Companies and entrepreneurs, subject to certain conditions, have the right to switch to preferential tax regimes. They can not only be used independently, but also combined. In this article we will talk about the combination of UTII and simplified tax system in 2021, as well as who benefits from it.

What are the advantages of the simplified tax system?

The main advantage of the “simplified” system is that businesses do not need to pay VAT, which is 20% from 2021. Also, those organizations that use the simplified tax system do not pay income tax, with the exception of the tax paid on income from dividends and certain types of debt obligations.

Also, the simplified tax system provides a benefit for the property tax of organizations, that is, this tax is not paid. Moreover, from January 1, 2015, for individual entrepreneurs on the simplified tax system, there is an obligation to pay property tax in relation to real estate objects that are included in the list determined in accordance with clause 7 of Art. 378.2 Tax Code of the Russian Federation.

Besides:

- The simplified tax system does not require quarterly payments and declarations. Only one declaration needs to be submitted: for organizations - by March 31 of the year following the expired tax period, and for individual entrepreneurs - by April 30.

- At the “simplified” and at the “income” object and at the “income minus expenses” object there are advance payments. Tax must be paid in advance no later than 25 calendar days from the end of the reporting period.

- The tax at the end of the year is paid by organizations - no later than March 31 of the year following the expired tax period, individual entrepreneurs - no later than April 30 of the year following the expired tax period.

It is worth remembering that under simplified taxation you can choose between two objects of taxation - “income” or “income minus expenses” (Article 346.14 of the Tax Code of the Russian Federation). You need to make a choice right away, since simplified taxation system payers indicate the object during registration. At the same time, the object of taxation can be changed annually. Accordingly, if in 2019 you apply the simplified tax system “income”, then you will be able to switch to the simplified tax system “income minus expenses” only from 2021.

Reporting when combining UTII and simplified tax system

If you conduct business both under the simplified tax system and under UTII, then no questions arise - declarations must be submitted under both special taxation regimes.

Let's consider situations where in practice only one taxation system is used:

| SITUATION | SOLUTION |

| Activities are carried out only on UTII, but a notification about the application of the simplified tax system was submitted | The issue of submitting a declaration under the simplified tax system in this case is definitely not resolved, but it is still safer to submit a zero tax once a year. Moreover, it does not require much time or labor. You can also send it by mail with acknowledgment of delivery. |

| Activities are carried out only according to the simplified tax system | In this case, there are no options: you will have to not only submit a UTII return, but also pay this tax. UTII does not depend on actual income received, so it must be paid even if there is no activity. For the same reasons, zeros for UTII are not provided. If you do not carry out activities on UTII, in order to avoid unnecessary payments, it is better to deregister as a UTII payer. |

Limitations of the simplified tax system

As part of the “simplified” plan, there is an income limit. The income limit for individual entrepreneurs on the simplified tax system has not changed compared to 2021 - until January 1, 2021, the effect of the deflator coefficient is not taken into account. It is assumed that the income limit is 150 million rubles. will continue for 2021 and 2021.

The average number of employees is also taken into account - 100 people. The average annual cost of fixed assets is 150 million rubles.

“Simplified” applies to all types of activities, with the exception of lawyers, banks, insurance funds, pawn shops and other organizations listed in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation.

The share of participation of other organizations in the capital structure should not exceed 25%.

Briefly about tax regimes

The simplified taxation system is very popular among small businesses. It is used everywhere and is suitable for almost any activity. There are certain conditions for the transition to the simplified tax system, including: the number of employees on average per year is no more than 100 people, the annual income, as well as the residual value of fixed assets, is no more than 150 million rubles. The simplified system is more profitable than the basic system, since instead of several taxes you need to pay one and at lower rates.

A single tax on imputed income applies to certain types of activities, including retail trade, catering services and many others. It is valid only in those territories where it is introduced by the laws of local authorities. The advantages of UTII are that the tax is paid on theoretical income and does not depend on how much the businessman actually earned. Numerous calculations show that for those types of activities for which UTII has been introduced, it is the most profitable.

