Payment

The simplified system is a special preferential regime, the declaration for which is submitted only once a year.

When paying wages to its employees, the employer informs them of all charges, deductions and payments,

Home / Taxes Back Published: 07/19/2020 Reading time: 7 min 0 362 One

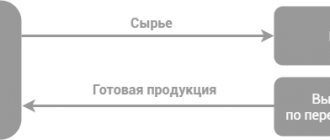

Regulatory regulation Toll processing is the performance of work on the production of products from the customer’s material

To find out which depreciation group a truck belongs to, you must be guided by the standards of the Classification of Basic

Documentation of accounting for fixed assets: receipt of fixed assets in the company Rules for documenting receipt of fixed assets

Individual entrepreneurs and organizations are required to pay different taxes. They are classified into calculated and withheld.

Most legal entities carry out settlements with counterparties, the budget, as well as extra-budgetary funds, and non-cash payments.

Legal entities are required to pay income tax to the state in the form of a monetary amount. It is presented

Individual entrepreneur wants to pay less taxes Artem makes and sells pottery, and also gives