Why were new control ratios for calculating insurance premiums introduced?

All primary and updated Calculations for insurance premiums, in which:

- the total amount of “pension” contributions for the policyholder as a whole does not correspond to the information on contributions for each insured individual,

- The personal data of insured individuals does not correspond to reality and may be considered unrepresented by tax authorities, in accordance with clause 7 of Art. 431 Tax Code of the Russian Federation. It does not matter whether the established deadlines for submitting the Calculation are met or violated.

Law No. 335-FZ dated November 27, 2017 set out clause 7 of Art. 431 of the Tax Code of the Russian Federation in the new edition, expanding the list of grounds on which the calculation of insurance premiums may not be accepted. From 01/01/2018, tax authorities have the right to refuse admission if errors are found in the information for each individual for the reporting period or for each of the last 3 months of the billing period:

- in the amount of payments in favor of individuals (line 210 of subsection 3.2.1),

- in the base for “pension” contributions not exceeding the maximum amount (line 220 of subsection 3.2.1),

- in the amount of insurance premiums calculated from this base (line 240 of subsection 3.2.1),

- in the amount of payments for which “pension” contributions are accrued under the additional tariff (line 280 of subsection 3.2.2),

- in “pension” contributions calculated according to the additional tariff (line 290 of subsection 3.2.2).

To verify compliance with these requirements when filling out reports, in addition to the already existing ones, new control ratios for the calculation of insurance premiums were developed, given in the letter of the Federal Tax Service of the Russian Federation dated December 13, 2017 No. GD-4-11/25417. Tax authorities began to use them when accepting calculations for 2021, and will continue to use them in the future. These innovations also apply to “clarifications” submitted in 2021 for the reporting periods of 2021.

Let us recall that this is the third version of the test ratios, which complements the ratios used previously: the first version of the control ratios of the form for calculating insurance premiums was published by the Federal Tax Service of the Russian Federation in its letter No. BS-4-11/4371 dated March 13, 2017, and updated on June 30, 2017 , setting out the second version in letter No. BS-4-11/12678.

Examples of changes

As an example of the changes made in the control ratios, we point out the formula for comparing calculation data with data from form 6-NDFL. If previously the difference between these lines 020 “Amount of accrued income” and 025 “Amount of accrued income in the form of dividends” of Section 1 of Form 6-NDFL was compared with line 030 of the Calculation “Amount of payments and other remuneration calculated in favor of individuals”:

KS = st. 020 rub. 1 6-NDFL - art. 025 rub. 1 6-NDFL >= Art. 030 gr. 1 other 1.1 rub. 1 NE,

then in the new version this indicator, determined according to form 6-NDFL, is compared with line 050 of the Calculation “Base for calculating insurance premiums”:

KS = st. 020 rub. 1 6-NDFL - art. 025 rub. 1 6-NDFL >= art. 050 gr. 1 other 1.1 rub. 1 ST.

It should also be noted that in the updated version, three new control ratios of 6-NDFL and insurance premiums have appeared to check the funds allocated by the Federal Social Insurance Fund of the Russian Federation for the payment of insurance coverage (monthly), for example:

KS = gr. 3 tbsp. 80 applications 2 r. 1 SV = the amount of funds allocated by the Federal Social Insurance Fund of Russia for the implementation (reimbursement) of expenses for the payment of insurance coverage in the 1st month of the reporting period.

If the control ratios in the Calculation of Insurance Premiums do not pass the test

When the ratios in which the Calculation is considered not submitted are violated, the Federal Tax Service Inspectorate sends the payer a notice of non-submission of the calculation: if the calculation was submitted electronically - no later than the next day after its receipt, and if the calculation was submitted in “paper” form - no later than 10 days after receiving the calculation of the Federal Tax Service Inspectorate .

