Leasing refers to one of the forms of lending. This is a long-term lease of fixed assets with purchase in the future. The organization gets the opportunity to rent vehicles, production equipment, structures and other real estate with subsequent purchase. Leasing accounting in 1C 8.3 occurs in stages. Below are the step-by-step steps of this procedure.

A leasing agreement is an agreement in which the lessor undertakes to purchase and transfer property to the lessee for temporary possession and use. Property purchased under a leasing agreement can be accounted for in two ways:

- on the balance sheet of the lessee;

- on the lessor's balance sheet.

The leasing agreement specifies who has the property on their balance sheet. If the agreement states “on the lessor’s balance sheet,” then the purchased property is recorded in off-balance sheet account 001 “Leased fixed assets.” In a situation where the contract specifies the method “on the lessee’s balance sheet,” then account 08 “Investments in non-current assets” is used. To account for leasing on the lessee’s balance sheet in the 1C 8.3 program, you should follow the instructions described below.

Depreciation in leasing

Although equipment purchased on lease is not the property of the organization, it still must be registered and depreciated accordingly. Depreciation is calculated using the document “Depreciation and depreciation of fixed assets” in the fixed assets and intangible assets menu. You can also calculate it automatically if you use the “Month Closing” assistant.

Fig. 15 Closing the month

In conclusion, it is important to pay attention to the fact that for leasing transactions there is a difference between accounting and tax accounting, since in the latter leasing expenses are taken into account minus tax depreciation. The 1C 8.3 program will automatically calculate depreciation and leasing expenses, and also reflect the difference between accounting and tax accounting. To do this, in 1C 8.3 it is necessary to correctly draw up the accounting policy of the enterprise.

If, in addition to leasing accounting, you regularly have questions about working with 1C programs, contact our specialists. We will be happy to advise you and also select the optimal tariffs for 1C subscription services, focusing on your individual tasks.

Nuances of accounting for leased property in 1C: Enterprise Accounting 8

Published 01/14/2019 12:39 Author: Administrator In this article we will look at the main nuances of accounting for leasing and reflecting related transactions in 1C: Enterprise Accounting 8 edition 3.0. When is leasing necessary, and what are its distinctive features? What accounts will be involved if the property is listed on the balance sheet of the lessor and the lessee? Are expenses for fuel and lubricants and insurance accepted for tax accounting purposes? How to reflect the repair of leased property and its repurchase for subsequent resale? Brief answers to all these questions await you in the article.

When does an organization need leasing?

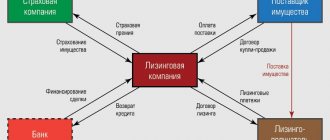

If the buyer organization does not have the opportunity to immediately purchase the property it is interested in, and the seller organization has no interest in leasing this property: there are transactions involving a third party who buys this property from the seller organization and leases it to the buyer organization.

This type of lease of real estate, vehicles or equipment is called finance lease or leasing.

When leasing, three parties are involved in contractual relations: the seller, the lessor and the lessee.

The lessor, using his own funds or borrowed funds at the order of the lessee, buys property from the seller and transfers it by installments. The property itself is of no economic interest to the lessor. The lessor has only a financial interest.

Let us recall the distinctive features of leasing (financial lease):

- ownership of the subject of the leasing agreement can pass to the lessee (this is not a mandatory condition of the leasing agreement);

- the property must be new;

- the contract is of a long-term nature; payments under the agreement are less than under a lease agreement;

- in case of prolonged downtime (accident, repair), the lessee pays leasing payments.

Leasing payments include:

— reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset;

— reimbursement of the lessor’s costs associated with the provision of other services provided for in the contract;

- lessor's income.

If the agreement provides for the transfer of ownership of the leased property, then the redemption value of this property is included in the agreement.

As a rule, during a transaction, two agreements are concluded: a leasing agreement (financial lease) and a purchase and sale agreement (for the redemption value of the leased asset).

In accounting, leasing payments are expenses for ordinary activities.

In tax accounting, leasing payments are classified as other expenses associated with production and sales.

Let's consider some scenarios for reflecting leasing transactions in the 1C program: Enterprise Accounting, edition 3.0.

1. An organization has purchased a car on lease, the property is listed on the lessor’s balance sheet.

The lessee has the leased asset listed on his off-balance sheet account at the cost of the lessor's expenses for the acquisition of this property, excluding VAT. The lessor specifies the purchase price in the contract.

2. The organization purchased a car on lease, the property is listed on the balance sheet of the lessor. The organization transferred the advance for the 1st year of leasing in one payment.

