From 01/01/2019, it is recommended that returns of goods to suppliers be processed through adjustment invoices. These recommendations are indicated in the letter from the Federal Tax Service.

Let's look at an example: The organization LLC "Confetprom" purchased goods from the counterparty LLC "Servislog" in the amount of 66,000.00 rubles. Including VAT 11,000.00 rub. During the resale process, one of the product items was found to be defective. The organization returns the goods to the supplier. Since the organization is a VAT payer, the supplier issues an adjustment invoice.

We go to the section Purchases - Receipts (acts, invoices).

Let’s create a document for receipt of goods and services and indicate in the header of the document

supplier Servicelog LLC and agreement. In the tabular section we enter the purchased goods: JVC TV - 1 piece, SHARP TV - 1 piece.

In the invoice received, check the box “Reflect the VAT deduction in the purchase book by the date of receipt.”

Using the document “Invoice received,” the program generates transactions for account 68.02 and makes an entry in the purchase book.

After a defect has been identified for the SHARP TV position, it is necessary to issue a return to the supplier. Because The supplier is a VAT payer, then he will issue an adjustment invoice for receipt.

You can display it in two ways:

- Document “Adjustment of receipts”.

- Document “return of goods to supplier” (starting from release 3.0.71).

What you need to pay attention to when returning to the supplier in 1C 8.3

Registration of a return transaction to a supplier in 1C 8.3 Accounting depends on some nuances:

- whether the Organization (buyer) is a VAT payer;

- whether the goods are registered before they are returned.

In this case, a quality or low-quality product is returned, does not affect the design.

Returning materials to a supplier in 1C 8.3 is no different from returning goods, so the step-by-step instructions for returning goods to a supplier in 1C 8.3 are also suitable for returning other goods.

The return of goods to the supplier is reflected according to Dt 76.02 “Calculations for claims” (chart of accounts 1C). If the returned goods have not previously been paid for, then when returning to the supplier in 1C 8.3, an additional entry Dt 60.01 Kt 76.02 is created, which automatically reduces the debt to the supplier by the cost of the returned goods.

Next, in step-by-step instructions, we will consider how to process the return of goods to the supplier in 1C 8.3 in various circumstances and what transactions are generated by 1C Accounting 8.3 in each case.

How to use the 1C program

In this case, you need to follow a slightly different algorithm of actions:

Registration of a return in the program

- First we need to enter the sales menu. And select the item dedicated to returning goods.

- The specialist then selects the implementation that requires reversal. The line "Shipping Document" is required. Forms are filled out automatically after pressing the button responsible for filling them out. If there is a desire or need, manual adjustments are made for quantitative information.

- Then you should check how correctly everything is filled out. To do this, use the “Document Results” button.

- A separate invoice is created on the VAT tab.

Reflection in 1C 8.3 of the return of goods not accepted for registration to the supplier

On September 10, the organization’s warehouse received the goods “Chairman Parm” Sofa (10 pcs.) from the supplier MebelLand LLC in the amount of 210,000 rubles. (including VAT 18%). Upon acceptance of the goods, a defect was discovered (5 pieces).

On September 12, the defective product was returned to the supplier.

If a defective product is taken into custody or only part of it is returned, then the low-quality product is first registered and then returned to the supplier.

Purchasing goods

Document the receipt of goods at the warehouse with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipt (acts, invoices).

If you are returning only part of the goods, then issue 2 documents Receipt (act, invoice) : one - for the receipt of goods accepted for registration, the second - for the receipt of goods not accepted for registration.

Fill in the data of primary documents in 1C (invoice and invoice) in the same way for both documents, according to the primary documents.

Receipt of registered goods

Receipt of goods not accepted for registration

In the form we indicate:

- Invoice No. from - number and date of the primary document;

- Amount - the total amount including VAT for the defective product;

- % VAT - Without VAT ;

- Accounting account - 002 “Inventory assets accepted for safekeeping.”

Postings upon receipt of goods not accepted for registration

Wiring is generated:

- Dt 002 - reflection of goods not accepted for registration.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

The List of supporting documents must contain both documents: receipt of goods accepted and goods not accepted for registration.

Returning goods to the supplier

For the return to the supplier of goods that have not been accepted for registration, fill out the document Return of goods to the supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

In the form we indicate:

- Receipt document - the document from which the batch is returned. May not be indicated if it is not known from which batch the item is being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Price, Amount - according to primary documents;

- Quantity - the number of returned goods;

- % VAT - VAT rate according to primary documents;

- Accounting account - 002 “Inventory assets accepted for safekeeping”, because the goods were not accepted for accounting.

Calculations tab unchanged.

Postings

Postings are generated:

- Kt 002 - goods returned to the supplier, not accepted for registration;

- Dt 60.01 Kt 76.02 - the debt to the supplier for returned goods has been reduced.

An invoice for the return of goods not accepted for accounting is not issued. An adjustment invoice from the supplier issued for a partial return of goods is not registered in the purchase book (Letter of the Ministry of Finance of the Russian Federation dated February 10, 2012 N 03-07-09/05).

