Individual entrepreneur wants to pay less taxes

Artem makes and sells pottery, and also gives pottery lessons.

He works as an individual entrepreneur under the simplified tax system “income minus expenses”. Artem earns about 100,000 rubles per month, investing 30,000 rubles in materials and equipment. The state receives 15% tax on the difference between income and expenses - 10,500 rubles. Artem also has to pay about 4,500 ₽ in contributions per month, but they are completely covered by taxes. It turns out 59,500 ₽ net earnings.

Artem wants to save on taxes and try to combine individual entrepreneurs and self-employment.

Who can become?

Any person who operates on the territory of the Russian Federation can become a self-employed citizen. Foreign citizens from Belarus, Kyrgyzstan, Kazakhstan and Armenia can also become self-employed if they have clients in Russia. They are allowed to change the tax regime under the same conditions as citizens of the Russian Federation.

Starting from October 2021, you can become self-employed in any region of the country.

From what age

Any citizen over the age of 18 and between the ages of 14 and 18 can become self-employed if he fulfills one of the conditions and is not an individual entrepreneur.

Who can become self-employed at 14-18 years old:

- who entered into marriage and became legally capable as a result;

- parents or guardians have given written consent to this;

- the court or guardianship authorities recognized him as fully capable in accordance with the established procedure.

You cannot: Become self-employed and remain an individual entrepreneur in a different tax regime

Now Artem is an individual entrepreneur using the simplified tax system “income minus expenses.” This tax regime suits him because Artem receives 50,000 rubles per month from pottery and spends 30,000 rubles on materials. It turns out only 3000 ₽ tax on net profit.

The income from pottery lessons has increased, and it is now unprofitable to pay such a tax. For the last three months, Artem has been earning 50,000 rubles per month from training. There are no expenses here, but he is still forced to pay 15% in the “income minus expenses” mode - 7,500 rubles. And in a no-expenses mode, for example, self-employment, he could reduce the tax rate to 4% and pay only 2,000 rubles.

Artem doesn’t want to lose profits and pay taxes on all income without taking into account the costs of clay. It would be more convenient for him to combine two tax regimes: apply the NAP for pottery lessons and the simplified tax system for the sale of dishes. But you can’t do that—you’ll have to choose one thing.

Self-employment is a special tax regime, NPI (professional income tax). Essentially the same as simplified, general system, patent, UTII. Only with its own conditions, and one of them is the incompatibility of the NAP with other tax regimes. This means that if an individual entrepreneur switches to NAP, he cannot maintain his old tax regime.

Individual entrepreneur and self-employment: how to combine to avoid tax claims

Let's look at these rules in more detail. So, if you want to combine individual entrepreneurs with self-employment, then you will have to comply with a number of conditions.

Refuse other special modes

An individual has the right to be an individual entrepreneur and self-employed at the same time, but he cannot combine the professional income tax (PIT) with other special tax regimes - simplified tax system, UTII and unified agricultural tax. That is, you cannot use two tax regimes at the same time.

You need to have time to refuse special regimes within a month from the day the individual entrepreneur registered as self-employed (Part 4 of Article 15 of the Federal Law of November 27, 2018 No. 422-FZ). Otherwise, the registration will not be counted. To do this, it is important to send to the tax office, with which the entrepreneur is registered, a notice of refusal of the simplified tax system, UTII or Unified Agricultural Tax in the standard form, which is given in the Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 N ММВ-7-3 / [email protected] This can be done in person, by mail, through the personal account of an individual entrepreneur.

To confirm that the notification has been sent to the tax office, you can make a copy or photograph the application with a note of acceptance.

If an individual entrepreneur applies a special regime for some type of activity that is not subject to professional income tax, he must pay personal income tax on income from this activity. In this case, self-employment for all income, including income from personal property, terminates automatically.

Please note that if an individual entrepreneur uses a patent taxation system, he will be able to register as a tax payer only after the patent expires or after he notifies the tax authority of the termination of such activities.

Monitor your income

They should not exceed the limit of 2.4 million rubles. in year. This is exactly the limit specified in Federal Law No. 422-FZ of November 27, 2018 for tax on professional income. If you go beyond this limit, the tax office will certainly notify you of the termination of your self-employed status.

Therefore, “it is important to monitor the level of your income and, if it exceeds it, promptly switch to other taxation regimes in order to avoid paying personal income tax of 13% and VAT of 20%,” notes lawyer and general director of SaaS Project Izabella Atlaskirova. “If a self-employed person is late in switching to the new tax regime, he will have to pay taxes under the general tax regime until the end of the year.”

