What is a PM form report?

Like most documents that entrepreneurs submit to Rosstat, the PM report form from small organizations consists of a title page and several tables. The current form was approved by Order No. 419 of July 22, 2019, and the rules for filling it out are prescribed in Order No. 22 of January 23, 2020.

The PM form was introduced to collect and analyze data on the main performance indicators of small businesses, including:

- number of employees;

- their wages;

- general economic indicators;

- production costs.

What you need to pay attention to

- Micro and small businesses report to Rosstat only at the request of statistics

- The types and timing of reporting depend on what you do.

- This does not apply to financial statements, which all LLCs must submit to Rosstat, regardless of whether they received the requirement or not.

- Check on the Rosstat website to see if statistical reporting is expected from you this year.

- Download the report form and instructions for filling it out on the Rosstat website.

- Do not ignore the requirements of Rosstat. Failure to submit reports may result in fines and penalties for officials.

Who reports on the PM form

Reporting is prepared only by legal entities whose indicators correspond to small enterprises. The main criteria for a small enterprise are established by Federal Law No. 209-FZ of July 24, 2007 and by-law of the Government of the Russian Federation No. 265 of April 4, 2016. The main ones are: employees - in the range of 16-100 people, and the maximum annual income - up to 800 million rubles.

IMPORTANT!

Individual entrepreneurs who operate without forming a legal entity and micro-enterprises are not included in the lists of those who submit PM reports to statistics; other forms have been approved for them.

Please note that the applied tax regime does not affect the obligation to report to Rosstat. It does not matter whether the company was operating or temporarily suspended work. Even if the company is bankrupt and bankruptcy proceedings have been initiated against it, it is necessary to report before making an entry in the Unified State Register of Legal Entities about liquidation.

ConsultantPlus experts examined the question of what to write in the PM form if the organization applies the simplified tax system and pays UTII. Use these instructions for free.

Who prepares the report

A report on the PM form is submitted to Rosstat by representatives of small businesses, except for micro-enterprises that were included in the sample.

An organization is small if it meets the following conditions:

- the number of employees does not exceed 100 people (for micro-firms this figure is 15 people);

- total annual income does not exceed 800 million rubles (120 million for micro).

You can check who submits the PM report to statistics in 2021 on the official website of the statistical service by entering the TIN or other details of the organization.

The PM form is not the only report that needs to be submitted to Rosstat. Use the statistical reporting calendar from ConsultantPlus for free so as not to violate the requirements.

to read.

When should I report on the PM form?

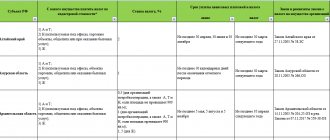

For all respondents who submit the PM statistics report in 2020, a single deadline has been established - until the 29th day of the month following the quarter. The table of due dates looks like this:

| Reporting period | Deadlines for submitting the PM form |

| IV quarter 2020 | January 29, 2021 |

| I quarter 2021 | April 29, 2021 |

| II quarter 2021 | July 29, 2021 |

| III quarter 2021 | October 29, 2021 |

| IV quarter 2021 | January 31, 2022 (postponed due to the fact that January 29, 2022 falls on a weekend, Saturday) |

As in the case of filing tax reports, there is a rule that allows you to postpone the deadline for submitting reports if the date coincides with a weekend or holiday. In addition, the government has the right to independently postpone the submission of reports due to various circumstances, as was the case in the spring during the coronavirus pandemic and mass quarantine.

What is it for?

The PM form is submitted by the company to transmit basic data on the activities of a small enterprise or individual entrepreneur. The PM-industry form has also been defined, which is required for submitting data on the manufacture of products by small companies.

The collection of statistical data is necessary to obtain certain information needed by the federal program. Reporting is required for:

- public authorities;

- local government bodies;

- legal entities;

- individual entrepreneurs;

- branches of foreign companies located on the territory of the Russian Federation.

The information will be used by Rosstat to obtain information about the economic state of the country or a particular industry. Each enterprise affects trade turnover, income and employment of citizens.

Step-by-step instructions for filling out the PM form

The procedure and rules for filling out the PM statistics report are simple. And here it is important not to make mistakes in the indicators themselves. And for this, we recommend using only the information contained in the documentation at the enterprise and the calculation formulas recommended by officials.

A couple more points: if an organization has branches or separate divisions, only the parent company reports, but passes it on to general information. The report is sent to the territorial authority at the place of registration of the legal entity, regardless of in which regions branches or separate divisions operate.

Step 1. Title page

At this stage there will be no difficulties. The person responsible for filling out enters the registration data about the enterprise into the PM form:

- full and short name;

- legal address;

- OKPO code.

Representatives of Rosstat recommend checking the OKPO code against notifications posted in the electronic system for collecting statistical information.

Step 2. Section 1

Another simple section is “Questionnaire”. To fill it out, you only need to answer the question whether the reporting company uses the simplified tax system. Answer options are 1 (yes) and 0 (no).

Step 3. Section 2

Section 2 of the form requires you to indicate the number of employees, their salaries and social benefits. There is a separate field for each indicator.

IMPORTANT!

Data for statistics in this and the next section are quarterly, and they are entered on an accrual basis.

Let's start with the average number. This indicator is calculated as an average, which includes all citizens who worked under an employment contract for at least 1 day in the reporting period, and the owners of the organization if they receive a salary. Not included in the PM form:

- external part-time workers - a separate line is provided for them;

- performers under GPC agreements;

- other citizens who do not receive a salary, although they are considered employees of the enterprise.

Read more: How to calculate the average number of employees

Let’s say that in our case the average number of employees is 20, there are no external part-time workers or employees on GPC contracts.

IMPORTANT!

It is allowed to indicate the indicator with one decimal place.

