, clause 20 of PBU 6/01 and clause 60 of the Guidelines for fixed assets accounting, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n, allow the extension of SPI if As a result of the work carried out, the functional characteristics of the facility improved. At the same time, changing the SPI of the reconstructed OS in accounting is a right and not an obligation of the company. Note that most often the SPI is extended by the amount of time necessary to write off capital costs.

- According to the Ministry of Finance, the amount of modernization costs increases the initial cost (IC) of the fixed assets, and the depreciation rates for writing off these costs are those that were initially applied when the property was put into operation. This opinion also works in practice.

Depreciation of fixed assets after modernization - how to write off its cost

As already mentioned, capital work on an asset increases its original cost, after which it is subject to write-off through depreciation. If the firm that owns the asset uses the straight-line method, use the formula below to determine the amount of depreciation charged for 1 month:

SANOM = PSOAI x NA

,

where SANOM is the amount of depreciation accrued for one month;

PSOAI – the initial cost of the depreciable property;

NA is the depreciation rate established for this asset (see clause 2 of Article 259.1 of the Tax Code of the Russian Federation).

Tax legislation does not provide for any exceptions to this procedure. This means that the above formula is also relevant in cases where we are talking about a fixed asset that has been completely depreciated and then modernized.

For tax accounting purposes, the initial cost of an asset that has undergone modernization must be increased by the amount of expenses incurred for restoration work. The amount of monthly depreciation, in turn, is calculated by multiplying the increased cost of fixed assets after modernization by the depreciation rate that was initially approved for the asset. Accordingly, after depreciation has been carried out, it is necessary:

- add to the initial cost of the asset the total amount of expenses for modernization of this facility;

- apply to the asset in question the depreciation rate that was initially determined for it, i.e. when putting the OS into operation.

Depreciation calculation after modernization:

example of calculating depreciation for a fully depreciated object

In 2021, the company completed the modernization of the production line belonging to the 4th depreciation group with SPI from 5 to 7 years. Substation lines upon commissioning (January 2010) – 500,000 rubles. The SPI was set at 80 months. Depreciation rate (RA) – 1.25% (1/80 month). Depreciation was calculated from February 2010 to September 2021, and at the end of 2021, when it was decided to reconstruct the line, the facility was fully depreciated. In March 2021, the corresponding work was completed, the amount of reconstruction without VAT amounted to 350,000 rubles. From April 2021, the company begins to write off modernization costs, using the mechanism for calculating depreciation as follows:

C after modernization is 850,000 rubles. (500,000 + 350,000). The NA should be the same as at the time the line was entered, i.e. 1.25%. Consequently, the amount of monthly depreciation will be 10,625 rubles. (RUB 850,000 x 1.25/100). The costs of the completed modernization should be written off over 32 months at 10,625 rubles. (340,000 rubles), in the 33rd month the amount of depreciation will be 10,000 rubles.

Common mistakes

Error:

The company carried out depreciation of completely worn-out equipment. The write-off of capital work costs was made at a time for tax accounting purposes.

A comment:

The costs of upgrading the OS should be written off through depreciation - gradually.

Error:

The company re-commissioned equipment that was completely worn out and self-sufficient. After upgrading the OS, its original cost was not increased by the amount of costs incurred. The new cost of the modernized fixed asset was taken as the cost of modernization, because this asset has already been depreciated.

A comment:

The initial cost of the OS must be taken into account. Moreover, the initial cost of the facility should increase by the cost of capital modernization work.

Calculation of depreciation during modernization

If an object with an existing residual value is being reconstructed, then monthly depreciation is calculated according to accepted standards throughout the entire period of capital work. Clause 23 of PBU 6/01 dictates the suspension of the accrual of depreciation if it continues for more than 12 months. The Tax Code of the Russian Federation in this case agrees with a similar approach (clause 3 of Article 256 of the Tax Code of the Russian Federation). After the modernized facility is put into operation, the amount of monthly deductions changes, since both the SPI and the cost of the operating system change.

The calculation of depreciation for an asset begins on the first day of the month following the month in which this object was accepted for accounting; for example, for an object put into operation in March, depreciation will begin to be calculated according to the adjusted calculation on April 1. And it doesn’t matter whether depreciation accumulations were suspended due to exceeding the legally established reconstruction period or not.

