Payment

An enterprise that produces a particular product invests certain funds in it. An important concept in

Tax period code In 3-NDFL, the tax period (code) is the period of time for which

Certificate of supporting documents (SPD) in form 0406010 was introduced by the Central Bank of the Russian Federation on October 1

To make it more convenient for you to keep track of the use of profits, you can open account 84

Residents of the Far North or equivalent areas have the right to receive additional

Value added tax is not an absolute charge. A number of entrepreneurial actions are subject to it, others

Is it profitable to work on VAT or is it better to do without it? Beginning businessmen wonder.

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

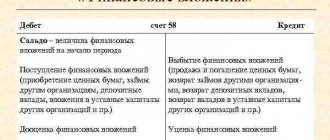

Every business has assets. These are material assets and investments, money that allows the company

Errors in VAT accounting Types of errors can be divided into two parts: those related