Home / Labor Law / Payment and Benefits / Compensation

Back

Published: 05/28/2016

Reading time: 7 min

0

1626

The standard annual paid leave for a citizen of the Russian Federation with official employment is 28 days.

But, in our country there are also special conditions for providing official rest to specialists whose activities are associated with difficult working conditions .

In addition to a month of paid rest, representatives of such professions can count on additional days of rest, or instead of the weekends allotted in addition to the standard vacation, demand monetary compensation.

- Legislation of the Russian Federation on additional leave

- Are all employees entitled to substitute additional leave compensation?

- How is compensation calculated?

- Calculation examples Example 1

- Example 2

- If an employee wants to quit

In what cases is vacation replaced with monetary compensation in 2021?

Vacation can be exchanged for cash only if the share of vacation allotted each year is more than 28 days. This happens if a person has the right to additional rest or his vacation has been increased.

Note! If an employee has a rest period of 28 days, and he did not use the opportunity to go on vacation, then the calendar days are not exchanged for monetary compensation.

Article 115 of the Labor Code of the Russian Federation

Situation: exchange of vacation, the duration of which exceeded 28 days, for monetary compensation this year.

In 1919, an employee of a certain company Alferov N.M. has the right to:

- main leave lasting 28 calendar days;

- additional leave for irregular working hours, the duration of which is 3 calendar days.

The entire duration of the paid vacation allotted to an employee each year is 31 days (calendar), since we added 28 and 3. This year, Alferov, with the consent of his superiors, has the right to exchange that part of his vacation that lasts 3 days for compensation in the form of money.

You can exchange “extra” vacation days, that is, those that are in excess of the 28 allotted to everyone, for monetary compensation

If a person is fired and has unused vacation time left, he has the right to receive financial compensation for all remaining vacation time (based on Article 127 of the Labor Code). When calculating compensation related to the dismissal of a citizen, it is necessary to take into account any additional and basic unused vacation days due to him for the entire time he performed his job duties in this company.

By the way, the right to receive compensation for vacation in cash has nothing to do with the reason why the employee was fired. The company must give the person money in any case. Even showing up at work drunk or systematic absenteeism does not in any way affect compensation.

Note! If a person has entered into a civil contract and works under it, he is not entitled to this type of compensation. After all, for such citizens, vacation is not expected every year.

An employee has the right upon dismissal to receive compensation for unused vacation days

Only people who work for the company for at least half a month have the right to receive compensation upon dismissal. It is important that the number of working days that are less than half a month must be discarded from the calculation of the length of service that grants the right to receive money for vacation (clause 35 of the Rules on regular and additional vacations dated April 30, 1930, number 169).

Situation: identifying an employee’s rights to provide financial compensation for leave balances upon dismissal.

Sorokina A.M. got a job at the company on November 9, 1919. Two weeks later, the woman filed a letter of resignation effective November 27, 1919 (this is the last day of her job duties). The vacation provided by the company every year consists of 28 calendar days.

The accounting department found out how many calendar days the employee worked in November of this year. It turned out that she worked for 19 days.

Obviously, this figure is more than half a month, so Sorokina has the right to monetary compensation for the remainder of her vacation: 2.33 days (28 days divided by 12 months).

You must work at least half a month to receive compensation for unused vacation

Rules for processing payments

How to apply for compensation upon dismissal

The following documents will be required for the procedure to take place legally:

- Statement from the employee himself.

- Administrative paper. Its function is assigned to the dismissal order. Why use a special form with the T-8 form. The responsible accountant may additionally write that compensation is being paid.

- A document in which all payments made by the time the dismissal procedure is completed are calculated. It also involves the use of a single T-8 form.

When won't you be able to exchange your vacation for money in 2021?

It is unacceptable to compensate vacation balances in cash for such categories of citizens.

| Category of citizens | Law |

| Pregnant women Minor workers Employees engaged in hazardous work activities or working in hazardous working conditions | Grounds – part three of article 126 of the Labor Code |

It will not yet be possible to exchange vacation for money for citizens whose vacation does not reach the 28 calendar day limit. If this is the case, then money can be paid in the event of dismissal - for any unused vacation days.

Note! When a person does not take advantage of the allotted vacation in a certain year, the vacation remains his and can be used the next year.

Article 126 of the Labor Code of the Russian Federation

How does unused vacation occur in the 19th year?

Unused vacation days occur when you add up all the earned vacation time that remains unused during the year.

Initially, you may not use the 28 days that you are entitled to every year. In addition to them, based on working conditions, you may not use additional paid leave if you are entitled to it. The remaining days that you did not take a vacation are added to the total number of the next main and additional vacation due in the next year.

