Most legal entities carry out settlements with counterparties, the budget, as well as extra-budgetary funds, and non-cash payments. The basis for a bank transfer of funds is a payment order, which must be filled out correctly. Our article will tell you how to design field 108, which reflects the document number of the tax or judicial authority.

Filling out the fields of the payment order is subject to the procedure and rules established by the Regulation of the Central Bank dated June 19, 2012 No. 383. It also approved the form of the document, which is prohibited from being modified.

More information about the payment

Based on current regulations in the field of financial legislation, a payment order is a legal and acceptable method of non-cash transfer of money to the addressee.

The Central Bank of the Russian Federation set out in regulation No. 383-P dated June 19, 2012 the procedure and rules for filling out the fields in the payment form. Attention is also paid to the subject of our consultation - the number of the tax document in the payment slip: what it is and why.

However, in this provision of the Central Bank of the Russian Federation we are talking not only about the rules and methods of entering data into the payment order form, but also about its very form and appearance. They are also shown in this position.

Thus, in all financial institutions in Russia that accept payment orders for transfers, its form looks the same. No bank is allowed to modify the form at will.

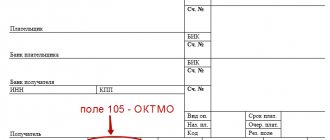

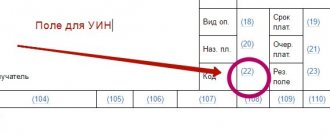

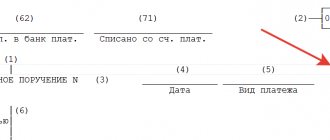

Let’s clarify in advance the question of where to look for the tax document number in the payment slip. It is transferred from the corresponding document received from the Federal Tax Service. And they indicate - in the very bottom line on the right (see figure).

Questions and answers

- Can I, as an individual, make voluntary payments to the Social Insurance Fund? What should you do?

Answer: You certainly can do this. To do this, you need to contact a Russian Post office or a bank branch, where specialists will help you draw up a payment order. If you generate a payment order yourself, please pay attention to filling out field 108 by indicating the code and number of the identity document.

- The Federal Tax Service made a decision to restructure tax debt for our organization. Do I always need to indicate the decision number when paying a debt?

Answer: Yes, when generating a payment order, you must always indicate the number of the decision on restructuring and the code “RT”. In this case, the “No” sign is not indicated.

When filling is required

In addition to other details, field 108 must also be filled out in the payment. Moreover, the sender of funds must know that this column is required to be filled out only if the payment is made to one or another budget of Russia. This important nuance is indicated by clause 4 of Appendix No. 1 to the mentioned Regulation No. 383-P.

If the payment is not addressed to the state budget, and the bank employee sees the completed column 108, the transfer of money to the addressee will not be made due to an error and subsequent refusal. After all, this field shows the tax document number in the 2021 payment order. This cannot be ignored when filling out the payment form.

Results

Field 108 of the payment order is filled in only if payments are transferred to the budget. In this detail it is necessary to display the document number - the basis of the fiscal (judicial) authority or the document number - the identifier of an individual in cases established by law.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to indicate

On November 12, 2013, the Russian Ministry of Finance issued order number 107n on the introduction into practice of rules for writing data when processing money transfers from the payer to budgets.

Clause 9 of Appendix No. 2 to Order No. 107n of the Ministry of Finance determines that field 108 of the payment form should reflect the number of the corresponding document.

Below are the abbreviations for field 108, which are specified in the law. Based on their transcripts, it can be seen that the field indicator 108 depends on the name of the document on the basis of which money is transferred to the treasury.

| TR | Number of the Federal Tax Service's request for payment of taxes/fees/contributions |

| RS | Installment decision number |

| FROM | Postponement decision number |

| RT | Restructuring decision number |

| PB | Number of the case or material considered by the arbitration court |

| ETC | Number of the decision to suspend collection |

| AP | Number of the decision to impose tax liability or to refuse it |

| AR | Number of the writ of execution and the proceedings initiated on it |

| IN | Number of the decision on granting an investment tax credit |

| TL | Number of the ruling of the AS on satisfaction of the statement of intention to repay the claims against the debtor |

EXAMPLE

The table shows that when transferring transport tax, field 108 should reflect the index “TR”. If current amounts of this tax are paid voluntarily, then “0” is entered.

It is important to note that in field 108 only the symbolic-numeric part of the number is entered, and the number sign “No” itself is excluded.

Remember that specifying other codes not designated by the Russian Ministry of Finance is not permitted!

In addition, it is necessary to understand that column 108 of the payment form is filled out only when making payments on the basis of documents issued by the Federal Tax Service/court/bailiffs mentioned in Order No. 107n of the Ministry of Finance.

If an enterprise voluntarily makes a payment to the state budget, enter the number zero “0” in field 108. When paying to the state budget of Russia, an individual also writes zero in column 108.

Also see “Deciphering the abbreviations of payment basis codes in a payment order.”

Why is a payment order necessary?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds. The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out. This document must be drawn up and submitted to the bank for execution in electronic or paper form.

