The construction of buildings or structures can be carried out on our own or with the involvement of a contractor. The stages of construction of objects and all technological processes must be reflected in the records of the customer of the work and the contractor. The contract may provide for not only construction activities, but also installation, repair, finishing, and reconstruction activities.

Question: How to reflect in an organization’s accounting the construction of a production workshop using its own resources (self-employed)? The organization's expenses for construction and installation work (CEM) incurred during the construction period amounted to: in March - 2,000,000 rubles, in April - 1,000,000 rubles, in May - 1,900,000 rubles, in June - 1 700,000 rub. In June, the state fee for registering property rights was paid and it was registered, the building was put into operation. View answer

Contractor accounting

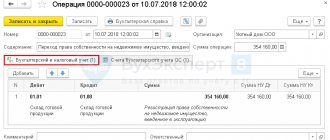

Accounting is carried out on the basis of the following regulations: PBU 9/99, PBU 10/99, PBU 2/94, PBU. The entire cost part is subject to division into the elements listed above. Construction costs are displayed in accordance with accounting account 20 “Main production”. Costs for materials, payments to employees are recorded, and settlements with suppliers are additionally displayed. Phased acceptance is carried out using account 46, with the formation of posting Dt 46 Kt 90.

Conclusion

When organizing construction work, a businessman can act as an investor, customer or contractor. For each of these situations, accounting has its own specifics.

The main features of the construction business that affect accounting: a long cycle of work, territorial distribution and management of several objects at the same time. Therefore, it is necessary to pay special attention to the division of costs by object and their write-off by period.

When reflecting costs in the contractor's accounting department, it is important to take into account the option of using materials: their own or toll.

Accounting in a construction organization

Accounting is somewhat different from the norms in force for other business entities. The differences lie in the documentation. To carry out mutual settlements with contractors, construction organizations use the following documents:

- Form No. KS-2;

- Form No. KS-3.

Form 2 is drawn up by the contractor based on the results of the work performed. Form 3 is the basis for mutual settlements between the customer and the contractor. The first document can be drawn up upon completion of the entire scope of construction or taking into account the phased implementation of work. The last option is most preferable for contractors.

Documentation of storage and movement of materials

Materials in a construction organization can be stored in closed warehouses and open areas. Regardless of the storage location, all inventories are assigned to the materially responsible person. The movement of materials between warehouses is documented with an internal movement invoice. An invoice is issued and material assets are released for construction to the foremen with the permission of the foreman. Read also the article: → “Form OS-2. Invoice for internal movement of fixed assets."

At the end of the month, storekeepers submit reports on inventory balances to the central warehouse. Based on this information, a summary report is compiled at the central warehouse with a breakdown of information about the movement of inventory by facility, which is transmitted to the accounting department. Superintendents provide monthly material reports to the accounting department, according to which materials are written off from the warehouse.

The acquisition of material resources by a construction enterprise involves the preparation of the following documents:

- purchase and sale agreements for materials;

- supplier invoices;

- certificates and other similar documents confirming the quality of purchased materials.

If, upon receipt of goods and materials, any quantitative or qualitative discrepancies with the data of primary documents are detected, or if they are received without documents, an inventory acceptance report is drawn up. Based on it, you can later file a claim with the supplier.

If materials come from the customer, then a separate contract for their supply does not need to be drawn up.

An additional agreement or annex to the contract is sufficient, which should reflect in detail the quantity, cost and timing of the transfer of inventories to the contractor. When releasing goods from the warehouse, limit and intake cards, requirements, and invoices are drawn up. When materials are issued in excess of the norms, demands or exculpatory acts are drawn up.

Postings for specific construction expenses

The status of the customer and his investments in construction determine the accounting plan. Postings for specific construction expenses are made as follows:

- The operation of the company transferring materials and equipment to the contractor in an amount over 20,000 rubles is reflected in the section “Contributions to non-current assets” (debit 08) and in the section “Settlements with suppliers and contractors” (credit 60).

- If the amount is less than 20,000 rubles, the action is carried out through “Materials” (debit 10) and “Settlements with suppliers” (credit 60).

- The fact of the initial operation of the object is recorded through “Fixed capital” and “Contribution to non-current assets”.

- To write off building materials, use the “List of Written Off Materials”.

- Percentage tax surcharges are displayed in the “VAT” section, indicating the amount in a special separate cell.

- After completion of the construction process, state registration of the object is carried out and data is entered into the “Fixed Capital”.

All of the above rules apply to accounting for the customer construction company.

Postings from the contractor are drawn up in accordance with debit 20 “Main production”, which will subsequently correlate with credit 60 (payment for supplies), credit 70 (settlements with employees) and credit 10 (inventories).

During phased construction, the customer accepts the results of the work at each stage. In this case, debit 46 is combined with credit 90.

Carrying out accounting operations requires highly qualified accountants. Quite often, companies invite highly specialized specialists to fill this position.

Categories

Construction is one of the most developing sectors of the economy in Russia at present due to the ever-increasing demand for housing, warehouses, hangars, and production facilities.

For an enterprise to be successful, it must be carried out on the basis of carefully developed plans and a well-thought-out strategy. The main task of planning in this case is the complete and timely provision of the company's needs with the resources necessary to carry out its activities.

Let's consider the issues of planning expenses of construction organizations, determining the planned cost of construction projects, as well as the prospects for investing in construction.

Construction is the creation of new buildings, structures, structures (including on the site of demolished capital construction projects), as well as restoration and reconstruction of existing fixed assets. New construction of the main and auxiliary complex facilities is carried out on new sites, and after commissioning the facility will be on an independent balance sheet.