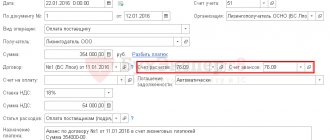

Accepted for deduction of VAT from the advance invoice.

When accruing and writing off leasing payments, part of the advance VAT on the cost of leasing payments is repaid monthly.

Repayment of the advance payment by monthly accruals of leasing payments.

3. The organization purchased a car on lease, the property is listed on the balance sheet of the lessor. Accounting for fuel and car insurance costs.

Expenses for fuel and lubricants and car insurance, despite the fact that the car is on the balance sheet of the lessor, are accepted for tax accounting purposes (Articles 252,253, 264 of the Tax Code of the Russian Federation).

4. The organization purchased a car on lease, the property was listed on the lessor’s balance sheet. Selling a repurchased car.

The leased asset was written off off-balance sheet due to redemption.

For subsequent sale, the purchased property is capitalized as goods. Input VAT on the purchase price is taken into account based on the lessor's invoice.

5. The organization purchased a car on lease with subsequent purchase; the leased item is accounted for on the balance sheet of the lessee.

Detailed reflection of the accounting of the leased asset on the lessee's balance sheet in 1C: Enterprise Accounting, ed. We reviewed 3.0 in the article Accounting for the leased asset on the lessee’s balance sheet in 1C: Enterprise Accounting 8

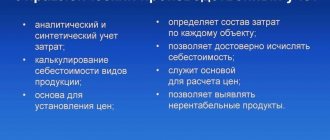

Checkpoints:

1. “Leasing accounting” is maintained on account 76.07 “Rent payments”

2. The leased item is accepted for accounting at the contractual value, i.e. redemption price + cost of leasing payments.

3. In accounting, the leased asset is depreciated.

4. In tax accounting, the leased item is taken into account in the amount of purchase costs by the lessor.

5. The difference between the accounting book and the NU is temporarily taken into account (“temporary difference”) in account 01.K “Adjustment of the value of leased property.” This is the non-depreciable part of the cost of the leased asset.

6. Deferred VAT is generated because the invoice is not initially issued by the lessor. As lease payments are written off, deferred VAT will be deducted (the lessor provides invoices for lease payments).

7. The purchased property is registered as a fixed asset, inventory or goods, depending on the amount of the redemption value and further purposes of use.

The leasing payment strategy in this case will look like this:

6. The organization purchased a car on lease, the lessee entered into an insurance agreement for the leased item (car) with the condition of paying for repairs to a car service organization.

During repairs, you can maintain separate records of the leased item. The organization does not reflect repair costs in accounting.

In tax accounting in this case, neither income nor expenses arise (letter of the Ministry of Finance dated October 8, 2009 No. 03-03-06/1/656).

7. The organization purchased a car on lease, the lessee entered into an insurance agreement for the leased item (car) with the condition of insurance compensation.

Insurance compensation received from an insurance company is taken into account in accounting as part of other income (clause 9 of PBU 9/99); in tax accounting - in non-operating income.

8. About seasonal write-offs of fuel and lubricants

The organization is not obliged to standardize costs for fuel and lubricants and has the right to develop its own standards. Winter norms for the write-off of fuel and lubricants can be fixed by an order on a seasonal increase in fuel and lubricant standards and a control check report.

9. About the seasonal replacement of summer tires with winter ones.

Replacing summer tires with winter tires is confirmed by a seasonal tire replacement certificate (free form).

In tax accounting, both types of seasonal expenses are expenses for the maintenance of official transport (clause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

PS: Education is not a result, but a process. In order to learn new things, you often need to consciously leave old habits and stereotypes in the past. Yesterday's experience is valuable only to the extent that it helps create the future.

We thank you for being with us! Thank you for sharing our values!

Team "Accounting without worries".

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Anastasia 10/28/2020 10:29 Hello, please tell me, if under a leasing agreement the insurance of the leased property is at the expense of the lessee (the property is accounted for on the lessee’s balance sheet), the insurance policy is issued to the lessor, is it possible to take the lessee’s insurance into account?

Quote

0 Tatyana 04/12/2020 03:18 Good afternoon! Thank you for the article

Quote

+1 Vasya 07/04/2019 15:43 Can someone simply write the entries for the following operation: The leased item was killed in an accident. It was returned to the lessor, and the insurance company received compensation. The Lessor compensated the Lessee for part of the losses under the leasing agreement. The leased item is on the balance sheet of the lessee. Standard accounting with Spanish b/c 76.07.01 76.07.02 76.07.09. Wiring only!!!!

