We continue the series of articles that are devoted to the legal and tax issues of concluding a contract. The previous article examined in detail the conditions for concluding a work contract, which have the same meaning for both parties to the contract (read more in No. 1 (January) “BUKH.1S”, p. 37). In the material offered, 1C:ITS specialists talk about what taxes the contractor must pay depending on the conditions contained in the contract.

Contract agreements are widely used in practice. It is concluded between organizations to perform various types of work. Let's consider what tax obligations arise for the contractor, who is one of the parties to this agreement.

Payment for work performed

The terms of the contract may provide for different payment procedures for work performed. These conditions affect the rules for calculating taxes for both the contractor and the customer. The customer can pay the contractor before the work begins or after it is completed.

Tax consequences

VAT

If the terms of the agreement provide for payment before the start of execution of the agreement (a separate stage), then VAT must be calculated and paid from the amount of the advance received (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation). In this case, no later than five calendar days from the date of receipt of the advance payment, the contractor must issue the customer an “advance” invoice for this amount (clause 3 of Article 168 of the Tax Code of the Russian Federation).

After the work is completed (stage of work) and the acceptance certificate is signed, the contractor, on the basis of paragraph 14 of Article 167 of the Tax Code of the Russian Federation, again has the moment of determining the tax base for VAT. Therefore, he must also calculate VAT on the cost of the work performed and issue a “shipping” invoice to the customer. At the same time, he can submit the VAT paid on the advance payment for deduction from the budget (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

If the customer transfers funds to the contractor after completion of the work, then he calculates VAT in relation to these works once on the date of signing the acceptance certificate for the work performed. Accordingly, he issues an invoice to the customer once.

Income tax

The procedure for reporting funds received from the customer in income for profit tax purposes depends on what method of income recognition the contractor uses.

If the contractor uses the accrual method, then income is recognized on the date of signing the acceptance certificate for the work performed, regardless of whether funds were actually received from the customer on this date or not (clauses 1, 3 of Article 271 of the Tax Code of the Russian Federation). This means that prepayment amounts received from the customer are not included in income until the completion of the work (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation).

If the contractor uses the cash method, then the moment of recognition of revenue in income does not depend on the date of signing the acceptance certificate for the work performed. For such a contractor, revenue is included in income on the date of receipt of funds from the customer (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation, clause 2, article 273 of the Tax Code of the Russian Federation).

Basics of legal relations

Before moving on to accounting, it is worth understanding the definitions. So, a subcontractor is considered to be a contractor whose customer is the general contractor. The latter enters into an agreement directly with the technical customer or developer.

A subcontract agreement is concluded between the general contractor and the direct contractor. Certain conditions in this document affect the specifics of how financial indicators are reflected in the subcontractor’s accounting. The key point is the method of acceptance of work by the customer (general contractor).

Work can be accepted under a subcontract as a whole and separately for completed stages. The latter refers to the results of work that can be used by the customer for the purposes of the project, regardless of whether all other work for which an agreement has been concluded with the contractor has been completed.

Part of the work performed is documented with the appropriate document. In this case, legal acceptance does not occur, since all obligations under the contract have not been fulfilled. Submission of interim results is relevant if the customer calculates the amount of the next advance payment and transfers funds to the subcontractor. The latter must reflect the received amount in accounting.

Costs associated with the work

In the process of performing work, the contracting organization bears costs.

Such expenses, in particular, include the cost of purchasing materials necessary to complete the work, paying wages to employees, transportation costs, etc.

Tax consequences

VAT

VAT paid on the purchase of materials, etc., can be deducted by the contractor if the necessary conditions are met, that is, if the materials are purchased for activities subject to VAT, an invoice is received from the supplier of the materials and the materials are registered.

Income tax

Expenses associated with the performance of work are reflected in the contractor's tax records as follows.

A contractor who uses the accrual method and whose expenses are divided into direct and indirect, assigns direct expenses to the current expenses of the reporting (tax) period in which revenue from the work is recognized. In this case, indirect expenses in full relate to the expenses of the reporting (tax) period in which they were incurred (clause 2 of Article 318 of the Tax Code of the Russian Federation).

A contractor using the cash method recognizes costs associated with the performance of work as expenses after their actual payment, regardless of the recognition of revenue from the work (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Accounting - postings for services

> > > September 17, 2021 Accounting for services - postings for transactions involving it will be discussed in the article - is regulated by PBU standards. 5 tbsp. 38 of the Tax Code of the Russian Federation). Services exist in a wide variety, in particular:

- real estate agents;

- communications;

- training, etc.

- consulting;

- transport;

- storage;

- audit;

- informational;

In accounting, all services are included in costs based on primary accounting documents.

Let's consider the main methods of accounting for services. Services are a type of activity that does not have material expression, the results of which are sold and consumed in the process of economic activity of the enterprise (clause

The main primary documents confirming the execution of services are:

- Agreement.