When using the linear method, depreciation in accounting is calculated using the formula:

A = (OS + M) / SPI, where:

- OS - residual value of fixed assets;

- M - modernization costs;

- SPI - new SPI after modernization or the remaining one if it has not been changed.

Accounting for modernization costs when applying the simplified tax system

When reflecting operations related to the modernization, completion and additional equipment of fixed assets, accounting should be guided by PBU 6/01, and for the purpose of calculating the single tax paid in connection with the application of the simplified tax system, Chapter 26.2 of the Tax Code of the Russian Federation.

In the 1C:Accounting 8 program, the document “OS Modernization” is intended to reflect the modernization, completion and additional equipment of fixed assets.

Example 2

The organization purchased a computer in January 2008 worth 20,000 rubles, with a useful life of 36 months. In April of the same year, it was decided to increase the computer's RAM capacity. The amount of modernization costs amounted to 1,500 rubles. This amount was made up of the cost of the RAM module (1,200 rubles) and the cost of installing it in the computer system unit, performed by a specialist from a service company.

Collection of modernization costs

Before increasing the value of a fixed asset, it is necessary to first collect the costs associated with its modernization. To accumulate such costs in accounting, account 08.03 “Construction of fixed assets” is intended. Analytical accounting on the account is carried out for construction projects. To account for modernization costs, the object of analytical accounting will be “Installing memory in the i1000 computer.”

Let's create this object in the "Construction Objects" directory.

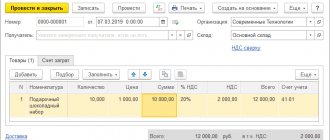

The purchase of a memory module from a third party and services for its installation are reflected in the document “Receipt of goods and services” with the type of operation “Construction objects”.

On the “Construction Objects” tab we indicate the cost of the memory module.

Services for installing a memory module are reflected in the same document on the “Not Accepted” tab.

This is due to the fact that such expenses are not accepted in the usual manner, but reduce the tax base as part of the cost of a constructed fixed asset or modernization carried out according to the rules that are provided for expenses for the acquisition, construction and modernization of fixed assets.

Increase in the initial cost of a fixed asset

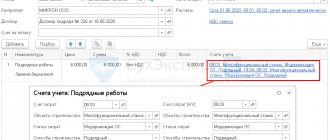

After the costs related to the modernization of a fixed asset are allocated to the construction site, you can fill out the “OS Modernization” document.

In the “Event” input field, you need to select an event that characterizes the modernization of a fixed asset.

The event type must be "Upgrade". If an event with this type is not in the directory, it needs to be created.

The specified event will be used in the name of the expense object in the book of income and expenses.

In the “Object” input field, you should select the construction object at which the costs for modernizing the fixed asset were collected.

On the “Fixed Assets” tab in the tabular section, you should list the fixed assets that are being modernized (see Fig. 4).

Rice. 4

If several fixed assets are selected in the tabular part of the OS Modernization document, then the amount of costs accumulated at the construction site will be distributed among these fixed assets in equal shares.

Then, on the “Accounting and Tax Accounting” tab, you should indicate the total amount of costs (for both accounting and tax accounting) accumulated at the construction site.

After the accounts for accounting of construction projects are indicated (in our example, 03/08), you can click on the “Calculate amounts” button and the corresponding fields will be filled in automatically by the program.

In the expense payment table, you must provide information about all payments, indicating the date and amount of payment.

If payment to the supplier is made after the execution of the document “OS Modernization”, such payment must be registered with the document “Registration of payment for OS and intangible assets for the simplified tax system and individual entrepreneurs”, for which the document provides a special tab “OS Modernization”, on which you can specify the modernization document.

Recognition of expenses for modernization of fixed assets

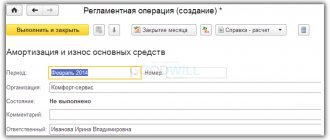

Recognition of expenses for modernization, completion and additional equipment of fixed assets is carried out in the same manner as the recognition of expenses for the acquisition of fixed assets - at the end of the reporting period with the document “Month Closing” (Fig. 5).

Rice. 5

As a result of the document, expenses will be recognized separately for the acquisition of a fixed asset and for its modernization, and the following records will be generated:

- in section I of the Book of Income and Expenses;

- in section II of the Book of Income and Expenses.

