Regulatory regulation

Toll processing is the performance of work on the production of products from the customer’s material under a contract (Article 702, Article 713 of the Civil Code of the Russian Federation).

BOO. When transferred for processing, there is no transfer of ownership: the materials continue to be accounted for on the customer’s balance sheet. For the processor, they are reflected in off-balance sheet account 003 “Materials accepted for processing” (clause 156 of the Guidelines for accounting for inventories, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n, Chart of Accounts 1C).

Income and expenses from processing work are related to income and expenses for ordinary activities (clause 5 of PBU 9/99, clause 5 of PBU 10/99.).

WELL. The contractor’s revenue from performing work on processing the customer’s raw materials (materials) is income from sales (clause 1 of Article 248 of the Tax Code of the Russian Federation).

VAT. The transfer of raw materials to the processor is not a sale to the customer and is not subject to VAT (Article 38, Article 146 of the Tax Code of the Russian Federation).

The implementation of processing work by the contractor is subject to VAT (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation, clause 5, article 154 of the Tax Code of the Russian Federation).

Recognition of expenses using the accrual method

When calculating income taxes using the accrual method, apply the following rules. The cost of materials transferred for processing on a toll basis can be taken into account in expenses at the time they are written off for production in the part used in it at the end of the month (clause 2 of Article 272, clause 5 of Article 254 of the Tax Code of the Russian Federation). In this case, the moment of transfer for processing is equivalent to the transfer of materials into production, since processing is one of the stages of production.

If processing costs are classified as direct, then they can be taken into account only after the work is completed (accepted by the customer). Such rules are established by paragraph 2 of Article 318 of the Tax Code of the Russian Federation.

Situation: should materials transferred for processing be taken into account as part of work in progress when calculating income tax?

Answer: yes, it is necessary.

This is due to the fact that the obligation to distribute direct expenses on a monthly basis is established for all production organizations (paragraph 3, paragraph 1, article 319 of the Tax Code of the Russian Federation). And no exceptions are provided for organizations that transfer materials for recycling.

Documentation of the amount of processed materials and unprocessed residue can be done with a report from the recycler. Such reports must contain data in quantitative terms on the consumption of raw materials and materials, on the availability of products that are partially ready.

This point of view is also shared by the tax department (see, for example, letter of the Department of Tax Administration of Russia for Moscow dated August 17, 2004 No. 26-12/54019).

Advice: include in the agreement on the transfer of raw materials to be supplied a condition on the submission by the processing organization of monthly reports on the balances of work in progress. Such reports must contain data on the consumption of raw materials and materials, on the availability of products that are partially ready. The submission of reports by the processor will allow the seller to confirm the validity of writing off direct expenses during a tax audit.

Step-by-step instruction

On September 02, the Organization received from the customer STROITEL LLC raw materials for the manufacture of products:

- edged board 5 cubic meters at a price of 6,000 rubles, in the amount of 30,000 rubles.

On September 12, the Organization manufactured the following products:

- street bench 100 pcs.

On September 13, the Organization handed over to the customer:

- finished products,

- certificate of completion of work in the amount of 120,000 rubles. (including VAT 20%).

On September 30, the salary of an employee engaged in processing work was accrued in the amount of 20,000 rubles.

On September 30, depreciation of fixed assets used in processing was accrued in the amount of RUB 5,208.33.

The Organization's accounting policy stipulates that the calculation of the cost of products (work) is carried out using planned prices. The planned cost of work on the manufacture of benches has been approved:

- 300 rub. - per unit products.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receipt of materials for processing | |||||||

| 02 September | 003.01 | — | 30 000 | Receipt of materials from the customer for processing | Receipt (act, invoice) - Materials for processing | ||

| Write-off of materials for production | |||||||

| 03 September | 003.02 | 003.01 | 30 000 | Write-off of materials for production | Request-invoice | ||

| Production of finished products | |||||||

| 12-th of September | 20.02 | 20.01 | 30 000 | 30 000 | 30 000 | Release of finished products at planned cost | Shift production report |

| Receipt of finished products | |||||||

| 12-th of September | 002 | — | 30 000 | Transfer of finished products to the warehouse | Manual entry - Operation | ||