Important! The remaining maternity days - parental leave until the age of one and a half or three years are not taken into account and are not added to. When you go to work earlier than the end of maternity leave, that is, before the baby reaches three years old, then you do not have the right to use the rest of the rest.

It will not be possible to use the “remains” of maternity leave later

Also, vacation days related to pregnancy or childbirth are not included in the “remains.” By the way, if an employer calls an employee to the workplace before her vacation ends, he may well face unpleasant consequences. After all, such leave is similar to being on sick leave, that is, the woman is given a certificate of incapacity for work.

Note! No monetary compensation is provided for remaining maternity leave.

You can use the remaining vacation time until you leave your current position. In other words, when you get a new job, you won’t be able to “take with you” the remains of your previous vacation. It is better to use the remaining time immediately before leaving the workplace or request compensation.

The employer has no right to call an employee back from maternity leave.

Additional information about payments

Payment of personal income tax and insurance premiums largely depends on the time frame within which settlement funds are transferred. But how does the legislation relate to the time of payment of compensation to the treasury?

On the last day, the employee may be absent from the workplace. If the reason for this is considered valid, then compensation and all other funds with documents are given the next day.

For those whose vacation is more than 28 days

Based on current legislation, civil servants have the right to rest longer if they have the appropriate length of service and an irregular work schedule. Long service leave is assigned based on the citizen’s current length of service. We have provided the details here

In addition to workers performing official duties in the Far North, there are subgroups of people entitled to leave for a period of more than the standard 28 days. Such people can ask to change their vacation to cash this year if they want. Let's list who can be included in this group:

- people working in pedagogy;

- people working in medicine;

- employees with identified disabilities;

- university researchers;

- civil servants of the state civil service;

- people involved in research activities.

Article 116 of the Labor Code of the Russian Federation

Any person engaged in the above-mentioned activities can rest for the standard 28 days, and compensate the rest in cash. It is worth noting that the employee’s superiors may refuse him, offering to use all vacation days.

Financial compensation for vacation balances upon dismissal

Let's say you want to leave your current job. At the time of writing your resignation letter, you had not taken a vacation for several years. In addition, you are not going to rest for the next long months, since you have already found a new position. You don’t want to waste time, so you directly inform your boss about your desire to receive financial compensation.

Important! Providing money for unused vacation days is a mandatory measure that the employer undertakes to comply with, as it is prescribed in the Labor Code.

The employer is obliged to pay compensation for unused vacation days

It doesn’t matter what kind of contract you entered into with your superiors - fixed-term or open-ended - the amount is calculated based on all remaining vacation days. When you decide to leave a position mid-year, the total applies to all time carried forward from previous years and 14 days from the current year. The calculation of deadlines and corresponding monetary compensation in such a situation is carried out by an employee of the personnel department and the company’s accountants.

There are cases in which a person had to engage in work activities during vacation (while working part-time). Thus, by the day of dismissal, the person had accumulated approximately 30.2 days of unused vacation. When management does not accept the use of fractional numbers, it is allowed to increase the period to a full day in favor of the employee, that is, 31 days. All this is stated in the recommendations of the Ministry of Health of our country.

Important! Compensation will be provided to you only if you write a statement. In other words, when writing a letter of resignation, you must indicate whether you intend to use the rest of your vacation time or not. There is absolutely no need to specifically write about compensation in the application, since management will do all the calculations on their own based on the Labor Code.

To receive compensation you need to write an application

What liability is imposed on employers for non-payment?

Most often, the punishment is administrative liability. This means that a fine is imposed, the amounts of which can be as follows:

- From 10 to 20 thousand rubles for company officials.

- For the enterprise itself – in the range of 30-50 thousand.

The Labor Inspectorate becomes the main body that holds people accountable and monitors compliance with requirements in this area. Violations are identified after a corresponding complaint is filed by an employee, or based on the results of inspections.

The employer faces financial liability if he violates deadlines when paying compensation. Fines are usually up to 1/300 of the Central Bank refinancing rate at the time of the incident.

Compensation for “remainders” of vacation without dismissal

The problem of exchanging “remaining” vacation time for cash arises not only when an employee wants to leave his position. If you are satisfied with the duration of your vacation, which is less than what you have accumulated over the past time, you may not go on vacation, but request financial compensation.

The difference between this event and dismissal is that refusal is allowed only for those days the amount of which is more than 28.

This can include both the time of the main paid leave (in the case where the amount is more than 28) and the days of additional paid leave.

You can only exchange vacation days for money when their amount is more than 28

For example, from the 17th to the 18th year they “roll over” 10 days. In the new year you can expect 28 regular days of rest, that is, the total will be 38 days. However, during the 18th year, you can use compensation only for 10 additional days and no more. If you still have vacation days left over the new year, then in the future you may be given money for the total number of days for 17 and 18 years as compensation.