To avoid this situation, you can again choose a special regime by submitting a notification to the tax office at your place of residence using a standard form within 20 days after termination of registration as a self-employed person (Part 6, Article 15 of Federal Law No. 422-FZ of November 27, 2018).

Online accounting for new business

Details

Do not count on a decrease in income for expenses

In the “Questions to an Expert” section of Kontur.Magazine, the following questions periodically appear: how can a self-employed person deduct expenses necessary for the manufacture of products?

But if a self-employed person is engaged in the manufacture of products, then the costs of creating them do not reduce the income received from the sale of these products. According to paragraph 1 of Art. 8 of Federal Law No. 422-FZ of November 27, 2018, when citizens apply the NDP, expenses associated with conducting activities are not taken into account. Income is considered the entire amount of proceeds from sales, regardless of the amount of business development expenses and net profit. Self-employed people pay tax on this income - in the amount of 4% or 6% of revenue, depending on whether they work with individuals or legal entities.

Thus, the NAP differs from the special regime of the simplified tax system with the object “income minus expenses”.

The simplified tax system with the object “income” may be more profitable than self-employment

“Individual entrepreneurs on the simplified tax system and self-employed people cooperating with legal entities pay the same tax - 6% of income, but at the same time, for individual entrepreneurs, the tax is reduced by the amount of insurance premiums, and self-employed people pay insurance premiums in full,” notes the lawyer and general director “SAAS project” Isabella Atlaskirova.

“Accordingly, an individual entrepreneur on the simplified tax system, cooperating with legal entities and other individual entrepreneurs, finds himself in a more advantageous position than a self-employed person.” In addition to the opportunity to reduce tax under the simplified tax system, you can also save your pension using insurance contributions. In addition, the simplified tax system, unlike the NAP, allows you to earn more than 2.4 million rubles. per year and still maintain the same tax rate.

Keep separate records of income and expenses

If an individual entrepreneur, in addition to entrepreneurial activities, carries out other activities as an employee, he will have to keep separate records of income and expenses.

When receiving income from ordinary individuals, a self-employed person applies a tax rate of 4% on income. In case of receiving income from individual entrepreneurs or legal entities, but deducts 6% of the income.

It is important to pay attention to the fact that when carrying out business activities as an individual entrepreneur, it is better if all cash receipts go through the individual entrepreneur’s current account. Although the Letter of the Federal Tax Service of the Russian Federation dated June 20, 2018 No. ED-3-2/ [email protected] states that an individual entrepreneur has the right to use a personal bank card issued to him as an individual to receive funds from customers, unless the bank account agreement directly prohibits the use personal account in commercial activities. Accordingly, these incomes are taken into account for tax accounting purposes if they are produced for the purposes of entrepreneurial activity.

For self-employed individuals providing personal services, an individual’s personal account opened with a bank is used. At the same time, self-employed people can accept payments via payment systems or electronic wallets. To do this, an agreement is concluded with the payment system. Self-employed people do not need an online cash register.

Expect some privileges

In particular, when switching to self-employment, you can maintain your current account and individual entrepreneur status. But he won't be able to hire employees or resell goods that someone else made. But if he wants to do this, then he will have to switch back to the simplified tax system or another tax regime.

According to Art. 2 of the Federal Law of November 27, 2018 No. 422-FZ, individual entrepreneurs applying NAP:

- are not recognized as VAT taxpayers, with the exception of VAT payable when importing goods into the territory of the Russian Federation and other territories under its jurisdiction (including tax amounts payable upon completion of the customs procedure of the free customs zone on the territory of the SEZ in the Kaliningrad region);

- are not exempt from performing the duties of a tax agent;

- are not recognized as payers of insurance premiums for the period of application of the NAP of individual entrepreneurs specified in subparagraph. 2 p. 1 art. 419 of the Tax Code of the Russian Federation).

When is it more profitable to completely close an individual entrepreneur?

If an entrepreneur, having become self-employed, accepts payments only from individuals, he does not need a current account for entrepreneurs, as well as the individual entrepreneur status itself. In this case, he can submit a tax application to close the individual entrepreneur.

A hired employee works under an employment contract, he is also an individual entrepreneur. Can he also be self-employed?

“There are no obstacles to registering as self-employed for persons working under employment contracts and at the same time being individual entrepreneurs,” assures Isabella Atlaskirova (SaaS project). – It is important that activities as a self-employed person do not overlap with activities as an individual entrepreneur and are not carried out in the interests of the organization in which he works under an employment contract.