| Transfer of products to the customer | |||||||

| September 13 | — | — | — | Transfer of finished products to the customer | Transfer of goods - Transfer of products to the customer | ||

| — | 002 | 30 000 | Write-off of finished products from warehouse | Manual entry - Operation | |||

| Implementation of processing work | |||||||

| September 13 | 62.01 | 90.01.1 | 120 000 | 120 000 | 100 000 | Proceeds from the sale of work | Sales of processing services |

| 90.02.1 | 20.02 | 30 000 | 30 000 | 30 000 | Write-off of the planned cost of work | ||

| — | 003.02 | 30 000 | Write-off of customer materials from accounting | ||||

| 90.03 | 68.02 | 20 000 | VAT accrual on revenue | ||||

| Submission of the SF for the implementation of work | |||||||

| September 13 | — | — | 120 000 | Drawing up an invoice for shipment | Invoice issued for sales | ||

| — | — | 20 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Calculation of wages and insurance premiums | |||||||

| September 30th | 20.01 | 70 | 20 000 | 20 000 | 20 000 | Payroll | Payroll |

| 70 | 68.01 | 2 600 | 2 600 | Withholding personal income tax | |||

| 20.01 | 69.01 | 580 | 580 | Calculation of contributions to the Social Insurance Fund | |||

| 20.01 | 69.03.1 | 1 020 | 1 020 | Calculation of contributions to the FFOMS | |||

| 20.01 | 69.11 | 40 | 40 | Calculation of contributions to NS and PP | |||

| 20.01 | 69.02.7 | 4 400 | 4 400 | Calculation of contributions to the Pension Fund | |||

| Depreciation calculation | |||||||

| September 30th | 20.01 | 02.01 | 5 208,33 | 5 208,33 | 5 208,33 | Depreciation calculation | Closing the month - Depreciation and wear and tear of fixed assets |

| Adjustment of the cost of processing materials supplied by the supplier | |||||||

| September 30th | 20.02 | 20.01 | 1 248,33 | 1 248,33 | 1 248,33 | Adjustment of the cost of work performed | Closing the month - Closing accounts 20, 23, 25, 26 |

| 90.02.1 | 20.02 | 1 248,33 | 1 248,33 | 1 248,33 | Adjustment of the cost of work performed | ||

Tolling transaction: we prepare accounting documents

Relationship diagram

A tolling transaction usually looks like this: the toller provides the processor with raw materials, which he refines (processes) or from which he produces finished products (hereinafter referred to as products). The peculiarity of this relationship is that the seller owns both the raw materials and the final product. The processor only processes <1>:

Transfer of raw materials for processing

The supplier prepares a delivery note for the transfer of raw materials for processing (commodity or commodity-transport, depending on the method of transportation). Cost indicators can be reflected in it based on the accounting prices of customer-supplied raw materials, collateral or others - determined by the terms of the processing agreement. But, as a rule, the dealer uses discount prices, i.e. those for which raw materials are listed in his accounting <2>.

The VAT amounts are not indicated in the invoice, since the transfer of raw materials to the processor is not recognized as subject to this tax (there is no fact of sale) <3>.

Receipt of products upon completion of the production cycle

Having processed the supplied raw materials and manufactured the final product from them, the processor performed work for the customer. This means that for the cost of such work, determined in the contract, he draws up a corresponding work acceptance certificate or other similar document. In addition, for the turnover of the sale, the processor creates and issues an ESCHF to the supplier - if he is a VAT payer for the work performed by the customer <4>.

The manufactured products are transferred to the seller using a consignment note (commodity or commodity-transport). The processor has the right to reflect cost indicators in it at prices calculated based on the cost of used raw materials per unit of manufactured product. But only if a different procedure for determining the cost of manufactured products is not specified in the processing agreement. For example, in the contract the parties may agree that the supplier forms the price of the finished product made from the raw materials supplied by the supplier and brings it to the attention of the processor. In this case, the processor uses exactly this price.

In addition to manufactured products, the processor can return to the supplier the remains of unused raw materials and returnable waste belonging to it. If all these assets are transferred at the same time, then all information can be included in one invoice. Returned raw materials are indicated in the invoice based on the prices at which they were received by the processor. Waste is usually recorded at the prices agreed upon in the treatment contract. But if they are not there, then you can take as a basis the cost of raw materials supplied by the customer, declared by the customer when transferring for processing <5>.