Quote

0 Irina 02/06/2019 22:40 Hello, Irina! According to the terms of the leasing agreement, the penultimate advance payment (D60.02-K51 = 150 0.00) was less than the lease payment for the current month (after postings D76.07.2-K60.02 = 1500.00 and D76.07.1-K76.07. 2=2000.00 and D19-K76.07.2=36 0.00) on account 76.07.2 the balance was 860.00. The payment for the last month is 3220.00 more than the lease payment of 2360.00. Now we have a balance on accounts 76.07.2 and 60.02. How to correctly account for these operations? Is it possible to use an accounting certificate or are there options for such accounting in 1C?

Quote

Update list of comments

JComments

simplified tax system

The redemption price, listed together with payments for the use of the property, is an advance towards the upcoming purchase of the leased asset. This follows from the provisions of Articles 624, 625 of the Civil Code of the Russian Federation and paragraph 1 of Article 11 of the Law of October 29, 1998 No. 164-FZ.

If you pay a single tax on income using a simplified tax system, then you cannot take into account expenses in the form of redemption value (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

When the basis for calculating a single tax is the difference between income and expenses, focus on a different order. Namely, the redemption value of the leased property can be taken into account, but only after the transfer of ownership of it to you (subclause 1, clause 1, clause 2, article 346.16 and clause 1, article 252 of the Tax Code of the Russian Federation).

After paying the entire redemption price and transferring ownership of the property, the generated costs can be written off.

If we are talking about a depreciable object, then include the amounts as expenses for the acquisition of fixed assets (subclause 1, clause 1 and clause 4, article 346.16 of the Tax Code of the Russian Federation).

When property does not meet the criteria for depreciation, its cost is included as part of material expenses. But only if the property is involved in production (subclause 5, clause 1 and clause 2, article 346.16, subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

And vice versa. Recognize the costs of purchasing property for resale as expenses for the purchase of goods (subclause 23, clause 1, article 346.16, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Input VAT, which was transferred as part of the redemption value recognized as expenses, is attributed to:

- to increase expenses associated with the acquisition of fixed assets - for depreciable property (clause 3 of Article 346.11, subclause 3 of clause 2 of Article 170 of the Tax Code of the Russian Federation);

- to reduce the tax base for a separate cost item - if the purchased object does not correspond to the characteristics of depreciable property (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

General concept of leasing and its purpose

Leasing is a kind of financial transaction through which the lessor purchases equipment, buildings, structures, transport, etc. for the lessee at his own expense for a time or for rent. This is beneficial for the buyer of the service, since he saves his own money by spending on the purchase, thereby acquiring what he needs at the expense of someone else’s money.

So leasing is essentially a form of lending, but it can be different:

- The leased asset can be purchased at the end of the year, this is called financial leasing

- If the equipment is not purchased, then it is an operating lease

For many companies, this is a lifesaver, as it significantly saves them money.

Acceptance of fixed assets for accounting

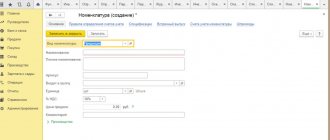

We have reflected the receipt of our lathe for leasing, and now it needs to be taken into account as fixed assets. To do this, go to the section “Fixed assets and intangible assets” and select “Acceptance for accounting of fixed assets”.

In the header of the created document, fill in the organization, financially responsible and location of the OS. The event will be “Acceptance for accounting with commissioning”.

On the first tab of the document we will indicate the method of receipt of the fixed assets - under a leasing agreement. For the equipment itself, we will choose our Steepline 4SL03 CNC machine. The division and warehouse are also indicated here. The account in our example will be 08.04.2.

On the next tab - equipment, it is enough to indicate the main tool itself, which is located in the directory of the same name. Inv. the number will be entered automatically. We will not describe in detail the creation of filling out the OS directory. You shouldn't have any problems with this.

Next, let's move on to the next tab - “Accounting”. Correctly filling out the data contained on it is very important, because you will be setting up not only the accounting system, but also how depreciation will be calculated.

The accounting account in our case is 01.03. We also indicated that we will calculate depreciation using the straight-line method (in equal parts). Depreciation will take place on account 02.03. We will take into account the expenses for it on account 20.01 - “Main production”. Our machine will be depreciated over five years (60 months).

These settings are not the only correct ones. You can fill in this information in your own way.

The tab with NU in this situation is almost identical to the accounting tab.

We have already indicated all the necessary data, and we can process the document.

Now, for this commercial machine, the data that we just filled out in the document on the corresponding tabs will appear in the fixed assets directory.

Purchase price in advance

Leasing payments towards the redemption value transferred during the term of the contract are an advance. When calculating income tax, the amounts of advances issued do not reduce taxable profit. This rule applies both when using the accrual method and when using the cash method.

