When it comes to paying customs duties, it is necessary to indicate the code of the customs authority in the payment order. A special field “107” of the document is reserved for it. This detail is not needed on tax payments; instead, the tax period should be indicated in field “107”. Explanations for correctly filling out field “107” are given in Letter of the Federal Treasury dated August 10, 2017 No. 07-04-05/05-660. When creating a payment order, the Federal Treasury recommends that you follow the standards set out in Appendix No. 3 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013 (as amended on April 5, 2017).

Differences in customs payments

First of all, it is worth noting that tax receipts must reflect the specific tax period in field 107. A customs payment is a code assigned to the body of the Federal Customs Service of Russia (FCS).

Other fields of the payment order for customs are also filled out differently so that you can understand exactly what the payment was made for. Let's look at this in more detail.

The general and special rules by which payments are formed are written down in Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013. Explanations regarding customs payments are given here in a separate Appendix No. 3. The procedure for filling out fields 104 – 109 in the payment order addressed to the Federal Customs Service authorities is described here.

However, first of all, to confidently pass control of this payment, it is necessary to correctly fill out column 101. It indicates the status of the payer himself as a participant in foreign economic transactions and transactions. It is prescribed with special digital codes such as 06 and 16 - 20. The purpose of these codes is to show that the person filling out the payment is a participant in foreign trade activities.

The budget classification code - abbreviated as KBK - is entered in field 104 to make a payment to the state customs office. A list of these codes and payment type codes specific to each BCC can be found on the official website of the Federal Customs Service in the “Information for Foreign Trade Participants” tab.

Here is the exact link.

In practice, most often you have to enter budget classification codes into payments:

- advances on payments to customs;

- duties for customs operations.

Line 104 may also contain a code indicating the payment of penalties on customs duties.

Based on the letter of the Federal Customs Service dated December 26, 2013 No. 01-11/59519, in field 105 it is necessary to indicate a single OKTMO code.

Reminder on payment of customs duties

We have collected all the common mistakes in a memo on paying customs duties, which you can download and use as an example when making payments. Below we have also prepared special instructions for paying customs duties, during which you will receive examples of payment orders for your individual case.

Click to view in a separate window

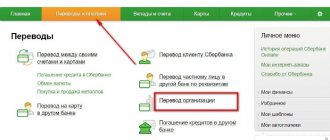

How to fill out field 107 for customs

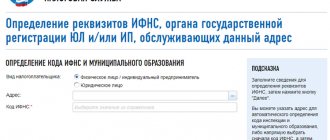

The payer must ask at the customs post at which customs office the payment will be made at this location. That is, what code does the higher customs office have for accepting transferred funds?

EXAMPLE

Bryansk customs has 10 posts for customs inspection. And each of them has its own individual code. But when a company fills out the customs authority code, in field 107 of the payment they indicate the numbers of the central office of the customs office of the Bryansk region. This code looks like this - 10102000.

This information is also provided on the website of the Customs Service of the Russian Federation https://ved.customs.ru/ in the “Databases” section. Everything that needs to be entered in field 107 is given at this link.

Filling out field 106

In field 106 indicate the basis for the payment. A note is made in the window in the form of a code that indicates the reason for the payment.

Important! If your payment has nothing to do with customs and tax duties, enter 0 in this field.

Bank of Russia Regulation No. 383-P “On the rules for transferring funds” states that in field 106 the entry must consist of a maximum of two characters representing capital letters of the Russian alphabet.

The value of this field affects the value of the following fields:

- 107 – tax period;

- 108 – date of the document on the basis of which payment is made.

Late payment

If this happens, the law requires the payer to pay a penalty. Their volume is directly dependent on the timing of the late payment.

There are KBK codes designed specifically for paying penalties. The same section “Information for foreign trade participants” of the official website of the Customs Service will help you find the BCC for penalties.

The payer of the penalty fills out all other fields in the same way as he would fill out a customs payment receipt.

If it is necessary to pay penalties at the request of the customs authority, then you must additionally fill out:

- field 106, where to enter the code “TK” or “TU”;

- In field 108, enter the date of the request.

Also see “Customs officers will control postal items of Russian Post.”

Read also

29.06.2017

Change in field 110

On August 8, Directive No. 4449-U came into force. He approved new rules for filling out field 110 of the payment order, namely, a special requisite “1” was established for this field. Employers ask: how to fill out field 110 of the payment slip now?

For field 110, the code for payments to individuals at the expense of the budget is set. This attribute is called "1". This code must be entered in field 110 if the work of employees of state and municipal bodies, institutions, state extra-budgetary funds is paid, state scholarships, pensions and other social benefits from the Pension Fund are paid, and other similar payments.