The VAT amounts are not indicated in the invoice, since the transfer of products to the seller and the return of unused raw materials and waste are not recognized as subject to VAT (there is no fact of sale of these assets) <6>.

NOTE If a processor produces excisable products from raw materials supplied by customers, then it is he who is recognized as the payer of excise taxes, despite the fact that the owner of these products is the customer. The processor presents the calculated amount of excise taxes to the seller. This can be done, for example, in an invoice for the transfer of finished products to the seller or in another PUD <7>.

In addition to the invoice and act, the processor provides the seller with a report on the consumption of raw materials <8>. The report form is not established, so the processor develops it independently (the parties can also fix the form in the processing agreement). The report usually indicates the name of the received raw material, its quantity, consumption rates, actual quantity consumed, residues after processing, waste (if any). The corresponding cost indicators can also be reflected.

If products, remaining raw materials, waste are transferred to pay for processing

Quite often, by agreement of the parties, the supplier does not transfer money to pay for the work, but transfers manufactured products, unused materials, and waste belonging to him as offset <9>. In this case, the seller sells the assets, and the processor acquires them.

So, when, in payment for work, the supplier leaves with the processor part of the products or waste belonging to him, for this part the processor first draws up a delivery note for the supplier so that he can accept the assets for accounting. The seller issues a bill of lading to the processor for the sale of the specified assets at the agreed prices. After which the processor enters them on the balance sheet as its own assets.

If the parties agree to offset the remaining unused raw materials as payment for the work, then, we believe, the supplier simply issues a sales invoice and the processor accepts the raw materials for balance <10>.

In the invoices for the sale of products, raw materials, and returnable waste, the seller allocates VAT, if, of course, he is a payer of this tax. In addition, he issues ESHF <11> to the processor.

Some companies, in order to optimize production processes, transfer their own materials to other companies for further processing. Accounting for these operations has its own characteristics both for the enterprise transferring raw materials and for the institution that takes on the processing function. In this case, a special agreement is concluded and the concept of raw materials supplied by customers is mentioned. The relations between the participants here are regulated by the Civil Code of Russia.

Receipt of materials for processing

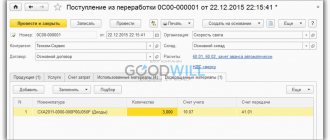

Register the receipt of raw materials from the customer with the document Receipt (act, invoice) operation type Materials for processing in the section Production - Processing - Receipt for processing - Create button (or section Purchases - Purchases - Receipts (acts, invoices) - Receipt - Materials for processing button) .

Indicate in the header of the document:

- Counterparty - customer under the processing agreement, selected from the Counterparties directory;

- Agreement - agreement with the customer: Type of agreement - With the buyer .

Specify on the Products :

- Nomenclature - the name of the received materials, selected from the Nomenclature directory;

- Amount - the cost of materials indicated in the transfer document (in our example - 6,000 rubles);

- Accounting account - 003.01 “Materials in warehouse”.

Postings according to the document

The document generates the posting:

- Dt 003.01 - reflection of customer-supplied materials on the balance sheet.

Under what conditions is it possible to transfer customer-supplied materials?

A contract agreement is concluded between the organization that uses the materials and their supplier. This agreement must take into account the interests of both parties. The following fundamentally important points are usually stated:

- Name of materials.

- Their number.

- Transfer deadlines.

- Specific transportation option. If the transfer process involves third parties in the form of transport companies, then these conditions may also be mentioned.

- If the equipment or structure is complex, then technical or design documentation must be transferred along with it. This fundamentally important point is specially discussed. The owner of the materials can either make correct copies or transfer the originals of these documents. Everything will depend on the positions of counterparties on this issue.

- When or under what conditions are customer-supplied materials returned?

- What happens to the remainder of the toll material, actions are prescribed in the event of shortages, failure of one of the parties to comply with the terms of the agreement, etc. When concluding such contracts, it is recommended to use the services of a professional lawyer, especially if we are talking about materials with a significant market value.