To make corrections and resubmit the Calculation of Insurance Premiums, in which the 2018 control ratios are violated, the policyholder is given 5 working days from the date of sending the electronic notification, and 10 days after sending the notification “on paper”. If everything is corrected on time, the date of submission of the Calculation will be considered the date of submission of the original (not accepted) version. If the deadline is not met, the payer is subject to a fine, as for late submission of reports (clause 1 of Article 119 of the Tax Code of the Russian Federation): 5% of the unpaid amount of contributions for each overdue month, but not more than 30% of this amount, and not less than 1000 rub.

If there is a violation of the control ratios in the report on insurance premiums that do not lead to refusal of admission, tax authorities may require that appropriate written explanations be submitted within 5 working days, or the necessary corrections be made to the Calculation.

What happens if there is a discrepancy?

Even if you submit a calculation on time, if there are discrepancies between the total amount of insurance premiums and the amount of contributions for each employee, the calculation will be considered unsubmitted. The Federal Tax Service will notify you about this. It is important how you submitted the calculation:

- electronically. Expect notification no later than the day following the day of payment;

- on paper. You will receive notification within 10 business days after the day the inspectors received the calculation.

Once you receive notice, you must correct your calculation within five business days. Then the date of submission of the specified calculation will be considered the date when you submitted it initially. If you do not have time to correct the calculation, there will be a fine. This follows from paragraph 7 of Article 431 of the Tax Code of the Russian Federation.

How to check the control ratio for insurance premiums yourself

All of the above letters from the Federal Tax Service on control ratios are in the public domain and can be used by insurance premium payers for self-checking of the compiled Calculations.

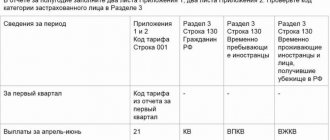

For the Calculation of insurance premiums, the control ratios are summarized in a table, the columns of which include: the code of the source document being compared, the serial number and wording of the control ratio, a link to the violated article of the law and a description of the violation, as well as an indication of what actions the Federal Tax Service should take in the case of each of violations.

When checking the control ratios for insurance premiums, the indicators are checked between the corresponding lines within the Calculation of insurance premiums (intra-document ratios), and also correlated with the indicators of the 6-NDFL Calculation and the Social Insurance Fund information on expenses incurred (inter-document ratios).

Payers can check the control ratios for the calculation of insurance premiums manually by referring directly to the text of the letter of the Federal Tax Service No. GD-4-11/25417 - this option can be used by those who submit the Calculation on paper. If the Calculation is filled out using the free ]]>service “Taxpayer Legal Entity”]]> on the Federal Tax Service website, then the updated control ratios will be checked there automatically.

What has changed in the CS for the DAM in 2021

The new control ratios used for the ERSV report created in 2021 are contained in the Letter of the Federal Tax Service of Russia dated 02/07/2020 No. BS-4-11/ [email protected] They are formed according to the same principles as the control ratios that preceded them (they were given in the Letter of the Federal Tax Service of Russia dated December 29, 2017 No. GD-4-11/ [email protected] ), i.e., they are divided into 3 types (related only to the current report, intra- and inter-documentary), each of which requires compliance with its own rules when check:

- according to the current report, the relevance of its form is checked, the correctness of entering data about the reporting period, about the submitter of the report and the individuals included in it, the correctness of the total ratios between the figures given in the sections and subsections of the report;

- the stage of internal document verification is based on linking the figures of the current report and the data of the same reports for previous periods, as well as line-by-line recalculation of the data shown in the report;

- Inter-document control involves linking the figures given in the report with information provided in other reports and publicly available information that allows one to assess the amount of income paid.

The changes made to the report form from 2021 affected the first 2 groups of control ratios, leading to:

- updating references to the line numbers of subsections of Appendix 1 and those that have changed their numbers of attachments to Section 1;

- adding relations relating to new lines that appeared in subsections 1.1, 1.2 of Appendix 1 and Appendix 2 to Section 1;

- changing the description of relationships using the line numbering of section 3;

- the need to take into account the payer type code when choosing an appropriate reference ratio.