And now more about the combination of the simplified tax system and UTII regimes, about taxation and the peculiarities of this process for individual entrepreneurs and organizations.

simplified tax system “income” in 2021: advantages

For the simplified tax system “income” the rate is 6%. That is, in this case, costs do not play any role. Only income is taken into account in the tax base and is multiplied by 6%. In this case, the tax can be reduced.

An organization or individual entrepreneur with hired employees can reduce tax by 50%. According to clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation, the tax is reduced:

- the amount of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory health insurance, compulsory social insurance against industrial accidents and occupational diseases paid in a given tax period;

- the amount of expenses for payment of temporary disability benefits for days of temporary disability of the employee, which are paid at the expense of the employer (with the exception of industrial accidents and occupational diseases);

- for the amount of payments (contributions) under voluntary personal insurance contracts.

Individual entrepreneurs who do not provide compensation to individuals reduce the amount of tax on insurance premiums paid for compulsory pension insurance and compulsory health insurance.

Another advantage of individual entrepreneurs using the simplified tax system “income” is rare checks. Using this “simplification” is beneficial for those whose share of expenses is less than 60% of the total.

Do I need to deregister as a UTII payer?

Another problem for those who combine or plan to combine UTII and the simplified tax system is related to the new rule on the need to switch to a common taxation system in the event of a “failure” from the “imputation” due to the sale of “non-retail” goods. At the same time, legislators did not make any exceptions for taxpayers under the simplified tax system (new edition of clause 2.3 of article 346.26 of the Tax Code of the Russian Federation). This means that if we interpret this norm literally, it will not be possible to remain on the “simplified” system in such a situation.

In our opinion, most likely this is a mistake by legislators who simply forgot to correct this part of the norm. This is evidenced, in particular, by the fact that for those who apply the PSN, in the same situation, the possibility of switching to the simplified tax system is directly enshrined in the Tax Code of the Russian Federation (new edition of clause 6 of Article 346.45 of the Tax Code of the Russian Federation).

But since there are no official clarifications on this matter yet, we advise those who plan to carry out “non-retail” sales in 2021 and have decided, in this regard, to switch to the simplified tax system for retail, to officially abandon the “imputation”. Otherwise, when the first “non-retail” operation appears, you will have to forcibly leave the UTII, and then there may be problems with the continued use of the “simplified” tax.

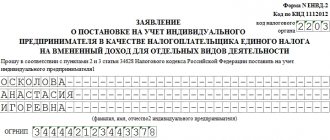

Let us remind you that in order to voluntarily leave the “imputation” in connection with the transition to the simplified tax system, you need to submit an application to the tax authority at the place of registration as a UTII taxpayer. Individual entrepreneurs submit such an application in the form of UTII-4, organizations - in the form of UTII-3. The filing deadline is no later than January 15, 2021 (clause 3 of article 346.28, clauses 6 and 7 of article 6.1 of the Tax Code of the Russian Federation). The application must indicate 01/01/2020 as the date of termination of the application of UTII.

Submit an application in the UTII-3 form via the Internet, submit reports according to the simplified tax system and UTII

What you need to know about UTII

This special regime is beneficial for many organizations, but it will only apply until 2021.

For UTII, it doesn’t matter how much you earn - there is no maximum limit. But imputed income is important, which is calculated according to the rules prescribed in Art. 346.29 of the Tax Code of the Russian Federation: calculated as the product of the basic profitability for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity. This is what needs to be paid.

Payers of UTII can reduce the amount of tax calculated for the tax period by the amounts of payments and benefits that were paid in favor of employees employed in those areas of activity for which a single tax is paid. In this case, the amount of reduction cannot exceed 50% of the calculated tax.

An individual entrepreneur without employees has the right to reduce the amount of UTII by the amount of insurance contributions paid (for himself) in a fixed amount to compulsory health insurance and compulsory medical insurance without applying the 50% limit.

Sending documents

In order not to be late with the start of patent activities, it is better to use the method of quickly and guaranteed submission of the application. There are several options:

- personal account on the website of the Federal Tax Service. applications, fill out and send online if you have your own digital signature. If there is no electronic signature, print out the application and take it to the Federal Tax Service or the MFC;

- personal visit to the Federal Tax Service inspection - we transfer the application from hand to hand;

- MFC branch. Specialists will accept the printed application and send it to the Federal Tax Service. Sending via electronic communication channels is possible, you need to check with your MFC;

- sending by courier or express mail with a valuable letter with notification;

- a special online accounting service “My Business”, from which an application is generated and sent in 3 clicks.

If it is not possible to send the application yourself, you need to prepare a notarized power of attorney for the guarantor.

As you can see, switching from UTII to the patent taxation system is not difficult; you just need to take care of preparing the application in advance and submit it on time.

Who benefits from using UTII and why?

UTII is beneficial for those who are engaged in retail, catering, provide household services, as well as transportation services.

Organizations and individual entrepreneurs on UTII providing services to the population, as well as individual entrepreneurs on UTII without employees, engaged in retail and catering, received a deferment on the use of online cash registers until July 1, 2021. This is one of the reasons why many switched to UTII - to save money. However, UTII has limitations:

1. If there is no limit on revenue, then there is one on the number of personnel - no more than 100 people.

2. For UTII in Art. 346.29 of the Tax Code of the Russian Federation and Art. 346.26 of the Tax Code of the Russian Federation specifies certain types of activities:

- retail;

- public catering;

- household and veterinary services;

- repair, maintenance and washing services for motor vehicles;

- distribution, advertising placement;

- services for the temporary use of trading places and land plots;

- temporary accommodation and accommodation services;

- services for the transportation of passengers and goods by motor transport;

- parking services.

3. The share of participation of other legal entities is no more than 25%. If a share in the authorized capital of an organization is sold to another legal entity and its share exceeds 25%, then it will automatically transfer to the OSN.

Also, for UTII there are no limits on the cost of fixed assets.

Combining “retail imputation” with wholesale trade

Note that exactly the same consequence - complete loss of the right to “retail imputation” - will occur in a situation if the retail UTII taxpayer conducts wholesale trade in the same municipality (within the framework of the simplified tax system or OSNO). The new version of paragraph 2.3 of Article 346.26 of the Tax Code of the Russian Federation states that the right to UTII for retail trade is lost by taxpayers who “sell goods not related to retail trade” in accordance with Article 346.27 of the Tax Code of the Russian Federation. And Article 346.27 of the Tax Code of the Russian Federation names the type of contract under which goods are sold as the main feature of retail trade. This can only be a retail purchase and sale agreement. (The article “Drawing up trade transactions: what is the difference between a supply agreement, a purchase and sale agreement and a retail purchase and sale agreement” will help you avoid making mistakes when drawing up a retail purchase and sale agreement).

Thus, after January 1, the “retail imputator” must take into account the following. As soon as he enters into another agreement for the sale of goods (purchase and sale or supply), he will not only have to pay taxes on this transaction under a different taxation system (as is happening now), but also completely leave the “retail” UTII.

Find out the tax system of the counterparty and the amount of taxes paid by him

How can tax systems be combined?

Organizations can combine the simplified tax system and UTII (clause 4 of article 346.12).

An individual entrepreneur can combine the simplified tax system and UTII, the simplified tax system and PSN, and even the simplified tax system with UTII and PSN.

But before you seriously engage in combination, it is worth calculating optimization. When choosing one or another tax regime, calculate the tax burden - this will allow you to understand the benefits.

It is often more profitable for individual entrepreneurs to use the simplified tax system of 6% and combine it with PSN or UTII.

For organizations involved in retail, it makes sense to use UTII.

Why is it necessary to combine special modes at all? Imagine that your organization is engaged in retail, that is, it has several stores that operate on UTII. But since UTII only applies to certain types of activities, tax authorities often try to prove that you sold goods to a legal entity, which is already considered wholesale trade. Therefore, on the amount received for selling goods to a legal entity, you need to pay tax under the OSN.

To avoid such situations, organizations almost always write an application to the simplified tax system at the same time as the UTII. Please note: new organizations can switch to the “simplified” system within 30 days, while existing organizations can only switch to the “simplified” system from the beginning of the year. Therefore, if you are currently on UTII, then in the middle of the year you will no longer be able to switch to the simplified tax system; this can only be done starting next year.