Important! If you can only take advantage of 28 days of vacation, then you will not be given compensation - there is simply nowhere to get it from. You can take advantage of this holiday or take it back completely or piecemeal for next year. You can always ask for compensation for vacation days dating back to the previous year.

Measures to provide monetary compensation in such a situation begin after filing the appropriate petition. You must indicate for what time period of work you have rest left, and how many days you have accumulated.

If you have 28 days of vacation, you will not be able to receive compensation for unused days - you can only use them later

Based on the application, accountants begin their calculations. If necessary, the number of unused days for compensation is rounded in favor of the employee.

On a note! You cannot exchange any vacation days for money if a pregnant woman or an employee under 18 years of age goes on vacation. If a person works in dangerous or harmful conditions, then only the temporary period of additional leave is prohibited.

You cannot exchange rest days if we are talking about the leave of a pregnant woman or a minor employee

Documentation

As mentioned earlier, compensation can be received by an employee based on his application. It must contain the following information:

- reference to the Labor Code of the Russian Federation, Art. 126;

- for what period of leave is granted;

- for how many days does the employee want to receive compensation payment?

If a citizen resigns, he is immediately compensated for the period of rest that he did not have time to use. Fill in f. T-61, note-calculation. The application is not processed. If he decided not to receive money, but to go on vacation and quit, he needs to write a statement (Article 127 of the Labor Code of the Russian Federation). Then they issue a personnel order and issue compensation.

How are compensation amounts calculated?

Compensation for vacation balances is calculated on the same principle as vacation pay. However, first you should find out how much time the money is due.

The number of remaining vacation days compensated in cash is calculated using the form given below:

Number of vacation days remaining = duration of entire vacation granted each year: 12 months * sum of fully worked months in a calendar year.

The calculator below will help you calculate the number of vacation days remaining.

Go to calculations

You can calculate the number of remaining vacation days using a special formula

Thus, for each fully worked month, the employee is given 2.3 days (28 days divided by 12 months). Of course, this applies to those companies where the vacation lasts the standard 28 days. What are the principles for rounding? There is no word about this anywhere in the official documentation. Usually the calculated amount is viewed with two decimal places; it is not at all necessary to use rounding to a whole number. Note that the more decimal places there are, the more accurate the number is considered.

On a note! When making calculations, it is more logical to round the results obtained. Let's say a person worked for three months. Therefore, he is entitled to a week of vacation (28 days divided by 12 months and multiplied by 3 months). That is, not at all the 6.99 days you get if you simply multiply 2.33 by 3.

It is permissible to use rounding fractions to whole numbers, but in this case they are not guided by mathematical rules, but simply do it upward. This is explained by the fact that the employer does not have the right to complicate the situation of employees (Article eight of the Labor Code). In other words, it is impossible to provide compensation not for 16.33 days, but only for 16. Therefore, many companies simply round the figure to 17.

Rounding of fractional numbers always occurs in favor of the employee

Situation: calculating the amount of remaining vacation days upon dismissal.

The employee left his position on November 2, 1919. He carried out his work duties there since January 9 of the same year. All this time he worked without breaks. How to find out how many days a citizen should receive compensation?

To find out the information we were interested in, the accounting department first found out how many full working months the person worked. Thus, there are nine of them - from January 9 to October 8. With the help of further calculations, we find out that there are 25 days left before dismissal (from October 9 to November 2). This is more than half a month, so this time can be calculated as a whole month.

As a result, we found out that the person worked for 10 months. The company has a rule that it is necessary to round the remaining vacation days to four digits following the decimal point.

You need to round the number of days remaining to four decimal places

So, the accountants performed the following calculations:

28 days: 12 months * 10 months = 23.3333 days.

Therefore, the person was compensated in cash for 23.3333 days.

On a note! When calculating compensation, income for the calculation period must be divided by the number of calendar days occupied by the time worked. Then multiply the resulting figure by the number of remaining vacation days.

The calculator below will help you calculate the amount of compensation for unused vacation days.

Go to calculations

Using a special formula, you can also calculate compensation for unused vacation days

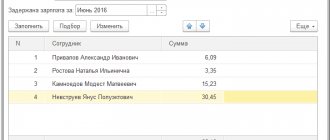

Situation: calculating compensation for vacation balances.

November 7, 19 Prokopyev N.S. I worked at my company for the last day. He has the right to receive compensation for 14 unused vacation days. The calculation period is from November 1 of the same year to October 31 of the 19th year. The employee’s salary as of November 1 last year was 30 thousand rubles. During the calculation periods, earnings did not change.