Write-off of materials for production

Reflect the transfer of materials to production with the document Requirement-invoice in the section Production - Production - Requirements-invoices - Create button (or Warehouse - Warehouse - Requirements-invoices - Create button).

Indicate in the header of the document:

- Warehouse - a warehouse from which materials are transferred.

Specify on the Customer Materials :

- Customer - the customer under the processing agreement, selected from the Counterparties directory.

Indicate in the table section:

- Nomenclature - transferred materials, selected from the Nomenclature directory;

- Accounting account - 003.01 “Materials in warehouse”;

- Transfer account - 003.02 “ Materials transferred to production.”

Postings according to the document

The document generates the posting:

- Dt 003.02 Kt 003.01 - transfer of customer-supplied materials to production.

Contract agreement and other documents for tolling scheme

Entering into a contractual relationship between the supplier and the owner of the production can be considered as the conclusion of one of the types of contract, therefore, legally, you need to focus on Chapter 37 of the Civil Code of the Russian Federation. Also, this type of cooperation is regulated in Art. 220 and 227 of the Civil Code of the Russian Federation.

How to conduct an inventory of customer-supplied materials ?

IMPORTANT! A sample report on the use of customer-supplied raw materials (materials) from ConsultantPlus is available here

There is no special form of agreement for the tolling scheme; there are no strict regulations for prescribing groups of raw materials or forms of their processing. Important points that must be recorded in the contract:

- name and volumes of raw materials transferred for processing;

- parameters of finished products;

- dates of provision of raw materials and their final processing;

- remuneration for the contractor's work;

- the procedure for making payments (payment terms and type - cash, non-cash, partially in the form of raw materials or waste from them);

- features of delivery of raw materials and then finished products;

- special requirements of the customer, if any (technological characteristics, wishes for processing methods, rates of consumption of raw materials, etc.): most often they are given in the annex to the contract;

- Unless otherwise specified, the default owner of materials, raw materials waste and residues is the seller.

In addition to the contract, an act of transfer of raw materials and an invoice (form No. M-15) are drawn up, and sometimes a receipt for transport is added. The entire time the contractor has the raw materials, he is responsible for their safety.

NOTE! The invoice must contain the details of the contract and indicate that the raw materials are provided on the basis of a tolling scheme.

Waste must be taken into account, since formally it also belongs to the customer.

All other methods of handling them must be reflected in the contract and taken into account in the documentation. If the customer simply wants to leave them with the processor, a free transfer agreement must be drawn up.

If the seller plans to return them, the Ministry of Finance in the Methodological Instructions provides an accounting procedure for this procedure: it is carried out at the possible cost of their sale or use, while the cost of the raw materials is reduced by this figure. Waste disposal is negotiated separately.

Finished products are stored in the contractor's warehouse, where they are moved using invoice No. MX-18, until they are transferred to the owner, which is carried out using invoice No. M-15.

Production of finished products

Reflect the production output from the customer's materials using the document Production Report for a Shift in the section Production - Product Output - Production Reports for a Shift - Create button.

Indicate in the header of the document:

- Cost account - 20.01 “Main production”;

- Warehouse - a warehouse where customer materials are stored.

Specify on the Products :

- Products - products made from customer materials are selected from the Nomenclature directory (in our example - Street Bench ): Type of nomenclature - Products .

Postings according to the document

The document generates the posting:

- Dt 20.02 Kt 20.01 - the costs of production are reflected at the planned cost.

Processing agreement

There are two main parties here - the supplier of raw materials and the processor. The first retains the role of owner. The contractor undertakes an obligation to complete certain work and timely delivery to the customer. In exchange for his help, he receives a certain amount.

Toll raw materials are materials transferred for processing to another enterprise in order to impart certain properties to it. Once it has been properly processed, the organization that submitted the material for processing receives a corresponding report.

This document indicates the amount of materials that were consumed, data on the products produced and waste generated during the activities of the processor.

It is also mandatory to hand over the acceptance certificate for completed work. Here you can find information about the list of manipulations performed and the final cost of the work. When receiving finished products, a special invoice is issued. The cost of such products is formed on the basis of the price of materials and the cost of work. It also includes payment costs:

- intermediary;

- transportation of material;

- business trips;

- general and general production expenses.

The procedure for forming the cost price must be indicated in the relevant documentation.