New ratios for contributions within the DAM

| 1.193 | |

| if field 001 adj. 1 rub. 1 SV = 20, then the presence of adj. 1 rub. 1 SV with value 01 in field 001 is required | Missing adj. 1 rub. 1 SV with the value 01 in the 001 field if there is an adj. 1 rub. 1 SV with value 20 in field 001 |

| 1.194 | |

| if in subsection 3.2.1 p. 3 SV according to FL (according to SNILS indicators, full name) field value 130 = MS, then the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = NR required | Subsection 3.2.1 p. is missing. 3 SV according to FL with a value in field 130 = NR in the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = MS |

| 1.195 | |

| if in subsection 3.2.1 p. 3 SV according to FL (according to SNILS full name indicators) field value 130 = VZHMS, then the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = VZHNR required | Subsection 3.2.1 p. is missing. 3 SV according to FL with a value in field 130 = VZHNR in the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = VZhMS |

| 1.196 | |

| if in subsection 3.2.1 p. 3 SV according to FL (according to SNILS full name indicators) field value 130 = VPMS, then the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = VPNR required | Subsection 3.2.1 p. is missing. 3 SV for FL with a value in field 130 = VPNR in the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = VPMS |

| if in subsection 3.2.1 p. 3 SV according to FL (according to SNILS indicators, full name) field value 130 = MS, then in subsection 3.2.1 p. 3 SV for this FL with a value in field 130 = NR line 150 for each field value 120 = minimum wage | Line 150 for each value of field 120 of subsection 3.2.1 p. 3 SV with a value in field 130 = NR < minimum wage in the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = MS |

| 1.198 | |

| if in subsection 3.2.1 p. 3 SV according to FL (according to SNILS full name indicators) field value 130 = VZHMS, then in subsection 3.2.1 p. 3 SV for this FL with a value in field 130 = VZHNR line 150 for each field value 120 = minimum wage | Line 150 for each value of field 120 of subsection 3.2.1 p. 3 SV with a value in field 130 = VZHNR < minimum wage in the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = VZhMS |

| 1.199 | |

| if in subsection 3.2.1 p. 3 SV according to FL (according to SNILS indicators, full name) field value 130 = VPMS, then in subsection 3.2.1 p. 3 SV for this FL with a value in field 130 = VPNR line 150 for each field value 120 = minimum wage | Line 150 for each value of field 120 of subsection 3.2.1 p. 3 SV with a value in field 130 = VPNR < minimum wage in the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = VPMS |

Filling RSV-1

Let's consider the preparation of the RSV-1 report.

The title page contains the following information:

- TIN. It is indicated in the tax registration certificate. For legal entities, the TIN is 2 characters shorter, for individual entrepreneurs. Therefore, dashes are placed in the remaining cells.

- Checkpoint. This parameter is indicated in the registration certificate. Individual entrepreneurs do not have it, so they put dashes in this column.

- Correction number. When submitting the report for the first time, enter 0.

- Billing period. The column indicates the reporting period for which RSV-1 is submitted. If the report is submitted for the 1st quarter, enter 21 (period codes are indicated in Appendix 3 to the Completion Procedure).

- Calendar year. When filing reports in 2021, enter “2020” in the field.

- Code of the Federal Tax Service to which the report is submitted.

In the column “By location (code)” indicate one of the following codes:

- 120 - individual entrepreneurs (individual entrepreneurs);

- 214 - Russian companies;

- 222 - separate divisions of Russian companies;

- 335 - separate divisions of foreign companies;

- 124 — members/heads of peasant farms;

- 240 - legal entities and heads of peasant farms;

- 122 - notaries engaged in private practice;

- 121 - lawyers who established a private office;

- 112 - individuals who are not individual entrepreneurs;

- 217 are legal successors of Russian companies;

- 350 - international organizations.

