How to calculate dividends

Payments of dividends in a company are initiated by the board of shareholders after the closure of the register. Profit is distributed according to the company's dividend policy.

The amount of payments on preferred shares is determined as a percentage of the par value, or in a fixed form.

Calculation of dividends on ordinary securities:

Distributable earnings / Number of common shares = Dividend amount per share.

To make calculations, you can use an online calculator or find examples of dividend calculations for similar stocks.

As a rule, this information is disclosed in the company's financial statements, so the shareholder does not need to independently calculate this indicator. The amount of dividends per share in the previous reporting year is indicated in the report “Information on accrued income on the issuer's securities,” which is also published in open sources.

Typically, the issuer transfers dividends to preferred shareholders into the account within ten business days. To other shareholders - within twenty-five working days. The maximum period during which dividends are transferred can be approximately a month after the cut-off date.

Such payments are subject to personal income tax of 13%. The amount of net dividend income will be the amount minus tax. No benefits - reduced rates or deductions are applied to income tax on dividends. When selling shares and receiving income from exchange rate differences, expenses incurred are taken into account - for the acquisition of securities and their maintenance.

Where do dividends come from, where can you get information?

Dividends are, first of all, an instrument of investment policy. Private companies that are interested in capitalization, attracting investment and creating a profitable business reputation, as a rule, willingly and often pay them to their shareholders.

In Russian companies, dividends are paid from the company's net profit for the reporting period. Less commonly, from the calculated amount of free or net cash flow.

The amount of net profit can be found out from the company’s accounting reports, in particular from Form No. 2 “Profit and Loss Statement”.

After market participants have learned the amount of net profit, it is necessary to find out one more indicator - what part of it the issuing company allocates to paying dividends this year. You can view this information in compiled form here.

To get an idea of how much money the company will allocate, you will need to multiply the amount of net profit by the dividend payout ratio. And to find out the size of the dividend due on one security, the resulting total must be divided by the number of issued shares.

But it should be borne in mind that this is still an approximate and not the only indicator. For example, some joint-stock companies pay dividends that in total exceed the profit received in the reporting year, for example, “Etalon” for 2021 will pay a total of 3.5 billion dividends for the year with a net profit of 0.8 billion rubles. Therefore, calculating net profit to pay dividends does not always help determine the profitability of shares.

You can get accurate information about how dividends are distributed among shareholders and how often they are paid from the company’s dividend policy. Often excerpts from it are contained on official websites.

Payment policies may change, so it is important to keep the information up to date. You should also be prepared for unforeseen circumstances that may affect the amount of dividend income.

You can find out about the most important dates from dividend calendars, for example here.

This is convenient because it contains information on:

- register closing dates,

- profitability of previous periods,

- dividend per share, etc.

Late payment

If during the payment period a participant or shareholder has not received dividends, then he has the right to demand the amounts due to him. He can do this within three years, starting from the next day after the end of the dividend payment period. The company's charter may provide for a longer period during which such demands can be made. But the maximum is five years. This procedure is provided for by paragraph 9 of Article 42 of the Law of December 26, 1995 No. 208-FZ and paragraph 4 of Article 28 of the Law of February 8, 1998 No. 14-FZ.

In addition, for delay, a participant or shareholder has the right to demand that the organization pay him interest (clause 16 of the Resolution of the Supreme Arbitration Court of the Russian Federation of November 18, 2003 No. 19). Determine their size based on the average interest rate on deposits published by the Bank of Russia for the corresponding periods at the location of the participant or shareholder.

Interest is calculated for the entire period of delay. That is, from the day following the last date for payment of dividends until the date of actual repayment of the debt (inclusive).

Such rules are established by paragraph 1 of Article 395 of the Civil Code of the Russian Federation.

When calculating percentages, take the number of days in a year equal to 360, and in a month - 30 (clause 2 of the resolution of the plenums of the Supreme Court of the Russian Federation and the Supreme Arbitration Court of the Russian Federation of October 8, 1998 No. 13/14). Determine the percentage using the formula:

| Interest on late payment of dividends | = | The amount of dividends due to the participant, shareholder | × | Interest rate | : | 360 days | × | Number of days overdue for the relevant period |

Attention: a joint stock company that pays dividends late may face fines.

By withholding dividends, the organization thereby commits an administrative offense. For this, the JSC can be fined from 500,000 to 700,000 rubles.

A fine is also provided for officials of a joint-stock company who are late in payment - from 20,000 to 30,000 rubles.

If the payment is late due to the mistakes of specific people, they may also be punished. For them, the fine will be from 2000 to 3000 rubles.

All this is established by Article 15.20 of the Code of the Russian Federation on Administrative Offences.

