Payment

What expenses reduce the simplified tax system “income minus expenses” in 2021? What is the new list of expenses?

Your company has already entered into a leasing agreement and you have questions about how to reflect the leasing

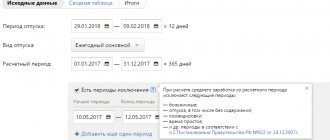

Legal framework How vacation payments will be made in 2019-2020 will be clear when

The owner of the current account instructs the bank to transfer funds using a payment order. filling-2021

Your company has already entered into a leasing agreement and you have questions about how to reflect the leasing

When a taxpayer submits reports, the Federal Tax Service launches a desk audit procedure that checks the declarations for

Who makes the decision to send an employee for qualification assessment In general, he is interested in qualified personnel

Taxpayers using the simplified taxation system are required to fill out and submit to their tax office the “Tax Form”.

What is accrued VAT? Activities subject to VAT are any activities that carry out

Fixed assets - assets used for production and/or management - cannot function indefinitely