For example, you can simultaneously work as a manager in an organization, be the owner of a store as an individual entrepreneur, and provide accounting services as a self-employed person.

Individual entrepreneurs that do not use the labor of hired workers, are not engaged in activities prohibited for self-employed workers, and apply special tax regimes (STS, UTII or Unified Agricultural Tax), have the right to switch to paying NAP.”

You can: Become an individual entrepreneur under the new NAP tax regime

For a long time, Artem spent 30,000 rubles a month on consumables, but then he started using cheaper clay and reduced his expenses to 15,000 rubles. Then he decided to become self-employed, because expenses had decreased, there were more pottery lessons and paying 13% was now definitely unprofitable.

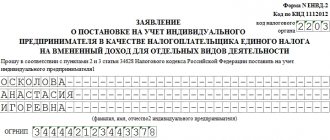

To become an individual entrepreneur on NPD, Artem:

- Registered in the “My Tax” application.

- I sent a written notification to the tax office where I was registered that I was abandoning the previous regime. Artem did this at the tax office in person, but it was possible to send a registered letter by mail or leave an application at the State Services.

- He submitted a declaration under the simplified tax system for 2021 - all this time he worked as an individual entrepreneur.

The notification must be sent within 30 days after registering as self-employed. If you don’t make it in time, the tax office will cancel your registration as a self-employed person and recalculate taxes at the simplified taxation system rate. So it's better to do everything at once.

Artem retained the status of an individual entrepreneur and some privileges, for example, an entrepreneur’s current account. Some of his LLC customers are still more willing to work with individual entrepreneurs because they know little about the self-employed.

How to become self-employed?

Let's figure out how to become self-employed through State Services and provide step-by-step instructions.

This is the easiest way. After the “My Tax” application is installed on your mobile phone, you need to log in to it. A window will open in which you need to select a registration and authorization method. Through the State Services portal this is the last, but the fastest and easiest among them.

You just need to click on it. Then you will need to enter the standard data that is usually entered when entering the State Services website - SNILS or mobile phone number and password.

Login to the My Tax application

From now on, registration will be semi-automatic. After confirming your personal data, mobile phone number and agreeing to the terms of registration, the citizen will be immediately registered as self-employed.

Data confirmation

If you register using a Russian passport, you will need to take a photo of the passport and yourself next to it. What documents are needed - passport, TIN, SNILS. Usually no other documents are required.

Personal Area

You can: Close your individual entrepreneur and switch to self-employment only

Over time, Artem had no more LLC clients. All individual clients pay in cash or by card, and a bank account for entrepreneurs is now useless. It also costs an extra 500 rubles a month for maintenance.

Artem also stopped using the status of individual entrepreneur, so he decided to abandon this form of entrepreneurial activity and remain only self-employed.

To do this, Artem came to the tax office and submitted an application to close the individual entrepreneur. In fact, nothing has changed for him: he continued to issue checks and pay taxes through the “My Tax” application, but as an individual with self-employed status.

Expenses

If you take on a one-time part-time job, you can declare your income and pay fees and 13% personal income tax. But even in this case, there is a small risk that you will be held accountable. If the work is regular, it is worth getting an official status.

Art. 224 Tax Code of the Russian Federation

The individual entrepreneur pays taxes in accordance with the chosen tax regime and annual contributions for himself to the pension fund and health insurance fund. In 2021, individual entrepreneur contributions, regardless of income (no matter whether there is one or not), amount to 29,354 rubles to the Pension Fund and 6,884 rubles to the Compulsory Medical Insurance Fund.

Art. 430 Tax Code of the Russian Federation

If your annual income does not exceed 2.4 million rubles and your industry allows it, you can apply for self-employment in any region of the Russian Federation.

Self-employed people only need to pay 4% on receipts from individual clients and 6% on payments from legal entities and individual entrepreneurs. There are no more mandatory payments or transfers to funds, and tax is paid only when there is income.

Art. 10 422-ФЗ

conclusions

An individual entrepreneur can become self-employed without losing his individual entrepreneur status if he meets the conditions for applying this special regime. The law does not prohibit registration of self-employment for individual entrepreneurs; the tax office has more than once answered the question “can an individual entrepreneur register as self-employed” in the affirmative.

To do this, he should register as an NPT payer and abandon the current taxation regime (except for OSNO). After the transition, the individual entrepreneur will not have to use the cash register, pay insurance premiums and submit declarations.