Next indicate the name. Then - the type of activity code according to OKVED. After this, enter a contact phone number. Finally, indicate the number of sheets on which the calculation was compiled. Indicate the number of application sheets, if any. Choose a code that matches the person submitting the report. If the RSV-1 is submitted by the employer personally, enter 1 in the box, if his representative - 2. Enter the full name of the manager or other responsible person acting on the basis of a power of attorney. If necessary, indicate the power of attorney data.

After compiling the title page, it is better to proceed to filling out Appendix 1 in Section 1.

We fill out Subsection 1.1 of Appendix 1. In the lines we indicate the following data:

- 001 — rate code of the fee payer (1 or 2);

- 010 - total number of insured employees (for the 1st quarter, for each month of the 1st quarter separately;

- 020 - the number of employees who are paid income subject to contributions to compulsory pension insurance;

- 021 - fill out if during the reporting period the employee’s income exceeded the maximum base for contributions (in 2021, the maximum base for compulsory pension insurance is 1,292,000.00 rubles);

- 030 - amounts of payments to employees subject to contributions to mandatory pension insurance;

- 040 - if during the year payments were not subject to contributions to compulsory pension insurance;

- 045 - amounts of incurred and confirmed expenses that are associated with making a profit, as well as amounts of expenses that cannot be documented, but are accepted for deduction in the amounts established by the Tax Code of the Russian Federation;

- 050 - contribution base (calculated using the formula: line 030 - line 040 - line 045);

- 051 - contribution base that exceeds the maximum limit;

- 060 - the amount of accrued insurance premiums (calculated by the formula: line 050 * tariff, and by the formula line 060 = line 061 + line 062);

- 061 - the amount of insurance premiums calculated for the reporting period from the base, which does not exceed the limit of 1,292,000.00 rubles;

- 062 - the amount of contributions calculated from the base, which exceeds the limit (calculated using the formula: line 051 * tariff).

Subsection 1.2 reflects data on contributions to compulsory medical insurance. It is filled out in the same way as Subsection 1.1.

Then fill out Appendix 2 to Section 1.

Fill in the following lines:

- 001 — tariff code in accordance with Appendix 5 to the Procedure for filling out the DAM;

- 002 - indicate code 1 if the employee benefit is paid by the Social Insurance Fund (direct payments, bypassing the employer), or code 2 if the VNiM benefit is paid by the employer with the offset of funds from the Social Insurance Fund;

- 010 - total number of insured persons in the reporting period;

- 015 - the total number of individuals from whose payments or rewards insurance premiums are calculated (on an accrual basis);

- 020 - amount of payments to employees in the reporting period;

- 030 - payments that are not subject to contributions (state benefits, compensation, one-time financial assistance and others);

- 040 - payments that exceed the maximum base for contributions to the Social Insurance Fund in 2021 (limit - 912,000.00 rubles);

- 050 - base for calculating contributions (calculated as follows: line 020 - line 030 - line 040);

- 055 - the basis for calculating insurance contributions for compulsory social insurance of VNiM in relation to the amount of payments and other remunerations that are accrued in favor of foreign citizens and stateless persons temporarily staying in the territory of the Russian Federation;

- 060 - the amount of calculated contributions based on the results of the reporting period;

- 070 - fill in if you use an offset payment system;

- 080 - the amount of expenses that are reimbursed by the Social Insurance Fund (filled in when using the credit system);

- 090 - the amount of contributions to be paid, or the amount of excess expenses over the calculated contributions (calculated using the formula: line 060 - line 070 + line 080), in the “sign” line indicate code 1, if contributions must be paid, code 2, if the cost of paying benefits exceeds the amount of calculated contributions.

Appendix 3 to Section 1 is completed if the following payments were made during the reporting period:

- for temporary disability;

- for child care;

- for pregnancy and childbirth;

- for registration of pregnancy and childbirth in the early stages;

- at the birth of a child;

- caring for a disabled child;

- for burial.