As a result, having generated the Book of Income and Expenses for the half-year, we will obtain a calculation of expenses for fixed assets.

Features of tax accounting for depreciation

Differences in taxation relate to different systems - simplified tax system, OSNO. For the simplified system, there is a special procedure for writing off expenses (also simplified in its own way), in accordance with clauses 3 and 4 of Article 346.16 of the Tax Code of the Russian Federation. Let's consider the rules for accounting for depreciation in the tax system for the general system (they are partially applied to the simplified tax system):

- In the normal calculation of depreciation. 100% / SPI (in months) = coefficient by which the initial cost (IC) is multiplied.

- The second option is used when calculating the new norm after reconstruction. 100% / new SPI = new factor by which the updated initial cost of the fixed asset is multiplied.

Example No. 2 : Let's take the data from example No. 1, but now calculate the depreciation rate for NU purposes:

- 360000 + 100000 = 400000 new PS.

- 100% / 60 = 1,67%.

- 400000 * 1,67% = 6680.

For comparison: the original depreciation rate for tax accounting was:

- 100% / 36 = 2,78%.

- 360000 * 2,78% = 10008.

If the SPI has increased, then you need to make sure that it is not greater than the limit value in the depreciation group to which the fixed asset belongs (clause 1 of Article 258 of the Tax Code of the Russian Federation).

Note! From January 1, 2021, amendments made to the Tax Code in the fall of 2021 are in effect. When the OS is re-preserved, depreciation continues to be accrued in the same order as before, but the SPI is not extended by the number of months of preservation, as was previously the case. Thus, for NU purposes, part of the cost will not be taken into account.

How to determine the amount of depreciation charges taking into account the approach under consideration.

The remaining fixed asset fixed asset period is 23 months. (61 – 38). In this case, the amount of monthly depreciation will be equal to RUB 37,634. ((RUB 1,800,000 - RUB 934,420) / 23 months).

It turns out that the organization recognizes expenses in tax accounting seven months earlier than in the version supported by the controllers, according to which monthly depreciation charges are equal to 29,507 rubles, that is, less by 8,127 rubles. (37,634 - 29,507).

According to the position of the judges, the amount of depreciation that will be accrued until the end of the useful life will be 865,582 rubles. (RUB 37,634 x 23 months). In total, through depreciation during the established SPI, the cost of the fixed asset will be completely written off - 1,800,000 rubles. (934 420 + 865 582).

Regulatory framework and local acts

I have already mentioned some of the documents required to carry out the work above. Throughout the organization, it is also necessary to develop and approve an accounting policy, including the specifics of accounting for fixed assets, as well as the specifics of repair, reconstruction, conservation, and depreciation.

Separate provisions may become part of the accounting policy, for example, “On the repair of fixed assets,” which specifically define tax and accounting for certain types of fixed assets or their homogeneous groups.

The following are often used as primary documents during OS operation:

- Invoice for movement. To reflect the movement of objects within the organization - between departments, workshops, buildings. When transferring to counterparties (for example, for rent), a different form is used.

- Acceptance certificate OS-3. It is drawn up upon transfer (receipt) for (from) repair (reconstruction, modernization, etc.) both within the organization and to a third party (contractor).

- Installation certificate OS-15. Usually used when purchasing or creating a fixed asset, when it requires assembly, installation and testing before launch. But if, for example, your equipment underwent modernization work in parts (this may be the case in the case of a single complex assembled from several components) and then you need to reassemble it, then it is also permissible to use this form.

- Inventory card. It reflects the main characteristics of objects and, accordingly, their changes, including useful life, initial cost, movement and revaluation data.

- To take into account the conservation of equipment, an order and an act are required. There are no approved forms, you can view them using the links.

There are many other forms (samples) on the Assistants website with comments on how to fill them out; to read them, just use the search.

Analysis of the results obtained.

Let us compare the results obtained from calculating the amounts of depreciation charges using the methodology of the Ministry of Finance and an alternative approach.

Situation 1. The useful life has not changed.

If the organization acts in accordance with the explanations of the officials, the amount of monthly depreciation will increase, but solely due to the increase in the initial cost of the property. However, over the useful life, the entire cost of the fixed asset (including modernization) will not be transferred to expenses for the purpose of calculating income tax, again due to a change in its initial cost. Therefore, depreciation will continue to be accrued outside the SPI.