During the period from August 1 to August 28, 1919, the employee was on vacation. In addition to vacation pay, for a given month he is entitled to another 3,913.04 rubles for the time worked.

The working hours in August consisted of three days.

The number of calendar days that fell within the time worked in the calculation period was calculated by the company’s accountant as follows:

29.3 days * 11 months + 29.3 days : 31 days * 3 days = 325.1355 days.

After this, we found out the amount provided as compensation:

(30 thousand rubles * 11 months + 3919.04 rubles): 325.1355 days * 14 days = 14,377.95 rubles.

The amount of compensation depends on the employee’s daily earnings

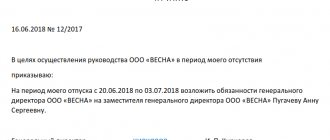

How to apply for a change of vacation for monetary compensation?

When an employee intends to compensate the remainder of his vacation with a sum of money, he should fill out an application.

How to make an application?

So, if you decide to receive compensation for the remaining days of your allotted rest, then you must write an application addressed to the head of the company. There is no strict form that must be followed, but general criteria for preparing business papers must be observed.

The application must provide clear information about its recipient. In the situation we are considering, this is the head of the company who makes the decision to provide this type of compensation. Information about the manager and the name of his position is written in the upper right part of the paper. On the same side, the applicant’s details are indicated – position title, structural unit and full name.

It is important to complete your application for compensation correctly.

Then they write the name of the paper - “Application”. If there is such a need, you can use a sample application for the next paid leave, replacing the text with: “I ask you to replace part of my paid leave with monetary compensation...”.

On a note! Do not forget to clarify: what type of vacation, the annual period in which you have vacation days remaining, the number of days to calculate the required amount of money.

If you decide to compensate for vacation balances over several years, you need to separately specify how many days for each year should be compensated.

Be sure to include the date and your signature at the end of the application. It is advisable to have the paper endorsed by the management of your structural unit.

The application must specify the number of days to be compensated and what type of leave it is.

We provide a sample application for greater clarity.

To the Director of Romashka LLC

P.V. Sorokin

junior sales specialist

L.N. Petrova

statement.

I ask you to provide me with monetary compensation instead of additional leave for an irregular working day lasting three calendar days.

10.05.2018

Signature

Full name

You can use a sample application so as not to make a mistake.

On a note! The company administration is responsible for the decision to pay this type of compensation if the reason has nothing to do with dismissal. However, remember: no one is obliged to pay you this money, so refusing your request will be quite legal.

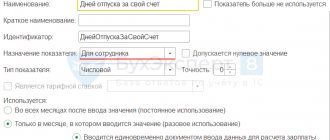

Formation of an application by an employee

Initially, the citizen himself, who officially works for the company, must decide on the need to replace the vacation with a cash payment. For this purpose, they draw up a special application. The employer himself cannot insist on such a replacement, since this violates the requirements of the Labor Code.

A sample application for compensation for additional leave is located below.

When forming it, the following rules are taken into account:

- a document is written addressed to the head of the enterprise or individual entrepreneur;

- there is no strict form of the document, so it is done in any form;

- it is indicated that non-mandatory additional days of rest are replaced by compensation.

At the end, the date of drawing up the application is indicated, as well as the signature of the company employee.

When to pay tax on compensation?

Note: it does not matter why a person receives this money - due to dismissal or replacement of any share of vacation, the duration of which is more than 28 days. On this basis, vacation compensation is subject to tax deductions both upon dismissal and without it. The tax amount must be sent to the budget no later than the day following receipt of the funds.

Personal income tax is deducted from vacation pay

Issuance of an order by the manager

The next stage assumes that the management of the company issues a corresponding order. This is done only if there is agreement to replace the employee’s vacation with a payment from the general director.

There is no unified order form on the basis of which compensation for additional leave is assigned. Therefore, the document, like the application, is drawn up in any form. To do this, enter the following information into the order:

- position and full name of the specialist counting on compensation;

- the number of days that will be replaced by payment of funds;

- the name of the document presented by the order is indicated;

- Enter the details of the employee’s bank account where the money will be transferred.

The employee must familiarize himself with this document against signature.

Contributions

Management must charge insurance plan contributions for the amount of any kind of compensation for vacation balances.

The boss does this for both pension and social or health insurance, as well as in cases of injuries and illnesses caused by professional activities.

On a note! Contributions are credited to the budget no later than the 15th of the next month. This applies to all insurance plan contributions to extra-budgetary funds: both those paid to the Federal Tax Service and those collected by the Social Insurance Fund.

The employer makes contributions to the Pension Fund and for compensation for vacation balances