Payment

The obligation to pay severance pay and average monthly earnings for the period of employment is established by the Labor Code

Loss of the current period In a situation where, at the end of the year, the enterprise’s expenses exceed income,

In what currency can residents make payments? Let us turn to Art. 140 of the Civil Code of the Russian Federation

In cases where the earned remuneration is not transferred to the employee’s bank card by non-cash method,

As always, we will try to answer the question “Kbk 18211603010010000140 Decoding In 2021”. A

General information An on-site inspection agreement is being formed on the basis of Art. No100 Tax Code of Russia. Issued

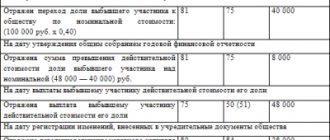

Depositing the authorized capital into the current account The financial transaction can be carried out by one or more

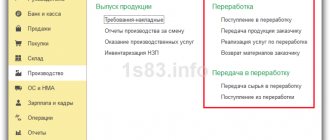

The organization can outsource materials for further processing and manufacturing of products. Such materials

Latest version of Art. 136 of the Labor Code of the Russian Federation established the rights of employees to receive equal income. Now

Situation: an organization bought a building and rights to the land plot on which the property is located for