Depending on the purpose of the objects under construction, the following types of construction :

• industrial (plants, factories);

• transport (roads, bridges, tunnels);

• civil (residential buildings, public buildings);

• military (military facilities);

• hydraulic engineering (dams, dikes, canals, bank protection structures and devices, reservoirs);

• irrigation and drainage systems (irrigation and drainage systems).

Currently, investing in construction is a profitable business. Let us recall that investments are cash, securities, other property, including property rights, other rights that have a monetary value, invested in objects of business and (or) other activities in order to make a profit and (or) achieve another useful effect.

The key to the successful implementation of any investment project is planning and calculation of the profitability of the investment project.

Note!

The time gap between investment, construction of the facility, its commissioning and the start of making a profit should be minimal.

Normative base

The implementation of investment activities is regulated by the legislation of the Russian Federation, primarily:

- Federal Law No. 39-FZ dated February 25, 1999 (as amended on December 28, 2013) “On investment activities in the Russian Federation carried out in the form of capital investments” (hereinafter referred to as Federal Law No. 39-FZ);

- Urban Planning Code of the City of Moscow, approved by the Law of the City of Moscow dated June 25, 2008 No. 28 (as amended on July 6, 2011);

- Federal Law No. 122-FZ dated July 21, 1997 (as amended on March 12, 2014) “On state registration of rights to real estate and transactions with it”;

- Town Planning, Civil, Housing, Land Codes of the Russian Federation.

Construction activities are carried out in accordance with legislative acts - federal laws, acts of the President of the Russian Federation and the Government of the Russian Federation, documents of the Ministry of Regional Development, the Ministry of Construction of Russia, Rosstroi (formerly Gosstroy), as well as other ministries and departments.

The regulatory and technical base of legislative acts on construction includes:

- current building codes and regulations (SNiPs);

- unified standards and prices for construction, installation and repair work (ENiR);

- standard instructions on labor protection for workers in construction, the building materials industry and housing and communal services;

- other types of regulatory and technical documentation: codes of practice, Sanitary Regulations, GOSTs, system guidelines, fire safety standards, departmental building codes, reference price guides, etc.

Subjects of investment activity in construction, their functions. Planning

The parties (subjects) of investment activity are investors, customers, contractors, users of capital investment objects, etc. Each of these entities can combine the functions of two or more parties, unless otherwise established by an agreement concluded between them (Clause 6, Article 4 of Federal Law No. 39-FZ). Thus, during construction, one organization can simultaneously perform several functions: investor and customer, customer and contractor, investor and contractor, developer and customer.

Investors (including developers ) are persons making capital investments using their own and (or) borrowed funds.

A developer is usually understood as an investor who invests in the construction of a property, wanting to make a profit from the sale or rental of this property after its construction (in whole or in parts).

Investors can be individuals and legal entities created on the basis of a joint activity agreement and not having the status of a legal entity, associations of legal entities, government bodies, local governments, as well as foreign business entities.

Developers are legal entities, regardless of their organizational and legal form, who have permission to build on a land plot owned or leased, and who ensure construction, reconstruction, overhaul of capital construction projects on their land plots, as well as the implementation of engineering works. surveys, preparation of design documentation for their construction, reconstruction, major repairs (clause 16 of article 1 of the Town Planning Code of the Russian Federation).

Customers are individuals and legal entities authorized by investors who implement investment projects. Customers can also be investors and finance construction. The customer, who is not an investor, is granted the rights to own, use and dispose of capital investments for the period and within the powers established by the agreement and (or) government contract. Based on an agreement or government contract concluded with the developer, customers carry out technical supervision and control over the work.

Contractors are individuals and legal entities who perform work under a contract and (or) a state or municipal contract.

Subcontractor is an organization engaged by the general contractor to participate in the construction of the facility. Typically, subcontractors perform design, individual construction and installation work and other work.

Users of capital investment objects are individuals and legal entities, including foreign ones, as well as state bodies, local governments, foreign states, international associations and organizations for which these objects are created. Users of capital investment objects can be investors.

For your information

When choosing an investor to finance construction, it is advisable for a developer to conduct marketing research of the real estate market and study sources of financing.

Sources of funding may be:

- the investor’s own financial resources and on-farm reserves, that is, funds received as a result of business activities, depreciation charges, profit, etc.;

- borrowed funds (bank loan, investment tax credit, budget loan, etc.);

- attracted investor funds, funds received from the sale of shares, shares and other contributions of legal entities and employees of the company;

- funds received through redistribution from centralized investment funds, concerns, associations and other associations of enterprises;

- investment allocations from the state budgets of the Russian Federation, republics and other subjects of the federation within the Russian Federation, local budgets and relevant extra-budgetary funds allocated to finance federal, regional or sectoral target programs;

- funds from foreign investors, for example, when creating joint ventures, as well as in the form of direct investments in cash from international organizations and financial institutions, states, enterprises of various forms of ownership, and individuals.

When drawing up strategic plans, construction organizations take into account the standards and prices established by legislative acts and regulatory and technical documentation, as well as the terms of contracts in accordance with which construction work is carried out.

The following basic requirements apply to planning:

- plans must be specific and feasible;

- plans must be intense.

For your information

Plans are considered tense if the entire planned increase in the volume of construction and installation work is planned to be achieved without increasing the number of workers in the construction organization and without increasing production assets, that is, only due to intensive factors: increased labor productivity, increased output of construction machines, for example, due to increased shifts their work, savings and better preservation of building materials.