- Certificate of completion of work or other document confirming acceptance of services.

IMPORTANT!

The Ministry of Finance believes that if the agreement does not provide for a clause on drawing up an act, then it needs to be drawn up only in cases provided for by law (letter dated November 13, 2009 No. 03-03-06/1/750). The Civil Code obliges the drawing up of an act confirming the acceptance of work only in the case of a construction contract (Art.

720 of the Civil Code of the Russian Federation). The procedure for concluding and terms of the contract for the provision of services are regulated by Ch.

37–41, 47–49, 51, 52 Civil Code of the Russian Federation. The main actors in the contract are the contractor and the customer of the services.

Let's look at the accounting procedures for each of them. The contractor's accounting directly depends on the type of activity and taxation regime. Most often, companies providing services in order to reduce the tax burden choose special regimes: UTII or simplified tax system.

Along with them, OSNO can also be used.

- Income accounting.

Revenue from services provided is income from ordinary activities.

The procedure for its accounting is regulated by clause 5 of PBU 9/99. Postings from the contractor when selling services will be as follows:

- Dt 62 Kt 90.1 - reflects the sale of services.

Reimbursement of expenses by the customer

The contract may provide that in addition to paying the cost of the work, the customer compensates the contractor for expenses that do not directly relate to the performance of the work, but without which it is impossible to complete the work. For example, travel expenses to the place of work, living expenses, etc. Are compensation amounts included in the tax base for VAT and income tax for the contractor?

Tax consequences

VAT

Chapter 21 of the Tax Code of the Russian Federation does not contain an answer to this question. However, there are two points of view on this issue.

Thus, in the opinion of the regulatory authorities, the contractor must include the reimbursement amounts received from the customer in the tax base for value added tax, since they are related to payment for work performed.

It does not matter that in contracts these expenses may be indicated separately from the cost of these works. The amounts are included in the tax base in the tax period in which the funds are received, and VAT on them is calculated at the rate of 18/118 (letter of the Ministry of Finance of Russia dated March 2, 2010 No. 03-07-11/37, dated November 9, 2009 No. 03- 07-11/288, etc.).

Some arbitration courts do not agree with this position. They believe that since the amounts of compensation received do not increase the cost of the work performed, then, therefore, they do not relate to the amounts that are associated with payment for these works, and therefore should not be included in the tax base for value added tax (resolutions of the Federal Antimonopoly Service of the North-West District dated 08/25/2008 in case No. A42-7064/2007, FAS Volga-Vyatka District dated 02/19/2007 in case No. A17-1843/5-2006, FAS East Siberian District dated 03/10/2006 No. A33-20073/04- S6-F02-876/05-S1 in case No. A33-20073/04-S6).

Since there is no clear answer to the question, the contractor will have to make the appropriate decision on his own. Moreover, if the contractor will charge VAT on the compensation amount, then he can issue an invoice in one of two ways. In the first case, the invoice is issued in one copy and is not presented to the customer. In the second case, the contractor issues an invoice in two copies, one of which is presented to the customer. Based on this invoice, the customer will be able to deduct VAT. Note that the second option is somewhat risky, since, according to regulatory authorities, the contractor does not have the right to issue an invoice to the customer for the amount of reimbursable expenses. The reason is that there is no sale of goods (works, services).

At the same time, the courts believe that the presentation of an invoice is possible (see decisions of the FAS North Caucasus District dated January 13, 2010 No. A53-9707/2009, dated January 20, 2009 No. A53-10111/2008-C5-44, FAS Moscow District dated 04/27/2010 No. KA-A40/4081-10, Federal Antimonopoly Service of the Ural District dated 05/25/2009 No. F09-3324/09-S3).

If the contractor does not include the reimbursement amounts in the VAT tax base, then he will not be able to deduct the VAT charged to him for these expenses by suppliers for the following reason. As you know, one of the conditions that must be met to deduct VAT is that the purchased goods (work, services) must be used in taxable activities. If these expenses are compensated by the customer, but are not included by the contractor in the VAT tax base, then it turns out that these expenses do not participate in taxable activities. Accordingly, VAT should not be deducted on such expenses.

Income tax

In Chapter 25 of the Tax Code of the Russian Federation there are no rules governing the procedure for recognizing for profit tax purposes the amounts that taxpayers receive as reimbursement of expenses. At the same time, in our opinion, the contractor should reflect them in tax accounting taking into account the following.

If the contractor includes costs that will be reimbursed by the customer as expenses, then he must recognize the received reimbursement amounts in income. If these costs are not included in tax accounting expenses, then the amounts reimbursed by the customer should not be reflected in income.

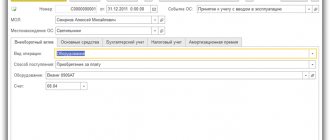

Registration of SF supplier

To register an incoming invoice, you must indicate its number and date at the bottom of the Receipt document form (act, invoice) and click the Register .

