On March 12, Boris Valit held a long-awaited online seminar for all management organizations and homeowners associations on the preparation of the annual report for 2019. The report must be submitted to the owners by April 1. There is still time to check what you have done and correct errors if there are any.

In what form should the MA prepare the annual report for 2021?

233006

What is a financial statement used for and who prepares it?

When the reporting period in any organization ends, all legal entities and individual entrepreneurs (IP) must submit annual financial statements. It is necessary for internal work, as well as for external specialists who will evaluate the activities of an enterprise or individual entrepreneur.

Organization or enterprise data

The preparatory part of drawing up this document consists of the following steps:

- the correctness of the recording of correspondence on accounting transactions for the previous year is checked;

- all erroneous entries that were identified during the inventory period are corrected;

- if the reporting needs to reflect transactions that were identified in the new year, then accountants make notes and carry out all events according to the documents;

- after checking all the data, taxes for the reporting period are calculated;

- the last step is to make accounting entries for the calculation of taxes and reform the balance sheet of the company or enterprise.

Chief accountant - responsible person

Annual reports are prepared by the chief accountant . The accountants who are subordinate to him must provide all the necessary figures for the reporting period for their area.

This document is the final document in the accounting process. This helps to trace the unity of all available indicators in primary papers and accounting registers.

Cancellation of transport tax declaration

Starting from 2021, the obligation for organizations to submit tax returns for transport tax to the Federal Tax Service is canceled (Article 3 of Federal Law No. 63-FZ of April 15, 2019).

Please note that from 01/01/2021, the deadlines for payment of transport tax and advance payments for it will change for organizations (clause 68, article 2 of Federal Law dated 09/29/2019 No. 325-FZ).

According to the new rules, the organization must pay transport tax for 2021 no later than 03/01/2021. Advance payments for transport tax are paid by companies no later than the last day of the month following the expired reporting period. Previously, these deadlines were established by regional laws.

Principles for drawing up the annual form

There are general requirements that apply to this document. These include the following:

- all information must be reliable, and each figure must be confirmed by another (monthly or quarterly) document;

- The sequence of filling out one or another form, which is a component of the annual accounting, must be followed. reporting;

- all figures must be verified and comparable with the figures reflected in the internal documents of the enterprise.

Also, the general requirements include the materiality and neutrality of the preparation of the annual report. The enterprise is obliged to attach to the papers with annual figures transcripts of individual items and, if necessary, additional indicators.

The following items should be disclosed in additional accompanying information:

- dynamics (in the form of a graph or table) of important financial indicators of the company or enterprise over the past few years;

- a certificate containing information about the planned development;

- planned financial investments;

- how the company uses borrowed funds and how risks are managed;

- the work of company specialists in the field of design work and during various experiments and scientific activities;

- environmentally friendly activities and so on.

Strict reporting forms: what applies to them

If errors were identified in the accounting entries for certain business transactions of the current period before the end of the year, then corrective entries should be made in the month when the shortcomings were identified. If distortions were identified after the end of the reporting year, then corrections should be made in December of the reporting year.

When errors were found after the annual report had already been completed and approved, then corrections were not made to the accounting records for the previous year.

Remember

There are half a month left until April 1st. During this time, you will still have time to prepare and present to the owners of premises in the apartment building a report on the work completed in 2021, and post it in the Housing and Communal Services GIS.

A video recording of our online seminar will help you test yourself and also think about whether you should stipulate in the management agreement the period for which you need to report and the form of the report. We have explained in detail how to do this, we hope our instructions will be useful to you.

If you don’t have time or can’t place the annual report in the Housing and Communal Services GIS, we can help with that too - write to us.

Composition of annual financial statements: what is included in the document

The chief accountant can draw up the document himself or instruct his deputy to do this, but he will sign it with his own hand.

Interim report

First, interim reporting must be prepared, which consists of the following forms:

- "Balance sheet".

- “Profit and Loss Report.”

In addition, the company must provide other reporting forms, for example, a “cash flow report.”

Find out more about rural business.

Are you planning to open a business for the summer? Ideas on our website.How to write a business plan for a beauty salon?

Annual

To provide annual financial statements, the chief accountant must be able to prepare the following documents:

- enterprise balance sheet;

- a document containing data on income and expenses;

- capital statement;

- a document containing figures reflecting the movement of money;

- document attachment to the balance sheet;

- a note explaining the figures reflected in the report;

- public, budgetary and non-profit companies submit a report on the use of funds;

- the result of the audit report, which is issued based on the results of the audit of the accounting records. report.

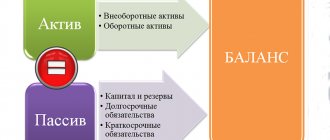

The balance sheet is generalized figures in rubles for a certain date. This document is a table with columns and rows.

In one part of the form, which is on the right, funds are reflected by receipt, and in the left - by expense or composition of placement.

These are the passive and active parts, in which each type of funds is called a “balance sheet item.”

The amounts in the “Total” column of assets and liabilities must be equal, since these lines reflect the same funds.

Income and Expense Report

The income and expense report contains the following data:

- profit or loss from sales of goods or services, management expenses;

- income (+) and expenses (-) from operations;

- income tax, VAT, operating profit, non-operating income and expenses;

- net income (retained) minus extraordinary expenses.

Statement of changes in equity

The statement of changes in capital consists of the following documents:

- “Section on capital” - reflects the remaining amount at the beginning and end of the year, income and expenses.

- “Reserve future expenses” – the balance at the beginning and end of the year, and the movement of future expenses.