Relations between participants in the construction process are built on a contractual basis, in particular they may include:

•agreement for the implementation of an investment project;

•agreement on participation in shared construction;

•contract for design and survey work;

•construction contract;

•agreement to perform technical supervision functions.

An agreement for the implementation of an investment project is concluded between the investor and the developer. The subject of the agreement is the implementation of an investment project for new construction (reconstruction, restoration) of a real estate property. In other words, the investment agreement regulates the developer’s attraction of funds for the construction of an object intended for the investor.

An investment project is understood as a set of organizational and technical measures for the creation (reconstruction, restoration) using investments of own or attracted capital (investments) from various sources of non-residential real estate, engineering structures, as well as for carrying out pre-design, preparatory, design, construction (repair) ), commissioning works, commissioning of the facility and registration of property rights.

The agreement for the implementation of an investment project must specify the location of the property (construction address), house number, total area of the property, price and deadline.

The price in the contract is the amount of money to be paid by the investor for the construction (creation) of the object. It can be defined as the amount of money to reimburse the costs of construction (creation) of an object and money to pay for the customer’s services.

If the investor is a developer, then an investment contract for the construction of a real estate property can be concluded by the investor-developer with local authorities. Such a contract usually contains two main conditions for its implementation:

- the investor's obligation to invest in construction;

- the right of the investor (after investments have been made) to register ownership of the constructed facility.

The customer (or customer-developer), within the framework of his powers, organizes construction and resolves issues related to it. For this purpose, he enters into contracts: with contractors - for construction and installation work, with suppliers - for the purchase of material assets and equipment. In addition, the customer participates in the acceptance (including by government authorities) of the results of the work performed, transfers to investors the real estate objects (parts thereof) due to them in accordance with the terms of investment agreements.

The contract for design and survey work is concluded with the design organization. The designer undertakes, on the customer’s instructions, to develop technical documentation or carry out survey work. The price of a contract for design and (or) survey work is determined in accordance with the estimate containing an itemized list of the designer’s costs for the development of technical documentation.

Technical documentation is a set of documents (feasibility study, drawings, diagrams, explanatory notes to them, specifications, etc.) defining the volume and content of construction work, as well as other requirements for them.

To perform construction and installation work, the customer enters into a contract with a specialized construction organization that has SRO approval.

For your information

A construction contract is a civil contract, by virtue of which one party (contractor) undertakes, within the period established by the construction contract, to build a certain object or perform other construction work on the instructions of the other party (customer), and the customer undertakes to create the necessary conditions for the contractor to carry out works, accept their result and pay the agreed price.

The contract for construction work is concluded in simple written form and contains the following essential conditions:

- the subject of the construction contract and the place where the work will be performed;

- term of the construction contract;

- contract price, terms and procedure for its payment.

The price of a construction contract is determined on the basis of estimate documentation, which is an itemized list of costs for performing work, purchasing equipment, purchasing building materials and structures, etc.

Estimate documentation is drawn up in a certain sequence, moving from small to larger construction elements (Fig. 1).

Sequence of drawing up estimate documentation

When drawing up estimate documentation, planned indicators are taken into account. As a rule, plans are drawn up for a period of 1 to 5 years.

For annual plans, the following indicators are usually accepted:

- commissioning of production capacities, facilities and structures;

- the scope of work to be performed in accordance with concluded contracts and estimate documentation;

- expenses;

- cost of work;

- volume of supplies of materials and equipment;

- profit

Production plan, or production program , is the most important section of the plan of any enterprise, which reflects the volume and types of construction and installation work performed.

Accounting in construction

When planning construction production, special attention is paid to costs and calculation of planned costs. The planned cost of construction work is formed on the basis of cost indicators. The organization establishes expense items and cost calculation methods independently in its accounting policies and other internal acts.

It is advisable to keep cost accounting in construction companies by economic elements (that is, by the composition of costs, their economic content - what and in what volume was spent on construction) and costing items - cost items (accounting for costs by intended purpose - where and for what these costs were incurred ).

Cost accounting by economic elements for all organizations includes:

- material costs (minus the cost of returnable waste);

- labor costs;

- contributions for social needs;

- depreciation of fixed assets;

- other costs.

This grouping characterizes the structure of production costs and is used in general economic calculations. Cost information for each economic element is grouped in the corresponding accounting accounts. For example, material costs written off for the construction of an object are reflected by the posting:

Debit of account 20 “Main production” (08 “Investments in non-current assets”) Credit of account 10 “Materials”,

accrued wages for builders - posting:

Debit of account 20 “Main production” (08 “Investments in non-current assets”) Credit of account 70 “Settlements with personnel for wages”.

When accounting for costs by costing items, the following expense items are used:

- materials;

- labor costs;

- expenses for the maintenance and operation of construction machinery and mechanisms;

- other expenses.

In addition, costs can be taken into account at the place of their occurrence - construction sites, facilities, auxiliary production and other structural divisions of the enterprise. This grouping is necessary for organizing internal accounting and determining the cost of construction and installation work for each construction project.

group by type of construction work in accordance with the All-Russian Classifier of Types of Economic Activities (OKVED). Specific types of work that are classified as construction are indicated in section F (clause 45). This is new construction, reconstruction, major and current repairs of buildings and structures, including individual construction and repairs on orders from the population.

Engineering surveys for construction, design of buildings and structures are included in a separate group with OKVED code 74.20.

According to the method of inclusion in the cost of certain types of construction work, costs are divided into:

- direct - costs associated with construction work, which can be directly and directly included in the cost of work on the corresponding accounting objects;

- indirect (invoices) are not directly related to a specific costing object, therefore they are subject to inclusion in its cost by indirect calculation.

Based on participation in the production process, costs are divided into basic and other.