For each such payment, indicate the number of cases that are the basis for the payment or their recipients, the amount of expenses incurred, the number of paid days of incapacity (number of benefits and payments). Line 100 records the total amount of expenses. It is calculated as the sum of the values indicated in lines 010-090. Line 110 reflects the amount of benefits accrued but not paid.

Then fill out Section 1.

It reflects summary data for each type of insurance premium. Indicate the OKTMO code by which insurance premiums were paid. Then fill in the following lines:

- 020 - KBK through which contributions were transferred;

- 030 - total amount of accrued insurance premiums;

- 031-033 - amount of accrued insurance premiums;

- 040 - KBK for insurance premiums for compulsory medical insurance;

- 050 - the amount of compulsory medical insurance contributions accrued since the beginning of the year for all employees;

- 051-053 - amount of contributions for the last quarter (monthly);

- 060-073 - fill out if in the reporting period there were contributions to compulsory pension insurance at an additional tariff;

- 080-093 - filled out if there were contributions for additional social security during the reporting period;

- 100 - BCC for contributions in case of VNiM;

- 110 - the amount of insurance contributions for compulsory social insurance in case of accidents, which is subject to payment to the budget for the reporting period;

- 111-113 - amount of contributions payable monthly;

- 120 - the difference if the amount of benefits issued exceeds the amount of accrued contributions;

- 121-123 - excess amount broken down by month.

In Section 1, fill out either block 110-113 or 120-123. These blocks cannot be filled at the same time.

Then fill out Section 3. The following information is indicated on the lines:

- 010 — sign of cancellation of information about the insured person (this field is not filled in when submitting the DAM for the first time);

- 020-070 - information about employees;

- 080 - code of the country of which the employee is a citizen (643 - Russian Federation and others);

- 090 - employee gender (1 - woman, 2 - man);

- 100 - identification document code (21 - passport, 10 - passport of a foreign citizen, 07 - military ID);

- 110 - passport data or data of another identity document;

- 120 - numbers of months of the reporting period;

- 130 - category code of the insured person (Appendix 7 to the Filling Out Procedure);

- 140 - the amount of payments to the employee on a monthly basis;

- 150 - base for contributions to compulsory pension insurance within the limit (in 2021 it is 1,292,000.00 rubles);

- 160 - the amount of payments under the GPC agreement;

- 170 - the amount of contributions from the base, which does not exceed the limit of 1,292,000.00 rubles (for OPS).

Block 3.2.2 is filled out if in the reporting period there were payments that are subject to contributions to compulsory pension insurance at an additional tariff.

Calculation of insurance premiums for individual entrepreneurs in 2018

Individual entrepreneurs must calculate and pay insurance premiums for themselves even if they do not have a single employee. When calculating, you will need to focus on the current minimum wage. However, this year contributions for entrepreneurs are set at a fixed amount. Accordingly, the minimum wage for calculating insurance premiums for individual entrepreneurs 2021 is not applied.

As for the need to form an ERSV in this case, this is not required, since the calculation does not reflect information about the contributions paid for the entrepreneur.

SZV-M may be canceled in 2021

As part of the initiative of the All-Russian Popular Front “Reducing reporting for business,” a proposal was made to optimize the reports that employers submit to the Pension Fund.

Experts noted that after the introduction of electronic work books, information from SZV-M, SZV-STAZH and SZV-TD duplicate each other. Therefore, it is necessary to cancel SZV-M in relation to persons working under an employment contract, since employers send information about them to the Pension Fund promptly using the SZV-TD form. For the SZV-TD form itself, the due date will be changed. Now it is only one day, but after the cancellation of SZV-M it will be increased to 3 days. The initiative will be considered before the end of the year, so perhaps in January policyholders will not have to fill out the SZV-M form.