Organizations engaged in trade very often combine UTII with the simplified tax system “income”, and not “income minus expenses”. Accordingly, they divide the indicators. Which ones exactly?

First of all, income.

For “simplified” there is an income limit of no more than 150 million rubles, so income must be divided clearly. Moreover, in Art. 346.13 of the Tax Code of the Russian Federation states that income from UTII is not included in the maximum limit. What can be done in this case?

- The best thing is to divide the income using accounting. That is, create separate accounts in accounting: income within the framework of the “simplified tax” and income within the framework of UTII.

- Divide revenue based on receipt reports. When using cash registers, the required check details are the taxation system that was used in the calculation. Accordingly, UTII will appear on one check, and “simplified” on the other.

- Divide by payment types. For example, everything that comes in “simplified” is by bank transfer, and everything that is in retail is through cash register, etc.

Often organizations switch to the simplified tax system for “income” precisely because expenses in this case are not important and there is no need to divide expenses according to different taxation systems.

If they choose UTII and simplified tax system “income minus expenses”, then expenses must be divided without fail: separately take into account what belongs to UTII, separately what belongs to simplified tax system, and separately maintain general business expenses.

But even when combining the simplified tax system “income” and the simplified tax system “income minus expenses”, the number of employees is necessarily divided. This is important because the UTII includes types of activities where people are the physical indicator - for example, household services. Therefore, you need to determine who will pay and who will not.

On UTII and “simplified” taxes, the tax is reduced by insurance premiums. Therefore, it is necessary to divide insurance premiums.

Results

The simultaneous use of the simplified tax system and UTII is possible subject to compliance with the criteria limiting the use of these special regimes. For legal entities, combining modes requires additional detailing of accounting and tax accounting data, and for individual entrepreneurs - organizing the distribution of tax accounting data.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Specifics of division

Questions often arise with division. Let's say there is an organization that is engaged in wholesale trade. In addition to this, she also does renovations. Repairs are classified as household services, so the organization switched to UTII. For household services on UTII, the physical indicator is people. Therefore, those who repair must pay UTII.

Nadezhda Samkova, a leading expert consultant on taxation and presenter of the webinar “Combining the simplified tax system with other tax regimes: UTII, patent,” notes that the division by people should be made by employment contracts and time sheets. This way it will be clear that, for example, employee Ivanov repairs for such and such an amount, and only UTII needs to be paid from him. And the other employee - Petrov - is engaged only in wholesale trade and he does not play any role in UTII.

Thus, if an organization combines the simplified tax system and UTII, the number of employees who belong to different areas of activity can be distributed. But if the same employees participate in activities both on the “simplified” and on UTII, it is impossible to divide their number by different types of activities. Such employees need to be fully taken into account.

Difficult situations arise with such employees as the director and accountant. And in companies that, for example, have two repairmen and two wholesale trade specialists, as well as a director and an accountant, they ask themselves the question: for how many people should they pay UTII? According to the explanations of the Ministry of Finance, when combining the simplified tax system and UTII, administrative and managerial personnel are not divided. Therefore, in this case, the tax authorities will force you to pay for two repairmen, as well as for the director and accountant.

Understanding the number of employees is important primarily because of the need to divide insurance premiums.

Another example: the company has wholesale and retail. For retail, the physical indicator on UTII is area. Therefore, if you have a store with an area of 150 sq. m, you need to pay UTII. But a director can work in the same store and engage in wholesale trade. In this case, can you pay UTII not on the area, but in proportion to the revenue? The answer to this question is contained in the Letter of the Ministry of Finance dated September 11, 2012 No. 03-11-11/276: “The area of the trading floor is recognized as the part of the store, pavilion, occupied by equipment intended for displaying, demonstrating goods, conducting cash payments and servicing customers, the control area - cash registers and cash booths, the area of work places for service personnel, as well as the area of aisles for customers. The area of the trading floor also includes the rented part of the trading floor area. The area of utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale, in which customer service is not provided, does not apply to the area of the trading floor.” And one more thing: the procedure for distributing the area of a sales floor (or part of it) when carrying out on it simultaneously a business activity taxed under the simplified tax system and a business activity in respect of which UTII is paid and the area of the sales floor is used as a physical indicator is not defined by the Tax Code.