And if an alternative approach is used, the taxpayer will be able to recognize expenses several months earlier than in the first case, that is, without going beyond the service life of the facility, which is especially important when carrying out expensive modernization work.

Of course, this option is much more attractive for the company from a tax optimization point of view. Moreover, as we have already noted, if disputes arise with regulatory authorities, there is a chance to defend your interests in the courts.

By the way, it should be noted that officials have formed a similar position regarding the calculation of depreciation of fixed assets after modernization, if its cost is fully depreciated

. The initial cost of this object is also subject to increase by the amount of modernization costs (clause 2 of Article 257 of the Tax Code of the Russian Federation). And since the asset is fully depreciated, its residual value is zero. The Ministry of Finance explains that in this situation, the depreciation rate established when putting the facility into operation should be applied (letters No. 03 03 10/66, No. 03 03 06/1/181, dated November 3, 2011 No. 03 03 06/1/714, dated 09/23/2011 No. 03 03 06/2/146, dated 03/02/2006 No. 03 03 04/1/168). How is the amount of depreciation calculated, according to the department?

In January 2013, Elitplast LLC decided to modernize fixed assets with an initial cost of 150,000 rubles. Modernization costs amounted to 50,000 rubles. In accordance with the Classification of fixed assets, fixed assets belong to the third depreciation group (useful life - from three to five years inclusive). The useful life is set at 60 months. By the time of the modernization, the fixed asset was completely depreciated. The accounting policy for tax purposes establishes the linear method of calculating depreciation on fixed assets.

The depreciation rate is 1.6667% (1/60 months x 100%). After the modernization, the initial cost of the fixed asset was 200,000 rubles. (150,000 + 50,000). The monthly depreciation amount for the modernized facility is 3,333 rubles. (RUB 200,000 x 1.6667%). From February 2013, the taxpayer for 15 months. (50,000 rubles / 3,333 rubles) must take into account the amount of depreciation charges of 3,333 rubles as expenses. until full repayment of the changed original cost.

What alternative could there be?

The author is aware of the position according to which the taxpayer writes off modernization costs as tax expenses in this case at a time, motivating his actions by the fact that the residual value of the object after modernization is equal to the costs of modernization, and the remaining useful life is zero. However, a certain company – a supporter of this approach, as a result of its application, ended up in the courtroom ( P

stop by FAS MO dated 04/23/2012 No. A40-24244/11 75 102 (Decision of the Supreme Arbitration Court of the Russian Federation dated 06/08/2012 No. VAS-7428/12 refused to transfer the case to the Presidium of the Supreme Arbitration Court for review in the order of supervision).

The courts of the first and appellate instances supported this company, concluding that it could write off the entire amount of expenses for restoring the operating system through depreciation charges within one month following the month the fixed asset was put into operation. However, federal arbitrators did not agree with this approach.

The judges noted that the issue of one-time write-off of modernization costs as tax expenses in a situation where the SPI of a fixed asset has expired, but its reconstruction (modernization) has been carried out, is not directly regulated in the Tax Code. At the same time, the taxpayer’s right to account for disputed expenses cannot be considered in isolation from the rules for calculating depreciation established by tax legislation. According to the arbitrators, if as a result of the reconstruction (modernization) of an object it continues to remain a fixed asset, then when determining the amount of depreciation the same norm

, which was

established upon commissioning

, since the method of calculating depreciation chosen by the taxpayer cannot be changed during the entire period of its accrual for the depreciable property.

Under such circumstances, the cassation court considered the taxpayer’s arguments about his right to a one-time write-off of the cost of reconstruction (modernization) work as depreciation as expenses to be unfounded and subject to rejection. Moreover, the arbitrators pointed to the judicial practice that has developed on this issue (resolutions of the FAS VVO dated 02/17/2011 No. A29-6272/2007, FAS MO dated 02.11.2011 No. A40-74739/08 127 372, dated 09.28.2010 No. A40-163626 /09 127 1322), as well as the established position of the regulatory authorities (discussed above).

As we see, on this issue the positions of regulatory and judicial authorities coincide. If similar circumstances arise, we believe that it is necessary to listen to the opinion of officials in order not to waste your time and avoid legal costs.