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

- Operation type code : “Receipt of goods, works, services.”

If the program does not maintain separate PDF accounting and in the Invoice received , the Reflect VAT deduction in the purchase book by the date of PDF receipt checkbox is selected , then when posting the Invoice received , entries will be made to accept VAT for deduction.

Otherwise, VAT is deducted using the document Generating purchase ledger entries .

Elimination of deficiencies in completed work

Sometimes, after completion of the work, the customer identifies shortcomings in the work performed and turns to the contractor with a demand to eliminate them. As a rule, the contractor eliminates these deficiencies free of charge. As a result of performing such work, he is faced with two questions: is it necessary to calculate VAT on the cost of gratuitous work and can the costs associated with the performance of this work be taken into account when taxing profits?

Tax consequences

VAT

In this case, the object of VAT taxation does not arise. The fact is that by eliminating deficiencies free of charge, the contractor, in fact, fulfills the obligations assumed under the contract. In turn, the cost of work under this agreement is already included in the VAT tax base. Therefore, there is no need to charge and pay VAT on the cost of “corrective” work.

Income tax

As for the recognition for profit tax purposes of the costs incurred by the contractor when carrying out work to eliminate deficiencies, they can be included in expenses in tax accounting on the basis of subparagraph 47 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation as losses from defects.

Accounting and tax accounting of operations under a construction contract

GENERAL PROCEDURE FOR ACCOUNTING AND DOCUMENTARY OPERATIONS When maintaining accounting records of transactions performed as part of the execution of a construction contract, the parties (customer and contractor) must be guided by the general accounting rules enshrined in the Accounting Law and in all accounting regulations in force today .

In this case, first of all, of course, you need to be guided by two documents: - Accounting Regulations

“Accounting for agreements (contracts) for capital construction”

(PBU 2/94), approved by Order of the Ministry of Finance of Russia dated December 20, 1994 N 167 (hereinafter referred to as PBU 2/94); — Regulations on accounting of long-term investments, approved by letter of the Ministry of Finance of Russia dated December 30, 1993 N 160 (hereinafter referred to as the Regulations on investment accounting). When using these documents, keep in mind that they were adopted quite a long time ago.

Since then, the accounting regulatory framework has changed significantly. Therefore, today these documents are largely outdated and are used to the extent that they do not contradict later regulatory documents governing accounting procedures. For example, in the Regulations on Investment Accounting there is clause.

3.1.7, which defines the procedure for accounting for costs that do not increase the cost of fixed assets. Such costs, in particular, include costs associated with the demolition of buildings when allocating land plots for construction, costs of paying interest on bank loans in excess of the discount rates of the Central Bank of the Russian Federation, etc. expenses. However, when forming the initial cost of fixed assets, it is currently necessary to be guided exclusively by the norms of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01 (approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n).

And paragraph 8 of PBU 6/01 stipulates that the initial cost of a fixed asset is formed based on the entire amount of actual costs associated with its construction. Therefore, the question of including certain costs

The customer refused to fulfill the contract

The customer may refuse to fulfill the contract for various reasons. Moreover, this can happen when some of the work has already been completed. The contractor's tax obligations in case of such a refusal depend on whether he received an advance payment for the work performed or not.

Tax consequences

VAT

If the customer refuses to fulfill the contract when part of the work has already been completed, then he must pay the contractor for the work actually performed. The contractor, in turn, must calculate VAT on the cost of these works in the generally established manner. Moreover, if under such an agreement the contractor received an advance payment from the customer and paid VAT on it to the budget, then, when deducting this VAT at the time of calculating the tax on the cost of work performed, he must remember the following.

If the amount of the advance received does not exceed the cost of the work actually performed, then value added tax is deducted in full amount as of the date of tax calculation on the cost of the work actually performed. If the amount of the prepayment exceeds the cost of the work actually performed, the contractor first transfers the corresponding part of the prepayment to the customer, reflects this operation in accounting, and only after that deducts “advance” VAT (clause 5 of Article 171, clause 4 of Article 172 of the Tax Code of the Russian Federation ).

Income tax

The cost of the work actually performed, paid by the customer in the event of refusal to fulfill the contract, is the contractor’s proceeds from the implementation of the work. Under the accrual method, it is included in income for tax purposes in the period in which part of the work is completed and the relevant documents are signed (clause 1, article 39, clause 3, article 271 of the Tax Code of the Russian Federation).

Moreover, if the customer made an advance payment to the contractor, then the income includes an amount corresponding to the cost of the work performed.

A contractor using the cash method includes the advance in income on the date the cash is actually received. Therefore, if the customer refuses the contract, he must exclude from income the amount of the advance payment that exceeds the cost of the work actually performed.