The main ones as technologically inevitable costs caused by the construction process. These include: costs of raw materials and supplies, process fuel, wages of construction workers, etc. Other costs are costs associated with servicing the production and management process.

Based on the degree of dependence on the volume of production (work performed), a distinction is made between variable and semi-fixed costs.

Variable costs change in proportion to changes in the volume of construction (mainly direct labor and material costs), since their value per unit of output remains constant.

Conditionally fixed costs do not change or change insignificantly when the volume of construction changes (wages of management and maintenance personnel, depreciation of production equipment, rent, etc.).

By calendar periods, costs are divided into current , that is, carried out constantly (daily), and one-time (one-time, associated with capital investments, investment activities).

Accounting for costs of construction work, depending on the types of accounting objects, can be organized using the order-by-order method or the method of accumulating costs over a certain period of time.

The method of accumulating costs for a certain period of time by type of work and location of costs is carried out, as a rule, by small construction organizations that perform homogeneous special types of work or carry out the construction of similar objects with a short duration of their construction. In this case, the cost of construction work delivered to the customer is determined by calculation (for example, based on a percentage calculated as the ratio of the actual costs of producing work in progress to their contract value and the contract value of the work being delivered).

With the order-by-order method, the accounting object is a separate order opened for each construction project.

The costs incurred form the cost of construction work.

Cost calculation

In general, the production cost of construction, installation, design and design work is defined as a set of direct material costs, direct labor costs, other direct costs, as well as variable overhead and constant distributed overhead costs associated with the performance of work (types of cost are presented in Fig. 2).

Rice. 2. Types of cost

Next, we will consider the formation of planned costs for the main participants in construction activities - the customer-developer and the contractor.

Planning the costs of maintaining the customer-developer service

When financing construction by private investors, the amount of customer financing is set by the investors themselves in the investment agreement. When calculating investments, the size of the customer’s organization and the costs of its maintenance are taken into account. For this purpose, a planned estimate is drawn up, which takes into account the costs of the customer-developer to fulfill obligations under the investment agreement.

The planned cost estimate is approved (agreed) with the investor and includes the following items:

- material costs;

- labor costs;

- the amount of accrued depreciation;

- other expenses.

Other expenses take into account insurance accruals to extra-budgetary funds, contributions for compulsory social insurance against accidents at work and occupational diseases, travel expenses, rent and maintenance of transport, rent of premises, communication services, etc.

Let's consider an example of drawing up a planned cost estimate for the maintenance of a customer-developer's service.

Example 1

Kolos LLC acts as a customer-developer during the construction of a cultural and entertainment center for an investment project. The planned investment amount is 500,000,000 rubles, the deadline for handing over the facility to the investor is 24 months after the start of construction.

Kolos LLC submitted to the investor for consideration a planned estimate for the maintenance of the customer-developer service and calculations for the year (Table 1).

| Table 1. Planned estimate for the maintenance of the customer-developer service | |||

| No. | Expenditures | Amount of costs, rub. | Rationale |

| Volume of planned investments | 500 000 000 | Investment contract | |

| Costs of maintaining the customer-developer service | 7 713 000 | Amount subp. 1–4 | |

| Including: | |||

| 1 | Labor costs | 4 000 000 | |

| Including: | |||

| Basic salary (salaries) | 3 200 000 | Staffing table | |

| Bonus payments once a quarter | 400 000 | Regulations on bonuses | |

| Long service bonus | 100 000 | Regulations on bonuses | |

| Vacation pay with an average vacation duration of 28 calendar days | 300 000 | Calculation of reserves for vacation pay based on accounting policies | |

| 2 | Insurance accruals on wages | 1 200 000 | 30% of labor costs |

| 3 | Depreciation of fixed assets | 250 000 | Sheet for calculating depreciation charges |

| 4 | Transport tax | 1000 | At current rates |

| 5 | Material costs and other costs, total | 2262500 | |

| Including: | |||

| Travel expenses | 1 350 000 | Calculation No. 1 | |

| Maintenance of official vehicles | 179 200 | Calculation No. 2 | |

| Office rental | 120 000 | Lease contract | |

| Training and advanced training of personnel | 20 000 | Actual data for the previous year | |

| Entertainment expenses | 40 000 | 1% of the wage fund | |

| Purchasing office supplies | 15 500 | Actual data for the previous year | |

| Purchasing technical literature | 10 000 | Actual data for the previous year | |

| Communication services | 100 000 | Agreement for the provision of communication services | |

| Purchase and maintenance of office equipment | 30 000 | Actual data for the previous year | |

| Advertising expenses | 62 800 | 3% of the amount clause 5 | |

| Postage | 10 000 | Actual data for the previous year | |

| Security costs | 100 000 | Security contract | |

| Legal services and consultations | 50 000 | Contracts for legal services | |

| Auditing services | 70 000 | Audit contract | |

| other expenses | 105 000 | 5% of the amount clause 5 | |

| Total expenses for a staff of 15 people | 2 094 700 | ||

Calculation of travel costs (Calculation No. 1)

The number of objects under construction is 20.

The average distance of the facility from the customer’s location is 100 km.

The number of visits to one site per year is 50.

The average cost of one trip is 200 rubles.

The average duration of one trip is 3 days.

Costs for technical supervision and resolving operational issues related to the construction of facilities (taking into account the fact that in 50% of trips issues are resolved within one working day and in 50% of trips you use your own transport):

- travel: 200 rub. × 20 × 50 × 50% = RUB 100,000;

- daily allowance: 600 rub. × 3 days × 20 × 50 × 50% = 900,000 rubles;

- accommodation: 700 rub. × 20 × 50 × 50% = 350,000 rub.