If within the established period a participant or shareholder does not demand payment of dividends to him, then he loses the right to them completely. An exception is a situation where a shareholder or participant did not assert their rights under the influence of violence or threat. If this was the case and he was able to confirm it, then the period of claim can be restored. That is, extend it for another three years.

Dividends declared (distributed) but not claimed by shareholders and participants are again included in the company’s retained earnings (clause 9, article 42 of the Law of December 26, 1995 No. 208-FZ, clause 4 of article 28 of the Law of February 8 1998 No. 14-FZ).

Types of dividends, on which shares are paid

Dividends are paid on both ordinary and preferred shares. These are types of dividends depending on the type of security.

Preferred shares according to the method of formation are:

- cumulative,

- non-cumulative

Cumulative ones accumulate partially or completely unpaid dividends for previous periods when, for example, the company was going through difficult financial times and suffered losses. In this case, dividends are not paid, they are accumulated and transferred to shareholders in financially favorable periods. They exist to maintain the loyalty of shareholders, so that the securities are not sold, but held, awaiting future dividends.

Cumulative preferred shares are more profitable than all others.

Dividend payments are also distinguished by purpose:

- regular , which are paid on an ongoing basis. Such income is beneficial to the holder, therefore there is the greatest demand for these securities in the market.

- additional , which the company can pay one-time, based on some positive events in its activities - a particularly profitable deal, retained earnings, etc. A company may decide to make a payment to maintain investor interest and enhance the attractiveness of its business reputation. May also be referred to as an extra or special dividend. As a rule, they are larger than regular ones, but are paid out much less frequently and are more difficult to predict.

- liquidation - due when the company is closed due to termination of activities.

According to the frequency of dividend payments, there are:

- once a year

- half year

- quarterly

- monthly

Based on the volume of payments, they are divided into:

- full

- partial (limited)

For example, if dividends are not paid in full, the issuer will pay a penalty to the investor.

By method of receipt:

- through a broker

- to a bank account

- in cash at the issuer's cash desk

- by postal money order

In order:

- cumulative privileged

- non-cumulative privileged

- preferred with a certain amount of dividend in the charter and with an indefinite amount

- ordinary shares

Dividend calendar

If you have 5–6 shares of individual issuers in your investment portfolio, then you can independently track the required dates for purchasing securities in order to increase the profitability of your investments. If there are more of them, the process becomes more complicated. For the convenience of investors, websites have long been operating where dividend calendars are published. I advise you not to split hairs, but to use ready-made solutions.

I’ll share links from my arsenal of useful things for investors:

- Calendar on the website of Sberbank CIB JSC. There is all the necessary information: the date of registration of the register, the recommended and approved rate for ordinary and preferred securities, the reporting period.

- The calendar from BCS Express is my favorite. The schedule is completely before your eyes, including the last day to become a shareholder and get on the register.

For which securities is a fixed dividend amount established?

A fixed dividend is established on preferred shares upon issue. It is paid on such securities in the first place and does not depend on the amount of net profit, which may vary in different reporting periods, but is paid from specially created reserve capital or other sources. That is, in this case, the amount of the company’s profit and the amount of dividends are not related.

In the dividend policy of companies, the formulation is often found that the company pays a certain fixed percentage on a preferred share, for example, 10% of its nominal value.

Preferred paper provides more guarantees for receiving dividend income than ordinary paper, since its payment is determined by the company's charter.

Dividend policy

Dividend policy is a section in the company's Articles of Association, which contains the following information:

- principles and conditions of payment;

- determining the amount of dividends;

- procedure, terms and form of payment;

- tax issues;

- disclosure and responsibility of the issuer.

Dividend policies can be found on the official websites of public companies admitted to trading on the stock exchange. They are required to place it in the public domain. Most often this is a tab in the “Investors and Shareholders” or “Information Disclosure” menu at the bottom of the main page of the site. Most of the document is the same for all companies because they formulate it in accordance with the law on joint stock companies. But each issuer will have specifics for determining the size of payments. This is what most shareholders are interested in.

Complete information about current strategies that have already brought millions of passive income to investors

Depending on how deeply you want to dive into the information, you can familiarize yourself with the policy by reading the lengthy document “Charter from Cover to Cover”, or use aggregator sites. They specifically prepare the most necessary information for investors and present the policy in a generalized form.

I already mentioned above that the source of payments is net profit. But the law does not specify what exactly the net profit is. The fact is that our public companies prepare two types of reporting: according to Russian legislation (RAS) and international (IFRS). The dividend policy must indicate what kind of reporting companies use to calculate dividends.

Bashneft allocates at least 25% of its net profit under IFRS for payments to shareholders. Sberbank plans to reach 50% of this value by 2021. “Lenenergo” – up to 10% of net profit according to RAS.

What formula is used to calculate dividends?