So, we have looked at the tax consequences of entering into a contract for a contractor.

In the next issue we will talk about the tax obligations that arise when concluding an agreement with the customer.

All information provided can be found in the ITS PROF system in the Handbook of Contractual Relations in the “Legal Support” section (see figure).

Rice. 1

Step-by-step instruction

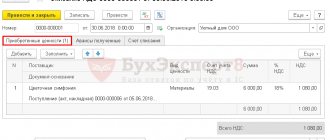

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Reflection in accounting of equipment installation work performed by a subcontractor | |||||||

| January 22 | 20.01 | 60.01 | 18 000 | 18 000 | 18 000 | Accounting for costs of subcontracting work | Receipt (act, invoice) - Goods (invoice) |

| 19.04 | 60.01 | 3 240 | 3 240 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| January 22 | — | — | 21 240 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 3 240 | Acceptance of VAT for deduction | ||||

| Implementation of installation work | |||||||

| January 29 | 62.01 | 90.01.1 | 30 090 | 30 090 | 25 500 | Proceeds from the sale of work | Sales (act, invoice) - Services (act) |

| 90.03 | 68.02 | 4 590 | VAT accrual on revenue | ||||

| Issuance of SF for sale to the buyer | |||||||

| January 29 | — | — | 30 090 | Submission of SF for sale | Invoice issued for sales | ||

| — | — | 4 590 | Reflection of VAT in the sales book | Sales book report | |||

| Calculation of the cost of work performed | |||||||

| January 31 | 90.02.1 | 20.01 | 18 000 | 18 000 | 18 000 | Adjustment of the cost of work | Closing the month - Closing accounts 20, 23, 25, 26 |

| Acceptance of VAT for deduction on work | |||||||

| January 31 | 68.02 | 19.04 | 3 240 | Acceptance of VAT for deduction | Generating purchase ledger entries | ||

| — | — | 3 240 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

Payment for work performed

The terms of the contract may provide for different payment procedures for work performed. These conditions affect the rules for calculating taxes for both the contractor and the customer. The customer can pay the contractor before the work begins or after it is completed.

Tax consequences

VAT

If the terms of the agreement provide for payment before the start of execution of the agreement (a separate stage), then VAT must be calculated and paid from the amount of the advance received (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation). In this case, no later than five calendar days from the date of receipt of the advance payment, the contractor must issue the customer an “advance” invoice for this amount (clause 3 of Article 168 of the Tax Code of the Russian Federation).

After the work is completed (stage of work) and the acceptance certificate is signed, the contractor, on the basis of paragraph 14 of Article 167 of the Tax Code of the Russian Federation, again has the moment of determining the tax base for VAT. Therefore, he must also calculate VAT on the cost of the work performed and issue a “shipping” invoice to the customer. At the same time, he can submit the VAT paid on the advance payment for deduction from the budget (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

If the customer transfers funds to the contractor after completion of the work, then he calculates VAT in relation to these works once on the date of signing the acceptance certificate for the work performed. Accordingly, he issues an invoice to the customer once.

Income tax

The procedure for reporting funds received from the customer in income for profit tax purposes depends on what method of income recognition the contractor uses.

If the contractor uses the accrual method, then income is recognized on the date of signing the acceptance certificate for the work performed, regardless of whether funds were actually received from the customer on this date or not (clauses 1, 3 of Article 271 of the Tax Code of the Russian Federation). This means that prepayment amounts received from the customer are not included in income until the completion of the work (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation).

If the contractor uses the cash method, then the moment of recognition of revenue in income does not depend on the date of signing the acceptance certificate for the work performed. For such a contractor, revenue is included in income on the date of receipt of funds from the customer (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation, clause 2, article 273 of the Tax Code of the Russian Federation).

Long-term construction work

If construction work is long-term in nature or a transitional period (the start and end dates of the contract fall on different reporting years), when reflecting operations under a construction contract in accounting, follow the rules of PBU 2/2008 (clause 1 of PBU 2/2008). According to this document, accounting for income, expenses and financial results is carried out separately for each executed contract (accounting object). For more information about the specifics of determining accounting objects when performing contract work, see How to reflect the contractor's expenses under a construction contract in accounting.

In accordance with PBU 2/2008, revenue from the implementation of contract work is recognized in the “as ready” method, taking into account the features provided for in paragraph 23 of PBU 2/2008.

The “as ready” method is applied if the financial result (profit or loss) of the execution of the contract as of the reporting date can be reliably determined. In this case, the contractor’s revenue is determined on an accrual basis, regardless of the cost of work performed in each reporting period being presented to the customer for payment. Such rules are established in paragraph 17 of PBU 2/2008. Depending on the procedure for determining the contract price agreed upon by the parties, revenue is recognized subject to certain conditions being met (clauses 18, 19 of PBU 2/2008).