Creation from purchases (shipment is made from the scrap warehouse)

Here all the steps are similar to the previous description, with one difference - you need to select a defect warehouse.

Fig. 13 Shipment from scrap warehouse

The user needs to know how much and what kind of product will be returned from the defective warehouse. The system will not allow you to post documents with a quantity exceeding the available balance in the scrap warehouse, or with items that are not in stock.

The subordination structure of the document is as follows:

Fig. 14 Document subordination structure

Returning goods accepted for registration to the supplier in 1C 8.3 - step-by-step instructions

On January 10, the Organization purchased the “Imperial” Table (100 pcs.) from the supplier “CLERMONT” LLC for the amount of RUB 1,416,000. (including VAT 18%). On the same day, the goods arrived at the warehouse and were accepted for accounting.

On February 6, part of the goods (38 pieces) was returned due to a defect.

Purchasing goods

The purchase of goods is documented with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipt (acts, invoices).

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

Postings

Wiring is generated:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Returning goods to the supplier

Fill out the return of goods accepted for registration with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

It does not matter whether part of the goods or the entire batch is returned.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of the MPZ; if the Receipt Document is specified, then the price is filled in automatically from the document; if not specified, then the last purchase price is indicated;

- % VAT - 18%, since the return of goods accepted for registration is a reverse sale.

Calculations tab unchanged.

Postings

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 76.02 Kt 68.02 - VAT is charged on the returned goods.

Issuance of invoices for return to the supplier

If goods already accepted for registration are returned to the supplier, then issue an invoice for their return at the bottom of the document form Return of goods to supplier .

Invoice issued for sales will be automatically created .

- Operation type code — .

Differences in Concepts

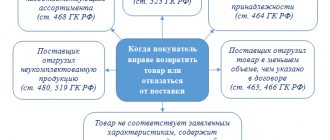

Some accountants do not share the concepts of “return of goods” and “reverse sales,” resulting in numerous problems with the preparation of documentation and with the reflection of transactions performed in accounting (tax, accounting).

If, some time after shipment of the purchased shipment, the purchaser returns what he received (in whole or in part) to the seller, it is important to find out the exact reason for this.

When the reason for the return movement of products is the non-compliance of the supply with the terms of the agreement (specification) in terms of configuration, color, quality or size, then the procedure should be interpreted as a return.

This situation arose as a result of the seller’s failure to properly fulfill its obligations to deliver what was ordered.

If the contract is terminated for the reason specified in the Civil Code of the Russian Federation, the obligations of the parties are not fulfilled, and there is no fact of implementation. With such a transfer, a waiver of the owner’s rights to the acquisition received is obtained, and not a restoration of the transferred right of ownership. The buyer, who has already recorded the receipt in accounting, must make reversing entries to correct it.

In cases where the purchaser does not have any claims to the received product, and its movement to the place of sale is carried out by agreement with the seller (for example, a part that was not sold on time), then the process is a reverse sale. In fact, 2 transactions take place: in the first transaction, the supplier sold goods to the buyer, and then in the second transaction, the buyer sold the same objects or part of them to the supplier. Both parties formalize and record the transaction as a regular purchase or sale of products.

By the way ! A product received under an agreement that meets the quality requirements is returned to the seller only by decision of the parties to the transaction or if the situation is stipulated by the terms of the current agreement (Article 450, Article 453 of the Civil Code of the Russian Federation). Upon receipt, ownership of the product is transferred to the acquirer (Article 223 of the Civil Code of the Russian Federation), and upon reverse sale, carried out at the same cost at which the product was purchased, ownership changes to its original state (before sale).

Return of goods by VAT non-payer

On March 29, the organization’s warehouse received the goods Computer desk “Boomerang-3N(M)” (20 pcs.) from the supplier KMH LLC in the amount of 139,240 rubles. (including VAT 18%).

On April 10, part of the goods (2 pieces) was returned due to a defect.

Purchasing goods

Reflect the purchase of goods in the document Receipt (act, invoice) type of transaction Goods in the section Purchases - Purchases - Receipts (acts, invoices) - Receipt button.

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

Returning goods to the supplier

Fill out the return of goods with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of MPZ including VAT;

- % VAT - Without VAT , because a company using the simplified tax system is not a VAT payer and does not issue an invoice (clause 5 of article 168 of the Tax Code of the Russian Federation).

Calculations tab unchanged.

Postings

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 60.01 Kt 76.02 - the debt to the supplier was reduced by the amount of the returned goods.

Refunds from the supplier: postings in 1C 8.3

On February 6, part of the goods (38 pieces) was returned due to a defect.

On February 8, payment was received to the bank account for the returned goods in the amount of RUB 538,080.

The return of funds from the supplier is documented using the document Receipt to the current account, transaction type Return from supplier in the Bank and cash desk - Bank - Bank statements section or based on the document Return of goods to supplier the Create based button .

In the form we indicate:

- Advances account - 76.02 “Calculations for claims.”

Postings

Wiring is generated:

- Dt Kt 76.02 - refund from the supplier for returned goods.