Tax on previously received income

Situation: should a simplified organization pay a single tax on income received from the sale of goods last year, if last year the organization was engaged only in wholesale trade, and this year the organization began to engage in retail trade, which is subject to UTII?

Answer: yes, it should.

If this year the organization has not lost the right to use the simplified tax regime, it must pay a single tax on payments received for goods that were sold in bulk last year. The payment amount must be included in income in the tax period in which the funds were received into its current account or cash register. That is, this year. This conclusion follows from the provisions of paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated July 24, 2008 No. 03-11-04/2/113.

Significance of accounting policies and distribution of insurance premiums

Since the mechanism for maintaining separate accounting is not clearly stated in the Tax Code, when combining regimes it is important to formulate an accounting policy. The wording can be taken from clause 8 of Art. 346.18 and paragraph 7 of Art. 346.26 of the Tax Code of the Russian Federation, as well as improve accounting. To simplify the process, use a special accounting policy creation wizard.

In the accounting policy, first of all, it is necessary to prescribe a mechanism for maintaining separate accounting for taxation. In Art. 346.18 and art. 346.26 of the Tax Code of the Russian Federation specifies that if the same expenses relate to different taxation systems, then these expenses must be divided in proportion to the income from these types of activities in the total.

Let’s say an organization combines “simplified” and “imputed”, the main employees work in different types of activities, but the accountant maintains both the simplified tax system and the UTII. The salary of this accountant is 35,000 rubles. Income from “simplified” is 300,000 rubles, and income from UTII is 100,000 rubles. If the special simplified tax system “income minus expenses” regime is used, then the whole 35,000 rubles cannot be paid. take the accountant's salary in simplified form. It is necessary to determine the share of “simplified” in the total mass, and only within this share take the amount for expenses.

To calculate the share, income received from the “simplified tax regime” is taken and divided by the total amount of income from both taxation regimes. Thus, for the example given, the share of “simplified” will be 75%, and the share of UTII will be 25%.

Then, to determine the share of the accountant’s salary according to the simplified tax system, his salary must be 35,000 rubles. multiply by 75% (0.75) - it turns out 26,250 rubles. The share of the salary for “imputation” is determined by multiplying 35,000 rubles. by 25% (0.25) - it turns out 8,750 rubles.

Insurance premiums from these amounts will be charged to expenses for the relevant types of activities.

Another example is that an individual entrepreneur pays fixed contributions for compulsory pension insurance in the amount of 29,354 rubles. Every year. If the income of an individual entrepreneur is more than 300,000 rubles, then the fixed amount is 29,354 rubles. + 1% of the amount of income exceeding RUB 300,000. How can an individual entrepreneur reduce fixed payments?

If an individual entrepreneur on UTII combines UTII and “simplified” tax, and hired employees work only on UTII, then you need to build on the Letter of the Federal Tax Service dated May 29, 2013 No. ED-4-3/ [email protected] , which states that an entrepreneur who combines The simplified tax system with the object “income” and UTII can reduce the tax under the simplified tax system by the entire amount of insurance premiums paid for itself if it attracts workers only to carry out activities transferred to UTII.

There is also a Letter from the Federal Tax Service dated August 10, 2017 No. 03-11-11/51316, the meaning of which is that insurance premiums that go to different regimes are divided in proportion to income. The Letter of the Federal Tax Service dated December 5, 2014 No. GD-4-3/25258 states that if you combine “simplified taxation” and UTII without employees, then you can send the payment wherever you want. But a problem arises: according to the simplified tax system, an individual entrepreneur pays tax at the place of residence, and according to UTII - at the place of business, and these can be different places. Therefore, it is better to include a fixed payment in any taxation regime, and take 1% into account in UTII and in the simplified tax system, so that there are no problems with the tax inspectorate.

If you have employees, then both the UTII and the simplified tax system can be reduced by only 50%. Until 2021, the rule worked: you could reduce the tax on UTII only for employees, but not for yourself. However, starting from 2021, this rule does not work - now individual entrepreneurs can reduce taxes both for themselves and for employees.