Author: Samitov Marat. The article was published in the telegram channel “Taxes, Laws, Business” and posted on the website with the permission of the author.

Do I need to renew contracts with clients?

If you already have concluded contracts with clients, after switching to NAP, it is not necessary to re-sign them, unless significant conditions have changed. Nothing changes in the work for your client, except that after switching to NAP, you will be required to generate a check in the application for each payment and issue it to the client in paper or electronic form. Without this check, your client will not be able to include payment in expenses, even if there are other supporting documents - an agreement, deed, etc.

If the essential terms of the agreement change in connection with the transition to the NAP, the Ministry of Finance recommends drawing up an additional agreement. For example, if the price of goods and services included VAT, and now, as a self-employed individual entrepreneur, he has ceased to be a VAT payer (Letter of the Federal Tax Service No. SD-4-3 / [email protected] dated 02/20/2019).

Pensioners

Meanwhile, for example, current pensioners are unlikely to be upset by the fact that pension rights have not been formed. Firstly, they have already earned a pension, and many consider it inappropriate to pay 40 thousand fixed contributions a year in order to earn an increase in pension of 100 rubles.

Self-employed pensions: what to count on in old age

Secondly, self-employed pensioners are not deprived of the right to pension indexation, while individual entrepreneur pensioners do not have such a right.

Should individual entrepreneurs become self-employed?

If you consider all the intricacies of transitioning to self-employment, the question arises as to whether the game is worth the candle. Individual entrepreneurs pay 6% on any income. For the self-employed – 4%, but only when working with individuals, in other cases – also 6%. As you can see, the difference in interest rates is not that big.

At the same time, individual entrepreneurs have their advantages. Individual entrepreneurs reduce tax due to insurance premiums, which perform an important function in the form of ensuring the future for the entrepreneur. The self-employed do not have the obligation to pay fixed insurance premiums.

But, if we take into account the fact that individual entrepreneurs reduce their tax due to insurance contributions, it turns out that the expenses of individual entrepreneurs and the self-employed on taxes are almost the same, however, individual entrepreneurs form pension savings, while the self-employed do not.

For the self-employed, the income limit is 2.4 million rubles per year. For individual entrepreneurs who use the simplified tax system, the limit is tens of times higher.

An individual entrepreneur may have employees. Self-employed are a caste that works for itself and only using its own labor. Need workers? Give up your self-employed status and switch to an individual entrepreneur.

Who has the right to transfer?

After the introduction of the new tax regime, many entrepreneurs thought about the possibility of a transition. But it is important to understand who can register as self-employed. Check your activities for compliance with the following conditions:

- receiving income from independently conducting activities or using property;

- conducting activities in the region of the experiment;

- the absence of an employment contract and an employer, upon the introduction of activities for which it is planned to apply the new regime;

- absence of employees under employment contracts;

- the type of activity and the amount of profit should not be on the list of exceptions specified in Articles 4 and 6 of Federal Law No. 422 of November 27, 2018.

Important! If you are geographically located outside this region, but your activities extend to the regions specified in the law, and you have clients in these regions, then you have the right to obtain self-employed status.

This is especially worth paying attention to if you conduct your business through the Internet. Place of registration also does not matter.

Who benefits from becoming self-employed?

- Sometimes the initiator is the customer of the service. For example, this opportunity was implemented in Yandex.Zen, promising to pay more money to authors who become self-employed. As far as we know, you can also work at Yandex.Taxi while being self-employed.

- This mode is suitable for people who provide services to individuals, for example, caregivers, hairdressers, stylists, photographers, craftsmen providing various household services, doing minor repairs, etc.

- People who make and sell hand-made things via the Internet often become self-employed.

- You can obtain self-employed status to register income from one-time part-time jobs, for example, from freelancing or blogging. At the same time, self-employed people can work for hire at the same time.

How many Russians received self-employed status?

The experiment, within which Russians had the opportunity to become self-employed, started only last year. But preliminary results are already impressive. According to Federal Tax Service estimates, the total number of self-employed people was 1 million. They brought their earnings worth more than 130 billion rubles out of the shadows. The self-employed managed to transfer taxes in the amount of 3.5 billion rubles to the treasury.

Let us remember that at first the experiment took place only in 4 regions, including Moscow, Moscow region, etc. From January 1, 2021, the experiment was expanded. However, the most significant expansion occurred in the summer of 2021. As a result, almost the entire territory of the country came under a special tax regime for the self-employed.