The total amount of travel expenses is RUB 1,350,000.

Calculation of costs for maintaining your own transport (Renault Megane car) (Calculation No. 2)

Spare parts and preventative repairs of the car - 100,000 rubles.

The average monthly mileage is 3300 km.

Gasoline consumption per 100 km is 10 liters.

The cost of 1 liter of gasoline is 20 rubles.

Cost of fuel and lubricants per year: 3300 km × 10 l/100 km × 20 rubles. × 12 months = 79,200 rub.

Total: 100,000 rub. + 79,200 rub. = 179,200 rub.

_______________

Capital expenditure planning

Determination of the planned cost of capital expenditures can be carried out according to the following items:

- construction works;

- equipment installation work;

- the cost of equipment (requiring and not requiring installation) provided for in construction estimates;

- cost of tools and equipment;

- other capital works and costs;

- costs that do not increase the cost of the facility under construction.

Let us give an example of planning the cost of a capital construction project by a customer-developer.

Example 2

The customer-developer received permission to build a business center in the South-Western district of Moscow. A building permit is a document certifying the right of the owner, owner, tenant or user of a real estate property to develop a land plot, construct, reconstruct a building, structures and structures, and improve the territory (Clause 1 of Article 62 of the Town Planning Code of the Russian Federation). The customer-developer owns the land plot on which the construction of the facility will be carried out. The investor finances the work. The customer-developer presented him with a planned cost estimate for the construction of the facility, according to which the amount of investment is 118,500,000 rubles. (Table 2). The facility must be put into operation 24 months from the start of construction. After completion of construction, the facility will be handed over to the investor.

| Table 2. Calculation of the planned construction cost to confirm the amount of investment | ||

| Expense item | Amount of expenses, rub. | Base |

| Design | 6 000 000 | Estimate for design work |

| Costs for permits and estimate documentation | 3 000 000 | Agreement with the design organization, calculation of the cost of tasks for developing estimates and obtaining permits |

| Construction and installation works | 102 500 000 | |

| Including: | ||

| Material costs | 60 000 000 | Calculation of planned indicators for the consumption of material assets |

| Costs for maintaining machinery and mechanisms | 8 000 000 | Calculation of planned indicators for the maintenance of construction machinery and mechanisms |

| Costs of wages for construction workers | 30 000 000 | 50% of the amount of material costs |

| Overheads | 4 500 000 | 15% of the wage fund |

| Costs of maintaining the customer-developer service | 2 000 000 | Cost estimate for maintaining customer service |

| Equipment installation work | 5 000 000 | Calculation of planned indicators for equipment installation |

| Total | 118 500 000 | |

____________________

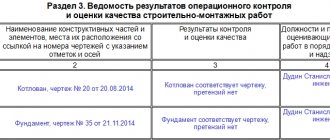

Planning of work during construction and installation works

Work on the construction of the construction project itself is carried out, as a rule, by a general contractor on the basis of a contract concluded between the customer and the contractor. A general contractor is an organization that is the main executor of a construction contract and has an SRO certificate of admission to construction work. The general contractor is responsible to the customer for the construction of the facility in full compliance with the terms of the contract, design and estimate documentation and building codes and regulations. By agreement with the customer, the general contractor engages subcontractors to perform certain sets of construction and installation work and is responsible for the quality of the work performed during the warranty period after the facility is put into operation.

The general contractor and subcontractors perform construction and installation work in accordance with the approval of the SRO.

The general contractor forms its production plan based on the generated order portfolio in the context of the following cost items:

- material costs;

- labor costs;

- costs of maintaining machinery and mechanisms;

- other expenses (including, in particular, the cost of work performed by subcontractors, the cost of operating machinery and mechanisms, rent, insurance premiums accrued on wages);

- general production expenses.

Let's consider the formation of planned production indicators when performing construction and installation work at the contractor.

Example 3

The organization, in accordance with the approval of the SRO, carries out construction, installation and finishing work. It forms its production plan based on concluded contracts. The company does not carry out long-term planning, since activities directly depend on the volume of orders. Planning horizon - 1 month, quarter.

The production program of work planned for the 2nd quarter of 2014 is presented in table. 3.

| Table 3. Production program of the enterprise | ||||

| Types of jobs | Month | Total for 2nd quarter | ||

| April | May | June | ||

| Plaster work, m2 | 530 | 320 | 260 | 1110 |

| Painting works, m2 | 215 | 115 | 120 | 450 |

| Roof dismantling, m2 | 412,5 | 240,1 | 160,4 | 813 |

| Roof installation, m2 | 415,5 | 245,1 | 165,4 | 826 |

The planned estimated cost of the work expected in the 2nd quarter was calculated for 100 m2 of roofing work and 100 m2 of plastered or painted surface. The calculation is presented in table. 4.

| Table 4. Calculation of the planned estimated cost of work | ||

| Type of work | Unit | Cost of work, rub. |

| Dismantling of roof coverings | 100 m2 | 20 000 |

| Installation of pitched roof coverings | 100 m2 | 40 000 |

| Plastering wall surfaces inside a building with cement-lime mortar | 100 m2 | 15 000 |

| Painting walls inside a building with oil paints | 100 m2 | 10 000 |

The prices include all costs of carrying out the work: material costs, costs of operating machines and mechanisms, basic wages of workers, determined as a percentage of the cost of materials (50%), overhead costs as a percentage of wages (25%), and VAT is also included. When planning, no provisions are made for unforeseen expenses.

