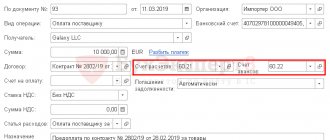

Payment

Accounting policy: regulatory framework, types, procedure and terms of approval Federal Law No. 402-FZ “On Accounting

Attention! From November 25, 2021, an application for amendments to the LLC must be submitted

Debit 76 Credit 76: what does it mean If a posting is made in the correspondence of accounts Dt

Simplified tax system When calculating the single tax on the difference between income and expenses, documented and

Accounting for import transactions In accordance with the Federal Law of December 8, 2003

An order for placing fixed assets on the balance sheet is one of the company’s basic documents, which

Home / Labor Law / Responsibility / Material Back Published: 04/29/2016 Reading time:

What is an account? Every business company is created for the purpose of making a profit. At the same time she

What does a sample personal income tax payment order look like in 2021? What are the features of income tax payment?

When registering with the tax authority of an organization as a taxpayer of the single tax on