Use ConsultantPlus materials to fill out and submit the SZV-M

Open instructions for filling out from ConsultantPlus experts

Let's sum it up

- From reports compiled for the periods of 2021, the form of the ERSV form has been changed. There are no fundamental changes in it, but they led to a change in the numbering of lines in sections 1 and 3 and appendices to section 1. In appendices 1 and 2 to Section 1, additional lines were introduced in the field to indicate the income payer type code.

- Changes in line numbering required adjustments to the description of previously used control ratios. The choice of this description should be made taking into account the type to which the income payer belongs.

- Introduced relationships for new rows.

If you find an error, please select a piece of text and press Ctrl+Enter.

Instructions for filling out section IV of the SZV-M report

The last section is presented in the form of a table, which contains a list of employees who have concluded labor contracts at the enterprise in the current period, including GPC agreements. The table consists of four columns:

- the first one contains the serial number of the line;

- in the second - full name. employee in the nominative case. If the patronymic is missing, it is not indicated;

- in the third - SNILS (employee registration number in the Pension Fund of Russia). This is mandatory information;

- in the fourth - TIN (employee registration number with the Federal Tax Service). As stated in Resolution of the Board of the Pension Fund of the Russian Federation No. 83p, this column is filled in if the policyholder has the necessary information.

You can enter data into the table either in alphabetical order or randomly.

At the end, the report must be signed by the general director or entrepreneur indicating the position and full name. The date of compilation of the form is also indicated here and a stamp is affixed if it is used in the company. Since the SZV-M form does not provide for the possibility of signing the report by a representative of the policyholder, it must be submitted personally either by the director of the organization or by the entrepreneur.

Sample of filling out section IV

A sample document completely filled out according to the instructions looks like this:

RSV - what has changed due to coronavirus

Coronavirus has caused many changes in insurance premiums. First, the state introduced a reduced tariff of 15% for all SMEs, and then additionally established a zero tariff for the most affected industries. Therefore, companies fill out the DAM for this half-year in one of three ways - at standard, reduced and zero tariffs.

We told you how to calculate contributions at a reduced rate and fill out the DAM.

Exemption from taxes and contributions for the second quarter is regulated by Federal Law No. 172-FZ dated 06/08/2020. The zero tariff is valid for insurance premiums for compulsory medical insurance, compulsory medical insurance, and VNiM for the period April - June 2020. This applies to both payments within the maximum base and above it.

The benefit is valid for the most affected individual entrepreneurs and organizations that were included in the SME register based on the results of reporting for 2021. It also applies to some socially oriented NPOs. You can check your right to benefits using your tax identification number (TIN) in a special service of the Federal Tax Service.

What are the changes?

On October 30, the Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] . It changed the form, filling procedure and electronic format.

The order comes into force starting from the submission of the DAM for 2020. Amendments to the form and filling procedure are related to changes in tax legislation. Thus, in 2021, the report on the average headcount was canceled, reduced contribution rates for SMEs were introduced, and from January 1, 2021, contributions for the IT sector will be reduced.

Delivery deadlines remain the same. Submit the DAM for 2021 no later than February 1, 2021, since January 30 falls on a Saturday.

Checking pension insurance contributions

For new field 045

, which includes the amount of expenses under the author's contract and the costs of intellectual property rights, also introduced a control ratio. The amount of expenses from the beginning of the billing period must match the same figure for the previous period plus expenses for 3 months of the reporting period.

The Federal Tax Service also clarified that when checking the reflection of the amount of taxable payments, it is necessary to take into account payments to students, which are indicated in Appendix No. 9.

It is also necessary to take into account the additions made to the inter-document control ratios for the DAM. Thus, the amount of payments to employees within the framework of labor relations must be compared with the minimum wage and the average industry salary in the constituent entity of the Russian Federation: payments should be higher.

You can simplify the process of submitting calculations for contributions for injuries by using the program for preparing and checking electronic reporting “Astral Report”, in which the forms and control ratios to them are updated automatically and are always up to date.

Document: