Payment

The employer, upon application of the employee, must issue a certificate of income received and personal income tax withheld. like this

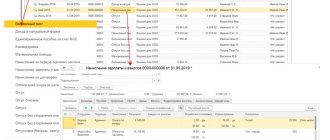

Any organization (individual entrepreneur) in its economic activities may be faced with the need to calculate and

Last modified: January 2021 The need to repay all debts of the employer to the employee upon his dismissal

Can an individual entrepreneur pay his own wages? According to the law, entrepreneurs have the right to hire people

Institutions and organizations provide financial assistance to employees, former employees, as well as members of their families

Legislative regulation The Labor Code of the Russian Federation clearly states all the points that must be regulated

The specificity of monitors is such that, during long and active work, the screens lose color rendering quality,

The balance sheet is one of the most reliable financial statements of an organization. It reflects information about

The need for accounting and accounting policies The basic provisions on the rules of accounting are contained

Notification of the transition to a simplified tax system Before switching to a simplified tax system, contact the tax office