Debit 76 Credit 76: what does it mean

If the posting of Dt 76 Kt 76 is made in the correspondence of accounts, this is an offset of mutual claims.

When, for example, he buys stationery from, and from - ready-made semi-finished products for employee lunches, at the same time a debt arises to and - to. The Civil Code allows in this case to offset the obligations of two companies (Article 410 of the Civil Code of the Russian Federation). To do this, the following conditions must be met:

- Direct presence of counterclaims. That is, companies must have at least 2 agreements between themselves: one of them is a creditor, and the other is a debtor. Likewise for .

- The requirements of companies must be uniform.

- Set-off is permitted upon the maturity of one of the companies' obligations. If the period is not specified in the contract or is determined by the moment of demand, offset can be made at any time.

The Civil Code of the Russian Federation requires for offset to be carried out an application from one of the parties to the transaction or the drawing up of an act of offset. Companies can also carry out a partial offset - for the amount of the smallest mutual debt.

On the date of receipt of the application for offset or signing of the act of offset, company accountants must make the following entry:

Dt 76 Kt 76 - for the amount of offset obligations (reflects the termination of the counter obligation to pay for goods, works, services by offsetting mutual claims).

Example 1

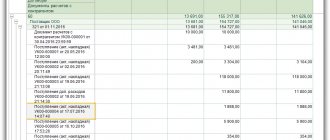

in the 3rd quarter of 2021, I purchased archival racks worth RUB 441,250. And “Paper Yard” bought several used refrigerators for the office kitchen for 353,000 rubles. Based on the results of the quarter, as of September 30, 2020, the firms signed a netting act for RUB 353,000. Let us assume that “Fas” take into account transactions between themselves on account 76, since for both companies these transactions are not the main activity.

In the accounting records, both companies will reflect the offset as follows: Dt 76 Kt 76 - in the amount of 353,000 rubles. (offset has been made).

Then the initial debit balance on account 76 as of 10/01/2020 will be 88,250 rubles. And the credit opening balance on the same day will be similar, that is, “Fastmil” will still owe “Bumazhny Dvor” 88,250 rubles.

In our example, debts for goods already delivered were closed by offset. Therefore, this offset did not affect VAT in any way. But the parties can also read out advances. Moreover, depending on the situation, the procedure for working with VAT will be different. A ready-made solution from ConsultantPlus will help you avoid making mistakes in this tax. If you do not already have access to this legal system, you can get a full access trial for free.

What to do if the creditor has not paid his debt, read the article “Writing off accounts payable with an expired statute of limitations.”

Penalties for failure to comply with cash register discipline

Any enterprise has the right to carry out cash payments in the course of its business activities. But only subject to compliance with the legal requirements for registration of such transactions. If the proceeds are not fully capitalized, cash order is not observed, violators may be subject to sanctions under the statute. 15.1 Code of Administrative Offences:

- For officials - a fine of 4000-5000 rubles.

- For legal entities - a fine of 40,000-50,000 rubles.

The general statute of limitations for bringing violators to administrative liability is insignificant and is only 2 months from the date of the actual commission of the offense (Article 4.5 of the Administrative Code). Tax authorities have the right to check a business for compliance with cash discipline regulations. There are no other types of penalties for such violations.

Debit 76 Credit 51

An accountant can post Dt 76 Kt 51 in the following cases:

- Payment has been made for property or personal insurance of personnel. Dt 76.1 Kt 51 - 10,000 rub. The accountant paid the insurance company the annual fee for the employee's insurance. Then, when receiving money from the insurance company upon the occurrence of an insured event, the Fastmil accountant will make a debit entry to account 51 in correspondence with account 76. And the accrual of insurance compensation to the employee will be reflected by entry Dt 76 Kt 73.

- The accounts payable to the counterparty has been repaid. A company can record settlements with suppliers both on account 62 and 76. In practice, accountants most often record on account 76 secondary counterparties, settlements with which occur infrequently.

- The supplier is paid for the claim or fine. In this case, mutual fines of 2 companies can be offset by posting Dt 76 Kt 76.

Example 2

I discovered that one of the archival shelves purchased from Bumazhny Dvor was deformed. And Bumazhny Dvor, in turn, filed a claim for the short supply of refrigerators.

According to the agreement between the parties, they are obliged to pay the counterparty a fine in the amount of 10,000 rubles. and remove the goods at your own expense. However, Bumazhny Dvor has the right to expect to receive monetary compensation from Fastmil for shortfalls in delivery. The fine is 5,000 rubles. The parties signed an act of mutual settlement for part of the mutual claims in the amount of 5,000 rubles.

In accounting it will be reflected as follows: Dt 76 Kt 76 - in the amount of 5,000 rubles. (mutual claims between are taken into account).

The paper yard accountant will make the following entries in accounting:

- Dt 76 Kt 76 - in the amount of 5,000 rubles. (part of the fine is offset against the due monetary compensation);

- Dt 76.2 Kt 51 - in the amount of 5,000 rubles. (a fine was paid for the supply of low-quality archival shelving).

Important! Tip from ConsultantPlus If you refuse a low-quality product and return it to the supplier, you have the right to return the money for it... The procedure for returning money can be specified in the contract or a separate agreement. If it is not indicated anywhere, ask the supplier in writing to return the money. In case of non-return, send him a claim and then file a lawsuit. For detailed refund procedures, see K+ after receiving a free trial access.

Correspondence of possible accounts

| Debit | Credit |

| 01, 04, 07, 02, 08, 03 NMA and OS | 91 “Other income and expenses” |

| 19, 16, 15, 14, 11, 10 Current assets, VAT | |

| 21, 20, 28, 29, 23 Defects, costs by department | |

| 58, 59 reserves, investments | |

| 66, 68, 69, 67, 60, 63 Settlements, loans | |

| 70, 76, 73, 79, 71 Settlements with personnel and other creditors and debtors | |

| 98, 99, 94 financial result, funds, losses and shortages of goods and materials |

Settlements on account 76: assignment agreement

Posting Dt 76 Kt 76 is drawn up by an accountant when concluding an assignment agreement or assignment of a claim. This is an agreement under which one company (assignor) sells to another company (assignee) the right to claim debt from a third company (Article 382 of the Civil Code of the Russian Federation). Moreover, the debtor does not appear in the assignment agreement itself. Let's look at an example of how settlements under an assignment agreement are accounted for by each participant.

Example 3

bought the right to demand debt from IP Kuznetsova E.I. The amount of debt of IP Kuznetsova E.I. is 400,000 rubles. Bumazhny Dvor sells this debt for 350,000 rubles.

Since before this transaction Fastmil owed 350,000 rubles, Bumazhny Dvor and Fastmil offset the debts to each other.

The accountant reflected the acquisition of debt as follows:

- Dt 58 Kt 76 - in the amount of 350,000 rubles. (the debt of individual entrepreneur E.I. Kuznetsova was acquired under an assignment agreement);

- Dt 76 Kt 76 - in the amount of 350,000 rubles. (the purchase of the debt of E. I. Kuznetsova was counted against the debt of Bumazhny Dvor).

If an individual entrepreneur transfers money, the accountant will make the following accounting entries: Dt 51 or 50 Kt 76 - in the amount of 400,000 rubles. (debt received from individual entrepreneur E. I. Kuznetsova).

The accountant will determine the financial result of the transaction as follows:

- Dt 76 Kt 91.1 - in the amount of 400,000 rubles. (the amount of repaid debt is included in the company’s income);

- Dt 91.2 Kt 58 - in the amount of 350,000 rubles. (the cost of the acquired right of claim is included in expenses).

The credit balance on account 91 is the company’s profit from the purchase of the debt of IP Kuznetsova E.I. in the amount of 50,000 rubles.

In turn, the Bumazhny Dvor accountant will reflect the receipt of money from the sale of stuck accounts receivable as follows:

- Dt 76 Kt 91.1 - in the amount of 350,000 rubles. (reflects the proceeds from the sale of the debt of IP Kuznetsova E.I.);

- Dt 91.2 Kt 62 - in the amount of 400,000 rubles. (the debt of individual entrepreneur E.I. Kuznetsova was written off).

“Paper Yard” received a loss of 50,000 rubles.

How VAT is calculated for all parties to the assignment agreement, see ConsultantPlus. Get free trial access and go to the Ready Solution.