Receipt of finished products

Reflect the receipt of the customer's finished products at the warehouse using the document Transaction entered manually in the Transactions - Accounting - Transactions entered manually - button Create - Transaction section.

Please indicate:

- Debit - 002 “Inventory assets accepted for safekeeping”;

- Col. — quantity of products arriving at the warehouse;

- Amount - the cost of incoming products at the price of the raw materials used.

What are the types of operations with DS?

Various operations are carried out with customer-supplied raw materials. It could be:

- oil refining to obtain fuels and lubricants;

- processing of agricultural products to obtain canned food, cereals, flour, oil, etc.;

- processing of polyethylene in granules to obtain PVC products;

- construction of facilities or repair of equipment;

- other.

The main goal for the supplier (customer) is to obtain finished products (semi-finished products) with specified characteristics from the raw materials transferred to the processor (performer).

Transfer of products to the customer

Create a document Transfer of goods type of operation Transfer of products to the customer in the section Production - Processing - Transfer of products to the customer - Create button.

Indicate in the header of the document:

- Counterparty - customer under the processing agreement, selected from the Counterparties directory;

- Agreement - an agreement with the customer;

- Warehouse - a warehouse from which products are transferred.

Specify on the Products :

- Nomenclature - product name, selected from the Nomenclature directory;

- Quantity - the quantity of products transferred.

The document does not generate postings: it is used to generate printed forms. By clicking the Print , you can print a form approved by the accounting policy as a document for transferring products to the customer:

- invoice for the release of materials to the side (M-15),

- waybill,

- consignment note (1-T),

- waybill (TORG-12),

- universal transfer document (UDD).

Actions at the customer

Transfer of raw materials for processing

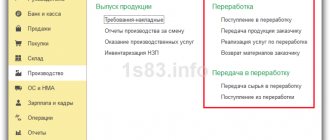

Let’s create a document “Transfer of raw materials for processing.”

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

We indicate the date, processor and contract, warehouse. On the “Products” tab, select the item for processing and its quantity.

We set the transfer account to 10.07.

Postings:

Receipt from processing

Let’s create a document “Receipt from processing”.

On the “Products” tab, we indicate what was produced for us, quantity, planned price and cost. We arrive at account 43 “Finished products”.

In the “Specification” field we indicate what materials the product is made from.

On the “Services” tab we will display the cost of the processor’s service.

We will indicate the cost account and analytics for it.

We will indicate the actual amount of materials used to manufacture the product.

As well as the amount of remaining materials.

Let's go through the document and look at the postings.

Write-off of products from warehouse

Reflect the write-off of products from the warehouse with the document Transaction entered manually in the section Operations - Accounting - Transactions entered manually - button Create - Transaction.

Please indicate:

- Credit - 002 “Inventory assets accepted for safekeeping”;

- Col. — quantity of products transferred from the warehouse;

- Amount - the cost of the transferred products.

Reflection in accounting

In this case, the described property will be listed in the accounting records of the tolling organization in the line “Materials” as fixed assets. And the company that accepts them must issue an off-balance sheet account for the equipment (or other property) with the corresponding listing of items.

As for the accounting of this issue, it is also necessary to divide customer-supplied raw materials into different accounts on a territorial basis, as well as post raw materials from different contractors into separate accounts.

Implementation of processing work

Create a document Sales of processing services in the section Production - Processing - Create button - Sales of processing services. It can also be created based on the document Request-invoice or Production report for a shift , then part of the document will be filled out automatically.

Check the completion of the document.

In the header please indicate:

- Counterparty - customer under the processing agreement, selected from the Nomenclature directory;

- Contract - an agreement with the customer,

On the Customer Materials , specify:

- Nomenclature - the name of the customer’s materials used, selected from the Nomenclature directory;

- Quantity - the amount of materials used;

- Accounting account - 003.02 “Materials transferred to production.”

On the Products (processing services) , indicate:

- Nomenclature - products made from customer materials are selected from the Nomenclature directory; in the bottom line, indicate the name of the processing work for the work completion certificate;

- Quantity - the number of products produced;

- Price - the price for work to produce a unit of product;

- Planned price - the planned cost of production per unit of production;

- Accounting account - 20.02 “Production of products from customer-supplied raw materials”;

- Nomenclature group - nomenclature group for processing work;

- Specification - filled in when using product specifications in 1C, selected from the Product Specifications (in our example, not filled in).