The calculation uses a simple formula, to apply which you need to know the par value of the share and the amount of the dividend.

Most often this value is expressed as a percentage. The amount of dividends on ordinary shares is calculated as the ratio of the nominal value of the securities to its yield.

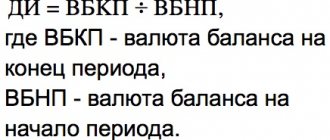

Dividend yield (DD) is equal to:

DD = YES / TA * 100%, where

YES is the dividend per share, TA is the nominal price of the share.

For example, how to calculate dividends on ordinary shares of Lukoil: the cost of the Central Bank is 1,124 rubles, and the dividend per share for this issuer is 28 rubles, then the dividend yield will be:

28 / 1124 x 100% = 2.49%

Thus, knowing how to calculate the dividend yield of an ordinary share, you can predict your future profit.

Until 2010, the average dividend yield on the Russian market was up to 1-2%, with a stock yield of 8-10%. By 2021, the average yield of Russian securities included in the Top 20 had already reached double-digit numbers and amounted to 12%. Moreover, some of the most profitable industries from this point of view for several years have been hydrocarbon production, telecommunications and the financial sector.

Kinds

Dividends are classified according to several criteria:

| Sign | View |

| Periodicity |

|

| Way |

|

| Type of shares |

|

| Size |

|

| Fiscal year stage |

|

| Privilege type |

|

All information about dividends (their type, timing and amount of payments) must be clarified when purchasing shares. Large companies post such information for investors on their official websites. Statistics on dividends paid earlier are also presented there.

Basic parameters of ordinary shares

Common stocks have their own special characteristics that every investor needs to know. Trading of ordinary securities is carried out on stock exchanges, as well as on over-the-counter markets.

The following types of share prices are distinguished:

- market - defined as the equilibrium price on the stock exchange, established between supply and demand;

- issue price during initial placement on the market, usually it is higher than the nominal value by the amount of issue proceeds;

- nominal - the share of the authorized capital that falls on one share;

- balance sheet is the result of dividing the company's net assets by the number of securities in circulation.

The purchase price is relevant only in relation to the income or dividends that the buyer will receive on that stock to calculate its dividend yield. All ordinary shares always have the same par value, and the sum of the par values of all ordinary securities is equal to the authorized capital of the company.

Current market rates are available on the official websites of exchanges, brokerage companies and other financial organizations.

Another parameter of stocks is the yield, that is, the ratio of the income received from a security (dividend or interest) to the investment in it, expressed as a percentage.

If the market value is lower than its book price, then the share is considered to be undervalued in the market and its value should be expected to increase in the near or long term. Conversely, if it is overvalued, then most likely it will experience a decrease in the market price.

Another characteristic of a stock is its volatility - that is, the variability of its market price over a certain period of time.

An ordinary share gives the holder the right to vote (according to the principle of one paper - one vote) at a shareholder meeting, but does not guarantee the payment of dividends. Unlike preferred ones, dividend income on them is not guaranteed. It is possible if the company completed the reporting period with profit remaining after payment to the holders of preferred shares.

Also, the reason for non-payment, in addition to loss, may be the presence of court decisions, seizure of the organization’s property and other unfavorable events.

Common shares are considered equity instruments of a lower status relative to other classes of securities, although in Russia the price of common stock on the stock exchange is often higher than preferred stock.

Ordinary shares are perpetual, that is, their buyer after acquisition cannot demand money back. At the same time, the issuer has the right to dispose of the capital received from the sale of securities at its own discretion and not to inform the holders about this.

The purchaser of common stock is issued a certificate of ownership upon purchase. This document contains basic information:

- registration number

- holder details

- name of the issuer's joint stock company

- number of pieces owned

- the name of the organization that is the holder of the register

- par price of paper

A common share is canceled upon the liquidation of the company that issued it. Such liquidation may be voluntary or compulsory.

❗ Expert opinion: is it possible to live on dividends

Expert opinion

Ilya Tarasov

Investor

Dividends are a high risk, the absence of any guarantees and at the same time not the highest profitability. Thus, the average yield on Russian shares is 6.9% per annum, which is not much higher than that of a bank deposit, and the profit received (as opposed to accrued interest on deposits) is taxable. But there are indeed companies that pay dividends above expectations and allow their investors to make money.

When choosing shares for dividends, market non-professionals who are far from financial analysis and forecasting have to rely on other people’s opinions and believe the promises of the company’s management, which may be biased and often do not come true.

When answering the question whether it is possible to live on dividends, it is worth considering the amount that a person would like to receive monthly for a comfortable living, and the amount of funds available for investment purposes.