In lines 06–09, the statistics agency wants to see data on the wage fund on an accrual basis, broken down by employee. When calculating such data, it is necessary to consider all amounts before withholding income taxes, regardless of the source of financing and the period of their payment. All amounts are taken into account, including vacation pay, bonuses, food and accommodation, and non-monetary income, if such were paid to employees. The rules for calculating the salary fund are specified in detail in paragraphs. 2.2.8 – 2.2.8.10 of Order No. 22 of 01/23/2020.

Since in our example there are neither part-time workers nor employees under civil contracts, we fill out only lines 06 and 07.

The last line of section 3 requires you to indicate social benefits. These are all severance pay, lump sum payments and other social benefits that the employing organization is obliged to pay according to labor legislation and approved internal rules. A complete list of payments that do not need to be taken into account when filling out line 10 is indicated in paragraphs. 2.2.10 – 2.2.10.26 of Order No. 22 of 01/23/2020.

Let’s assume that in our case, social payments for January–December amounted to 100,000 rubles. We enter these numbers for statistics.

Step 4. Section 3

To fill out this section of the PM form to Rosstat, you will need financial statements, since it is necessary to enter such economic indicators as:

- how many goods of own production were shipped (line 11), including through the retail network (line 12);

- what volume of them is food (line 15);

- how many goods of non-own production were sold (line 13), including at retail (line 14);

- what are the investments in fixed capital (line 16), including at the expense of the budget (line 17).

What data should be taken into account and what data should not be shown, officials specified in detail in the rules approved by Order No. 22 of January 23, 2020. It provides not only general information on how to fill out PM reports in statistics in section 3, but also individual recommendations for enterprises depending on their field of activity. For example, budget organizations that enter into catering contracts should fill in line 11. But if the same organization receives services for free, then this line is not filled in.

Let’s assume that our respondent belongs to cultural organizations created by a commercial structure, therefore he shows data on lines 11 and 12, and these data completely coincide, since all services are provided through retail trade to the population. There are no investments this year.

Step 5. Section 4

Another section of the PM form for Rosstat, where you can’t do without accounting data. It requires you to indicate:

- man-hours worked (line 18);

- research expenses (line 19);

- expenses for the purchase of goods and real estate for resale (lines 20 and 22);

- the cost of sold real estate for resale (line 21).

If your organization, as in our example, does not spend money on research, buying and selling real estate and various goods for resale, lines 19–22 are left blank. All that remains is to fill in information about man-hours.

Read more: How to calculate man-hours

IMPORTANT!

Section 4 is filled out only based on the results of 4 quarters - for the year. If the company reports for a different period, you do not need to fill out anything.

Step 6. Sign the report

In a specially designated place, the PM form is signed by an authorized official. Leave contact information and set the date of sending to the statistics agency.

Is there an approved reporting form?

The legislation defines more than 300 reporting forms , some of them:

- P-1 : basic data of the enterprise in the field of its own activities, submitted monthly;

- P-3 : financial position of the enterprise, rented monthly;

- P-4 : reflects information about each employee and his salary, submitted quarterly;

- P-4 (NZ) : data on employees who are not fully employed, submitted quarterly.

There are also a number of forms that are required to be filled out only for individual entrepreneurs and small entrepreneurs:

- PM : basic data on the activities of the enterprise, submitted quarterly;

- PM-prom : data on products manufactured by the enterprise, submitted monthly;

- 1-IP : performance indicators of the enterprise, submitted annually;

- 1-IP (trade) : only for individual entrepreneurs from the spheres of retail trade and services, rented annually;

- TZV-MP : data on revenue from the sale of goods and the funds that were spent for their production, submitted annually.

How to pass

Reports are submitted either electronically or in paper form. The second option this year is available only to organizations with less than 25 people. You can submit the form in person, through a representative or by mail.

IMPORTANT!

When choosing a method for transmitting the PM form to statistical authorities on paper through postal services, take into account the delivery time. If the report arrives after the established date, the organization has the right to be punished for violating the deadlines for providing statistical data.

Results

Legal entities belonging to the category of small enterprises - in accordance with the criteria established by Law No. 209-FZ, as well as those included in the Rosstat sample, must report to the department based on the results of the quarter using the PM form. This form provides information about the company’s staff, employee salaries, company turnover, that is, the main economic indicators of the company’s activities.

Sources:

- Law “On the Development of Small and Medium Businesses” dated July 24, 2007 No. 209-FZ

- Decree of the Government of the Russian Federation dated April 4, 2016 No. 265

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out lines 14 and 20 in the MP (micro) form?

Good afternoon

Quote: line No. 14 (goods of own production sold) Line 14 of the MP (micro) form is called “Goods of non-own production sold”, i.e. goods purchased for sale.

From the instructions for filling out the form: "Line 14 reflects the cost of goods sold, purchased externally for resale (their acquisition was reflected in accounting on the Debit of account 41): products, materials, products purchased specifically for sale or finished products intended for assembly , the cost of which is not included in the cost of products sold, but is subject to reimbursement by buyers separately. The cost of goods sold is reflected upon the fact of sale, regardless of whether the money has been credited to the seller’s account or not. Organizations (commission agents, attorneys, agents) carrying out activities in trade in the interests of another person under commission agreements, commissions or agency agreements do not fill out line 14, since the cost of goods sold on line 14 is reflected by the owners of these goods - organizations that are principals, principals , principals. Line 20 shows wholesale trade turnover, which represents revenue from the sale of goods previously purchased externally for the purpose of resale to legal entities and individual entrepreneurs for professional use (processing or further sale). Commission agents (attorneys, agents) carrying out activities in wholesale trade in the interests of another person (committent, principal, principal) under commission (mandate) agreements or agency agreements on line 20 reflect only the amount of remuneration received.”