Account correspondence

| Debit | Credit |

| 91 “Other income and expenses” | 08, 07 Non-current assets |

| 10, 11, 15, 14 Current assets | |

| 20, 29, 23, 28 cost accounts, production defects | |

| 41, 43, 45 Finished, shipped products | |

| 50, 52, 59, 57, 51, 58, 55 cash | |

| 60, 63, 66, 62, 67 settlements with counterparties, loans | |

| 71, 76, 79, 73 various debtors and creditors, accountable persons | |

| 96, 99, 98 financial results, reserves, funds |

Debit 76 Credit 91

Posting Dt 76 Kt 91 is drawn up, as can be seen from the previous paragraph, in the event of receiving income from an assignment agreement. Also, an entry to the debit of account 76 in correspondence with the credit of account 91 is made in the case of leasing property, provided that this is a non-core activity of the company.

Unclaimed accounts payable, which were accounted for under Kt 76, after the expiration of the limitation period are written off in Kt 91.1 as other income of the enterprise.

Also, posting Dt 76 Kt 91 reflects amounts of money received in payment of fines and other sanctions from other companies. Let's remember the example about the fine, which is “Fas. The Fastmil accountant, upon receiving penalty payments from the Paper Yard, will make the following entries in the accounting:

- Dt 51 Kt 76.2 - in the amount of 10,000 rubles. (received a fine from the Paper Yard);

- Dt 76.2 Kt 91.1 - in the amount of 10,000 rubles. (the fine is included in income).

Insurance

If there are insurance operations for employees and property, subaccount 76 of account is used - 76.1.

It is worth noting that this does not take into account the costs associated with the calculation and payment of wage insurance premiums. Payments are calculated in correspondence with cost accounts. These may be production costs (20, 25, 26 and others) or other expenses not related to production activities (account 91). Examples of insurance transactions:

| Dt | CT | Purpose of the operation |

| 20 | 76.1 | Insurance premiums have been calculated for insured production equipment |

| 76.1 | 51 | Transfer of insurance amounts |

| 91.2 | 76.1 | Other assets not involved in the production process are insured |

| 76.1 | 91.1 | Calculation of insurance compensation |

| 51 | 76.1 | Insurance amount received |

| 76.1 | 73 | The amount of insurance compensation has been accrued in favor of the injured employee |

| 51 | 76.1 | The insured amount was reimbursed |

| 73 | 51 | The employee received insurance compensation |

Example 1. Production equipment is insured for the amount of 300,000 rubles. Every month the organization accrued and paid insurance amounts in the amount of 2,000 rubles. Some time later, a fire occurred that destroyed the insured asset. The insurance company agreed to pay compensation. Typical entries are as follows:

- Dt 20 – Kt 76.1 (2,000 rubles) – calculation of the monthly insurance amount.

- Dt 76.1 – Kt 51 (2,000 rubles) – transfer of the insured amount.

- Dt 76.1 - Kt 91.1 (300,000 rubles) - the compensation amount was accrued as a result of the occurrence of an insured event.

- Dt 51 – Kt 76.1 (300,000 rubles) – compensation received.

Example 2. An employee previously insured against industrial accidents was injured in the workplace. The amount of compensation from the insurance company was 150,000 rubles. Previously, insurance amounts in the amount of 800 rubles were transferred monthly. The following entries have been generated in accounting:

- Dt 20 – Kt 76.1 (800 rubles) – accrual of the insured amount for transfer to the insurance company.

- Dt 76.1 – Kt 51 (800 rubles) – transfer of insurance premium.

- Dt 76.1 – Kt 73 (150,000 rubles) – reflection of the amount payable for insurance compensation.

- Dt 51 – Kt 76.1 (150,000 rubles) – receipt of funds to the organization’s account.

- Kt 73 – Dt 51 (150,000 rubles) – insurance compensation was paid to the victim.

Results

The debit of account 76 reflects various transactions: personnel insurance, settlements of claims and fines issued to counterparties, deposited amounts, the amount of debt purchased from another company. Posting Dt 76 Kt 76 reflects transactions carried out under the assignment agreement. When offsetting, a posting is also made Dt 76 Kt 76 .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.