For example, an investor selected good stable shares with a yield of 10% per annum. He would like to receive an income of 50 thousand rubles. monthly. Accordingly, its dividend income should be 600 thousand rubles. annually. In order to have such dividends, the initial amount of investment must be at the level of 6 million rubles. Next, everyone can decide for themselves whether they are ready to part with such an amount and how attractive dividend investments are for them.

Example of profitability calculation

How to calculate dividend yield: the price of one share on the stock market is 150 rubles per share. During the reporting period, this company announced that it would pay 10 rubles per ordinary security. In this case, an example of calculating dividend yield is as follows:

10 / 150 x 100% = 6.67%

The issuer, which acts as a tax agent when paying dividends, by law will withhold 13% personal income tax from each payment. That is, after paying the tax on 10 rubles declared by the company, the investor’s account will actually receive 8.7 rubles. This means that the net dividend yield using the formula will be:

8.7 / 150 x 100% = 5.8%

Where are dividends credited?

The main assistants to investors are brokers. Interest payments go to the brokerage account. For residents of Russia (that is, those people who stay in the country for more than 183 days annually), dividends are subject to the same tax burden as any income - 13%. It is the broker’s task to withdraw and transfer personal income tax to the budget.

You can track receipt of dividend payments in the user’s “Personal Account”. After receiving funds, the investor can transfer the money to his bank account or leave it with the servicing broker, from where he can make further investments and replenish his portfolio.

How the closure of the register affects the timing of stock purchases

The closing of the register (or dividend cut-off) is the calendar date on which the register of company shareholders entitled to receive dividends is compiled.

To get into the register, you need to buy the company's shares before the cutoff - at least two business days in advance, so that the exchange has time to process the purchase request. Closing the register has a serious impact on the value of the security. As a rule, in anticipation of the payment of dividends, the price of the stock begins to rise - the closer to the cut-off date, the higher it is. This is due to increased demand for shares from investors who want to purchase a stake in the company to receive quick profits in the form of dividends. Therefore, if you want to receive dividends and not overpay for a share, buy them in advance, before the company announces the payment of dividends.

When using this strategy when buying shares, it is worth remembering that immediately after dividends are paid, the value of the security decreases - as a rule, by the amount of dividends paid. This phenomenon is called a dividend gap. Shares of strong companies usually regain their value quite quickly - thus shareholders receive dividends and continue to hold assets at the same price as at the time of purchase.

Shareholders who hold shares for a long time may not focus on whether before or after the closure of the register to buy securities. The share price will even out over time. Its further growth or decline will depend on the situation on the market in general and within the company in particular.

Traders (or speculators) whose goal is to buy shares at a low price and sell at a higher price should remember that buying shares before the close of the register and selling them immediately after paying dividends is not the most profitable strategy. In the best case, dividends will cover the fall in the value of the stock; in the worst case, the difference between the purchase price and the sale price will exceed the amount of dividends.

To make a profit, it is better to wait for the price to fully recover to the level it was at before the register was closed.

When to expect dividend payment

The frequency of dividend payments by companies is not regulated. The source of financing dividends is the company’s net profit - the founders can send it to shareholders, or they can save it by investing in production development (for example, by purchasing new equipment). According to the law, dividends can be paid every three months - after the preparation of interim financial statements (Clause 1, Article 42 of the Law “On Joint Stock Companies...” dated December 26, 1995 No. 208-FZ). Of course, they can be paid less frequently, for example once every six months or year.

If the company’s management nevertheless decided to pay profit or part of it as dividends, the money will have to be transferred to shareholders within 25 business days from the date of closure of the register (clause 6 of article 42 of Federal Law No. 208). In practice, money usually arrives earlier - within 8-10 days.

Taxation

Dividends, like any income of a tax resident of the Russian Federation, are subject to income tax (NDFL) in the amount of 13% of the funds received (clause 1 of Article 224 of the Tax Code of the Russian Federation). In this case, the tax agent (i.e., the party on whom the legislator assigns the responsibility for calculating and paying taxes) is a trustee or broker who provides the investor with access to the stock exchange and allows him to trade securities (subclause 1, clause 2, art. 226.1 Tax Code of the Russian Federation). This means that the shareholder will not have to take any independent actions to pay taxes - dividends will go to his account minus the mandatory payment.

Note! However, the issuing company is registered outside the Russian Federation, the broker will not withhold tax, and you will have to pay it yourself. If Russia has entered into an agreement to avoid double taxation with the state in which the company is registered, personal income tax is reduced by the amount of tax paid in another country (clause 2 of Article 214 of the Tax Code of the Russian Federation).

What it is

Dividends are part of the profits that a company pays to its shareholders.

Any commercial organization created with the support of investments from individuals or legal entities and receiving profit in the course of its activities may pay a portion of the income to its shareholders.

Accordingly, shareholders become those participants who invested their money in the development of the company, i.e. bought its shares.