In other situations, field 110 of the payment order is still not filled in.

In what cases is customs duty 1010 not charged?

Payments indicated in the declaration by code 1010 are not collected in a number of cases. The list of such situations is large (more than 24 items), so we will list the most common situations:

- Goods that are declared as humanitarian aid, that is, are provided free of charge. This applies to both goods of Russian organizations and international organizations.

- Various cultural assets that are temporarily in another country. For example, an art exhibition.

- Various technical achievements that are used to demonstrate them at international exhibitions.

- Goods whose cost does not exceed 5,000 rubles.

- Cash currency that is imported and exported by the Central Bank of the Russian Federation.

Moscow customs codes

All structural divisions of Moscow Customs and their codes are presented in the list:

- 10129020 – Moscow railway customs post;

- 10129030 – Diplomatic customs post;

- 10129040 – Scientific and innovative customs post;

- 10129010 – Exhibition customs post;

- 10129050 – TP International Post Office;

- 10129060 – Moscow customs post (Electronic Declaration Center);

- 10129070 – Mikhnevsky customs post.

Why do we pay state duty?

State duty is a federal tax established by the Tax Code of the Russian Federation (Chapter 25.3 of the Tax Code of the Russian Federation). It is paid in case of contacting various bodies (state, municipal, etc.) for the commission of certain legally significant actions.

The type of BCC you indicate in the payment depends on what action is required. For convenience, we will present the main types of actions for which a duty is paid in a table and immediately present the BCC for payment.

Legally significant action

(for 2019–2020)

BCC for state duty

22,000 rub. - for organizations.

2,000 rub. — for “physicists”

321 1 0800 110

|

Can a bank compulsorily require

Many taxpayers, regardless of status, are faced with the fact that banking institutions are required to fill out field 22 when paying taxes. And the question arises how legitimate these requirements are.

Much depends on the purpose of the payment order.

- If the payment was calculated independently , then the value of the unique identifier is unknown to the payer. It is enough to put the number “0” in the indicated column.

- If payment is made based on the request of the fiscal authority, then the UIN is entered only when it is indicated in the document from the tax office.

Banks have the right to require the code only when it is known to the payer.

Where can an individual get it?

A unique identifier can be obtained using documents sent from the tax authority to pay a fine or penalty. If the payer is not a debtor, he does not need a UIN. This code is generated and provided exclusively to those individual entrepreneurs or organizations that are debtors to pay taxes and fees.

As for physical persons, then the UIN is used when paying obligatory payments to the budget. This is transport, property tax, etc.

Every year, all citizens who pay such taxes receive corresponding notifications from the Federal Tax Service. They are sent to the citizens’ registration address.

Important to remember!

Each notice already contains a code that, when paying taxes, will be used by individuals. persons is the index of the payment transfer notification. If a citizen has not received a notification from the tax authority, he can find his code in his personal account on the website of the Federal Tax Service.

When the code is not known, physical. persons are allowed to indicate their TIN.

IP

Individual entrepreneurs, according to general rules, can indicate both UIN and Taxpayer Identification Number (TIN) in payment documents.

A unique identifier is provided if the individual entrepreneur knows it. But he can use the TIN and then put “0” in field 22. If both codes are missing from the payment document, the bank will not accept it.

Legal

Legal entities calculate and pay taxes independently. The UIN is not used in this case, so “0” is entered in the corresponding column.

A unique identifier is required only when paying penalties or fines.

In this case, the payer receives the necessary papers with UIN from the tax service.

If not filled in

Since 2021, due to changes in legislation, filling out field 22 in the payment document is mandatory. If there is no value for the unique identifier of the individual. individuals and individual entrepreneurs can indicate their tax identification number, and legal entities. faces – number “0”.

If field 22 is left blank, this will be considered a violation of the law. The bank will refuse to accept such a receipt for payment.

In the application for cash expense

The application for cash expenses is filled out according to special rules that are established by several regulations. To fill out, use the special section “Basic Document Details”.

Be sure to take into account that there are four columns:

- View. The text of the UIN is indicated.

- Number. You need to write code.

- The third column is not filled in.

- In the fourth column there is a dash.

A unique identifier is indicated in the application for cash expenses in accordance with the Letter of the Treasury of Russia dated 12/19/13.

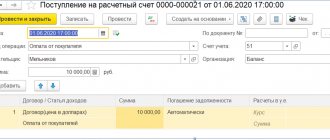

Filling out field 108

When making customs transfers, the values in field 108 depend on the characters entered in field 106 to display the basis for the payment:

- DE or CT. Please provide the last 7 digits of the customs declaration.