Using the data from table. 4, we determine the planned revenue from the completed volume of work planned for the 2nd quarter of 2014 (Table 5).

| Table 5. Calculation of planned revenue | |||||

| Type of work | Price per 100 m2, rub. | Month | Total for the 2nd quarter, rub. | ||

| April, rub. | May, rub. | June, rub. | |||

| Plaster work, m2 | 20 000 | 106 000 | 64 000 | 52 000 | 222 000 |

| Painting works, m2 | 40 000 | 84 000 | 46 000 | 48 000 | 178 000 |

| Roof dismantling, m2 | 15 000 | 61 875 | 36 015 | 24 060 | 121 950 |

| Roof installation, m2 | 10 000 | 41 550 | 24 510 | 16 540 | 82 600 |

| Total | 293 425 | 170 525 | 140 570 | 604 550 | |

Thus, with the successful implementation of the planned construction and installation work, the revenue for the 2nd quarter will be 604,550 rubles.

Planning of material and technical supply is carried out taking into account the availability of inventories of inventory items (material assets) in the warehouses of the enterprise based on the order portfolio.

The enterprise's logistics plan for April is presented in table. 6.

| Table 6. Logistics plan for the enterprise for April | ||

| Name of goods and materials | Unit | Required quantity |

| Colored paints, ready for use, for interior work | kg | 100 |

| Porous crushed stone from metallurgical slag | m3 | 0,010 |

| Oil-adhesive putty | kg | 150 |

| Drying oil | kg | 100 |

| Ready-made masonry cement mortar | m3 | 2,500 |

| Ready-made finishing cement-lime mortar | m3 | 2,000 |

| Sand for construction work | m3 | 25,300 |

| Water | m3 | 31,80 |

| Nails | T | 0,050 |

| Galvanized rope wire with a diameter of 5 mm | T | 1,200 |

| Galvanized sheet steel, sheet thickness 0.7 mm | T | 1,200 |

Subsequently, planned indicators are compared with actual ones. In case of overspending, the reasons for its occurrence are determined.

Planned indicators are adjusted when current prices change or additional work occurs, but at least once every six months.

______________

Competent planning of the company’s activities is a guarantee of its successful operation. With the help of competent production planning, you can assess the real financial situation of the organization and determine the need for capital and material resources, study sales markets, and determine the optimal price of goods, works, and services sold.

Taxation in construction

Keeping tax records in construction allows you to create and summarize information that will allow you to determine the tax base based on primary documentation data. The goals are the following: generating reliable information, ensuring control of the completeness and correctness of calculations for subsequent payment to the budget.

The basic principles of taxation in construction are the economic justification of expenses and their documentary justification. Taxation in construction should be compiled in such a way that the information makes clear the following nuances:

- methods for determining income and expenses;

- algorithms for the formation of tax bases;

- the methods used to form reserves;

- methods of temporary distribution of expenses;

- mechanisms for transferring part of expenses to subsequent periods;

- formation of other tax parameters.

The activities of construction organizations are carried out in accordance with current tax legislation. Regulatory documents contain provisions that take into account the specifics of construction activities.

Income tax does not include expenses for the acquisition of depreciable property, expenses for modernization and technical re-equipment of the facility. Income tax is not calculated in the case of additional work to restore the property.

Amounts saved during construction work are subject to income tax as non-operating income. Accounting is carried out for both direct and indirect expenses of the company. The customer independently determines the list of funds spent related to the provision of services and the procedure for their distribution. The result is necessarily recorded in the tax accounting policy of the enterprise.

Contractor's expenses before construction starts

Even before signing the contract, the construction company incurs preliminary costs, which must be reflected in account 97 “Future expenses” (FPR). This could be, for example, the costs of participating in a tender or paying for a bank guarantee.

DT 97 – KT 76 – costs incurred are taken into account as RBP

DT 20 – KT 97 – RBP included in cost after the start of main work

Insurance costs can also be reported as BPO, as shown above. However, another option is also possible. The amount paid to the insurer can be taken into account as an advance, and then the insurance costs can be written off gradually as the period expires. Most often, the insurance amounts are distributed in equal shares over the entire construction period.

DT 76 – CT 51 – advance payment from the insurance company is transferred

DT 20 – KT 76 – insurance payments are expensed

An insurance contract can be concluded for several objects, the construction of which is carried out under one contract. In this case, the method of dividing costs between objects must be reflected in the accounting policy. For example, in proportion to the cost of work for each object, but it is possible to use other criteria.

Program "BIT.CONSTRUCTION"

The BIT.CONSTRUCTION program is used to automate the tasks of all departments of a construction company. The program allows you to conduct prompt and reliable reporting on objects. The BIT.CONSTRUCTION program allows you to:

- calculate workers' salaries for each facility;

- manage financial flows, consolidate, maintain management accounting;

- maintain accounting records for contractors and customer-developers;

- automate the work of supply departments;

- systematize the work of sales departments;

- automate control processes for construction machines and mechanisms.

The BIT.CONSTRUCTION system is distinguished by its modular architecture. Each module is designed to solve a specific industry problem. The program includes several automated systems and includes comprehensive solutions for customers, contractors, supply department employees, foremen, accountants, etc. The selection of a line module is made by the customer depending on the goals and objectives set.

Using automation programs

Automation programs allow you to quickly and successfully solve many problems of enterprises in any field of activity. Nobody will argue with this. But it's not that simple.

Often, to automate the accounting of materials in construction, “ordinary” accounting and warehouse applications are used, the functionality of which was developed not for construction organizations, but for trading companies. Let us note once again that such “ordinary” programs have a lot of advantages and working capabilities. However, with their help it is impossible to eliminate all the difficulties of keeping records of materials.