The “as ready” method provides that revenue and expenses are determined based on the degree of completion of work confirmed by the organization as of the reporting date. In turn, the degree of completion of work can be determined by one of two options specified in paragraph 20 of PBU 2/2008. The selected option must be fixed in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

Option 1 . The degree of completion is determined by the share of the volume of work completed as of the reporting date in the total volume of work under the contract. For example, by the share of completed work in physical terms (in kilometers of road surface, cubic meters of concrete, etc.). The accountant can request information about the scope of work completed as of the reporting date from the construction department, which is required to keep a log of work performed in Form No. KS-6a. In this case, to determine the degree of completion of the work, use the formula:

| Degree of completion of work | = | The volume of work actually performed as of the reporting date in physical terms | : | Total volume of work under the contract in kind | × | 100 |

In addition, the degree of completion can be determined by the share of the volume of work completed using expert assessment. Such an expert assessment may be the data of Form No. KS-3, signed by the parties for the reporting period.

An example of determining revenue under a long-term construction contract. Revenue is recognized on an “as-available” basis. The contractor determines the degree of completion of work by the share of completed work in the total amount of work under the contract (the expert assessment method is used)

LLC "Alfa" (contractor), on the basis of a construction contract, performs work on the construction of a facility for the developer - LLC "Proizvodstvennaya". The contract was concluded for a period from January 20, 2015 to March 20, 2021.

The cost of work under the contract is 1,400,000 rubles. (without VAT). Actual expenses incurred - 900,000 rubles. In accordance with Alpha's accounting policy, for accounting purposes, the degree of completion of work is determined by the share of completed work in the total volume of work under the contract.

According to Alpha's engineering service, as of December 31, 2015, the volume of work performed at the site amounted to 80 percent of the total volume of work under the contract.

Based on this, in 2015, under the agreement with “Master”, the following indicators are reflected in Alpha’s accounting:

- revenue from the sale of contract work in the amount of RUB 1,120,000. (RUB 1,400,000 × 80%);

- expenses associated with the performance of contract work in the amount of RUB 900,000.

The work was fully completed and handed over to the developer on time - March 2016. The revenue reflected in Alpha's accounting records in the first quarter of 2021 is: RUB 1,400,000. – 1,120,000 rub. = 280,000 rub.

Option 2 . The degree of completion is determined by the share of expenses incurred as of the reporting date in the estimated total expenses under the contract:

| Degree of completion of work | = | Costs actually incurred as of the reporting date for work performed | : | Total costs under the contract (calculated amount) | × | 100 |

Expenses incurred at the reporting date are determined only for work performed. The cost of materials transferred to perform work, but not yet used to fulfill the contract, is not included in the amount of expenses (clause 21 of PBU 2/2008).

In accounting, reflect income and expenses under construction contracts separately for each concluded contract (in the context of analytical accounting). However, some agreements have a number of specific features. This is stated in section II of PBU 2/2008.

With the “as ready” method, until the work is completely completed, revenue is accounted for as a separate asset - “accrued revenue not presented for payment” (clauses 25, 26 of PBU 2/2008). If the contractor does not have, in accordance with the terms of the contract, the right to present the cost of work performed for payment, it is impossible to reflect the revenue on account 62 (Instructions for the chart of accounts). Therefore, the organization reflects it on account 46 “Completed stages of work in progress” (paragraph 9 of the Instructions to the chart of accounts). It is this account that is used, if necessary, by organizations performing long-term work (Instructions for the chart of accounts). After the contractor has received the right to present the cost of work performed to the customer for payment, account 46 is closed as a debit to account 62.

In accounting at the end of each reporting period (month), reflect the revenue with the following entries:

Debit 46 Credit 90-1 – revenue is taken into account using the “as ready” method;

Debit 90-2 Credit 20 – expenses under a construction contract are recognized.

Upon completion of all work as a whole, make the following wiring:

Debit 62 Credit 46 – accrued revenue presented for payment.

If the contractor is a VAT payer, then he needs to reflect the VAT accrued on the amount of revenue (Instructions for the chart of accounts). The procedure for reflecting VAT in accounting in such a situation is not regulated by law, so the organization has the right to develop it independently (paragraph 9 of the Instructions for the chart of accounts). In this case, to account for accrued VAT, you can use account 76 “Settlements with various debtors and creditors” (Instructions for the chart of accounts). It is advisable to open a separate sub-account for this account:

Debit 90-3 Credit 76 subaccount “VAT on completed but not completed construction work” - reflects VAT on accrued revenue from the work.

As the work is delivered to the customer on the date of signing the acceptance certificate, make the following entry in accounting:

Debit 76 subaccount “VAT on completed but not delivered construction work” Credit 68 subaccount “VAT settlements” - reflects the debt to pay VAT to the budget.