If you combine the simplified tax system “income minus expenses” with UTII, insurance premiums will be reduced by UTII, and in the “simplified tax” they will go to expenses. Therefore, you need to share the costs.

Separate accounting

The procedure for maintaining separate accounting when combining simplified taxation and UTII is not established by law. Therefore, develop it yourself and consolidate it in the accounting policy or in another local document approved by the head of the organization. When developing a procedure for maintaining separate accounting, be guided by the general standards of accounting.

You can organize separate accounting by distributing all income and expenses into several groups.

Divide your income into two groups:

- from simplified activities;

- from activities on UTII.

Divide expenses into three groups:

- related to activities in simplified language;

- related to activities on UTII;

- simultaneously related to the organization’s activities on a simplified basis and on UTII (for example, general business expenses).

Separate accounting for different types of activities can be maintained using additional sub-accounts opened to the income and expense accounts.

Division of non-operating expenses

One of the private questions is where to send non-operating income - to the “simplified” or to the “imputed” income. They can be divided. But there is a Letter from the Ministry of Finance dated January 29, 2016 No. 03-11-09/4088 and a Letter from the Ministry of Finance dated December 19, 2014 No. 03-11-06/2/65762 - they say that non-operating income, which you do not understand what type activities are required to be taken into account in the simplified tax system.

When distributing general expenses, you need to pay attention to Letter of the Ministry of Finance dated November 23, 2009 No. 03-11-06/3/271. It spells out the mechanism for generating general expenses.

Conditions for combining special modes

The Tax Code of the Russian Federation allows the combination of several special regimes, that is, the use of two or three at the same time by one legal entity or individual entrepreneur.

To do this, it is necessary that the business parameters simultaneously comply with the conditions of all combined modes. The Tax Code of the Russian Federation prohibits combining certain tax systems.

Let's look at the alternatives in table form.

Combination options

Of the listed options, combining the simplified tax system and UTII is the most common. PSN can only be used by individual entrepreneurs, and the Unified Agricultural Tax is limited to one area of activity - agriculture.

Next, we’ll talk in more detail about combining the simplified tax system and UTII.

Calculation procedure for UTII (individual entrepreneurs with employees)

If an individual entrepreneur operating under a single tax system attracts employees, then he is deprived of the right to take into account fixed contributions to reduce tax. However, he can reduce the tax burden through payments contained in Article 346.32 of the Code:

- insurance premiums for employees;

- benefits paid;

- payments under insurance contracts of hired citizens.

Fixed contributions of individual entrepreneurs are no longer subject to accounting. Until 2013, single tax payers could take into account contributions transferred for themselves, however, the Tax Code was edited, and such a privilege for individual entrepreneurs on UTII is no longer provided.

Definition of “Individual Entrepreneur with Employees”

To correctly calculate fixed payments, it is necessary to clearly understand which taxpayer is considered to have employees. If an individual entrepreneur has entered into an employment (or civil) contract with an individual, pays him wages or other remuneration, and makes insurance payments for him, everything seems obvious.

But ambiguous situations arise:

1. The individual entrepreneur who had employees fired everyone and no longer entered into employment contracts with individuals.

The Ministry of Finance explains that after all employees are fired, the entrepreneur, from the point of view of the UTII regime, turns into an individual entrepreneur without employees, and can reduce the amount of tax on fixed payments transferred in the prescribed manner (letter No. 03-11-11/41509, published 10/07/2013).

In this case, the status of individual entrepreneurs should be considered quarterly. If employees were fired in the 1st quarter, but at the beginning of the quarter they were still on the payroll, then fixed contributions are not deducted for that quarter. In the 2nd quarter, a deduction can be made, provided that no new employees were hired before its end. Only in quarters that the individual entrepreneur worked from start to finish without employees can fixed payments be deducted.

It must be remembered that unaccounted contribution amounts are not transferred to other quarters. If an individual entrepreneur paid a contribution while being an employer, then in the next quarter, when he works alone, this contribution will not be taken into account. In order for contributions to be taken into account, they must be transferred in the period that was worked without employees.