Situation 2. The useful life has been changed.

From the above examples it is clear that the monthly amounts of depreciation charges, calculated according to the position of the Ministry of Finance (based on the initial cost of the fixed asset, increased by the cost of restoration work), which are equal to 25,000 rubles. (example 3) practically correspond to the amount of depreciation determined taking into account the approach of the arbitrators based on the residual value of fixed assets - 25,458 rubles. (example 5). Obviously, the difference is 458 rubles. due to arithmetic rounding errors. However, in our opinion, the alternative method of recalculating the depreciation rate (based on 34 months, not 72) is more accurate, since in example 5 the fixed asset is fully depreciated within 72 months, and in example 3 - 73 months.

It should be noted that the Ministry of Finance’s opinion that an increase in the fixed asset’s fixed assets does not lead to a change in the depreciation rate established on the date of its commissioning (example 2) is more attractive to taxpayers than the alternative approach (example 5). Indeed, in the first case, the OS depreciates faster - in 68 months, and not in 72.

Please note that the financial department also expresses a different point of view (see Letter No. 03 03 06/1/503). And the author was unable to find any judicial acts on this topic. Perhaps this indicates that tax authorities during audits did not identify cases of taxpayers using such an approach.

By the way, when using an alternative method for an organization, it is also important that there are no differences in accounting and tax accounting

.

In accounting, the amount of depreciation is determined based on the residual value

of the object (taking into account modernization costs) and

the remaining

useful life (clause 60 of the Guidelines for OS accounting [4]). Accordingly, for a taxpayer who used an alternative approach, the calculation of the new depreciation amount in tax accounting looks the same as the calculation for accounting purposes, and therefore the application of PBU 18/02 “Accounting for calculations of corporate income tax” [5] (hereinafter referred to as PBU 18/02) is not required.

In addition, a negative point when applying the position of the Ministry of Finance under consideration is the emergence of a difference between tax and accounting accounting for the taxpayer (after all, in tax accounting, fixed assets are depreciated over 68 months, and in accounting – over 72). We believe that this issue will be important for business entities. Let's discuss it in more detail.

Accounting

Most often, the decision on reconstruction and modernization is made on the basis of expert assessments (engineers, designers, builders, adjusters, etc. specialists) and acts of the relevant commission. It can be created by the enterprise itself or come from outside - as inspectors, for example, the parent organization or representatives of the supervisory authority.

In accounting, when reconstructing an operating system, the costs for it are collected in account 08 in a separate subaccount; programs may provide a ready-made subaccount or you will have to install it (let’s denote it as number 9 for convenience). The postings will look like this - Debit everywhere 08.9, on credit:

- 10 – materials have been transferred from the warehouse; you will need to issue invoice requirements and write-off acts.

- 70, 69 – wages and contributions from them for workers carrying out reconstruction (for self-financing), supporting documents – timesheets, work orders, payslips, accounting certificates.

- 23 – costs of auxiliary production (transport workshop, production of spare parts and mechanisms), internal documentation – orders, requirements, invoices for the release of materials to third parties.

- 25 – general production expenses (security, wages of the foreman of workers, if they are employed in different jobs, etc.).

- 26 – managerial (salary of manager, chief engineer, designer).

- 60, 76 – payment for services and work of third-party workers and organizations (contractors under GPC agreements, experts, consultants, lawyers, other specialists, carriers) – contracts, acts, consignment notes, invoices. The VAT amount is not included in the costs.

- 66, 67 – interest on a loan received for reconstruction is taken into account until the completion of the work performed and the putting into operation of the reconstructed building or other facility or from the moment the actual operation of the OS begins.

After all costs are grouped on account 08 and the OS is ready for further use, you can apply two options for accounting for the changes made:

- We take into account costs separately (in fact, as an independent object) on account 01. This possibility is provided for in paragraph 42 of section 3 of Methodological Recommendations No. 91n.

- We include expenses in the cost of the OS, increasing the initial cost established upon purchase or creation (the same paragraph 42 and paragraph 27 of section 4 of PBU 6/01).

The method must be prescribed in internal local regulations (primarily accounting policies). It is determined depending on the influence on the change in indicators that were initially accepted as the norm during creation (purchase) - power, class, SPI, etc.