Payment

Object of taxation Based on accounting theory, an object is the base that is taxed,

The concept of cash discipline The rules for conducting cash transactions in an organization are enshrined in the instructions of the Central Bank of Russia No.

Land is a special type of non-depreciable asset. It can be purchased, sold, resold, realized

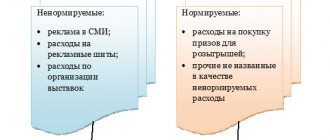

First, let’s find out what is generally considered advertising. This way we will understand what expenses can be attributed

Let us assume that some time after submitting the Tax Return for personal tax

The advance travel report in 2021 remains one of the few mandatory travel documents.

Administrative and management costs are one of the main expense items of a manufacturing enterprise.

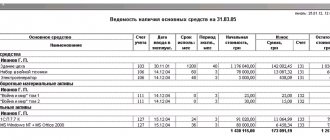

In accordance with Accounting Regulations 6/01, the cost of fixed assets is repaid by

Calculate the amount of sick leave benefits for child care based on average earnings

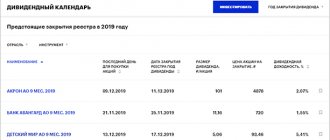

How to calculate the amount of dividends Dividend payments in a company are initiated by the board of shareholders after the closure of the register.