Postings according to the document

The document generates transactions:

- Dt 62.01 Kt 90.01.1 - revenue from the implementation of processing work;

- Dt 90.02.1 Kt 20.02 - write-off of the cost of work performed at the planned price;

- Kt 003.02 - write-off of customer materials;

- Dt 90.03 Kt 68.02 - VAT calculation.

Documentation of transactions with DS

When transferring the DS to the contractor, the customer usually draws up an invoice in the M-15 form and must make a note “on toll terms” or “toll raw materials”. Although it is possible to use any forms of primary documents, since the use of unified forms has ceased to be mandatory since 2013. But often the M-15 form is taken as a model.

The invoice is issued in two original copies, one of which is handed over to the contractor, and the second remains in the warehouse when the DS is issued.

You can learn more about this form of invoice from the article “Unified form No. M-15 - form and sample” .

The data for issuing an invoice is taken from the contract, work order and other related documents. Upon acceptance of the DS, the contractor gives the customer a power of attorney to receive the goods and materials.

The receipt of DS at the supplier's warehouse is documented by a primary document, which can be issued as a receipt order of form M-4; it also contains the note “supply raw materials”.

The M-4 form can be downloaded from the material “Documentation of inventories”.

The transfer of products made from DS from the supplier to the customer is formalized by a transfer and acceptance certificate. Based on the results of the provision of processing services, the contractor also draws up a report.

The report describes the fact of using DS during processing and reflects the presence of surplus and waste. The material assets (and/or waste) remaining after processing must be returned to the customer, unless the processing contract specifies the condition of payment for the work performed using excess raw materials (returnable waste). The contract also stipulates the conditions for the transfer of returnable waste to the customer and the procedure for disposal of irrecoverable waste. It should be noted here that payment for returnable waste is a commodity exchange operation and entails not only additional taxes (on profit and VAT), but also the need to prepare shipping documents for the transfer of ownership of returnable waste to the contractor.

The forms of the act and report have not been approved at the legislative level. Therefore, the forms of these documents should be developed independently and attached as additions to the processing agreement.

The products obtained as a result of processing the DS (semi-finished products that will be further processed by the customer company) are received by the customer at its warehouse according to a receipt order issued in the M-4 form. The document is drawn up in one copy and remains with the financially responsible person.

Read more about document flow in a warehouse in our article “Maintaining document flow for warehouse accounting of materials” .

Submission of the SF for the implementation of work

Register an invoice using the Write invoice at the bottom of the document Sales of processing services .

Invoice data is automatically filled in based on the document Sales of processing services :

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Calculation of wages and insurance premiums

At the end of the month, accrue wages to employees involved in the production of work using the Payroll document in the Salaries and Personnel section - Salary - All accruals - Create button - Payroll.

Postings according to the document

The document generates transactions:

- Dt 20.01 Kt - payroll;

- Dt Kt 68.01 - personal income tax withholding from wages;

- Dt 20.01 Kt 69.01 - calculation of insurance contributions for social insurance;

- Dt 20.01 Kt 69.03.1 - calculation of insurance premiums to the Federal Compulsory Medical Insurance Fund;

- Dt 20.01 Kt 69.11 - calculation of insurance premiums from NS and PZ;

- Dt 20.01 Kt 69.02.7 - calculation of insurance premiums for pension insurance.

Recycling Process Stages

To reflect all stages of material processing, from acceptance of raw materials to delivery of work to the customer, it is necessary to sequentially create several documents in the database, each of which will reflect the current stage or the transition from one stage to another.

It is important to follow the specified sequence of operations, otherwise the data on balances may be incorrect and cannot serve as a reliable basis for generating reports on production and gross profit. And this is provided that all documents are processed - if you violate the sequence of actions, you risk finding yourself in a situation where one of the documents may not be processed, and then there is no question of formalizing the processing process.

Adjustment of the cost of processing materials supplied by the supplier

At the end of the period, when all information on costs has been collected, when performing the Month Closing procedure in the Operations - Period Closing - Month Closing section, the amount of planned expenses is compared with the actual ones. Regular operation Closing accounts 20, 23, 25, 26 adjusts the cost of production (work, services) for the difference between plan and actual.