This procedure follows from the Instructions for the chart of accounts (accounts 90, 62, 76, 20, 68) and paragraphs 25, 26 of PBU 2/2008.

If at the reporting date it is impossible to determine the financial result from the execution of the contract (degree of completion of work), recognize revenue in the amount of actual expenses incurred that can be reimbursed (clauses 17, 23 of PBU 2/2008). This situation may arise, for example, when negotiations with the customer on the final estimate for the work to be performed have not been completed.

An example of determining revenue under a construction contract based on the amount of expenses actually incurred, which during the reporting period are considered possible for reimbursement

LLC "Alfa" (contractor), on the basis of a construction contract, performs work on the construction of a facility for the developer - LLC "Proizvodstvennaya". The agreement was concluded in December 2015. The completion date is July 2021.

The total cost of work under the contract is RUB 78,000,000. excluding VAT. Estimated expenses under the contract (according to the estimate) – 50,000,000 rubles.

In 2015, Alpha (contractor) incurred costs for work not included in the estimate. The actual amount of expenses for such work amounted to RUB 3,000,000 as of December 31, 2015. At the same time, the contractor had confidence that the customer would reimburse these costs. No other work was carried out during this period.

We recognize revenue under the contract for 2021 in the amount of actual expenses incurred. In accounting we reflect:

- expenses associated with the performance of contract work - RUB 3,000,000;

- income from sales in the same amount - 3,000,000 rubles.

In January 2021, the contractor's expenses amount to RUB 3,000,000. for unforeseen work were agreed upon with the customer. No more unforeseen work was carried out. Starting from January 2021, Alpha switched to recognizing income and expenses in the generally established manner - the “as ready” method.

Costs associated with the work

In the process of performing work, the contracting organization bears costs.

Such expenses, in particular, include the cost of purchasing materials necessary to complete the work, paying wages to employees, transportation costs, etc.

Tax consequences

VAT

VAT paid on the purchase of materials, etc., can be deducted by the contractor if the necessary conditions are met, that is, if the materials are purchased for activities subject to VAT, an invoice is received from the supplier of the materials and the materials are registered.

Income tax

Expenses associated with the performance of work are reflected in the contractor's tax records as follows.

A contractor who uses the accrual method and whose expenses are divided into direct and indirect, assigns direct expenses to the current expenses of the reporting (tax) period in which revenue from the work is recognized. In this case, indirect expenses in full relate to the expenses of the reporting (tax) period in which they were incurred (clause 2 of Article 318 of the Tax Code of the Russian Federation).

A contractor using the cash method recognizes costs associated with the performance of work as expenses after their actual payment, regardless of the recognition of revenue from the work (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Provision of services – accounting entries

Author of the article Olga Evseeva 20 minutes to read 13,551 views Contents In this material we will look at the provision of services - accounting entries.

We will find out how services are reflected in accounting, how services are accounted for by the customer/performer, as well as what are the features of the provision of services by an agent.

We will answer frequently asked questions and analyze common mistakes. Service is a type of activity that cannot be expressed financially. Its results are provided to individuals and legal entities for a fee or are used in the course of business activities within the company. When providing any types of services, the parties to the transaction are:

- Consumer (customer).

- Service Seller,

Services are: (click to expand)

- Storage services;

- Other types of services.

- Auditing;

- Communication services (telephone, postal, Internet provider);

- Educational;

- Transport;

- Informational;

- Services in trade (work of consultants with clients, merchandisers for displaying goods, etc.);

- Legal;

- Medical services in various medical centers.

institutions; - For leasing premises, fixed assets, inventories, etc.;

The main document issued upon completion of the service is the Service Provision Certificate. Also, companies paying VAT draw up an invoice.

Reimbursement of expenses by the customer

The contract may provide that in addition to paying the cost of the work, the customer compensates the contractor for expenses that do not directly relate to the performance of the work, but without which it is impossible to complete the work. For example, travel expenses to the place of work, living expenses, etc. Are compensation amounts included in the tax base for VAT and income tax for the contractor?

Tax consequences

VAT

Chapter 21 of the Tax Code of the Russian Federation does not contain an answer to this question. However, there are two points of view on this issue.

Thus, in the opinion of the regulatory authorities, the contractor must include the reimbursement amounts received from the customer in the tax base for value added tax, since they are related to payment for work performed.

It does not matter that in contracts these expenses may be indicated separately from the cost of these works. The amounts are included in the tax base in the tax period in which the funds are received, and VAT on them is calculated at the rate of 18/118 (letter of the Ministry of Finance of Russia dated March 2, 2010 No. 03-07-11/37, dated November 9, 2009 No. 03- 07-11/288, etc.).