Another important point: the construction industry is very specific. It is necessary to automate a huge number of areas of activity: the estimate and contract department, project and contract management, accounting for inventories, equipment, control of expenses and income, and also be sure to establish their close integration with each other.

Let's look at a current example. Program "1C. Accounting 8" is a fairly functional and powerful solution, with the help of which construction companies, among others, conduct accounting. However, we note once again that organizations involved in the construction industry have special accounting needs related to specific relationships between construction and installation customers and contractors, special analytics, and non-standard accounting forms.

Working with the standard “Accounting 8” program, which is rightfully considered a model of accounting automation in the Russian Federation, construction companies cannot automatically perform some business operations. Accountants enter information manually, spend extra time and effort, collect data for various sections of accounting, and enter adjustment entries. It happens that in order to obtain the necessary cross-section of activities, for example, mutual settlements with a subcontractor in the context of objects, an accountant must first perform complex calculations.

Important! If you want to comprehensively and professionally solve the issues of accounting for materials at your construction enterprise, stop using standard accounting and warehouse programs. You need software specialized for construction needs that can handle a large number of specific tasks. For example, "BIT.CONSTRUCTION".

Reflection of movement on accounts

Displaying the movement of materials at the customer's location

The customer may display materials at actual cost or at book price. In the first case, their movement is taken into account on account 10 (for building materials, regardless of their type, in the “Building Materials” sub-account). If materials are transferred to the contractor for processing, then at the time of transfer they are not written off from the balance sheet, but internal postings are made within the 10th account.

Upon completion of construction, the cost of these MCs will be included in the cost of the finished facility. Materials purchased by the developer not for construction purposes are accounted for in account 10 in other subaccounts.

Individual characteristics of the construction process

Despite the fact that accounting in construction in the Russian Federation is carried out on the basis of general requirements and regulations, it is characterized by a large number of individual features. The reason for the presence of these features is the specifics of the construction process. For this article, we will highlight the following as the main individual characteristics of the construction site:

- Duration of execution of contract agreements. As a result, the start of work and its completion usually belong to different reporting (including tax) periods.

- The following feature follows from the atypical duration of the work cycle: phasing. Both delivery to the customer and payment by the customer usually take place in several stages. This leads to specificity in the formation of revenue and cost.

- With regard to the formation of cost in construction, there are also a number of special techniques and methods. The main purpose of these methods is, if possible, to compensate for the uncertainty in the reliability of the assessment of the financial result of the construction project being taken into account. On the one hand, based on accounting principles, receiving advances from construction customers does not provide sufficient confidence that revenue can be determined on the basis of these advances. On the other hand, the planned cost indicators determined during the work also cannot be considered completely suitable values for taking them into account in expenses when forming the financial result.

Let us examine in more detail the accounting features arising from the above aspects.

Direct and indirect costs

All costs incurred by the contractor are divided into direct, indirect and other. This is provided for in paragraph 11 of PBU 2/2008.

Direct expenses include expenses that are directly related to the execution of a construction contract. They can be of two types:

- actual costs of executing the contract. For example, wages, depreciation, rent, cost of accepted subcontract work;

- Foreseen expenses are expected unavoidable expenses that are reimbursed by the customer under the terms of the contract. These, in particular, include the costs of eliminating deficiencies in projects and construction and installation works, dismantling equipment due to defects in anti-corrosion protection, etc.

In accounting, reflect actual direct expenses in the debit of account 20 (in correspondence with cost accounts) on the date of their occurrence. In this case, make the following entries:

Debit 20 Credit 10 (68, 69, 70, 76, 60...) – direct costs under the construction contract are taken into account.

Anticipated direct costs can be recognized in one of two ways:

- as it arises;

- forming a special reserve.

In the first case, reflect the costs in the debit of account 20 in correspondence with the expense accounts. In this case, make the following entries:

Debit 20 Credit 10 (68, 69, 70, 76, 60...) – anticipated direct costs under the construction contract are taken into account.

A reserve to cover anticipated expenses is created provided that such expenses can be reliably determined. The amount of the provision is an estimated liability. The procedure for forming the reserve shall be established in the accounting policy for accounting purposes. This is provided for in paragraph 7 of PBU 1/2008 and paragraph 12 of PBU 2/2008, the procedure for determining estimated liabilities is enshrined in PBU 8/2010.

In accounting, reflect the reserve for covering expenses in account 96 “Reserves for future expenses.” Analytical accounting for this account is carried out by type of reserves. Therefore, to account 96, open a subaccount “Reserve for covering anticipated expenses under a construction contract.” Additionally, in this sub-account, divide the amounts under different agreements (Instructions for the chart of accounts).

When reserving funds, make the following entries:

Debit 20 Credit 96 subaccount “Reserve for covering unforeseen expenses under a construction contract” - deductions have been made to the reserve for covering unforeseen expenses.

Write off expenses from the reserve as follows:

Debit 96 subaccount “Reserve for covering anticipated expenses under a construction contract” Credit 10 (23, 25, 26, 60, 70, 76, 97...) - current expenses are written off from the reserve.

Costs directly related to the preparation and signing of the contract that the organization incurred before signing it are included in direct costs if it is probable that the contract will be signed. Such costs, in particular, include the costs of developing a feasibility study and preparing an insurance contract for the risks of construction work. If the organization is not confident in signing the contract, the amount of such costs should be charged to other expenses for the period in which they were incurred. This is stated in paragraph 15 of PBU 2/2008.