- BY. Enter the current customs receipt order number.

- ID. Indicate the number of the writ of execution that serves as the basis for payment.

- THAT. Applies if customs duties are paid upon request.

- IN. Enter the number of the collection document.

- DB. Indicate the number of the document created by the accounting department of the customs authorities.

- KP. Enter the number of the current agreement between large taxpayers when paying centralized payments.

Filling field 108 with numbers indicating the numbers of documents on the basis of which the payment is made is possible only if there are certain statuses in field 101 of the payment.

Reference. In field (108), if the payment document details (101) indicate one of the statuses “03” and “16”, “19”, “20”, an identifier of information about an individual or zero can be indicated.

If you transfer funds to the budget and extra-budgetary funds of the Russian Federation by non-cash method, in window 108 indicate not only the number, but also information about the type of document on the basis of which the payment was made.

Common mistakes

Main mistakes when filling out payment orders:

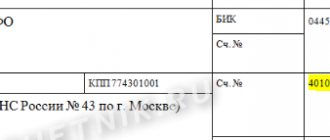

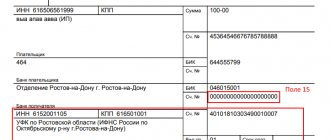

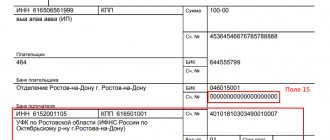

1. The customs code is indicated incorrectly in field 107 of the payment order (point “D” in the picture below).

St. Petersburg customs code is “1021 0000”;

Baltic customs - “1021 6000”;

The code for a single personal account is “1000 0010”;

The most common mistake: the code is present in the payment purpose, but is missing in column 107. The customs code must be in column 107 of the payment order!

2. The payer status is indicated with an error in field 101 (item “A”).

Payer status code for legal entities is “06”;

For individual entrepreneurs – “17”;

Important! Individual entrepreneur is not a legal entity and has its own payer status code. According to the Tax Code: “individual entrepreneurs are individuals registered in the prescribed manner and carrying out entrepreneurial activities without forming a legal entity”

3. The order of payment is mixed up in field 21 (item “B”).

The order of payment in this case is always “5”.

4. The wrong budget classification code (BCC) , which determines the payment of the advance payment or import duty, field 104 (item “B”).

BCC for advance payments - “1531 1009 0000 1000 0180”;

BCC for import customs duty - “1531 1011 0100 1100 0180”;

Import duties and advance payment must be paid separately . Accordingly, if you made both payments, you will have two payment orders with different BCC codes;

The advance payment includes a fee to the state for customs clearance, as well as VAT payable upon release of the goods into free circulation. Read more in the article “All costs during customs clearance”

5. Incorrect OKTMO code in field 105 : All-Russian Classifier of Municipal Territories (point “D”).

6. Extra information in fields 106,108, 109, 110. These fields must be empty or filled in according to the rules of your bank (point “E”).

Column 106 of the payment order is the basis for the payment. According to the bank’s rules, there may be “0”, “00” or DE.

For example, Sberbank requires that column 106 contain the designation “DE”, which means payment according to the customs declaration (current as of 02/08/16).

Alfabank requires that you fill in the date in field 109 (valid as of 02/08/16).

Always check with your bank about the details of filling out the fields in the payment order before paying customs duties.

How to “read” the declaration correctly

To understand the customs declaration, you need to know the procedure for filling it out. The instructions on the procedure for filling out were approved by the Decision of the Customs Union Commission dated May 20, 2010 No. 257. It contains both general provisions and the procedure for filling out the declaration for various procedures carried out when goods cross through customs.

In general, information about transported products contained in the same consignment, which are placed under the same customs procedure, is entered into one goods declaration.

If goods contained in one consignment are declared for placement under different customs procedures, separate declarations for goods are submitted for each customs procedure.

Important! One customs declaration can contain information about no more than 999 goods.

The declaration of goods consists of the main (DT1) and additional (DT2) sheets. Additional sheets are filled out if information on two or more types of goods is declared in one declaration.

If the goods declaration is filled out in writing, it is submitted on A4 sheets. The main sheet of the customs declaration contains information about one product. One additional sheet can contain data on three products. The goods declaration is filled out in capital letters using printing devices, legibly, without erasures, blots or corrections. Submission of the customs declaration in writing (in triplicate) is accompanied by the provision of an electronic copy to the customs authority.

The detailed procedure for filling out the customs declaration is given in the Instructions approved by the Decision of the Customs Union Commission dated May 20, 2010 No. 257.