Some arbitration courts do not agree with this position. They believe that since the amounts of compensation received do not increase the cost of the work performed, then, therefore, they do not relate to the amounts that are associated with payment for these works, and therefore should not be included in the tax base for value added tax (resolutions of the Federal Antimonopoly Service of the North-West District dated 08/25/2008 in case No. A42-7064/2007, FAS Volga-Vyatka District dated 02/19/2007 in case No. A17-1843/5-2006, FAS East Siberian District dated 03/10/2006 No. A33-20073/04- S6-F02-876/05-S1 in case No. A33-20073/04-S6).

Since there is no clear answer to the question, the contractor will have to make the appropriate decision on his own. Moreover, if the contractor will charge VAT on the compensation amount, then he can issue an invoice in one of two ways. In the first case, the invoice is issued in one copy and is not presented to the customer. In the second case, the contractor issues an invoice in two copies, one of which is presented to the customer. Based on this invoice, the customer will be able to deduct VAT. Note that the second option is somewhat risky, since, according to regulatory authorities, the contractor does not have the right to issue an invoice to the customer for the amount of reimbursable expenses. The reason is that there is no sale of goods (works, services).

At the same time, the courts believe that the presentation of an invoice is possible (see decisions of the FAS North Caucasus District dated January 13, 2010 No. A53-9707/2009, dated January 20, 2009 No. A53-10111/2008-C5-44, FAS Moscow District dated 04/27/2010 No. KA-A40/4081-10, Federal Antimonopoly Service of the Ural District dated 05/25/2009 No. F09-3324/09-S3).

If the contractor does not include the reimbursement amounts in the VAT tax base, then he will not be able to deduct the VAT charged to him for these expenses by suppliers for the following reason. As you know, one of the conditions that must be met to deduct VAT is that the purchased goods (work, services) must be used in taxable activities. If these expenses are compensated by the customer, but are not included by the contractor in the VAT tax base, then it turns out that these expenses do not participate in taxable activities. Accordingly, VAT should not be deducted on such expenses.

Income tax

In Chapter 25 of the Tax Code of the Russian Federation there are no rules governing the procedure for recognizing for profit tax purposes the amounts that taxpayers receive as reimbursement of expenses. At the same time, in our opinion, the contractor should reflect them in tax accounting taking into account the following.

If the contractor includes costs that will be reimbursed by the customer as expenses, then he must recognize the received reimbursement amounts in income. If these costs are not included in tax accounting expenses, then the amounts reimbursed by the customer should not be reflected in income.

Introduction of accounting in construction for a contractor: an example

signed a contract for construction and installation works with delivery of work in 2 separate stages. The cost of the 1st stage of work is 2000 thousand rubles, the 2nd stage is 2400 thousand rubles.

The customer makes an advance payment for the purchase of building materials for future work in the amount of 90% of the estimated cost of construction and installation work.

Work began in April 2015, an advance payment of 1,800,000 rubles was received.

In May, the 1st stage of work was completed, an act was drawn up. KS-2, the cost of work has been calculated -

1720 thousand rubles.

In June, an advance payment of 2,160,000 rubles was transferred, and the 2nd stage of work began. The object was completed and handed over to the customer in July, the cost of the 2nd stage of work was 1980 thousand rubles.

Wiring in construction :

| Period | D/t | K/t | Amount (rub.) | Accounting in a construction organization |

| 20.04 | 51 | 62-1 | 1 800 000 | prepayment received |

| 20.04 | 62-1 | 68-1 | 274 576 | VAT charged |

| 25.05 | 46 | 90-1 | 2 000 000 | Stage 1 of work completed |

| 25.05 | 90-3 | 68-1 | 305 085 | VAT charged |

| 25.05 | 68-1 | 62-1 | 274 576 | VAT has been restored from the prepayment amount |

| 25.05 | 90-2 | 20 | 1 720 000 | the cost of the 1st stage of work was written off |

| 25.05 | 90-9 | 99 | 100 610 | profit from the delivery of the 1st stage of work |

| 15.06 | 51 | 62-1 | 2 160 000 | prepayment for the 2nd stage of work |

| 15.06 | 62-1 | 68-1 | 486 000 | VAT on prepayment |

| 20.07 | 62 | 46 | 2 000 000 | the cost of the 1st stage of work was written off |

| 20.07 | 62 | 90-1 | 2 400 000 | revenue is reflected |

| 20.07 | 90-3 | 68 | 366 102 | VAT charged |

| 20.07 | 68 | 62-1 | 486 000 | VAT refunded on prepayment |

| 20.07 | 90-2 | 20 | 1 980 000 | costs of the 2nd stage of work were written off |

| 20.07 | 90-9 | 99 | 420 000 | profit from the 2nd stage of completed work |

| 20.07 | 62-1 | 62 | 3 960 000 | The amount of the received advance payment is credited |

Although in real life construction accounting for a contractor is more complex, the example presented demonstrates the basic accounting records.

