In the activities of every company, there are situations when in the reporting time period expenses of previous periods are revealed, since only in theory the primary documents and the dates of actual transactions are identical. In the process of work, it often happens differently: goods and services are accepted in one period, and supporting documents for them (invoices, delivery notes, remote control documents, acts) are received from the seller in another. It turns out that the company is aware of the transactions performed, but there is no reason to reflect them in tax and accounting records. There are a lot of other situations, the result of which is the discovery of expenses that were not reflected in previous periods or mistakes were made. Let's figure out what to do in such a situation and recognize the costs.

Determination of loss at the end of the year

Throughout the calendar year, the company uses entries to record the following transactions:

- Score 90 reflects profitability

- Account 91 – expenses incurred

To summarize the financial results of the company, it is necessary to close both of these accounts. For the past year, those economic activities whose account 90 is less than the amount in account 91 are considered unprofitable - i.e. expenses exceeded income.

The Tax Code itself does not contain an exact list of documents that confirm the write-off of losses for early years. This is usually evidenced by primary documentation:

- invoices

- accounts

- statements

Therefore, all accounting documents are suitable. The exceptions are:

- accounting cards

- tax registers

Company losses in trading on video:

Taxpayers are not required to justify losses (Article 252 of the Tax Code). To recognize expenses when calculating tax, two conditions must be present:

- Economic feasibility of this circumstance

- Confirmation of losses in company documentation

The amount of income tax to be paid in the coming reporting periods depends on whether losses are recorded correctly in accounting. In accounting it is calculated at the end of the period. To determine it, it is necessary to compare the costs incurred with the amount of cash receipts received. The final result is calculated from the sum of the results for all types of activities carried out by the enterprise, and other receipts and disposals.

Litigation

The Supreme Court of the Russian Federation has considered cases of this kind more than once. In their decisions, judges have always been of the opinion that there is no need to submit an updated declaration, and the discovered expenses must be written off for the current year.

The judges believe that the organization has every reason to demand a refund or offset of the overpaid amount. The only condition is that no more than three years must pass, as evidenced by Art. 78 Tax Code of the Russian Federation.

However, the situation when an enterprise discovers unaccounted expenses from last year remains controversial to this day. If the organization fails to resolve the issue with the tax inspectorate at the initial stage, then the proceedings will most likely end up in court. Therefore, in order to avoid judicial red tape and disputes with the inspectorate, it is better to approach the issue of initially filling out declarations more carefully.

Reflection of losses in accounting

To correctly reflect all financial results, it is necessary to use special account 99 (Order of the Ministry of Finance of the Russian Federation No. 94). During the year, periods are gradually closed, after which interim reports are drawn up. As a result, a short-term reduction in the current tax base may be established.

It is possible to determine exactly how much the tax burden is allowed to be reduced only at the end of the year, when the final size of the tax base is established. To reflect losses in accounting records, the entries described in Table 1 are made.

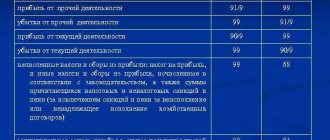

| Debit | Credit | The essence of wiring |

| 90.9 | 99 | Reflects the profit received from all normal types of company activity |

| 91.9 | 99 | Shows “cons” for other, non-core activities |

| 99 | 90.9 | Demonstrates losses across the entire list of main types of economic activity |

| 99 | 91.9 | Fixes the resulting loss for other activities |

To transfer losses to other periods, you will need to close account 99. For this purpose, use the posting Dt 94 Kt 99.

Important! All results of the enterprise’s activity in subaccounts of accounts 90 and 91 are reflected throughout the year. Therefore, the resulting values will increase in ascending order.

An exception is the balance sheet reform carried out at the end of the reporting year. In this case, they are reset using the entries:

- Dt 90.1 Kt 90.9

- Dt 90.9 Kt 90.2 (90.3)

In account 91, the reformation is carried out in a similar way. Therefore, the loss accumulated at the end of the interim reporting periods remains untouched - all financial results are simply reflected in account 99.

In the current tax period it is necessary to show profit

The final condition was put forward by the Ministry of Finance of the Russian Federation in a letter dated April 6, 2021 No. 03-03-06/2/27064.

The letter once again emphasized the importance of the fact of overpayment of tax in the last reporting year. In addition, officials said that in order to take into account last year’s expenses in the current year, profits must be calculated in 2021 based on the results of 12 months.

In their opinion, officials did not consider it necessary to refer to any legislative act.

Current year losses

If at the end of the year it becomes known that the credit of account 99 is less than the debit of 99, this indicates that the past year was unprofitable for the company. Summarizing the results, the accumulated balance of account 99 is included in the array of retained earnings or unclosed losses, making 2 entries (Table 2).

| Dt | CT | Description |

| 84 | 99 | Reflects an unclosed loss |

| 99 | 84 | Shows profit in the amount of unspent profit |

Conclusion

Expenses that were not recognized in a timely manner in the 2016 financial statements must first of all be tested to determine whether they belong to an event after the reporting date (APD). If they are classified according to the rules of PBU 7/98 as proprietary financial statements, then they are subject to reflection in the financial statements according to the rules of PBU 7/98.

If these expenses are not classified by the organization as income tax, then they are recognized according to the rules of PBU 22/2010. Errors identified before the date of signing the financial statements are corrected by entries in the relevant accounting accounts in December 2021.

It turns out that in any case, in accounting, the reflection of last year’s data received before the signing of the financial statements should be made by entries in December of the year for which the financial statements are prepared.

The method you proposed in your question for reflecting expenses of the previous reporting period is acceptable for a situation where they are identified after signing the financial statements and are insignificant.

Losses from previous years: postings

If a company has found an error in the documents in the current year, due to which the amount of profit was previously overestimated or the amount of loss was underestimated, then the methods for correcting such a deficiency depend on:

- moment of discovery of the defect

- how critical is the error itself?

Video lesson on reflecting losses from previous years:

There are two options for action here (Table 3).

| When the flaw was discovered | Wiring used | When to make a recording | ||

| After signing the accounting statements | Dt 91 | Kt 62 | In the month the error was discovered | |

| After approval of accounting reports | Dt 84 | Kt 62 | In the month when errors were discovered | |

In Art. 54 of the Tax Code establishes the following conditions for recalculating the tax base:

- If you were able to determine the period of occurrence of the error, you need to recalculate the database exactly for this time interval

- When the period has not been established for certain, amendments are made to the base of the current

Controllers with both hands “for”

Local tax authorities (as evidenced by examples from arbitration practice) often insist on precisely this method of recognizing the expenses in question in accounting. They justify their demands by reference to the provisions of paragraph 1 of Art. 54 of the Tax Code of the Russian Federation (which corresponds to clause 1 of Article 272 of the Tax Code of the Russian Federation ), which determines the procedure for correcting the tax base in the event of detection of errors and inaccuracies relating to previous periods.

We believe that to a large extent, such categoricalness of the controllers was influenced by the explanations given in the Letter of the Federal Tax Service of Russia dated August 17, 2011 No. AS-4-3/13421 . Let us recall that in it, tax department specialists came to the conclusion that a taxpayer may not submit an amended return only when the period of occurrence of the error is not clear. With regard to documents received late, there can be no such ambiguity, since the period when the costs were incurred is determined.