For example, an individual entrepreneur fires all employees in mid-May and then hires new people in December. Thus, the 3rd quarter was worked without employees. The individual entrepreneur fully paid the fixed contribution in July, which fully covered his tax for the 3rd quarter in the amount of 12 thousand rubles. The remaining amount (more than 8 thousand rubles) will not be taken into account in any of the periods, because it cannot be transferred.

When an individual entrepreneur hires his first employee, he becomes an employer and must undergo appropriate registration with the Pension Fund and the Social Insurance Fund. When all employees are laid off, deregistration is not necessary, as new employees may be needed in the future. The very fact of being registered as an employer does not in any way affect the procedure for deducting contributions from UTII. According to the comments of the Tax Service (letter No. ED-4-3/18595 dated 10.17.13) and the Ministry of Finance (letter No. 03-11-09/39228 dated 09.23.13), there are no employees employed under the contract yet and no payments are being made for them, Individual entrepreneurs deduct from tax fixed contributions paid for themselves.

2) The entrepreneur has non-working employees (on vacation, maternity leave, or sick leave).

Such a taxpayer cannot take into account fixed contributions for UTII. The existence of an agreement concluded with an employee and making payments in his favor are sufficient grounds for considering an individual entrepreneur an employer. Therefore, like any employer, he cannot reduce the tax.

For example, an individual entrepreneur has one employee who is on maternity leave. He makes payments required by law in her favor, and when calculating UTII, he is considered an entrepreneur using hired labor. This fact is confirmed by the Ministry of Finance (letter No. 03-11-11/14473, published on 04/25/13).

3) An entrepreneur conducts several types of activities under a single tax, but hired labor is used only in one.

Such an individual entrepreneur is the employer in relation to all activities. The presence of an employee even in one area of activity deprives him of the right to deduct contributions from UTII. The ban remains in force even when different activities are carried out in different municipal units and employees are employed in only one region. According to letter No. 03-11-09/37786, published by the Ministry of Finance on September 13, 2013, the presence of employees in any form with a single tax excludes the possibility of deducting fixed contributions.

For example, a taxpayer operates a retail store that employs contract salespeople. He also independently provides cargo transportation services. Both types are subject to UTII. In this case, he will be listed as an employer in both directions of his business.

4) The entrepreneur does not regularly employ employees, but once made a one-time payment.

This situation can arise when an individual entrepreneur has problems that cannot be solved by one person. Then he can enter into a contract with some person for a short period. In this case, he still becomes an employer, and a short period of time is not a reason for an exception to the general rules. Registration of an employee and making payments in his favor automatically deprives the taxpayer of the opportunity to deduct fixed contributions from tax. Even if the contract is concluded for 1 day, the individual entrepreneur will be considered the employer for the entire quarter.

5) The entrepreneur uses the services of workers hired informally (without a contract and without deduction of insurance payments for them).

If the tax service suspects that an entrepreneur uses unofficial workers, then he cannot use the restrictions that apply to individual entrepreneurs with employees based on guesswork alone. However, during the next inspection, the presence of employees will be clarified especially carefully, and their identification will result in serious fines. You should not put yourself at risk by using “shadow” labor, because sooner or later this fact will be revealed and the employer will be punished.

Date of payment of individual entrepreneur contributions

Having decided on the amount above which cannot be included in the calculation of taxes, you should then control the timing of payment.

Individual entrepreneurs are limited only by the general dates for payment of fixed contributions. In 2013, there was only one date - no later than December 31, 2013. During the year, individual entrepreneurs had the right to pay contributions in any amount or not pay at all, but transfer them in full at the end of the year. It was important to meet the only deadline - to transfer contributions for 2013 no later than December 31, 2013. If suddenly the individual entrepreneur did not meet the allotted time and transferred the contributions late, say in January 2014, then they can no longer be taken into account in calculating taxes, since the established deadline has been missed. For those who paid some part of their fixed contributions during 2013 (i.e., met the deadline by December 31, 2013), and the rest late, only the timely paid part can be taken into account. If you have taken into account the contributions in full, recalculate the tax as soon as possible, pay it additionally, and submit an updated declaration.