This follows from the provisions of paragraph 14 of Article 270, paragraph 3 of Article 273 of the Tax Code of the Russian Federation, articles 624, 625 of the Civil Code of the Russian Federation, paragraph 1 of Article 11 of the Law of October 29, 1998 No. 164-FZ and is confirmed in a letter from the Department of Tax Administration of Russia for Moscow dated December 15, 2003 No. 23-10/4/69784.

Income tax

In tax accounting, costs in the amount of leasing payments for the use of property reduce the base for calculating income tax. The procedure for recognizing such costs depends on the method of determining income and expenses and on whose balance sheet the leased asset is listed.

But for the recognition of expenses in the form of redemption value, it does not matter which party accounted for the leased property on its balance sheet before its redemption. The redemption value of the leased asset is a payment for the acquisition of ownership of the property, and not for the use and possession of it. Consequently, such expenses can be recognized after the end of the leasing agreement in the usual manner established for the recognition of costs for the acquisition of a new object. That is, depending on whether such property is recognized as depreciable or not. In addition, the cost recognition procedure will be different for property that will be used in production and intended for sale.

If you plan to use the purchased property in production and it meets all the criteria for depreciation, then write off the costs of its acquisition through depreciation (clause 1 of Article 256, clause 4 of Article 259 of the Tax Code of the Russian Federation).

In the initial cost of such property, in addition to the redemption price, also include the costs associated with the transfer of ownership. As a general rule, do not take VAT and excise taxes into account in the initial cost.

Determine the depreciation rate for such property based on its useful life. However, do not forget to reduce this period for the period of its operation before redemption. That is, the period provided for the depreciation group to which the property belongs can be reduced by the period of time during which it was leased. In this case, it does not matter on whose balance sheet the object was listed. This possibility is provided for in paragraph 7 of Article 258 of the Tax Code of the Russian Federation. In addition, part of the redemption costs can be recognized as a lump sum by applying bonus depreciation.

This procedure follows from the provisions of paragraph 1 of Article 256, paragraph 1 of Article 257, Article 258 and paragraph 4 of Article 259 of the Tax Code of the Russian Federation and is confirmed in letters of the Ministry of Finance of Russia dated May 18, 2012 No. 03-03-06/1/253 and dated 3 November 2010 No. 03-07-11/434.

If the purchased item cannot be classified as depreciable, but you plan to use it in production activities, consider it as part of material expenses. In this case, the organization has the right to independently determine the procedure for writing off such an object, taking into account the period of its use and other economic indicators. For example, at a time or evenly over several reporting periods (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

If the purchased item is intended for sale, recognize its value in the general manner for goods. That is, charge it to expenses at a time in the period when income from the sale of such goods was received. This follows from the provisions of paragraph 1 of Article 268, paragraph 3 of Article 273 and Article 320 of the Tax Code of the Russian Federation.

Recognition of costs when leasing property

Perform month end closing.

Depreciation calculation

Only from next month, after registration.

Recognition of lease payment

In the first month the amount does not take into account depreciation.

In the second and subsequent periods - minus the amount of depreciation.

To control, generate a report Recognition of expenses for fixed assets received under lease . The calculation certificate is generated in BU and NU separately.

VAT

Input VAT on purchased property should be deducted in the period when all required conditions are met. That is, the property has been accepted for accounting and a correctly executed invoice has been received from the lessor.

Situation: when can the amount of input VAT be deducted from the redemption value of the leased property, which was paid during the term of the leasing agreement?

Deduct input VAT in the general manner for advances.

Do this if all necessary conditions are met. After the ownership of the leased asset is transferred to you from the lessor and an invoice is received, the amount of VAT previously accepted for deduction on part of the redemption price will have to be restored. And then again deduct the tax imposed by the lessor, but this time on the value of the asset received into ownership.

This procedure is established in paragraph 1 of Article 154 of the Tax Code of the Russian Federation.

Leasing payments

- Calculation of leasing payments. Using the document “Manual Operation” (“Accounting and NU Operation”), the accrued monthly payment is reflected by postings Dt 76.05 Kt 76.09 for the payment amount. For tax accounting purposes under the simplified tax system, this amount is accepted in full in accordance with the act issued by the lessor. But since in this case “Manual Operation” is used, you should not wait for the expense to be automatically registered in KUDiR when paying for it. To do this, you need to perform an additional operation.

- Payment of the lease payment. The payment itself is recorded by the bank statement document “Write-off from the current account”, but given the specifics, the type of transaction should be selected “Other write-off” to be able to indicate the corresponding account 76.09 and, using the KUDiR button, indicate the amount to be reflected in the book of income and expenses, unchecking the “Reflect” flag automatically".