Elimination of deficiencies in completed work

Sometimes, after completion of the work, the customer identifies shortcomings in the work performed and turns to the contractor with a demand to eliminate them. As a rule, the contractor eliminates these deficiencies free of charge. As a result of performing such work, he is faced with two questions: is it necessary to calculate VAT on the cost of gratuitous work and can the costs associated with the performance of this work be taken into account when taxing profits?

Tax consequences

VAT

In this case, the object of VAT taxation does not arise. The fact is that by eliminating deficiencies free of charge, the contractor, in fact, fulfills the obligations assumed under the contract. In turn, the cost of work under this agreement is already included in the VAT tax base. Therefore, there is no need to charge and pay VAT on the cost of “corrective” work.

Income tax

As for the recognition for profit tax purposes of the costs incurred by the contractor when carrying out work to eliminate deficiencies, they can be included in expenses in tax accounting on the basis of subparagraph 47 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation as losses from defects.

Accounting in construction: formation of costs for construction and installation works

The allocation of production costs is carried out according to the elements used in the accounting of construction companies: materials, wages, operation of mechanisms, overhead costs.

Production costs are accumulated in the debit of the account. No. 20, corresponding to the credit of accounts:

• 10 “Materials” - for the cost of inventories, building materials, structures;

• 23 “Auxiliary production” - for the amount of services from auxiliary production;

• 60 “Settlements with suppliers” - for the cost of services provided by organizations, incl. resource suppliers. For example, the supply and consumption of water for production needs during construction are taken into account.

Separate subaccount. 20 “Performance of construction work by subcontractors” is opened for the general contractor to take into account the estimated cost of work accepted from the subcontractor before delivery to the customer, and not included in the general contractor’s costs.

Provision of services - accounting entries accounting for the provision of services

» » Accounting entries for services Accounting entries for transport services Accounting entries for sales of services The source of income for an enterprise can be not only the sale of goods, but also the provision of services. This activity has its own characteristics.

And this, naturally, is reflected in the accounting. Accounting entries for services for the customer and the contractor will, naturally, be different.

The service provider uses account 90 “Sales” for this purpose.

On it, actual expenses are taken into account as a debit, and as a credit, the revenue received is taken into account in accordance with the established tariffs. From the very specifics of the operation it follows that account 43 “Finished products” is not used in this case.

After all, services are always transferred directly to the client.

The answer to the question whether account 40 is used in this case (that is, “Output of products (services)”) depends on whether the enterprise uses the planned cost in current accounting.

Accordingly, the accounting entries for services in this case look like this: the amount of revenue from the debit of account 62 is transferred to the credit of account 90 (under subaccount 90-1).

This is how the debt for services rendered is reflected. The actual cost is taken into account by posting Debit 90-2 – Credit 20 “Main production” (or account 23). If the company pays VAT, then it is necessary to reflect the tax accrual - posting Debit 90 (under subaccount 3) - Credit 68 (under the subaccount of the corresponding tax).

When the buyer pays for the services, this will be reflected by an entry in which the amount of debt will be written off to the debit of account 51 from the credit of account 62.

Otherwise, the purchase of services from the customer is reflected. The costs of their purchase must be taken into account in accordance with PBU 10/99.

Expenses that are generated for ordinary activities include all costs for the acquisition of services, except those related to the creation or purchase of fixed assets or other non-current assets. As for the accounting entries for services directly, settlements with the contractor are reflected by entries Debit 60 - Credit 51 (this entry is made on the basis of a bank statement).

The concept of settlements with suppliers and contractors

Suppliers and contractors are entities typically engaged in the following activities:

- Supply of raw materials.

- Provision of services.

- Repair and construction.

Transactions with the entities in question are divided into two types:

- Purchase of rights or property. For example, this could be a sales deed or a supply agreement.

- Settlements with contractors. For example, this is a contract agreement for the provision of services.

Question: How to reflect in accounting the calculations for a claim issued to a supplier (contractor, other counterparty)? View answer

All payments are made on the basis of agreements between both parties. They are produced after receiving goods or services. Calculations are made based on the invoice. This paper must be registered in the Accounting Journal. To account for calculations, account 60 of the same name is used. Accounting is carried out here in these areas:

- According to settlement papers for which payment is made.

- Based on calculations performed during scheduled payments.

- For settlement papers for which there are no invoices.

- Based on excess valuables discovered upon acceptance.

- For advances paid.

Let's consider the basic tasks of accounting for settlements with counterparties:

- Creation of an information system about the status of settlements, which will be used by managers, founders, and investors.

- Collection of documentary evidence of compliance of the company’s activities with legal acts.

- Ensuring compliance with established payment forms.

- Tracking the status of receivables and payables.

- Prevention of overdue debts.

- Control over the implementation of the delivery plan.

- Control over the implementation of contract clauses.

- Ensuring timely receipt of valuables.

Account information is used by both external and internal users. External users can be both investors and regulatory authorities.