Regular operation Closing accounts 20,23,25,26 generates the following posting:

- Dt 20.02 Kt 20.01 - adjustment of the planned cost of work to the actual cost.

Calculation of actual cost:

Expenses Actual amount Planned cost Difference Salary 20 000,00 Insurance premiums 6 000,00 Depreciation 5 208,33 Contributions to the Social Insurance Fund from NS and PP 40,00 Total 31 248,33 30 000,00 1 248,33 In the example, the actual cost of finished products, calculated at the end of the month, is greater than the planned cost. Therefore, the program brings the planned cost of production to the actual cost using additional posting Dt 20.02 Kt 20.01 for the amount of the difference between the actual and the plan.

Differences between the tolling scheme and other forms of product manufacturing

The production of finished products can be carried out using various entrepreneurial schemes, each of which has its own pros and cons and differs in certain parameters. The main differences between the tolling scheme for processing raw materials for the production of goods are the following features:

- the seller voices and establishes in contractual form the requirements for the finished product, including its characteristics, manufacturing process, design, packaging, etc.;

- the cost of production will be lower than in conventional production, which means that the product will cost less on the market, which increases its competitiveness and promotes demand among the end consumer;

- concluding an agreement under a tolling scheme has a beneficial effect on the taxation of the customer, since he sells his own products, as it were, and does not resell the goods.

Question: Is the cost of customer-supplied materials (equipment) transferred to the contractor included in the VAT tax base when performing construction and installation work for one’s own consumption (clause 2 of Article 159 of the Tax Code of the Russian Federation)? View answer

Income tax return

In the income tax return, proceeds from the sale of processing work are reflected:

- Sheet 02 Appendix No. 1: PDF page 011 “revenue from the sale of goods (works, services) of own production.”

The nomenclature group related to the sale of products, services and works of own production must be indicated in the Nomenclature groups for the sale of products and services in the Main section - Settings - Taxes and reports - Income tax tab. PDF

The correct completion of page 011 of Appendix No. 1 to Sheet 02 of the income tax return depends on this setting.

Read more Setting up accounting policies

Tax accounting

Tax accounting for transactions that occur between two organizations can be accompanied by a number of difficulties. They concern costs - direct and indirect. Difficulties are also possible with regard to production balances and the procedure for their assessment.

The method for allocating different types of expenses must be determined by companies initially. This point is regulated by Article 318 of the Tax Code of the Russian Federation. Direct costs must be distributed in accordance with the accounting policies of the company, which in this case plays the role of the taxpayer. Indirect expenses are considered in the current period and are classified as a cost type for tax accounting purposes. They are recorded in full.

When planning and selling finished products in a warehouse, the processing organization must distribute direct costs of general purpose between types of activities. VAT is 18%. The law does not look at either the manufactured products or the processed raw materials. The object of taxation is the work performed by the processor, and not the moment relating to the sale of products.

You can deduct VAT if it was paid at the time of purchasing raw materials for production. The same applies to the tax at the time of payment for services, work of employees, and other items on which the processor had to spend money.

Tolling conditions are any conditions defined in contracts between a business entity (customer) and a business entity (manufacturer), under which excisable products are manufactured, which are the property of the customer.

An agreement for the processing of customer-supplied raw materials is a civil law agreement, since it contains the characteristics of a contract agreement. The subject of the agreement for the processing of toll raw materials is the provision of services and the processing, enrichment or processing of toll raw materials into finished products.

Contracting agreements on tolling terms spread during the period of market reforms. Processing of raw materials supplied on a toll basis is quite widely used in the agricultural sector of the economy, the oil refining industry, in the production of alcohol and other areas of production. A characteristic feature of these relationships is that in all cases, the owners of customer-supplied raw materials transferred for processing and the manufacture of finished products from them are the customers, except for raw materials and finished products, which are payment to the performers for processing.

According to tolling conditions, payments for processing, processing, enrichment or use of tolling raw materials can be carried out in cash, by allocating part of tolling raw materials or finished products, or using three forms simultaneously with the consent of the customer and the contractor.