Payment

Why do we need the statistics form 1-Enterprise Along with tax and accounting reporting, Russian companies

To what account should the state fee be attributed to the accountant? It would seem that the answer is simple: in Art. 13 NK

This article describes the method of reflecting an increase in the initial cost of fixed assets in 1C: Accounting 8.

In the activities of every company there are situations when past expenses are revealed in the reporting time period.

VAT is levied on products or services sold at a price higher than their cost. The tax is calculated based on

September 18, 2020 Each group of assets has its own specifics. Fixed assets that cannot be used

In any organization on the territory of the Russian Federation it is rare to find an employee who at least

Acceptance of fixed assets for accounting So, the company has acquired fixed assets, on which depreciation is calculated in

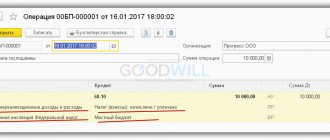

To make a non-cash transfer from your bank account in favor of the budget or any other

Purpose of the article: generalization of available information on the placement of free funds of the company for short-term investment