Accounting for returnable materials

During the construction of a facility, it is possible that materials may be generated that are reused. Returnable MCs are the property of the person who owns the dismantled object. The conditions for documentation and their use must be reflected in the contract .

The transfer of such materials to the owner of the dismantled object is shown on account 002 “Inventory and materials accepted for safekeeping” at the price that is reflected in the estimate or conditional valuation. If the contractor will use these material assets in the future for construction, then they must be taken into account by analogy with customer-supplied materials. When transferred into the ownership of the contractor, they must be capitalized on the terms of purchase or gratuitous receipt and valued at market value. When transferring free of charge, the cost limit for returnable MCs is set at 3,000 rubles.

Determining the price of work

During the execution of a construction contract, the contractor incurs expenses, which, along with the remuneration due to him, form the price of the contract (clause 2 of Article 709 of the Civil Code of the Russian Federation). As a general rule, the price of work under a construction contract is determined based on the estimate (clause 3 of Article 709, clause 1 of Article 743 of the Civil Code of the Russian Federation). The estimate drawn up by the contractor becomes valid and becomes part of the contract from the moment it is confirmed by the customer (paragraph 2, paragraph 3, article 709 of the Civil Code of the Russian Federation).

The price of the work (including that indicated in the estimate) can be approximate or fixed. Moreover, if the price is approximate, the condition for this must be directly stated in the contract (clause 4 of article 709 of the Civil Code of the Russian Federation).

If it follows from the terms of the contract that the price is fixed, the contractor has the right to demand an increase only in the event of a significant increase in the price of materials, equipment and services provided by contractors. Provided that such a rise in price could not have been foreseen when concluding the contract (clause 6 of Article 709 of the Civil Code of the Russian Federation).

The opposite situation may also arise when the contractor's actual expenses turned out to be less than those taken into account when determining the contract price (contractor savings). In such a situation, the contractor has the right to demand payment at the contract price, provided that the reduction in costs did not affect the quality of the work (clause 1 of Article 710 of the Civil Code of the Russian Federation).

Situation: is it possible not to prepare an estimate when concluding a construction contract?

The answer to this question depends on how the contractor is paid for construction and installation work.

It is mandatory that estimates be drawn up for capital construction projects financed from budget funds (subclause 11, clause 12, article 48 of the Town Planning Code of the Russian Federation).

If the object is being built through private investment and a fixed price is established in the contract, then it is not necessary to draw up an estimate to determine the contract price.

Situation: how to prepare a cost estimate for a construction contract?

The cost estimate is a document justifying the contractor's expenses under a construction contract (clauses 2, 3 of Article 709, clause 1 of Article 743 of the Civil Code of the Russian Federation). If the work is carried out in accordance with the estimate, then the estimate drawn up by the contractor becomes valid and becomes part of the contract from the moment it is confirmed by the customer (paragraph 2, paragraph 3, article 709 of the Civil Code of the Russian Federation).

The basic document in the field of estimate regulation in construction is the Methodology approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1. In accordance with it, estimated standards are divided into:

- state estimate standards (GSN);

- industry estimate standards (OSN);

- territorial estimate standards (TSN);

- branded estimate standards (FSN);

- individual estimate standards (ISN).

This is stated in paragraph 2.3 of the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1.

Recommended samples of estimate documentation are given in Appendix 2 to the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1. Among them are typical forms:

- local estimate;

- object estimate;

- estimates for design and survey work;

- summary estimate.

The procedure for drawing up estimate documentation is prescribed in Section IV of the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1.

Procedure for creating an OS

The process of construction or creation can be carried out in two ways - economic or contracting. The first involves the use of one’s own forces and resources, the second involves turning to third-party specialized persons. Accounting for the economic method of constructing OS.

Accounting for construction or manufacturing costs is carried out differently in both methods. The costs will be different, but the principle of forming the initial cost of the final OS object will be the same for both methods. This indicator will be collected from the sum of all expenses incurred.

Accounting: acceptance of ready-made objects for accounting

Reflect the acceptance of ready-made objects for accounting on account 01 “Fixed Assets” or account 03 “Profitable Investments in Material Assets”, to which open the subaccounts “Fixed Assets in Warehouse (In Stock)” and “Fixed Assets in Operation”. If the time of registration of a fixed asset and its commissioning coincides, make the following entry:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 08-3

– the created fixed asset was accepted for accounting and put into operation at its original cost.

If the moments of registering a fixed asset and its putting into operation do not coincide, make the following posting:

Debit 01 (03) subaccount “Fixed asset in warehouse (in stock)” Credit 08-3

– the created object is taken into account as part of fixed assets at its original cost.

This procedure is provided for in paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts.

Contractors' liability

The subcontractor is responsible to the general contractor for the quality of work, in particular, for violations of the requirements of technical documentation, building codes and regulations binding on the parties (clause 1 of Article 754 of the Civil Code of the Russian Federation). The general contractor is responsible to the developer for the consequences of non-fulfillment or improper fulfillment of obligations by the subcontractor, and to the subcontractor for the non-fulfillment or improper fulfillment of obligations by the developer under the contract. At the same time, the developer and the subcontractor do not have the right to present claims to each other related to the violation of contracts concluded by each of them with the general contractor. Such rules are established in paragraph 3 of Article 706 of the Civil Code of the Russian Federation.

Works related to construction

- construction, reconstruction and expansion of permanent and temporary buildings and structures and associated installation work;

- installation and dismantling of crane tracks;

- construction of external and internal networks of water supply, sewerage, district heating, gasification and energy supply;

- arrangement of foundations, foundations and supporting structures for equipment;

- landscaping and landscaping of development areas, as well as towns and cities;

- other construction work.