Individuals can also process payment orders without opening a bank account. In this case, an order to the bank from an individual can be drawn up in the form of an application, in which the following information must be indicated:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

Based on the order, the bank employee generates a payment order.

When drawing up an order to the bank electronically, it is very important to correctly indicate the payer, recipient of the transfer, amount, and purpose of payment.

Example

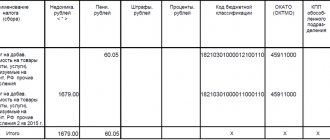

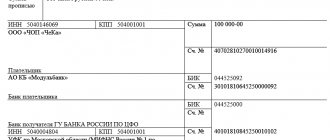

When filling out a payment order for payment of income tax, it may look like:

And contributions for injuries transferred voluntarily to social insurance will be reflected in the payment slip as follows:

Please note that the field contains only the document number or the number 0. The No. symbol is not indicated.

In addition, you should fill out column 108 of the payment order only when making payment transfers according to documents issued by the tax authority, court or bailiffs. The list of such documents is reflected in Order of the Ministry of Finance No. 107n.

Voluntary payment is made by indicating zero field 108 in the payment slip. This detail is filled in similarly by an individual.

Field value 108 for tax payments

The value of field 108 depends on the basis of the payment. If the current debt on taxes (insurance fees) is being repaid or we are talking about voluntary payment of arrears, the value 0 should be entered in field 108 of the payment order. In this case, the basis for payment (TP or PO) is indicated in field 106.

But in some cases, when transferring money to the budget, field 108 should be filled in, indicating the document number - the basis for the payment. To do this, it is necessary to have a document that obliges the taxpayer to repay the debt on the basis of decisions made by tax or judicial authorities. The document number must correspond to one of the following codes entered in field 106:

- TR. Indicates a requirement issued by the tax authorities. If arrears are detected, the inspection has the right to send the taxpayer a document indicating the type of tax or insurance contribution and the amount to be transferred. The debt repayment period is indicated in the request.

- RS. Paying off debt in installments. In accordance with paragraph 3 of Art. 61 of the Tax Code of the Russian Federation, taxpayers who are unable to repay their debt to the budget on time can receive an installment plan. The tax authority may issue a permit allowing you to make the required payment evenly throughout the year. But for this it is necessary to provide compelling reasons (damage resulting from a natural disaster, seasonal nature of the work) with supporting documents. In addition, you will have to pay interest on the amount of debt not repaid on time (Clause 2 of Article 61 of the Tax Code of the Russian Federation).

Read about the nuances of obtaining installment plans here .

- FROM. Number of the decision to defer the current payment made by the tax authority. In some circumstances, entities are unable to pay the assessed tax in full on time. In this case, you can contact the inspectorate with an application for a deferred payment. Tax authorities are required to make an appropriate decision no later than 30 days.

- RT. The number of the decision made by the tax authorities on restructuring is indicated. If an organization is unable to repay debts on taxes and penalties, it can take advantage of preferential conditions in accordance with the adopted debt repayment schedule.

- PB. Case number regarding the decision made by the arbitration court. Sometimes disputes arise between taxpayers and regulatory authorities regarding the correctness of calculation and completeness of payment of budget obligations. If the arbitration court agrees with the demands of the tax authorities, the payer will have to transfer the missing amounts for taxes based on the decision made by the arbitration court.

- ETC. The number of the decision to suspend collection is used when the payer repays this debt.

- AP. This refers to the number of the on-site or desk audit report, as a result of which additional taxes, penalties and fines were assessed.

- AR. Payment according to the number of the writ of execution issued as a result of the initiated case.

Features of drawing up line 107 in the payment slip for 2021

Accountants are interested in the subtleties of filling out line 107 in the payment document in 2021. Detail 107 indicates the tax period when the contribution or tax is paid. If it is not possible to determine the tax period, “0” is entered in column 107.

What components does the tax period indicator consist of and what does it indicate, experts shared:

- The 8 digits of the combination differ in their semantic meaning;

- 2 digits are considered separating digits and are therefore separated by a dot.

The value of detail 107 determines the frequency of payment:

- monthly regularity (MS);

- quarterly (QW);

- semi-annual (PL);

- annual (AP).

What document numbers are indicated when making customs payments?

In the case of customs transfers, field 108 can take numeric values when the following payment grounds are indicated in field 106:

- DE or CT. The last 7 digits of the customs declaration are written down.

- BY. The existing customs receipt order number is indicated.

- ID. The number of the executive document serving as the basis for payment is indicated.

- THAT. Applies if customs duties are paid upon request.

- IN. The number of the collection document is indicated.

- DB. Number of the document created by the accounting department of the customs authorities.

- KP. The number of the current agreement between large taxpayers when paying centralized payments is indicated.

Filling field 108 with numbers indicating the numbers of documents on the basis of which the payment is made is possible only if there are certain statuses in field 101 of the payment.

Read about payer statuses in the payment order in this material .

NOTE! The number sign (No.) is not indicated in field 108.