- “Data on estimated reserves” – the balance at the beginning and end of the reporting period, and estimated reserves.

- “Change in capital amounts” – information about the amount of capital, its increase or decrease.

- “Certificate” reflects data on assets at the beginning and end of the reporting period and information on budgetary and extra-budgetary funds for capital investments.

More information about reporting is described in this video:

The cash flow report consists of the following subsections:

- amount at the beginning of the period;

- incoming monetary units during the year;

- money was sent for expenses;

- residual amount at the end of the reporting year.

The “Intangible assets” section is presented in the form of two tables with detailed information on the amounts of accrued depreciation. Types of intangible assets include :

- intellectual property;

- organizational expenses;

- business reputation;

- other assets.

Find out what business you can start with minimal investment.

What business is relevant for women in Russia?Is it worth opening a franchise business?

Calculation of insurance premiums

The Federal Tax Service of Russia, by order of October 15, 2020 No. ED-7-11/ [email protected] , made changes to the form, procedure for filling out and format of electronic submission of calculations for insurance premiums, previously approved. by order of the tax service dated September 18, 2019 No. ММВ-7-11/ [email protected] Most of the changes are related to amendments to legislation adopted this year. For the first time, a calculation using the updated form will need to be submitted based on the results of 2021 no later than 02/01/2021, since 01/30/2021 falls on a day off (clause 7 of article 431, clause 7 of article 6.1 of the Tax Code of the Russian Federation).

Main changes to the calculation form:

- The title page has been supplemented with a new field in which it is necessary to indicate the average number of employees. We remind you that starting from 2021, it is no longer necessary to submit a special report on the average number of employees to the Federal Tax Service (paragraph 6, paragraph 3, Article 80 of the Tax Code of the Russian Federation, as amended by Federal Law No. 5-FZ dated January 28, 2020, order of the Federal Tax Service of Russia dated October 15. 2020 No. ED-7-11/ [email protected] );

- new codes have been added to Appendix No. 5, Appendix No. 7 and Appendix No. 6;

- a new Appendix 5.1 has been added to Section 1 of the calculation, which must be filled out by payers entitled to reduced contribution rates starting from the report for the first quarter of 2021. These are organizations engaged in activities in the field of information technology, as well as activities in the design and development of electronic component products and electronic (radio-electronic) products.

1C:ITS

For a detailed commentary on the new form of calculation of insurance premiums, see the “Legislative Consultations” section.

Laws governing annual accounts

Article 14 of Law 402-FZ talks about documents that should be included in the annual financial statements. When drawing up a document, you must be guided by the following legislative acts:

- PBU 4/99 “Accounting statements”.

- Regulations on accounting and accounting. reporting in the Russian Federation No. 34n.

- Order of the Ministry of Finance dated July 2, 2010 No. 66n “On accounting forms. reporting of enterprises".

Based on these legislative documents, every enterprise and company must fully disclose its costs and expenses in the form of annual financial statements.

Extra-budgetary funds: reporting deadlines for 2021

| SZV-M to the Pension Fund of Russia | Instructions for filling | ||

| From January to December | Until the 15th of every month |

| >Reporting SZV-M: step-by-step instructions for filling out >How to prepare and submit the SZV-M report on the Pension Fund website >Judicial practice based on the SZV-M report >How to fill out the supplementary form SZV-M >In what cases is a “zero” SZV-M issued and submitted? |

| SZV-STAZH is submitted to the Pension Fund of Russia | |||

| For 2020 | 01.03.2021 |

| >Fill out and submit the SZV-STAZH form to the Pension Fund of Russia |

| DSV-3 | |||

| 1st quarter | 22.04.2020 |

| >How to fill out the DSV-3 form |

| 2nd quarter | 22.07.2020 | ||

| 3rd quarter | 22.10.2020 | ||

| Deadlines for submitting reports for the 4th quarter of 2020 | 20.01.2020 | ||

| 4-FSS in paper form | |||

| January March | 22.04.2020 |

| >Sample of filling out form 4-FSS for the 1st quarter of 2020 |

| 1st half of the year | 22.07.2020 | ||

| 9 months | 21.10.2020 | ||

| 12 months | 20.01.2021 | ||

| 4-FSS in electronic form | |||

| January March | 25.04.2020 |

| |

| 1st half of the year | 25.07.2020 | ||

| 9 months | 25.10.2021 | ||

| 12 months | 27.01.2021 | ||

Results

- Annual financial statements are prepared by the chief accountant. This document is necessary for work within the company and for users who are involved in assessing the activities of the enterprise.

- The principles for drawing up the annual form are the correctness of the format and the reliability of all the numbers provided.

- The annual report includes a balance sheet of the enterprise, a document with reflected profits and losses, and others.

- The legal regulation of this document is carried out by certain documents.

Cancellation of land tax declaration

Since 2021, organizations do not submit land tax returns to the Federal Tax Service (Article 3 of Law No. 63-FZ). According to Law No. 325-FZ, the deadlines for paying land tax and advance payments for this tax are changing for organizations. Tax for 2020 must be paid no later than 03/01/2021. As for transport tax, advance payments for land tax will also be paid no later than the last day of the month following the expired reporting period.

If an organization has the right to benefits for transport and (or) land taxes, then it must submit an application for the provision of these benefits to the Federal Tax Service in advance. The form and format of the application for benefits were approved by order of the Federal Tax Service of Russia dated July 25, 2019 No. ММВ-7-21/ [email protected] and supported in 1C programs.